![]()

If you’ve only got a minute:

- The Buy-Write (also known as covered call) is an investment strategy that entails buying a security and simultaneously selling a call option against it.

- It can be used to generate extra income from equity investments.

- The CIO Barbell Income Fund is one avenue for retail investors to tap the benefits of the strategy

![]()

In investing, there is no single way or strategy to adopt to make your money work harder for you and achieve your retirement goals. Income investing has been a popular investment strategy for investors looking for a regular stream of cash flow to meet one’s needs and cushion market volatility. This has grown in prominence amidst rising inflation, as investors seek to supplement their income to meet their living needs.

In a yield-starved world, one of the ways an investor can go about this is to employ a Buy-Write strategy. Employing this strategy offers an alternative means of deriving a sustainable income stream from growth equities that otherwise pay little to no dividends to complement investments in traditional fixed income and dividend-yielding stocks.

What is the Buy-Write strategy?

Buy-Write (also known as covered call) is an investment strategy that entails buying a security and simultaneously selling a call option against it. When an investor sells a call option, he or she is essentially entering into a contract with a buyer to exchange the security (e.g. stock) at a pre-determined price on or before a particular date.

Investors who engage in this strategy believe that:

- The security will not fluctuate widely in either direction

- Income can be enhanced by capturing premiums on the option

But like all things in life, investment strategies come with their own unique advantages and disadvantages.

In the case of Buy-Write strategy, an investor has to forfeit the full potential of a security’s price gain and sell it to a buyer if the option is exercised. In other words, the upside is capped. That said, the benefit of this is that the option premium (i.e. the price of the option contract) helps to enhance income generation as well as mitigate the downside in times of market volatility.

Why this strategy?

DBS Chief Investment Office (CIO) views adopting the Buy-Write strategy as a timely complement to traditional equity income strategies, which tend to be focused on investing in dividend paying stocks. Such strategies have worked well in the past when traditional companies were able to maintain their ability to generate cashflow for dividend payouts.

But times have changed with two key developments in recent years. The first is the global disruption of traditional industries caused by the rise of Big Tech. Today, technology is gradually taking over every aspect of the business world and companies that fail to adapt to the new environment face existential threats. The other development is the Covid-19 pandemic, which saw economic lockdowns leading to the collapse in demand for several industries.

A common denominator in these two events is the rising investor concern surrounding dividend payments as traditional industries succumb to these headwinds. And these concerns are valid.

In an era where e-Commerce platforms have taken over the role played by departmental stores and live stadium events are gradually substituted with e-Sports, the expectation of consistent and growing dividend payments can no longer be taken for granted.

In order to generate the same income stream in the past, a more robust approach is required today, and this is where the Buy-Write strategy can come into play.

How has this strategy performed?

Given that the upside is capped to a certain extent with the Buy-Write strategy, it is commonly presumed it will underperform traditional Long Only strategies (e.g Buy and hold) over a long market cycle. But data suggests otherwise.

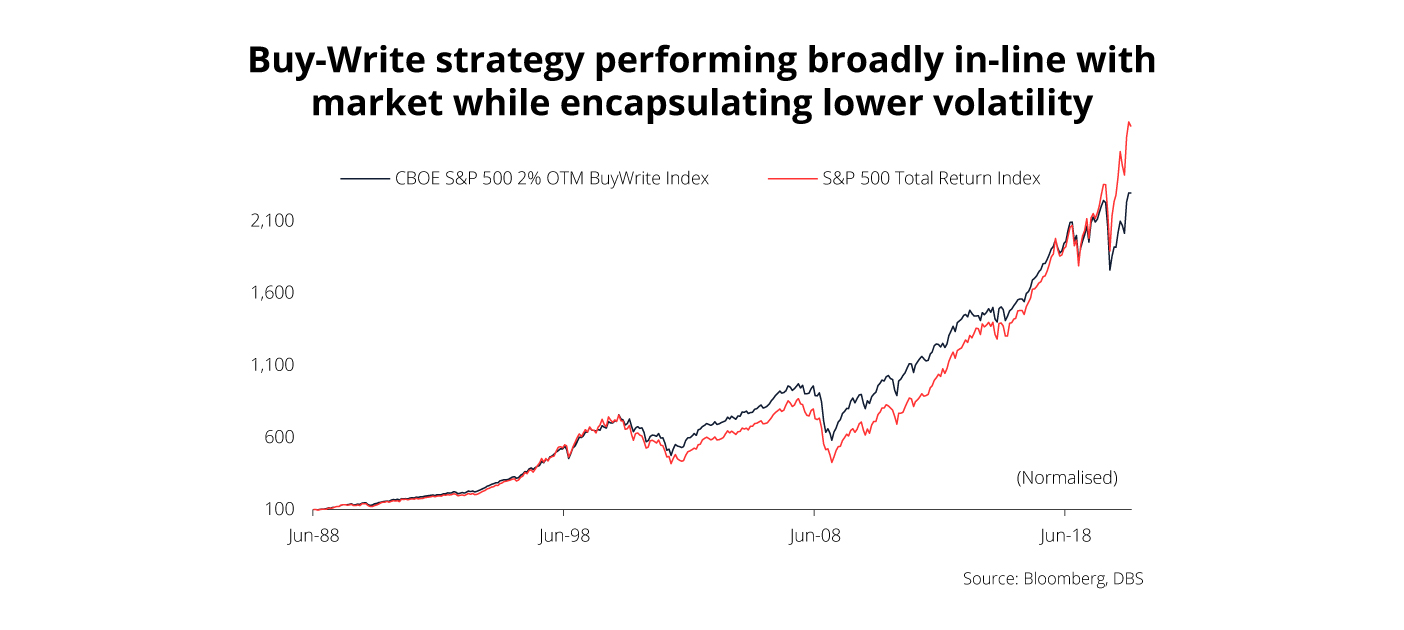

In order to understand the long-term performance of this strategy, we take a look at two indices. The first, the S&P 500 Total Return Index, tracks the total return (capital appreciation + dividend returns) of the stocks that make up the S&P 500. Meanwhile, the CBOE S&P 500 2% OTM BuyWrite Index (BXY), tracks the value of a hypothetical portfolio that overlays a short 2% out-of-the-money call on an investment in S&P 500 stocks.

Since July 1988, the BXY has registered average annualised monthly returns of 10.4%, marginally lower than the 11.3% returns registered by the S&P 500 Index on a total return basis. However, volatility for BXY is lower, and its performance relative to the amount of risk an investor is taking is better.

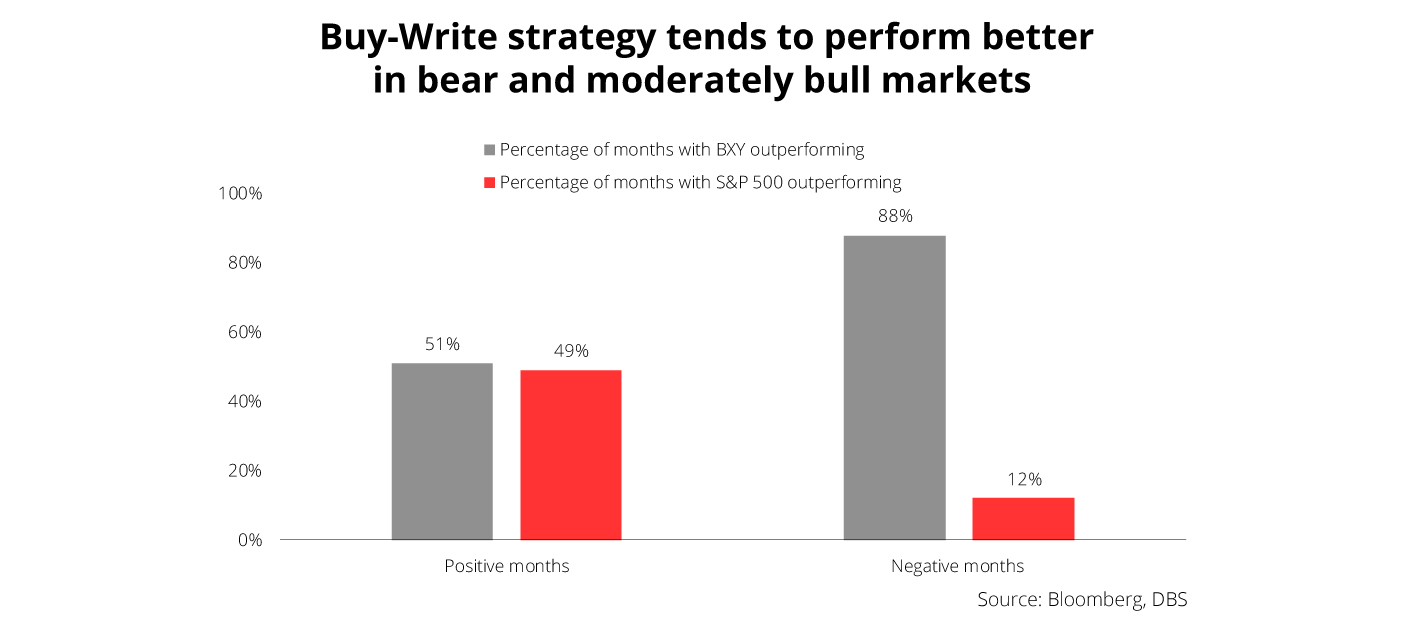

Another misconception is that the Buy-Write strategy performs better in a bear market but performs worse in a bull market. Based on months where the S&P 500 had positive returns, the S&P 500 registered higher returns during positive months, while BXY has a higher frequency of outperforming the former.

BXY’s outperformance tends to take place during months when market returns are moderate, whereas S&P 500’s outperformance tends to take place during months when market returns are stronger. During months where the S&P 500 had negative returns, BXY outperformed the S&P 500 the vast majority of the time.

These findings show that the BXY not only suffered less losses during bear markets, it also has significantly higher frequency of outperforming the S&P 500 when sentiments are negative.

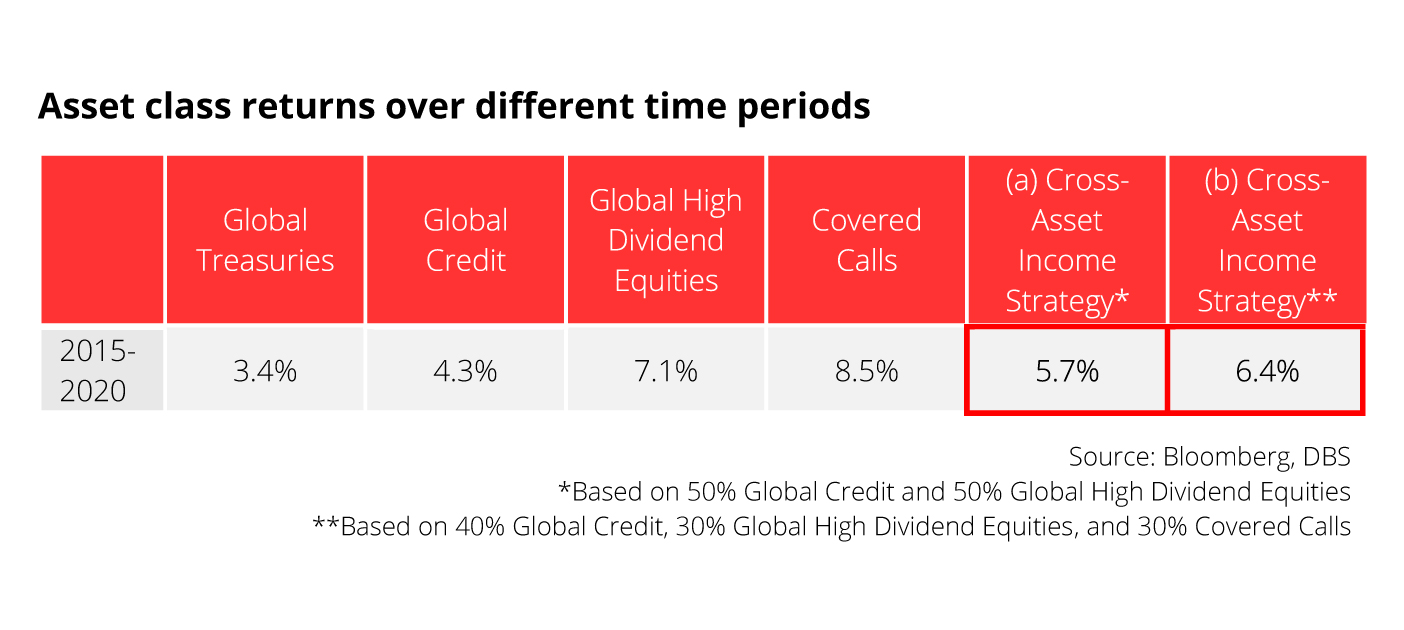

When looking at how a multi-asset income portfolio performs when a Buy-Write strategy is employed, DBS CIO analysis showed that average annualised monthly returns (2015-2020) when covered calls were included was 6.4% compared to 5.7% if they were not.

This illustrates that a multi-asset income strategy incorporating call writing will garner higher returns for investors in the present environment.

Employing the strategy without buying individual stocks

Thankfully, there are ready-made options available, often for little cash outlay.

In recent years, there are a number of exchange-traded funds (ETFs) that employ a Buy-Write strategy. This includes covered call ETFs that track the performance of the S&P 500 and NASDAQ 100 indices.

While ETFs are a convenient way for retail investors to take advantage of the strategy, they should always exercise due diligence and understand the strategy, their risk profile as well as expenses before making an investment decision.

ETFs provide an easy vehicle for investors to capitalize on this strategy, although they should carefully consider each fund’s strategy, total returns, dividend yield, risk profile and expenses before making a decision.

How it works with the DBS Barbell Strategy

In the current investment climate, DBS CIO advocates the use of the Barbell Strategy to investment portfolio construction, where investors achieve a balance between risk and reward by investing in assets at both ends of the risk spectrum. They often avoid holding assets that would make up the middle of the spectrum.

Barbell strategy-influenced investment portfolios can be made up of only stocks, only bonds or a combination of both asset classes along with alternative investments like Gold.

Covered calls are simply employed as part of the Barbell Strategy. It is that simple!