![]()

If you’ve only got a minute:

- Looking at your goals, philosophy, tools, investment period and profits are ways to differentiate if you are a trader or investor.

- Trading involves quick profits and also daily monitoring and speculation.

- Investing requires a slow and steady approach with a long-term perspective to generate stable income.

![]()

Two people could call themselves investors but in reality, have very different views on what it means to invest.

One might view investing as watching the market every day for a “good deal”. This individual should more accurately be called a trader as the goal is to take advantage of rising and falling prices of securities in order to make quick profits over the short-term.

Meanwhile, the other might prefer to take a long-term view on financial markets. This means taking a slow and steady approach to growing the value of an investment portfolio and generate stable income.

As different as they sound, in all fairness, there are a few key similarities between traders and investors. For instance, both are market participants seeking profit from financial markets.

What separates traders from investors are the different ways they take to pursue the common goal of profiting from financial markets. This means they tend to have different philosophies and use different methods of analyses to make decisions.

However, this does not make the trader superior to the investor or vice versa. As the saying goes: “All roads lead to Rome,” so various methods of doing something will achieve the same result in the end. Are you more of a trader or investor?

Let’s find out!

Here are five common differences between traders and investors.

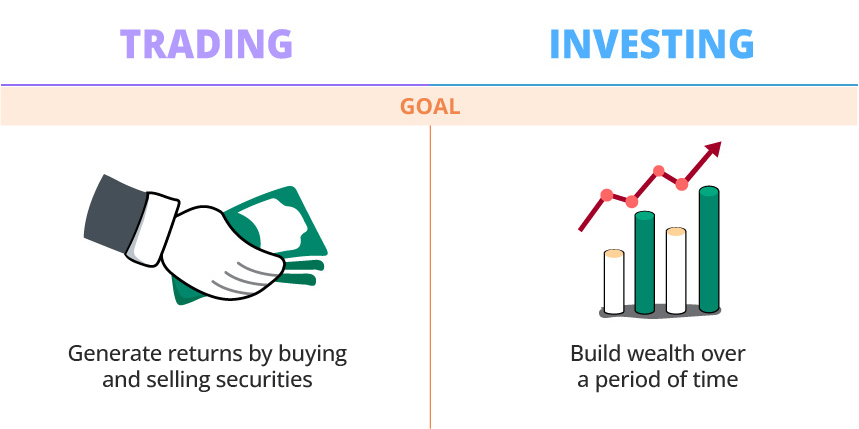

Goals

While traders and investors both aim to profit from financial markets, the way they go about it couldn’t be more different.

Traders seek to maximise profit through buying and selling frequently as the market moves, through buying at lower prices and selling at higher prices. In general, this is how they generate returns. For traders, positive outcomes can also come in the form of successful short-selling, where profits are made by selling at a higher price and buying to cover at a lower price.

On the other hand, investors tend to think long-term, preferring to take a slow and steady approach to portfolio growth, bearing in mind that history is on the side of those who wait. These individuals understand that in general, markets go through cycles of ups and downs. Investors aim to buy good stocks at reasonable prices and ride through these cycles.

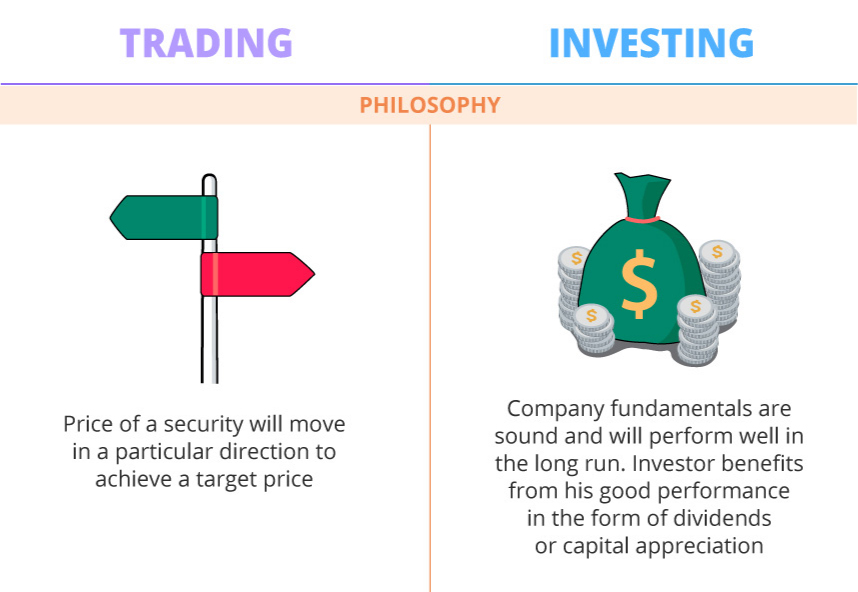

Philosophy

Traders are more concerned with securities they purchase hitting the target price (it can be lower or higher than the current price). The target price is set through technical chart analysis.

For investors, what is more important to them is to evaluate a company’s long-term prospects and if they will be able to achieve capital appreciation.

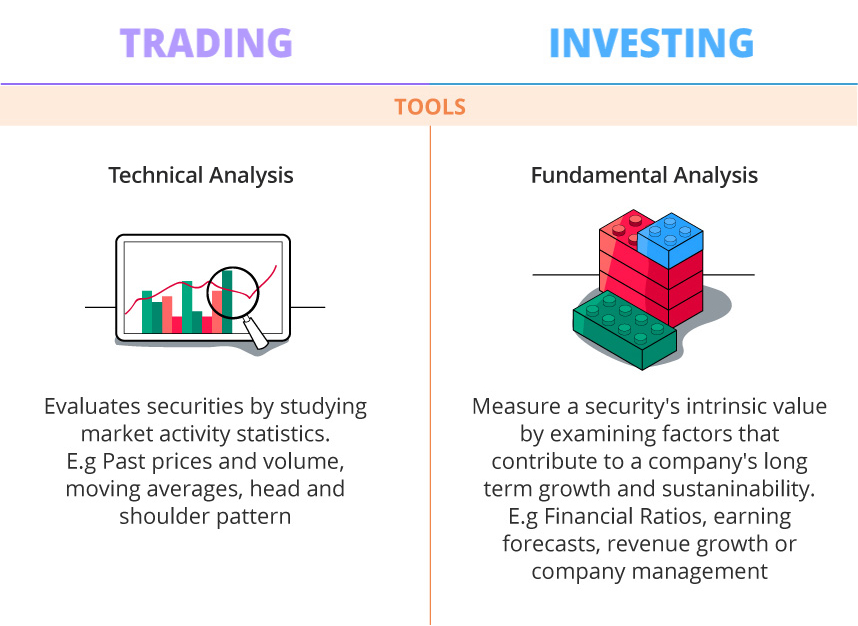

Financial tools

Traders and investors tend to rely on different methods of analysing securities.

As traders usually focus on predicting future price movement and how to profit from it, they rely on technical analysis. This involves gathering and analysing statistical data on market activity including returns, stock prices, and volume of trades. Moreover, they use chart patterns and trends, support and resistance levels, and price and volume behaviour to identify trading opportunities with positive expectancy.

Investors focus on fundamental analysis, which involves measuring a security’s intrinsic value or its true value. This is done through examining related economic and financial factors including microeconomic indicators like the balance sheet and management performance to macroeconomic factors such as the state of the economy, industry conditions and changes in consumer behaviour.

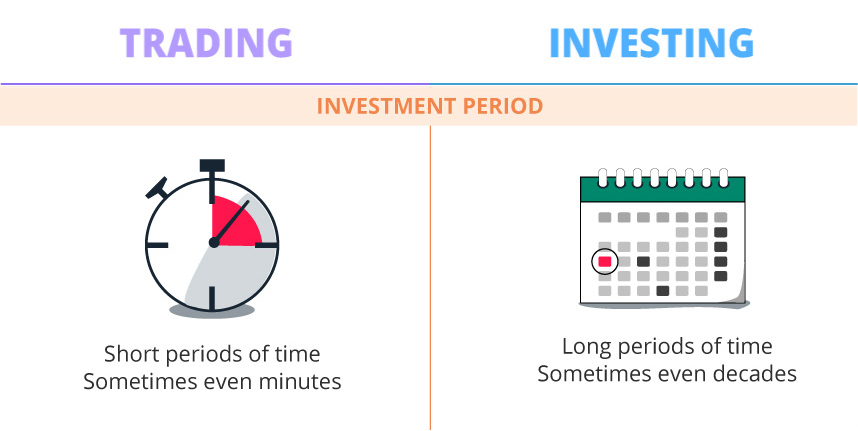

Investment period

More often than not, traders are concerned with short-term returns. But exactly how short is short here? There are a few different timeframes ranging from minutes to a couple of years.

Short-term traders can be broadly categorised into 3 groups.

Swing traders usually hold positions for a few days to weeks, day traders hold positions throughout the market session while scalp traders hold positions for as little as a few seconds to minutes.

There are also position traders, who hold securities from a couple of months to years. To some, they are considered investors too.

In contrast, a long-term or “buy and hold” investor who typically holds a security or asset for a long period of time, such as 10 years or more.

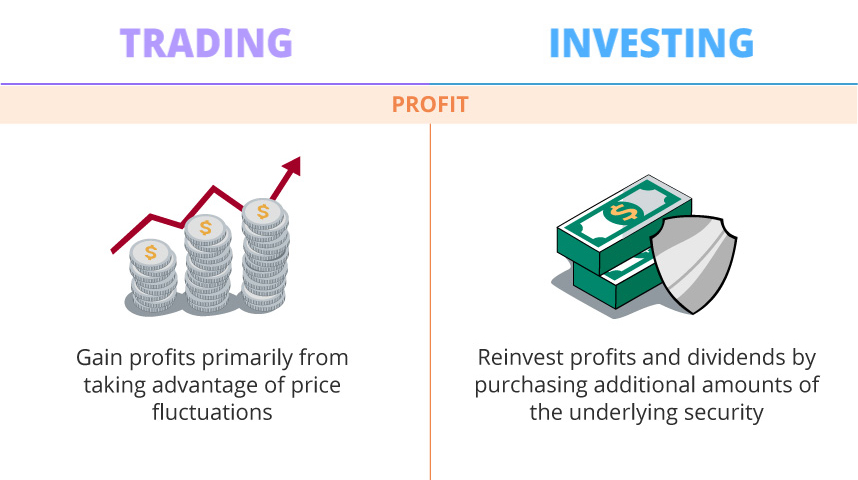

Profit

Traders aim to gain profits through price fluctuations. Once target prices have been reached, they are disciplined, taking profit and moving onto the next trading idea.

Being long-term, investors are more likely to reinvest profits and dividends by adding to their positions.

Aren’t we all a little bit of both traders and investors?

Just like how we embody character traits or have physical features from both our parents, we can also take elements of the trader and investor.

While some stick strictly to be either one, being a combination of both can bring about many benefits.

For example, you can use fundamental analysis to identify an undervalued stock and back that up by using a trader’s strategy of relying on technical analysis to ensure that you make the purchase within a reasonable price range to maximise your long-run profits.

In summary

Traders and investors may have different philosophies, and use different methods of analyses to make decisions but that does not mean one method is superior to the other.

As with all things in life, it is most important to do your diligence before you start.

Would-be traders must understand the skills, resources and limitations involved. They should also take note that at times, trading can be risky and they should not expect a 100% success rate in making profitable trades.

Catching market movements at the best instance can be very difficult, even for the professionals. Successful traders are often very attuned to what going on in financial markets and are disciplined.

Meanwhile, investors should understand the importance of risk profiling, setting investment goals and time horizons, by undertaking thorough research to gain knowledge on the investments they are considering making.