![]()

If you've only got a minute:

- Car loans are regulated by the MAS, with the maximum loan amount determined by the OMV of your vehicle, and the maximum tenor capped at 7 years.

- The actual amount of loan you will get is determined by the financial institution or company you are borrowing from, based on factors like your income, credit score and existing debt.

- To be eligible to apply for a car loan, you have to be at least 21 years of age and meet the minimum income and TDSR requirements.

![]()

Owning a car in Singapore comes with a very hefty price tag. This is why most of us would need to take a car loan. Even if we have the means to pay in full at one go, there is an opportunity cost on what you could use the money for, to generate higher returns.

Getting a car loan can seem daunting, especially if it is your first time. Here are some things to know beforehand, including applying for one, how much you can borrow, what the loan terms are and how to calculate your monthly repayments.

The cost of owning a car

The total initial cost of buying a car in Singapore is made up of multiple components including the Certificate of Entitlement (COE), the Open Market Value (OMV), registration fees, duties, and taxes.

In relation to a car loan, the 2 main components to note are the COE and OMV.

When you buy a new car, you will have to bid for a COE. This gives you the right to own and use a vehicle in Singapore for a period of 10 years, after which it will be automatically deregistered. That said, you can choose to renew your COE before it expires for a period of 5 or 10 years.

The OMV reflects the price of the car on the open market when it is imported into Singapore. This is the value which determines the highest amount you can borrow for your loan.

Read more: Budgeting for a car in Singapore

Deciding on your loan amount

To encourage financial prudence and support a car-lite society in Singapore for the long run, the Monetary Authority of Singapore (MAS) has set maximum limits on the amounts and tenors for car loans.

This restriction is based on the OMV of the car and not the total initial purchase price. It is applicable to new or used motor vehicles and does not apply to motorcycles, commercial vehicles, or motor vehicles for the physically disabled and their caregivers.

In Singapore, your monthly car loan repayments are included in the calculation of your total debt servicing ratio (TDSR). The TDSR limit is currently 55%, which means your total monthly debt obligations cannot make up more than 55% of your gross monthly income.

You can use the DBS Car Loan Calculator to give you an idea of the maximum loan amount you can be granted based on your existing cashflows, and the estimated purchase price of your car.

Do remember that the 60% and 70% loan limits represent the maximum amount of financing you can take up. In other words, the loan amount you are given by the bank or financial institution is determined by your existing financial situation – your credit score, your TDSR, and income. This means the initial downpayment you will have to make in cash is the total cost of the car, less the approved loan amount.

Do your due diligence to work out your cashflows and ensure that you have sufficient cash on hand for the downpayment and recurring loan repayments.

Read more: Why is my credit score important?

Deciding on your loan term

When purchasing a new car, the maximum loan term is 7 years. For second-hand cars, the maximum car loan period is determined by the registration date of the car.

Car loans are typically available for cars less than 10 years old, with the maximum loan term calculated based on the original date of registration. For example, if you purchase a used car that was registered in 2018 (6 years old in 2024), the maximum loan period for that car will correspond with the remaining 4 years left on its registration.

What if you’d like a loan for less than the maximum term available? Fret not, as you have the flexibility to do so.

While opting for a shorter loan term means that you can be debt free sooner, it means that you have to make higher monthly repayments over the term of the loan, which might affect your cashflow. However, taking a longer loan term will eventually result in you paying more interest over the course of the loan.

Let’s assume you’re taking up a loan of S$100,000 at an interest rate of 2.78% per annum (p.a.). Use the DBS Car Instalment Calculator to estimate your monthly instalment on your car loans for a 5- and 7- year period.

Even though the base loan amount is the same, the total interest payable on a 7-year loan is approximately S$5,592 more than a 5-year one. However, your monthly commitments will be S$476 lower.

What’s key here is to balance the affordability of servicing your monthly loan commitments against the car loan period.

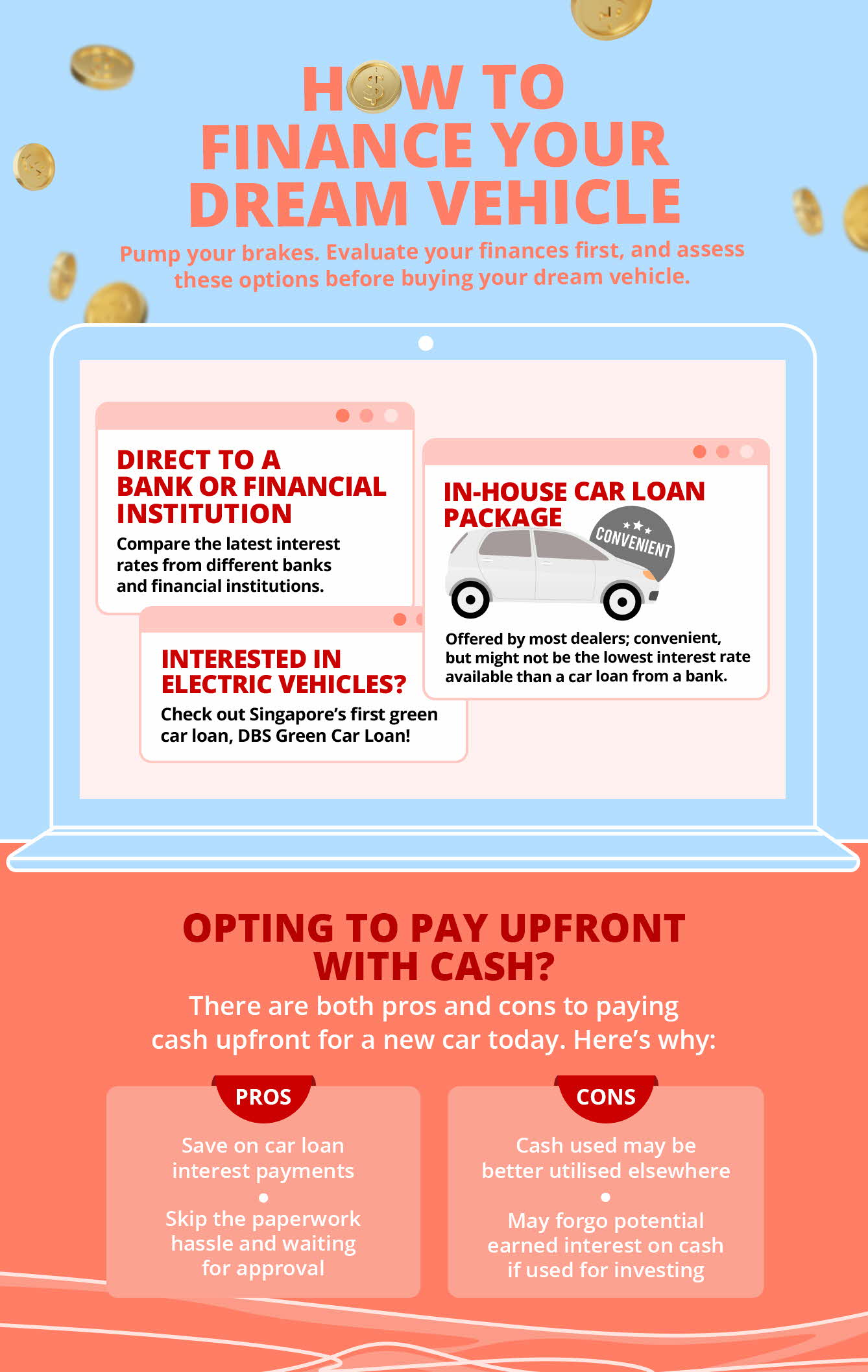

Deciding on your financing options

While you can choose to pay upfront with cash and skip the car loan interest payments and hassle of paperwork, doing so can severely affect your ability to use cash for other purposes like day-to-day expenses, savings, or investments.

This is why even those who can afford to pay for the car in full often opt to take a loan.

Here are 3 main options to consider when for taking a car loan.

1. Direct bank loan

Most banks offer car loans. Be sure to understand the terms and conditions before making any decisions. If you’re worried about your application, you can get an in-principle approval from the bank before you transfer car ownership to your name. This will provide some peace of mind and a good idea of how much you will be able to borrow.

The DBS Car Loan offers competitive interest rates and a seamless application process when you log in via digibank and retrieve your personal information using Singpass.

Find out more about: DBS Car Loan

2. Dealer in-house loan package

Some car dealers in Singapore offer in-house financing or have tie-ups with banks. When you take a loan from the dealer, they usually handle most of the paperwork for you, making it a fairly seamless process.

However, if you choose to take financing through the car dealer, you will not have the flexibility to shop around to compare interest rates offered by other financial institutions and pick a lower one.

3. Get a green car loan

Opt to go green for the environment by switching to green cars. The DBS Green Car Loan is the first green car loan in Singapore and helps you to save both on running costs and interest rates. This means you can drive to a more sustainable future!

Find out more about: DBS Green Car Loan

Whether you decide to pay for your ride in cash upfront or through a loan package, make sure to evaluate your financial situation, commitments, and goals beforehand.

Additional fees involved

These are additional fees on top of the car loan downpayment and monthly interest repayments that contribute to the effective interest rate of your car loan.

Do note that a car loan is a type of secured loan with the car as the underlying collateral. This means that if you default on your car loan, the lender has a legal right to terminate the loan contract and repossess your car.

How do I apply for a car loan?

Before you start your application, ensure that you have checked the car loan requirements and that you have all the documents for the car loan.

Car loan applicants have to be above 21 years of age. Applicants who are Singapore Citizens and Permanent Residents must have a monthly income of at least S$2,000 (S$4,000 for foreigners). While you do not need to have a driving license to buy a car (only the financial means to do so), the main driver will have to be named in the car insurance document.

Information and documents needed for the car loan include the vehicle sales agreement (and log card where applicable), applicant employment details, existing financial commitments, as well as income documentation. Choosing to retrieve your personal information details via Singpass will help make the process a smoother one.

Read more: Cost of getting a driver’s license in SG

In summary

All in all, when buying a car and taking a loan, think about the overall costs involved and the feasibility of servicing your loan over the long-term. In your excitement, it may be easy to focus only on the downpayment and lose sight of the ongoing costs of owning and driving a car, like insurance, petrol, parking, and road charges.

Be financially responsible by choosing a vehicle within your budget that’s best equipped to serve your needs.