![]()

If you’ve only got a minute:

- The general rule of thumb is to set aside at least 3 to 6 months of expenses as emergency cash.

- A sole breadwinner of the family should consider what are the fixed and variable expenses.

- If you are planning on switching jobs, ensure you are financially ready in case the search for the next job takes longer than expected.

- Thinking of taking a sabbatical? Calculate how much you need and build your savings before starting your break.

![]()

When life throws you a curveball, the peace of mind that comes from knowing you have enough money to tide you through is priceless.

This is why having an emergency fund is important. If you are faced with a sudden loss of income, you would have ready cash for medical costs before insurance claims are processed, car repairs, or even paying your monthly bills.

While setting aside at least 3 to 6 months’ worth of expenses is a helpful guideline, this figure will differ for each person because we have different needs and wants. This means some of us might need to set aside more.

Having the appropriate amount of savings means your focus can shift from worrying to other important matters. These include resolving any crisis at hand, being emotionally present for your loved ones, or simply having the freedom to make choices like taking time off work to handle other interests.

Here are 4 potential circumstances you may identify with, and factors to consider in deciding how much is “enough”.

Being the sole breadwinner is a heavy financial responsibility. Not only do you have to manage your own expenses, but those of your dependants too.

As part of your financial planning, here are some considerations.

How many dependants do you have?

The more people in your household or family who are financially dependent on you, the more you have to set aside.

For example, someone with 2 young children, a spouse, and elderly parents to provide for, has considerably higher financial commitments than a newlywed couple with no children and financially independent parents.

What are their various life stages?

It is important to have an idea of how long you have to provide for them, and how much you might need to budget.

If you have a child in kindergarten, you will need to buffer for a longer period of dependence as compared to someone with a child already in university.

2. I am planning to switch jobs

If you are contemplating a mid-career switch, ensure you have sufficient financial resources if your job hunt takes longer than expected.

Market uncertainties, a recession, or simply trying to secure a suitable job fit might inadvertently prolong your job search.

What is your desired lifestyle between jobs?

Are you going to live differently than when you are still on a full paycheck? If you do not plan to make any adjustments to your existing lifestyle, remember to reflect this in your budgeting.

Will you incur extra expenses?

Do you plan to take a course, pick up a new a skill, or travel while you are off work? Given these costs are on top of your regular expenses, you need to set aside extra funds to do so.

3. I am a freelancer

Being a freelancer means your income stream can be variable, seasonal, and even unpredictable at times.

Examples include artists who get paid when a job is booked or a piece gets sold, or a salesperson who may face lull periods from time to time depending on market demand.

For freelancers, the recommended guideline for emergency savings is at least 12 months. When calculating your financial position and cashflows, remember to make provisions for setting aside Central Provident Fund (CPF) contributions for your future.

Medisave contributions

Mandatory Medisave contributions are required for self-employed persons who earn an annual net trade income of more than $6,000.

CPF contributions

Salaried employees have mandatory CPF contributions made by themselves and their employers. As a freelancer, you may also consider making voluntary cash contributions to your CPF Ordinary Account (OA) or Special Account (SA) to grow your nest egg for retirement.

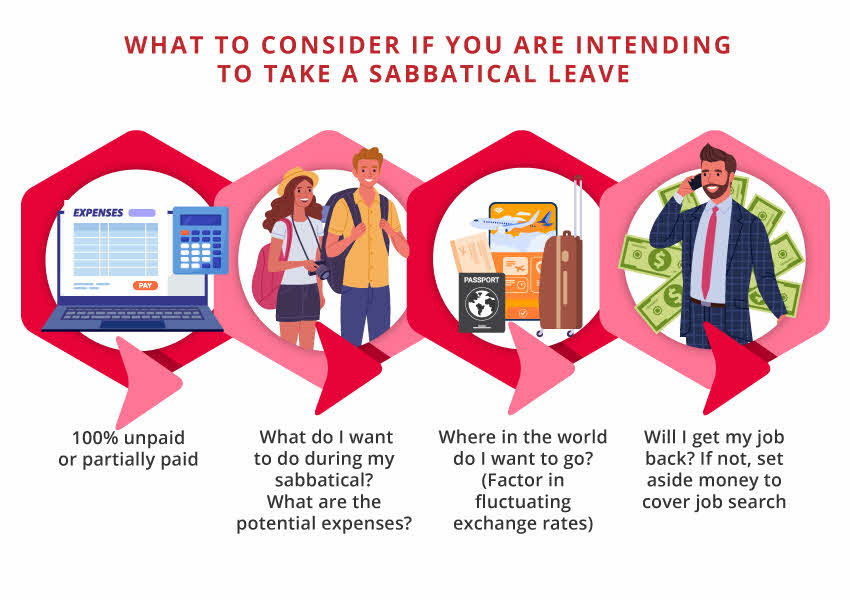

4. I want to take a sabbatical

At some point in your career, you might want to take a sabbatical to recharge or explore other ventures.

As sabbaticals tend to be planned ahead of time, you can calculate the amount of savings you need to set aside, and even grow these savings before taking your break.

The length of your sabbatical along with how much paid or unpaid leave you wish to take, will impact your cashflows as well.

What will you do during your sabbatical?

Activities that you plan for during your sabbatical will affect how much you’ll need to set aside. If you are planning to explore hobbies that can earn you some income, it will provide you some financial relief.

On the other hand, if you plan to pursue further studies or embark on a specialised course, it will likely translate to higher expenses than normally planned for.

Will you be overseas?

If long-term travel is on the cards, take note of the strength of the Singapore Dollar against the currency used in the places you plan to visit.

Consider doing a currency exchange first if the currency is in your favour and growing the funds in a foreign currency fixed deposit until your intended travel dates.

Do you have a guaranteed job to return to?

If your current employer has made provisions for your sabbatical, like guaranteeing your employment after your break, then good on you!

If you plan to look for a new job after your break, you must set aside enough savings to cover your job search period, in addition to your sabbatical.

What next?

Having a robust financial plan gives you a greater peace of mind. Begin with an overview of your financial data by using the digital financial advisory tool in digibank. It provides a holistic view of your assets, liabilities, and overall financial wellness.

Most financial plans assume an inflation rate of 3% when projecting future income flows to determine retirement adequacy. When planning for yourself, do remember to account for higher costs of living by assuming different inflation scenarios of 3%, 4% or 5%.

Once you have done that, work out how these different rates impact your future cash flows and retirement planning to prevent inflation from eroding the value of your money.

Besides common expenses like utilities, groceries, parents’, and children’s allowances, it is important to account for funds that will be locked up or have to be set aside for regular payments like insurance premiums, investment commitments, taxes, mortgage, and other debt repayments.

Read more: Let’s get better at money: Beyond budgeting

Find out more about: digiWealth

Insurance policy premiums

Most insurance policies are paid annually and can be easy to miss out in your monthly budgeting. It is vital to budget for your insurance premiums so that you have enough funds to pay for them and not risk your policies lapsing.

Investment commitments

Any locked-in investment commitments like regular savings plans (RSPs) should be accounted for in planning your budget as these are funds that you are setting aside and not for spending.

Taxes

Make provisions for income tax, property tax, and road tax (if you own a car) in your planning.

Debt repayments

Home mortgage repayments, especially if you are using cash partially or fully to fund your repayments (instead of your CPF-OA).

Reducing your spending

As income is something you have less control over, the most straightforward way of increasing your savings and cashflow is to adjust some expenses downwards.

Reduce your discretionary (non-essential) expenses like entertainment and gym subscriptions and consider budget-friendly options if you do not want to cut out the expense entirely. For example, instead of having 2 or 3 entertainment subscriptions simultaneously (e.g. Netflix, Disney+, Prime), opt for one at a time and switch to another when the subscription term is up.

If you have a mortgage which is out of the lock-in period, consider refinancing or repricing your mortgage if rates are attractive, or even paying off your loan through your CPF OA to maintain extra liquidity.

When cashflow is no longer a constraint and you have idle cash, you can always opt to do a voluntary housing refund to your CPF OA.

Read more: Habits to embrace in your financial journey

In summary

Given the elevated inflation rates, more people are dealing with increased expenses and income growth that is not keeping pace with inflation. This makes it harder (but not impossible) to save. Remember to focus on the things within your control to better manage your finances.

Stress-test your financials to ensure you have enough emergency funds to meet your financial commitments during period of exigency. Reduce outstanding debts – especially those with high interest - and pay your bills in full and on time, to avoid chalking up additional debts.

When you are not in immediate need of these savings, consider placing them in high-yielding savings accounts, fixed deposits, or Singapore Savings Bonds (which are capital protected and carry no early withdrawal penalty) to earn higher interest rates.

Read more: Get more interest out of your idle cash