DBS Economic Insights – Forecast for 2022 Year of the Tiger

How is Asia positioned to handle 2022?

If all goes well, we are heading for the pandemic's concluding chapter in 2022. But while the pandemic is hopefully inching into our rear-view mirror, the world is in the middle of a different kind of turmoil — Russia's war with Ukraine, throwing Europe and the markets into disarray.

DBS's Economic Insights Webinar Series attempts to make sense of a constantly changing world for business leaders. In the first webinar of 2022, DBS Chief Economist Taimur Baig addressed a few key topics that will form the basis of any investment strategy going ahead on the back of a Fed policy normalisation.

- Inflation - is the worst behind us?

- What is the growth impetus in Asia and potential challenges for emerging markets?

- How vulnerable are Asian countries?

Please watch the webinar (at the bottom of the page), but some forecasts for the busy leader are here.

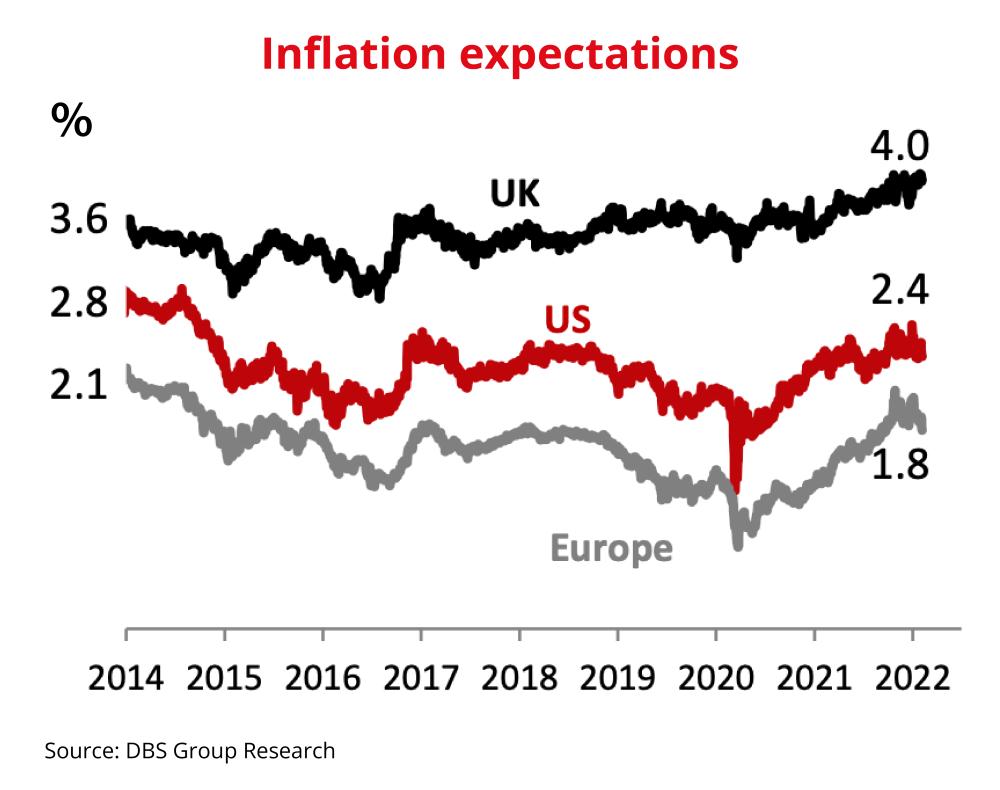

Inflation expectations are well anchored, but the conflict has raised concerns

Indeed, inflation is everywhere and a global phenomenon, but we do not see global markets punishing Asia. However, it is essential to note that inflation expectations are well anchored. This graph (Figure 1) shows that inflation has picked up a little bit but when you stretch the time horizon, and go back eight to ten years ago, it's no different from what it was: “It is just not as deflationary as it was a few years ago”, explains Taimur.

While this was our position at the time of the webinar, there are significant inflationary pressures due to the Ukraine-Russia conflict as supply chains are further impeding the flow of commodities (wheat, oil, and gas in particular). "Unfortunately, we do not see an easy solution to the inflation issue even if the conflict gets resolved as sanctions will likely still remove a chunk of commodities from the world economy,” says Taimur. “In particular, we would be watching to see if wage growth can keep up to ensure that there is no substantial decline in purchasing power that would undermine the US consumer.”

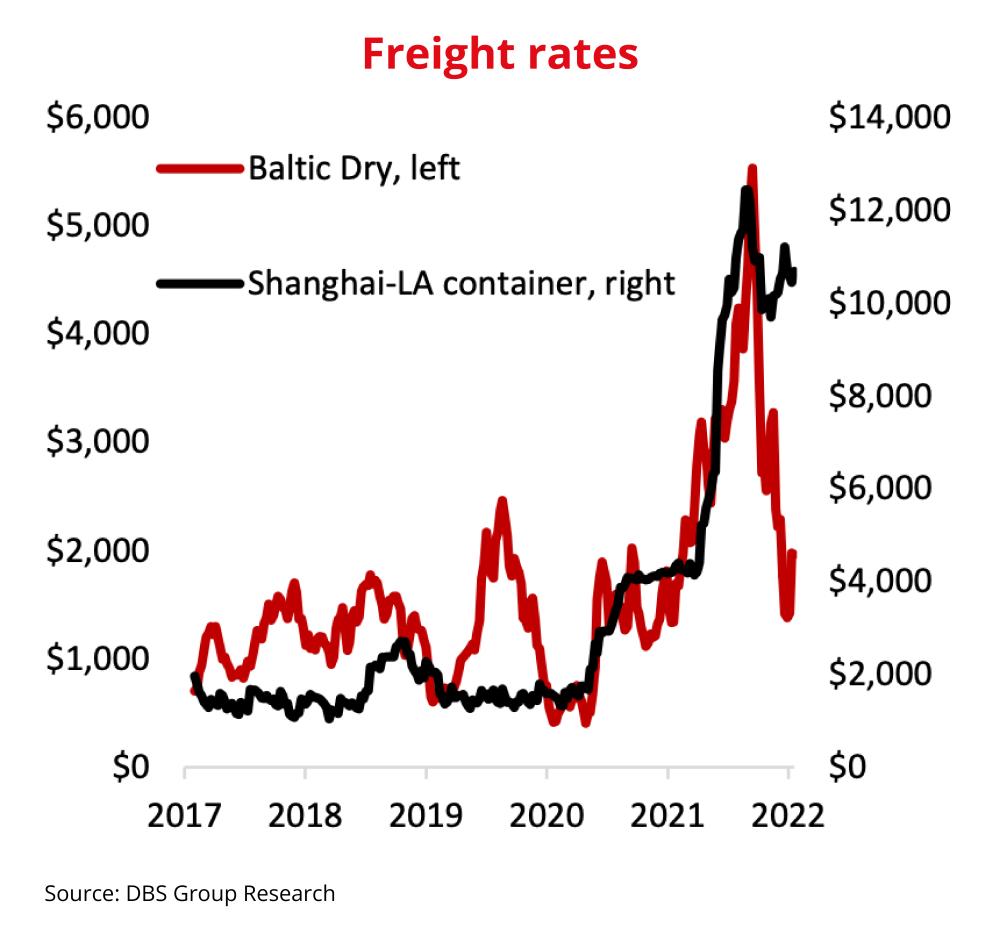

The cost pull from shipping is peaking out

The real shipment-related problems are in the US, where the congested ports, overburdened with containers piling up and a worker shortage, have led to a shipping crisis. Fuelling this is a rocks solid domestic demand in the US, which will remain strong in 2022.

The Shanghai to LA container cost is currently an astonishing US$ 10,000 to US$ 12,000, and it was less than US$ 2000 just two years ago (Figure 2). Thankfully, the world is beginning to see a dip and some normalisation in shipping rates. “The Baltic Dry Index has come down to earth,” comments Taimur.

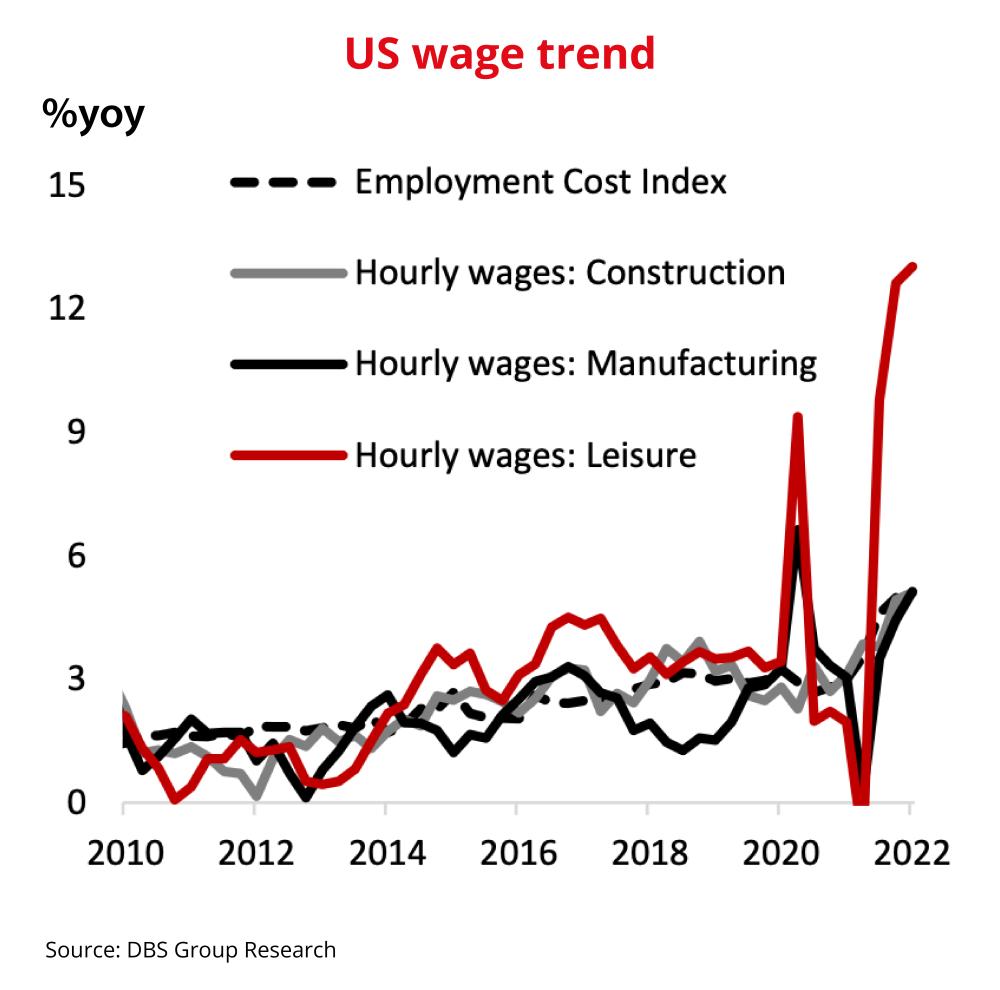

Demand and supply mismatch in the labour markets will continue to be a concern

Since 2020, hourly wages, particularly in sectors such as leisure (restaurants, spas), have multiplied. Covid-related pressures—people are reluctant to return to work—have contributed to this tight labour market. Wages will continue to be a concern in the year ahead as the landscape for employment is wholly transformed. "This is keeping the Fed awake at night. Powerful momentum for wages in certain sectors may spill over into other sectors," explains Taimur.

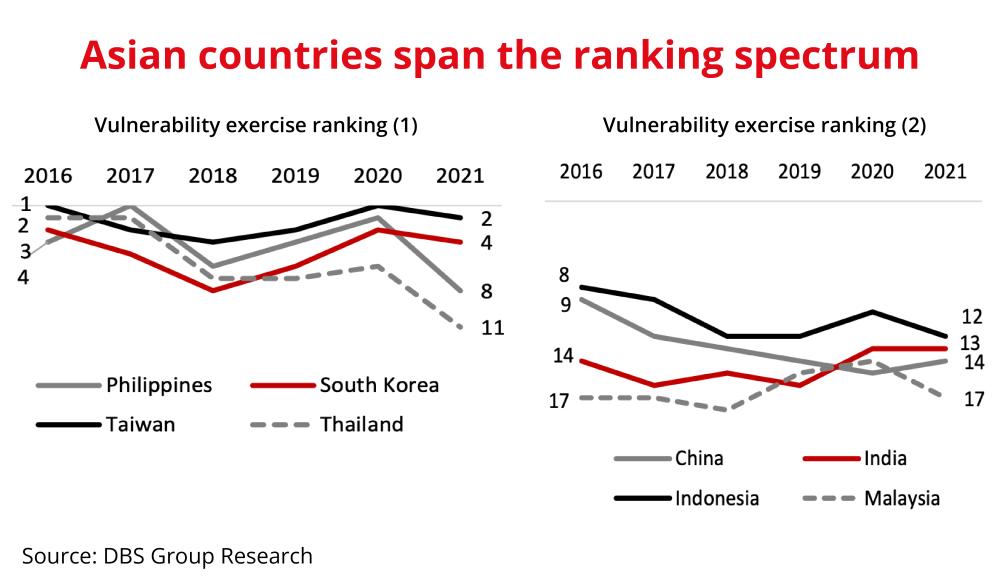

Emerging Market (EM) Risk Heatmap: Compared to some large emerging market economies, Asian countries look healthy

In an annual exercise, we look at 25 key emerging market economies and assess their macro position across various vulnerability indicators, such as currency valuation, debt metrics, external accounts, and payment buffers.

Taiwan and South Korea have some of the best scores in the EM space. Thailand and the Philippines have fallen from strong external positions a few years ago: Thailand used to be one of the best performers in 2016 and has slipped considerably. China, India, Malaysia, and Indonesia fall in the middle of the EM vulnerability cohort. Asserts Taimur: "I'm amazed at China's slide."

An important point to note: The look and feel of Asia is not alarming in our vulnerability analysis.

There’s much more to uncover from our wide-ranging discussion, including unwrapping the implications of the Ukraine-Russia conflict. Discover more Business Insights from our DBS team and access our latest research here.

References