![]()

If you’ve only got a minute:

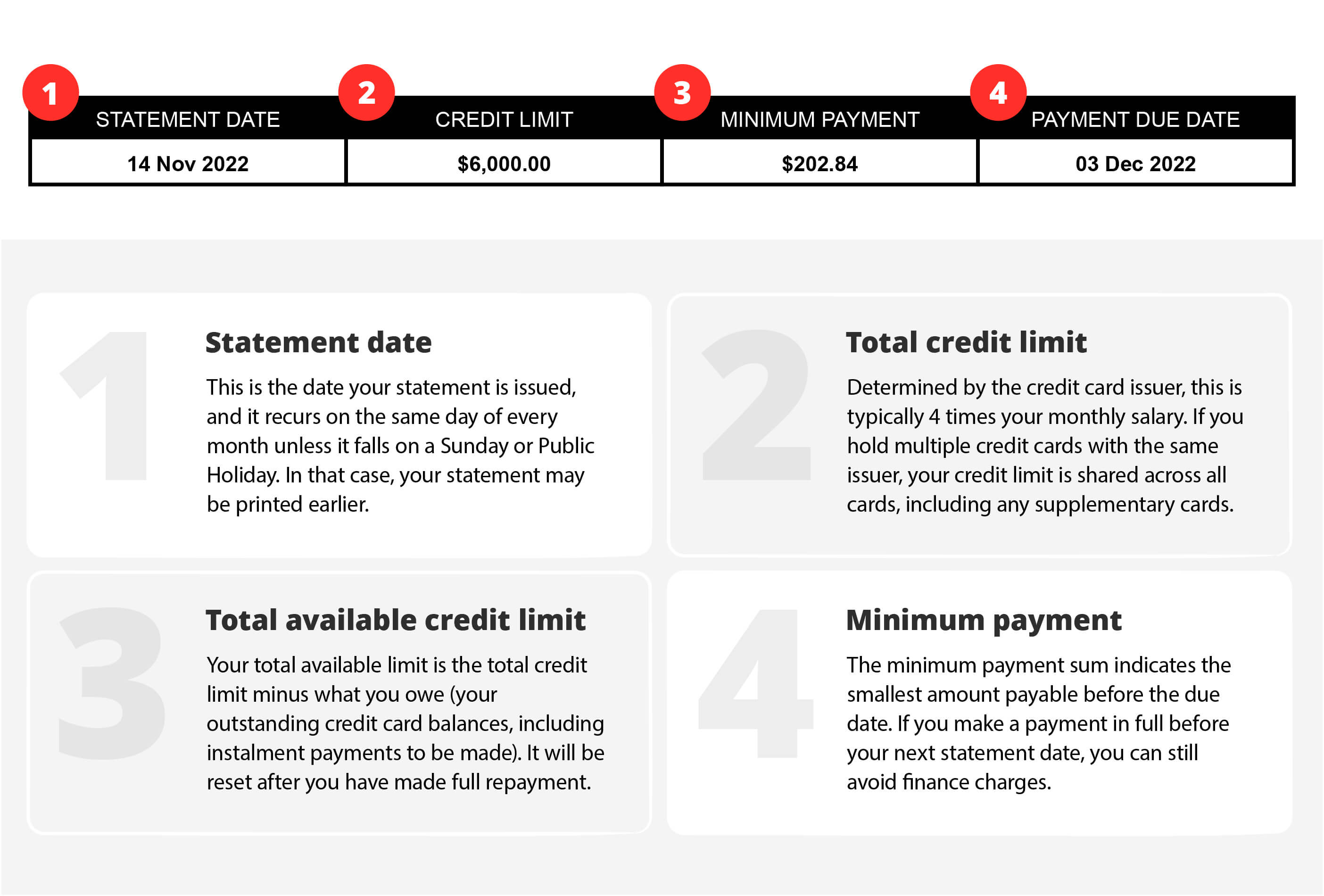

- With a credit card, you are essentially taking a loan from the card-issuer, which must be repaid in the next billing cycle to avoid interest charges.

- Late payment of a credit card bill will result in high interest charges which are charged and compounded on a daily basis, making it easy to snowball quickly.

- Credit limits do not reset like a data plan. You must repay every last dollar, with interest.

![]()

Credit cards are an ubiquitous part of our lives, and still relevant (in Singapore, at least), even in the age of e-wallets and other modes of digital payments.

The speed of a swipe (or tap), the ease of payments, and even the prestige of "platinum" or "titanium" cards are among their attractions. On top of that, those shiny, sometimes colourful pieces of plastic, offer rebates, rewards, or miles when you make purchases.

But before you happily swipe, swipe, swipe (or tap, tap, tap), it is important to know that when you use a credit card, you are not actually making payments out of your own pocket at the point of transaction.

Unlike a debit card, where charges are deducted directly from your bank account, charges made to your credit card are essentially short-term loans from the card issuer (e.g. bank), which must be repaid. As with any loan, amounts owed are subject to interest charges.

On the upside, if you pay your card bills in full before the due date, you do not have to pay any interest on it.

Read more: Knowing the different types of payment cards