![]()

If you’ve only got a minute:

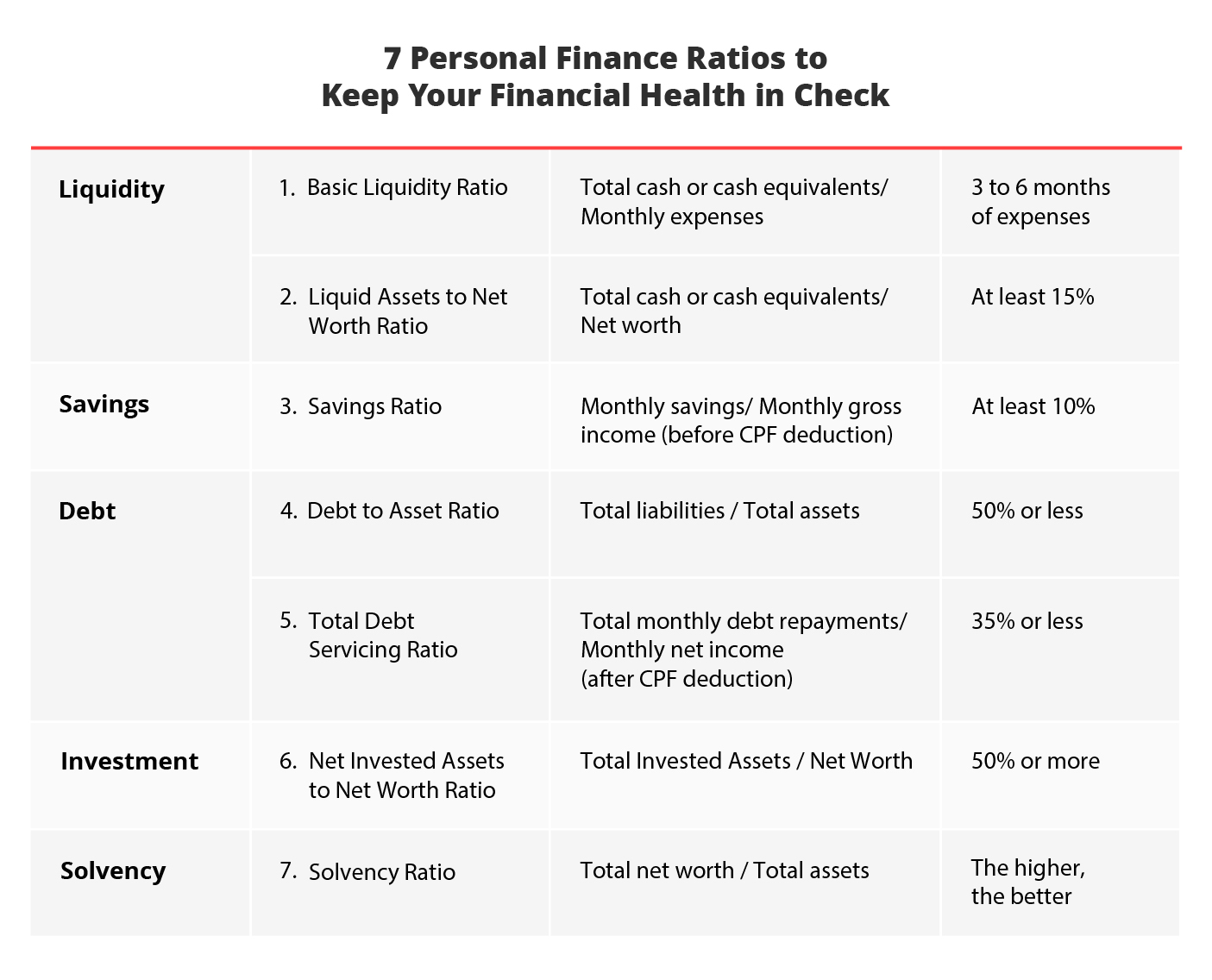

- Financial ratios aren’t limited to businesses and stocks. They can also be used to evaluate your financial health.

- Personal finance ratios can help determine your money strengths and weaknesses, identify potential pitfalls and help you make informed financial decisions for the long-term.

- Find out how these ratios can help you understand areas concerning your liquidity, debt management, savings, investments, and solvency better.

![]()

Financial ratios form an integral part of a company’s financial statement and are often useful in guiding investors in their investment decisions. However, these ratios aren’t limited to businesses and stocks.

In similar fashion, you (and I!) can utilise specific ratios to evaluate your financial health. Unlike corporate ratios, personal financial ratios are relatively easy to compute and can be used to determine your money strengths and concurrently, shed light to areas that require improvement.

Here are 7 noteworthy ratios you could use to help you identify potential financial pitfalls and make informed financial decisions for the long haul.