Interest Optimisation

Interest optimisation is an arrangement whereby the bank offers tighter spreads (lower funding cost and higher yields) in return for the corporate leaving balances with the bank. It can be conceived as a volume discount on the bank's normal interest rates. Interest optimisation is normally based on the credit balances that the corporate holds with the bank – i.e. commonly referred to as CASA (current account and savings account) balances.

How it works?

Interest optimisation normally works with tiers of CASA balances, just like other volume discounts. So, the higher the volume (CASA balances), the greater the discounts (finer credit and debit spreads).

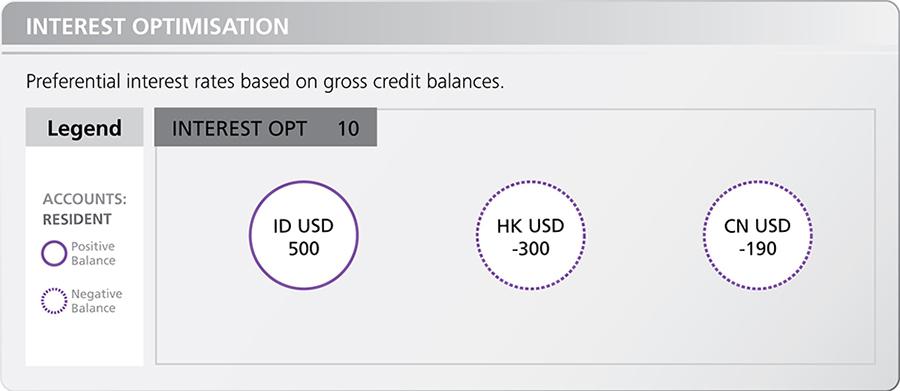

In some cases, interest optimisation relates to two specific balances or markets – for instance, CASA balances in one market can reduce funding costs in another. More commonly, interest optimisation is applied regionally or globally.

Interest optimisation is essentially a commercial agreement (akin to a volume discount). Generally, it does not have any additional implication to the normal regulatory capital or bank capital which CASA account balances generate on a stand-alone basis. It is simple and easy to document. It also means that the bank has no balance sheet efficiency to leverage in the absence of balance offsetting ability from interest optimisation, so the pricing must allow for the bank’s full capital cost. In this regard, notional pooling is more efficient but also more complicated. However, In some countries, there are regulatory implications for interest on CASA balances.

Interest optimisation – contrary to notional pooling which can only include accounts at one branch – works across the whole of the bank’s network. In addition, as it does not seek special regulatory capital treatment, it works across different regulatory capital pools (mainly across different countries but also if needed across branches and subsidiaries of the bank).

Interest optimisation compared

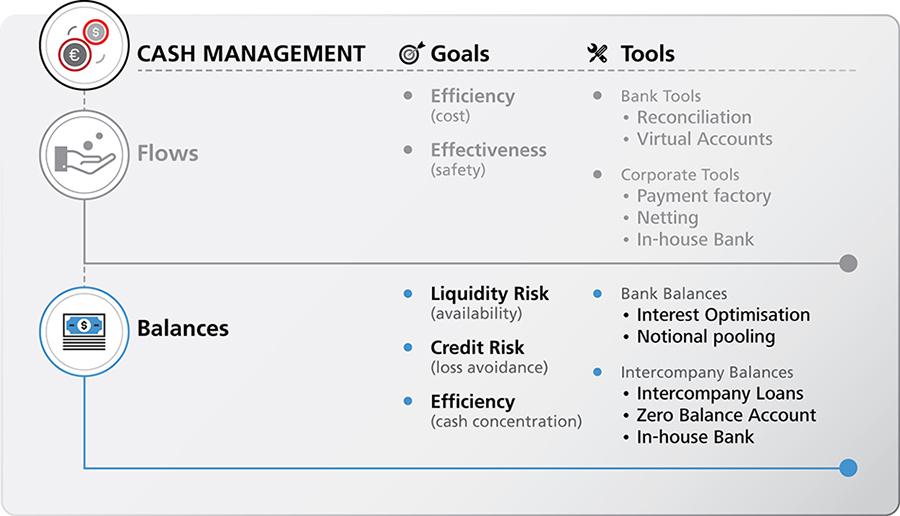

Interest optimisation is a balance management tool. Interest optimisation results in bank balances.

Comparing interest optimisation to notional pooling, the key difference is in the regulatory capital required on the bank’s side. Under interest optimisation, the bank must allocate full regulatory capital against all the corporate’s balances. Under notional pooling, the bank can (partially or wholly) offset the corporate’s debit and credit balances thus reducing its regulatory capital costs.

Regulations and Tax

Interest optimisation has minimal regulatory constraints. Wherever the bank is willing and able to take deposits and make loans, interest optimisation works.

Some countries regulate interest rates – i.e. banks have to pay and charge regulated interest rates and in some cases cannot pay interest on current accounts. In such countries, the interest optimisation benefit cannot be implemented in country but the corporate will get a commercial benefit in other countries. Such countries are called 'CASA contributors' because their CASA balances benefit the group overall but they cannot benefit from the interest optimisation themselves because of regulated interest rates.

The tax situation of interest optimisation is the same as for any normal bank account, bank deposit, and bank loan. Interest optimisation has basically no tax implications in and of itself.

Implementation

Interest optimisation is simply a pricing agreement between bank and corporate. Implementation amounts to ensuring that balances are kept with the interest optimisation bank rather than deposited or invested elsewhere.

Since interest optimisation normally applies in tiers (the bigger the volume, the bigger the discount), the cost of leaked cash is just the slightly lower yield or slightly higher funding cost.

The information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only.

All case studies provided, and figures and amounts stated, are for illustration purposes only and shall not bind DBS Group. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed herein.

The information is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

DBS Bank Ltd. All rights reserved. All services are subject to applicable laws and regulations and service terms. Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by DBS Bank Ltd and/or its affiliates/subsidiaries.