From controller to conductor: CFOs navigate the supply chain reset

Finance leaders are becoming strategic architects, using treasury operations to build resilient supply networks as geopolitical tensions and regulatory shifts trigger unprecedented volatility

Finance leaders in the global auto industry are expanding their roles far beyond traditional financial stewardship to orchestrate complex supply chain transformations as the new realities of electrification, evolving regulation and geopolitics reshape the sector. Chief Financial Officers are now architects of resilience, leveraging treasury operations to forge intentional supply networks that can withstand disruption.

In China, there are currently more than 100 electric and hybrid vehicle manufacturers, many of which now produce technologically advanced, competitively priced cars that are rapidly growing in popularity worldwide. “Manufacturing and innovation are increasingly centred in Asia, with China setting the pace in cost reduction, innovation and improved quality and design,” says Sriram Muthukrishnan, Group Head of Product Management, Global Transaction Services, Institutional Banking Group at DBS Bank.

Meanwhile, traditional vehicle manufacturers are transitioning operations to adapt to evolving policies and shifting consumer tastes globally. And not without success: for example, General Motors’ third-quarter results1 considerably surpassed Wall Street expectations, prompting the company to raise its 2025 earnings forecast.

The shift to software and regionalisation

While established players and new entrants in the automotive sector may face differing financial priorities, they share a common challenge: that of meeting the new reality of perpetual disruption associated with geopolitical uncertainties, shifting tariffs and regulatory pressures.

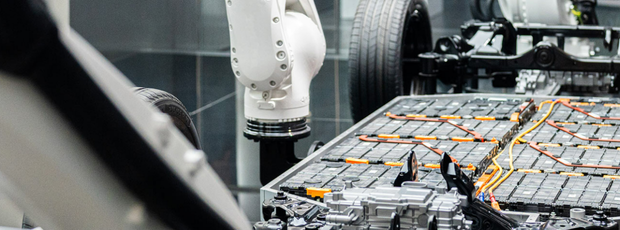

This is evident in the sector’s fundamental shift, as Adrian Chai, Group Head of Global Industries, Institutional Banking Group at DBS Bank, explains. “The transition from primarily mechanical engineering-based capabilities to a software-first architecture creates a big challenge. There’s more dependency on electronics, especially semiconductor chips, increasing demand for battery materials, leading to new supply chain vulnerabilities, and cyber security concerns, as well as challenges around hiring skilled workers who are able to address these challenges.”

The answer? A move towards regionalisation and localisation, and less over-reliance on single sources of supply. For GM, this means tightening up its supply chain and ramping up domestic manufacturing, allowing the company to offset around 35 per cent of tariff costs. For Chinese electric vehicle manufacturer BYD, it means supporting its European growth by building2 factories in Hungary and Turkey, which will rely on a localised European supply chain.

"Today, companies need to maintain strategic balances of core inventory, whether it’s batteries or chips or other critical raw materials"

Chai notes that some Chinese manufacturers are moving their entire value chain abroad. “From parts makers to battery makers to the original equipment manufacturers themselves, in terms of assembly, we’re seeing them move their whole operations to countries such as Thailand and Malaysia,” he says. This strategic shift towards “intentional” supply chains – designed for regional self-sufficiency and enhanced operational control – is leading companies to set up vertically integrated car manufacturing plants around the region.

Inventory strategies are also evolving rapidly to meet the new global economic reality. Increasingly, the “just in time” approach, first introduced and championed by Toyota in the 1970s to streamline production flows, is being complemented by “just in case”.

“Today, companies need to maintain strategic balances of core inventory, whether it’s batteries or chips or other critical raw materials,” says Muthukrishnan. For those that get it right, the transition to substantive local operations can future proof their business and create competitive differentiation.

CFOs drive resilience and supply chain strategy

DBS Bank’s global study, New Realities, New Possibilities, surveyed more than 800 finance leaders across 14 markets, to reveal that CFOs and treasurers are increasingly transcending their traditional roles as financial stewards and becoming central to decision-making in their organisations. This is especially true when it comes to supply chains and the finances that power them. More than two-thirds of CFOs cited business and supply chain reconfiguration as an increasing strategic remit, and this was particularly the case in the automotive sector.

"As you regionalise and localise, you are dealing with a lot more different currencies and a lot more volatility. There is a lot more complexity, not just in terms of supply chain financing but also new distribution chains. That’s why it makes sense for CFOs to decentralise treasury operations"

While these intentional supply chains provide opportunities for better local financing and leveraging liquidity, they inevitably drive up inventory costs. This is a key challenge for finance leaders navigating the establishment of new, more localised operational hubs. There are also a number of different requirements in terms of regulations, capital raising, inventory financing and capital management. The DBS survey revealed that many are establishing regional treasury centres as a way of helping to manage the process. “As you regionalise and localise, you are dealing with a lot more different currencies and a lot more volatility,” says Chai. “There is a lot more complexity, not just in terms of supply chain financing but also new distribution chains. That’s why it makes sense for CFOs to decentralise treasury operations.”

Revolutionising supplier finance to stabilise the value chain

Finance leaders in the survey highlighted cash management services and trade finance solutions as vital pillars in supply chain reorganisation. Extending financing to suppliers, particularly smaller players with less access to liquidity, can also be critical when setting up new operations. “We establish reverse factoring platforms in our major production hubs to stabilise our supply base along the entire value chain and to create stronger partnerships with suppliers,” says Michelle Ang, CFO at Daimler Truck Financial Services, referring to a financing solution that allows suppliers to receive cash early.

"We establish reverse factoring platforms in our major production hubs to stabilise our supply base along the entire value chain and to create stronger partnerships with suppliers"

Banks also play an important role in easing the process of establishing new operations. They can help companies accelerate collections, optimise liquidity, provide fit-for-purpose financing and off-balance-sheet solutions at each business stage – buy, store or sell. Additionally, banks deliver data-driven financial intelligence for real-time monitoring and forecasting.

Innovative financing solutions are emerging, such as those that enable the financing of goods in transit by using electronic bills of lading to manage title transfers to support evolving supply chain needs. “The automotive sector is very much a focus for us at DBS, where we bank the entire value chain and support emerging players in the new vehicle ecosystem, creating future opportunities for collections as their trusted partner,” notes Muthukrishnan.

Ultimately, the challenge for finance leaders lies in transforming the treasury function from guardians of capital into strategic architects of intentional, regionally focused supply chains. By embracing three pillars of modern business resilience – agility, optionality and speed of execution – CFOs can unlock new possibilities to transform uncertainty into competitive opportunity.

To discover what more than 800 CFOs and treasurers are prioritising for their businesses, download the full New Realities, New Possibilities report here.

- finimize.com/content/gm-lifts-earnings-forecast-and-wins-over-wall-street

- Exclusive: BYD to delay mass production at new Hungarian plant, make fewer EVs, sources say | Reuters