By Gwendoline Tan

![]()

If you've only got a minute:

- There are more costs to owning a car than meets the eye. Besides the initial outlay, there are running costs to consider.

- The overall initial cost of buying a car in Singapore is not just its market value but also includes other components like COE, registration fees, duties, taxes and more.

- If you do not need the use of a car daily, alternative options include short term car rentals, car sharing or simply to book a private hire.

![]()

Owning a car in Singapore often comes with a hefty price tag, thanks to our dense traffic and the various costs involved.

While public transport system is both convenient and relatively affordable, making car ownership a "want" rather than a "need" for many, there are valid reasons why some find a car essential.

Think juggling multiple work appointments across the island or needing to transport children and elderly family members. But regardless of whether a car is a practical necessity or a coveted aspiration, smart budgeting is paramount.

How you plan and prioritise for it will differ depending on the factors driving your purchase – do you have a family to ferry around; or is that latest car model just too irresistible?

Read more: Guide for young adults: Planning for milestones

What makes up the total initial cost of a car?

Given the vast number of vehicles in land-scarce Singapore, the government has implemented measures over the years to keep traffic congestion at manageable levels.

Examples include additional fees and taxes, as well as the renowned Certificate of Entitlement (COE), before you can buy a car.

Here is a breakdown of what makes up the total initial cost of a car.

Certificate of Entitlement (COE)

Unique to Singapore, you will have to bid for a COE and it is part of the process for buying a brand-new car. The open bidding exercises are conducted twice a month.

Depending on the demand as well as the quota for vehicles allocated by the Land Transport Authority (LTA), the prices are then determined after the bidding exercise has ended.

After you have secured a COE from the bidding exercise, you can then register a vehicle in the corresponding category for a period of 10 years.

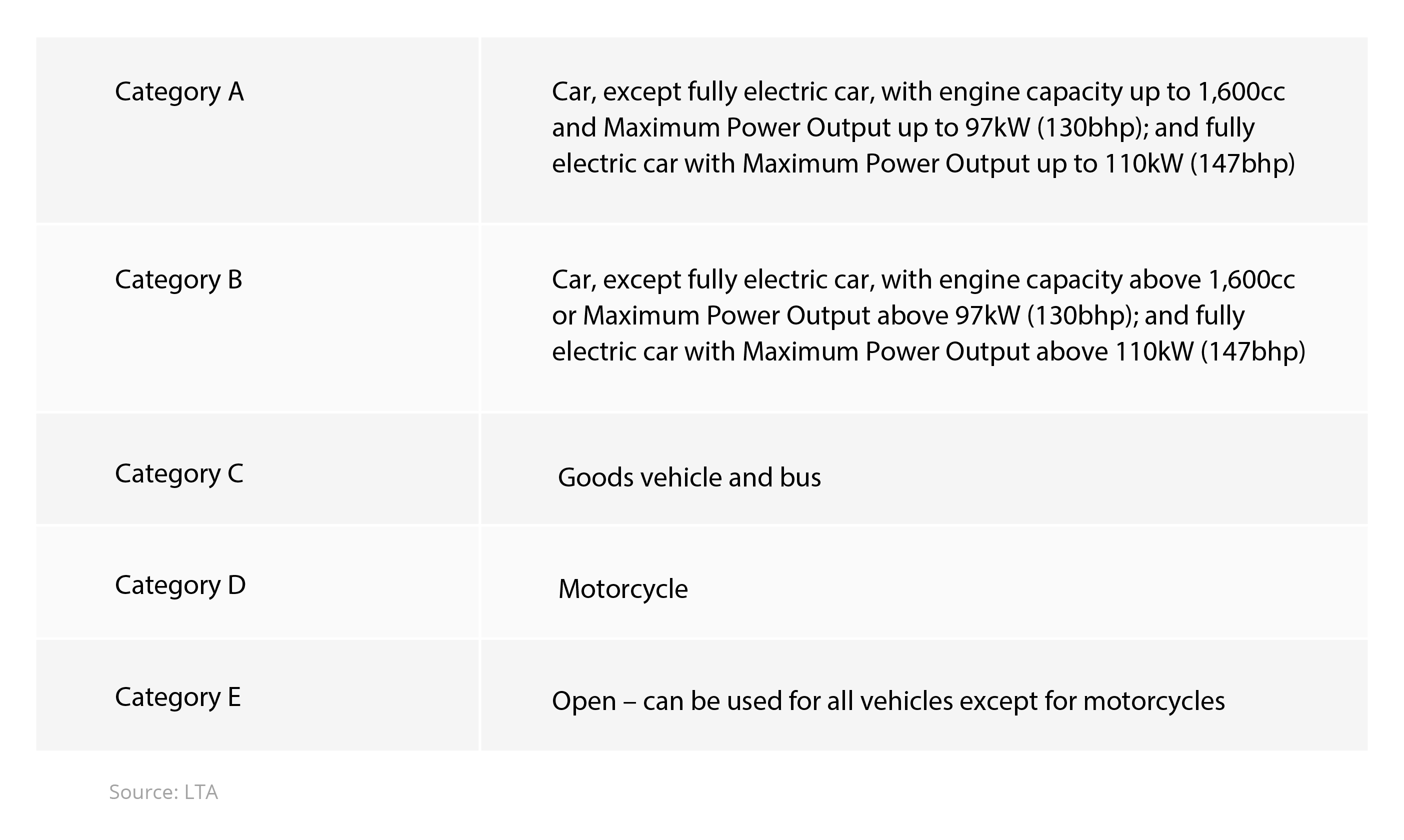

Of the 5 COE categories1, the ones that apply to buying a car for personal use are A and B.

While Category A and B COEs must be bidded for a specific vehicle registration plate and are non-transferable, Category E COEs are transferrable for up to a period of 3 months.

At the point of writing, the COE2 (1st bidding of March 2025) is S$92,730 for Category A cars, and S$113,000 for Category B. Given the high prices for COE, it comes as no surprise that it accounts for a sizeable amount of your overall purchase price.

Open Market Value (OMV)

The OMV reflects the price of the vehicle on the open market of the car itself. It determines the upper limit on the amount of loan you are eligible for and is also used to calculate some of the fees and charges levied.

Registration Fee and Additional Registration Fee (ARF)

At point of writing, the fee for registering a new car is S$350.

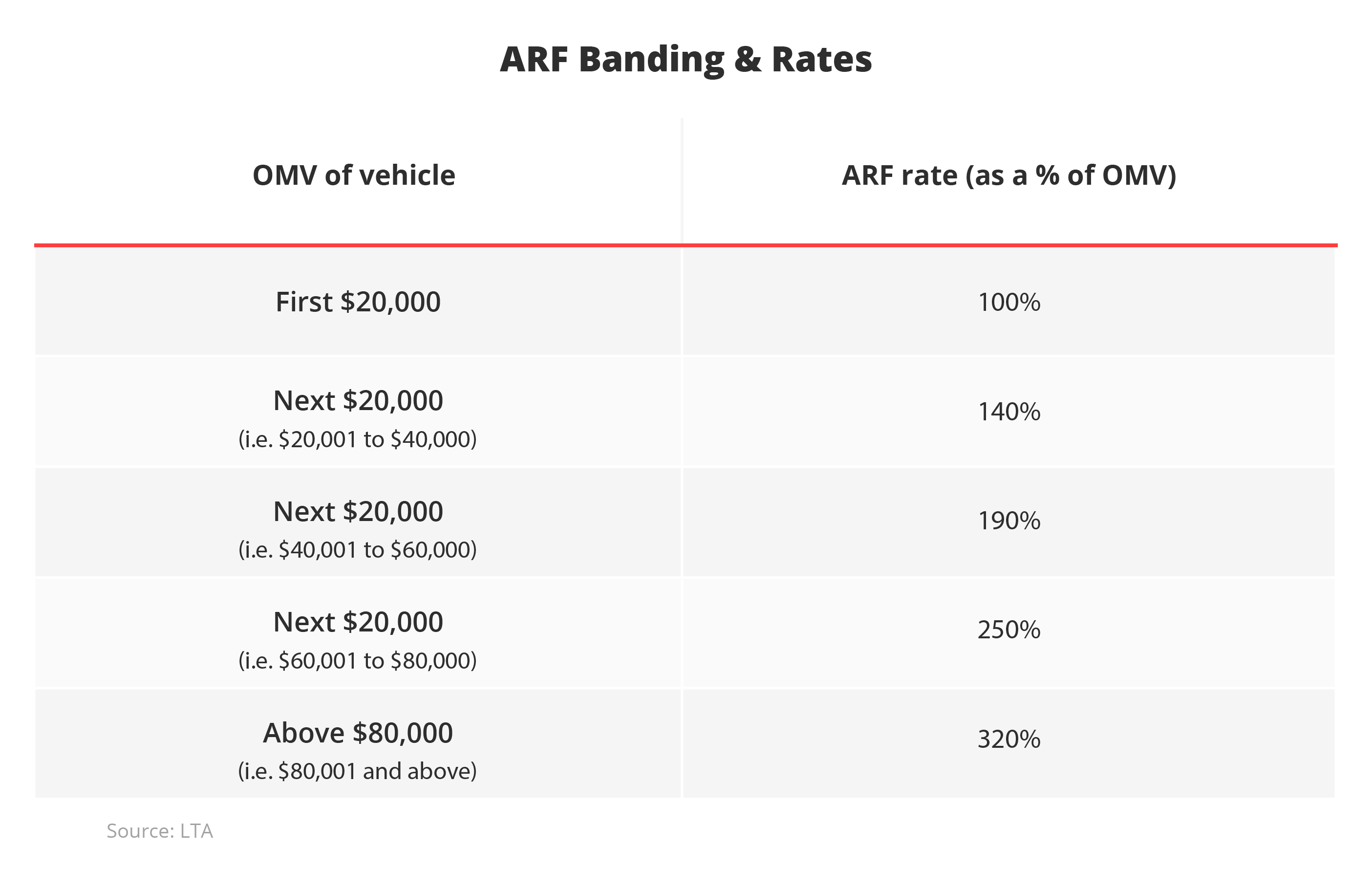

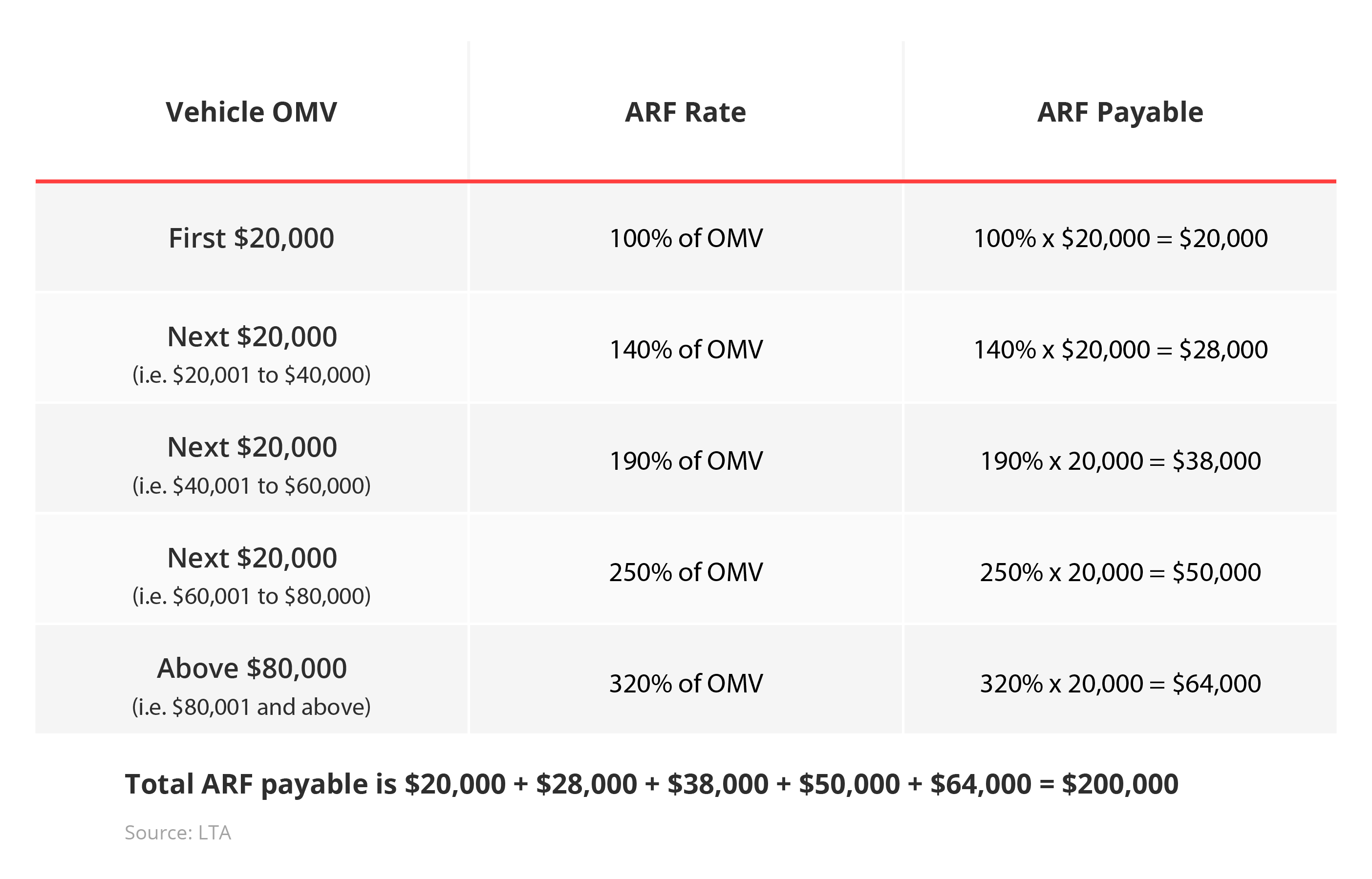

The ARF is a tax imposed when you register a vehicle in Singapore. It is calculated based on a percentage of the OMV of your car.

For example, a car with an OMV of S$17,500 falls in the first tier, hence the ARF payable would be 100% of OMV which is S$17,500.

If the OMV of the car is higher, say S$100,000, it would incur an ARF payable of S$200,000 based on the following calculation:

Excise Duty and Goods & Services Tax (GST)

An excise duty is charged on imported goods into Singapore – in this case it is 20% of the OMV. The GST of 9% is charged on the OMV.

Vehicular Emissions Scheme (VES)

The aim of the VES is to encourage road users to buy more environmentally friendly cars. Based on a set of standard testing mechanics to measure the pollutants which your car is giving off, you can either get a rebate or incur a surcharge. This amount is applied to the ARF.

On-Board Unit (OBU)

Before you drive your new car, you will need to have an OBU installed to facilitate paying for Electronic Road Pricing (ERP) charges and parking at certain places. This replaces the previous in-vehicle unit (IU) in line with the new ERP 2.0 system.

For used vehicles, this is usually included in the cost of the car. With a brand-new vehicle, it is best to check with your dealership if they have included the cost of the OBU in the overall cost of the car as it differs from place to place.

Initial down payment

According to guidelines by the Monetary Authority of Singapore (MAS), you can take a loan of up to 70% of the OMV of your car. However, the actual loan amount you eventually get will depend on other factors such as your total debt servicing ratio (TDSR), your credit score and your income.

The amount you have to fork out for the initial downpayment will be the total cost of the car, less the approved loan amount.

On top of all the costs already mentioned, the dealer which you purchase your car from will also impose a markup to the cost of the car as part of its profits and to cover its own costs. This can usually range between 10% and 50% depending on whether you are buying a basic or luxury car.

Read more: Applying for a car loan in Singapore

Find out more about: Car loan in Singapore

What next?

Once you’ve figured out how much you can afford to pay, which bank to take a loan from, how you are financing your purchase and consequently what car you can (afford to) buy in your current financial situation.....It’s time to celebrate the purchase of your new baby!

But is it really?

This might just be the beginning of a laundry list of considerations.

Owning a car comes with recurring costs of running and maintaining it.

Non-negotiable running costs

There are some running costs that are non-negotiable. These are costs that you will naturally incur as a car-owner.

You will have to pay road tax - every 6 or 12 months - and in accordance with the engine capacity of your car.

Having a valid driver’s insurance is a legal requirement and the premiums vary among insurers and depends on different driver profiles, averaging between S$700 and S$2,000 per year.

Sending your car for regular maintenance is necessary to ensure it is running well and safe for driving. This is usually done either every 6 months or depending on mileage. The servicing cost can vary depending on whether it is serviced by a dealership or a third-party workshop.

Assuming you have taken up a loan to purchase your car, don’t forget to include the costs of your monthly loan and interest repayment. You can also use our handy car loan calculators to figure out your maximum loan amount and corresponding monthly instalments.

Flexible running costs

Other running costs that you have more control over, based on your driving habits and schedules, include petrol, parking and ERP. Alas, the prices of which have steadily increased over the last decade.

Find out more about: Calculating your car loan budget

Hidden running costs

All predictable costs aside, there are also hidden costs that can occur while using the car. These include potential repairs should the car get scratched or in the unfortunate event of an accident.

Other costs may include yes, a speeding fine, a parking ticket or worse depending on the offence committed, whether intentionally or not.

Budgeting for a car

As you can see, even if you have a solid amount of funds on hand to afford the initial costs of owning a car, you still need to consider your personal budget and cash flows to decide if you can responsibly afford the recurring costs.

It is good to take time to do a quick financial health check. Do you have emergency funds set aside for a rainy day?

This should be at least 3 to 6 months of your monthly expenses and up to 12 months if you are self-employed or have dependants. You should also ensure that your basic insurance needs are covered before considering buying a car.

As for your monthly cashflows, it is important to ensure you can set aside at least 10% of your monthly take-home income each month as savings, while having enough for your daily necessities such as meals, transportation, and bills.

You can also use the digital financial advisory tool in the DBS digibank app to help in your budgeting. It automatically works out your money flows, provides money and investing tips, and projects your income flows so you can achieve holistic financial wellness.

As an example, if you wanted to buy a brand new Toyota Corolla Altis 1.6 Standard3 (last updated 6 Mar 2025) is S$162,888. With an OMV of S$19,402, and assuming you are able to get the maximum loan of 70%, your initial down payment would be S$48,866. This might seem a reasonable amount especially if you have been diligently saving for some time.

With this example and at the current DBS car loan online promotion rate of 2.78% p.a., your monthly loan repayment works out to S$1,622.

These costs do not consider other variable costs like parking charges at the office or at malls. There are also petrol costs and ERP to add in if you drive around regularly. Conservatively speaking, even if you avoid the ERP gantries and find free parking options where you are going, petrol can still set you back S$250 each month.

Based on all the above assumptions, you are looking at a monthly expenditure of minimally S$2,100 a month. This is just the running cost of the car.

If you do not have any other major financial commitments (like a home loan or family commitments), you might spend S$1,500 on your meals, bills and other general daily expenses. This means your total monthly expenses would amount to S$3,600.

Needless to say, if you have your sights on a luxury car, the monthly expenses involved will be significantly higher due to higher COE, higher road tax, higher insurance premiums, higher petrol consumption and so on.

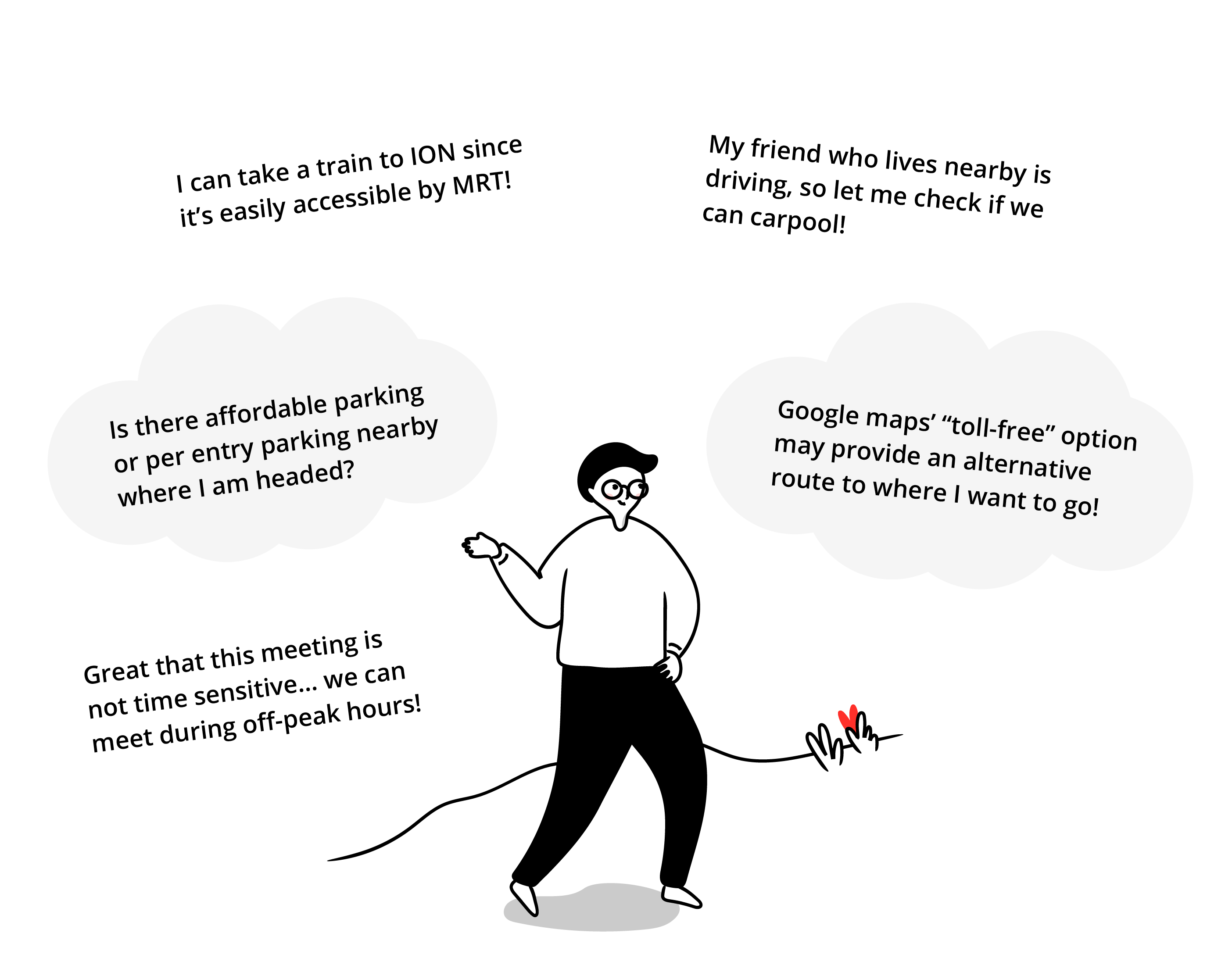

If you need a car for your lifestyle and can afford the downpayment, but monthly cashflows are tight, here are some handy tips to consider lowering your average monthly costs.

Read more: Making Financial Planning Simple

Find out more about: digiWealth

Alternatives to consider

There are some who may choose to buy a second-hand car as a cheaper alternative.

While that is viable, it is not ideal unless you have a trustworthy second-hand car dealership, and you know the vehicle has been thoroughly inspected and has been well maintained by its previous owner.

If it is not in good condition, the overall maintenance and repairs might end up costing you more in the long run than buying a brand-new car. Do also note that the regulations on loans differ for buying used cars and buying new cars.

Read more: Buying a second hand car in Singapore

Find out more about: DBS Car Marketplace

If you do not need to use the car daily, you may consider getting an off-peak car, short term car rental, car sharing services, or even using a private hire/taxi service.

The current red-plate car scheme is the Revised Off-Peak Car (ROPC) scheme5 which restricts the usage of your car to weekdays (only between 7pm and 7am), and full days on weekends, public holidays and the eve of pre-specified public holidays.

If these restrictions work for your schedule, you can consider getting a ROPC as it entitles you to a S$17,000 rebate (offset against the COE and ARF) as well as a S$500 discount off your annual road tax.

If you need to use the car on a restricted day, you can purchase a valid e-Day License for S$20 per day with a specific usage date indicated. Driving your car without this on a restricted day will result in hefty fines.

When it comes to short term rental, the Toyota Corolla Altis in the earlier example will cost S$70 per day with car sharing companies like GetGo, and alternatively costs around S$5 per hour (Economy tier) for an even shorter-term option.

These do not contribute to your TDSR as no loan is required, and do not require any ongoing maintenance expenses. You pay for the period or mileage of vehicle use and if you are feeling generous with your budget, you might even rent luxury car models for a day.

All in all, having a car provides conveniences, especially if you need to travel across the island for work or ferry your dependents around in the day. However, whether the pros outweigh the cons in totality depends on how you value the car in relation to your preferences and habits.

Besides the obvious cons to owning a car such as the high upfront and recurring costs, there are also intangible benefits of not driving. Given the acceleration of global warming, choosing not to drive would undoubtedly reduce the overall carbon footprint and toll on the environment.

Taking a private hire or public transport will also save you the stress of potential traffic jams, worrying about where is the best place to park and even allow you to unwind and relax as you are ferried around.

At the end of the day, a car is a depreciating asset. If your lifestyle allows, you can choose to save the monthly expenses that would instead be spent on your car and put the funds to work, growing it for other future goals you might have.