By Lorna Tan

![]()

If you’ve only got a minute:

- A financial health check can be a meaningful gift for your parents – ensure they have the right insurance coverage to cover their healthcare needs

- You can help your parents build up their nest egg with CPF top-ups and investing their surplus cash in low-risk investments

- Spending quality time and creating precious memories with our parents need not cost an arm or a leg – a simple walk, helping them to navigate digital tools and accompanying them on health visits are some ways.

![]()

Mother’s and Father’s Day occur in the months of May and June. Besides the usual array of family meals, chocolates and gifts, it’s timely to take a different approach and give them a financial health check to enhance their financial well-being.

Surveys show that some people are clueless on how to plan for their retirement. To make matters worse, parents tend to take care of their kids’ needs first which may adversely impact their financial future.

It is prudent for parents to learn to take care of themselves and their money matters early. Still, it just may take gentle nudges from their children to point them in the right direction. Here are 6 gifts you can consider for your parents.

1. Gift of sustainable healthcare

Being able to fund healthcare costs is one of the top concerns of pre-retirees and retirees what with double digit medical inflation here, due to the ageing population, and costly advancement of medical technology.

The premiums for our hospital insurance plans increase with age. Do note that the Central Provident Fund (CPF) MediSave Account (MA) savings may be used to pay the premiums of the basic hospitalisation & surgical insurance plan MediShield Life in full, to minimise cash payment. You can also use your MA savings to help cover the premiums of your parents.

In addition, some parents may own hospital insurance riders that provide cover against the deductible and/or co-insurance components of the bill. The premiums of these riders for older policyholders have spiked up in recent years. Do note that CPF MA savings cannot be used to pay for the riders.

Take the opportunity to assess if your parents have appropriate hospitalisation insurance in accordance to their needs and preferences such as staying in a private hospital and being able to select their doctors and so on. Furthermore, review if there is a need to downgrade their riders which will help to lower the premiums.

Read more: Insurance needs for different life stages

2. Gift of benefits via Government schemes

Find out if your parents qualify for subsidies, especially if they belong to the Pioneer Generation category. For instance, check out the Agency for Integrated Care (AIC) website for financial assistance schemes that help elderly disabled Singaporeans living in HDB flats.

By doing so, I have helped my father-in-law apply for a subsidised wheelchair and hearing aid under the Seniors Mobility And Enabling Fund (SMF) as well as obtain payouts from the Pioneer Generation Disability Assistance Scheme (PioneerDAS).

There is also an Interim Disability Assistance Programme for the Elderly (IDAPE) which offers help for disabled Singaporeans who were not eligible for ElderShield when it was launched.

Ensure that your parents’ flat is elderly-friendly by installing grab bars, non-slip bathroom floors, and so on. The Enhancement for Active Seniors (EASE) programme subsidises such home modifications so that older residents can live at ease in their own homes.

3. Gift of an adequate nest egg

Singapore topped the world in life expectancy with an expected lifespan at birth of 84.8 years. With the prospect of living longer and the impact of inflation, we need to help our parents take steps to ensure that they are not in danger of outliving their financial resources in their retirement. Helping them build multiple income flows to fund their golden years is a sustainable way to achieve financial wellness and peace of mind.

Their emergency cash of at least 3 to 6 months can be parked in cash or near-cash instruments like higher-yielding savings accounts and fixed deposits.

For surplus cash, they can look into investing in instruments that offer safer and guaranteed income flows. One such product is the Singapore Savings Bonds (SSBs) which is flexible and risk-free and it offers twice-yearly cash payouts.

Other “safer” instruments include annuities or retirement insurance plans which either come with a one-time premium payment or regular premiums for a specific period. Depending on the plan, parents can be assured of regular cash payouts for their entire life or for a limited number of years. Studies have shown that people typically spend more in the first 10 to 20 years of their retirement on travelling, pursuing hobbies or running a business while they are still mentally and physically able.

The DBS Retirement digiPortfolio could be a product for consideration as well. It is a hassle-free, ready-made portfolio that helps you invest for your retirement, starting from S$1,000 without any lock-in or withdrawal penalties.

Asset allocation is determined based on how far you are from retirement and shifts automatically as you age - in the early stages, your portfolio is geared towards growth assets to help you accumulate your wealth over the years to retirement. As retirement approaches, your investments will be shifted to more stable assets like fixed income funds, building a more conservative and stable portfolio to ease into your retirement years.

Read more: Investing according to your changing life stages

Find out more about: Singapore Government Securities

4. Gift of lifelong income payouts

The CPF Board’s Retirement Sum Topping-Up Scheme helps build retirement savings for yourself or your loved ones. If your parents are in the CPF LIFE scheme, your top-ups will ensure that they enjoy higher payouts upon reaching their payout eligibility age, for as long as they live. If your parents are on the Retirement Sum Scheme, your top-ups will help increase their monthly CPF payouts and/or extend the duration of payouts up to age 90.

Making small but regular top-ups throughout the year may be more affordable instead of a one-off lump-sum. A Giro arrangement can make those regular payments easier to carry out. As an added benefit, by making cash top-ups to specific family members, like parents, you can qualify for personal income tax relief of up to S$8,000 per year.

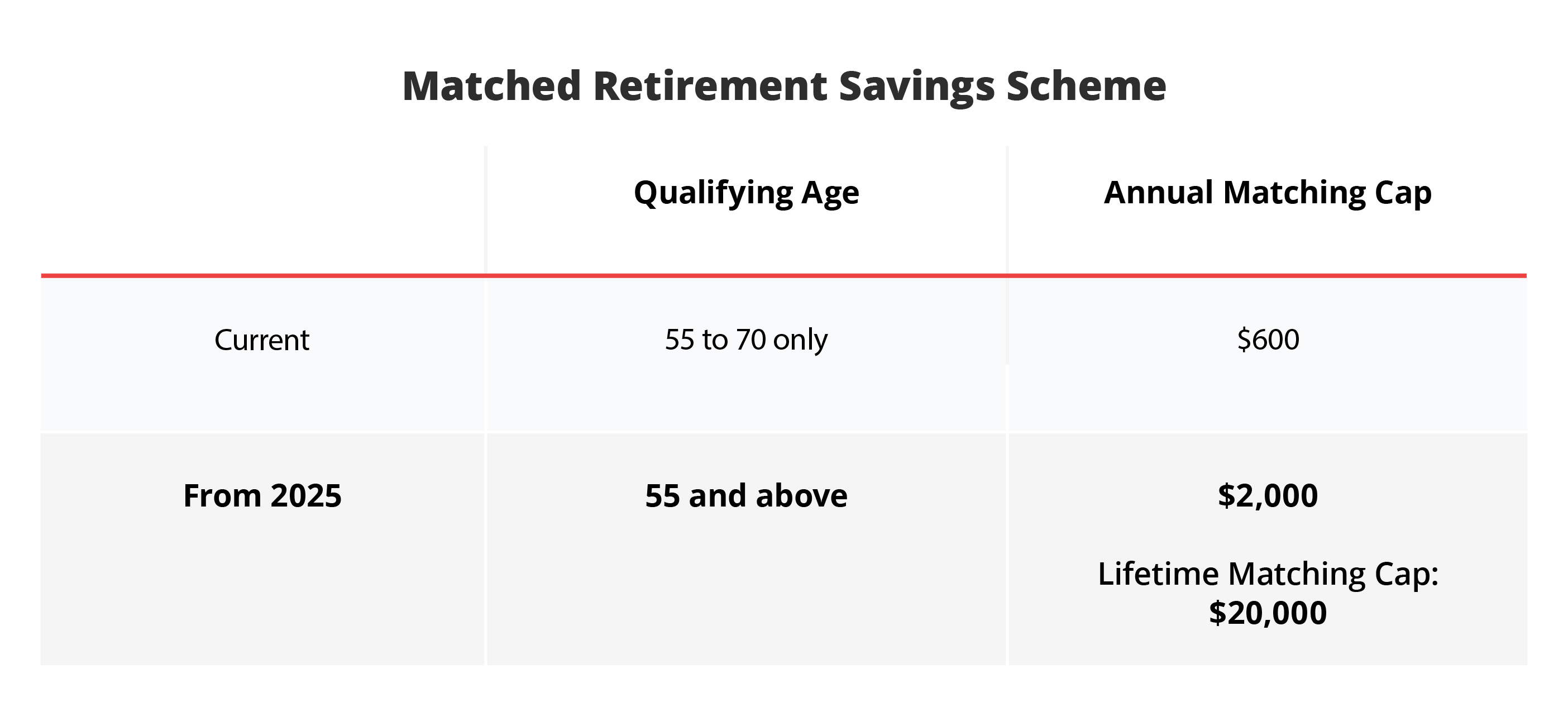

The Matched Retirement Savings Scheme (MRSS) will also be enhanced next year to help senior Singaporeans build up their retirement savings, through dollar-for-dollar matching grants from the Government to their Retirement Accounts. You can help your parents top up their CPF account in order to take advantage of the matching grants from the government.

Do note that from 2025 onwards, any tax relief for cash top-ups that attract the MRSS matching grant will be removed.

Read more: CPF LIFE or Retirement Sum Scheme?

5. Gift of a proper estate plan (include gifting to charity)

This is likely a sensitive issue but it is essential and will help to minimise future conflicts among family members. This includes making their respective wills and updating their CPF nominations. A will allows a person to plan how his estate will be managed and distributed after death. If a will has already been made, then advise your parents to review it over time particularly if there are changes in family circumstances. Do note that charities can be included as one of the beneficiaries in wills and CPF nominations.

I have helped my parents and relatives prepare their wills and set up a Lasting Power of Attorney (LPA). An LPA allows a person (donor) to appoint “donees” who will help to manage the donor’s personal welfare, property and affairs while the donor is still alive but has lost mental capacity.

Other tools to consider include a trust that helps to preserve a family’s assets, and an Advance Medical Directive. The latter is an instruction to the doctor (in the event you become terminally ill and unconscious) that you do not want any extraordinary life-sustaining treatment to be used to prolong your life.

Read more: The importance of Estate Planning

6. Gift of time and memories

Spending quality time and creating precious memories with our parents need not cost an arm or a leg. Besides taking time to go for walks and holidays together, we can help them navigate digital tools so they can communicate better with their loved ones and friends. Another avenue is to accompany them on doctor consultations so that we have a better picture of their health. After all, health is also wealth.

Let us enjoy more good years with our parents to give them the love, concern and support that they so richly deserve. To all parents out there, have a blessed Mother’s and Father’s Day!