By Navin Sregantan

![]()

If you’ve only got a minute:

- Hedge funds employ investment strategies that go beyond just managing a portfolio of stocks and bonds. The strategies include the use of short selling, leverage, and derivatives.

- Hedge fund ETFs offer retail investors the opportunity to gain exposure to an asset class usually reserved for institutional and high net worth investors.

- As with all investments, it is important to do your due diligence by understanding the risks involved as well as building up your knowledge of hedge fund strategies.

![]()

Hedge funds are managed investments where investor funds are pooled together to purchase financial instruments in accordance with an investment mandate or strategy.

On the surface, they sound like unit trusts and exchange-traded funds (ETFs), right? But that’s where their similarities end.

What is a hedge fund?

Unlike conventional investment instruments which invest mostly in a portfolio of stocks and/or bonds, hedge funds often employ strategies that use a variety of sophisticated strategies to deliver better than market average returns for investors.

These complex strategies – usually in relatively illiquid assets – include the use short selling, leverage, and derivatives (e.g futures, options), among others.

Furthermore, the use of complex strategies is why these funds typically charge higher fees. While fee structures may vary by factors like the type of hedge fund strategy used, they typically charge a 2% annual management fee as well as 20% in fees for profits. This is known as the 2/20 model.

Investing directly in hedge funds is also limited to institutional investors and high net worth individuals. This contrasts with unit trusts and ETFs, which are regulated investments that are available to retail investors.

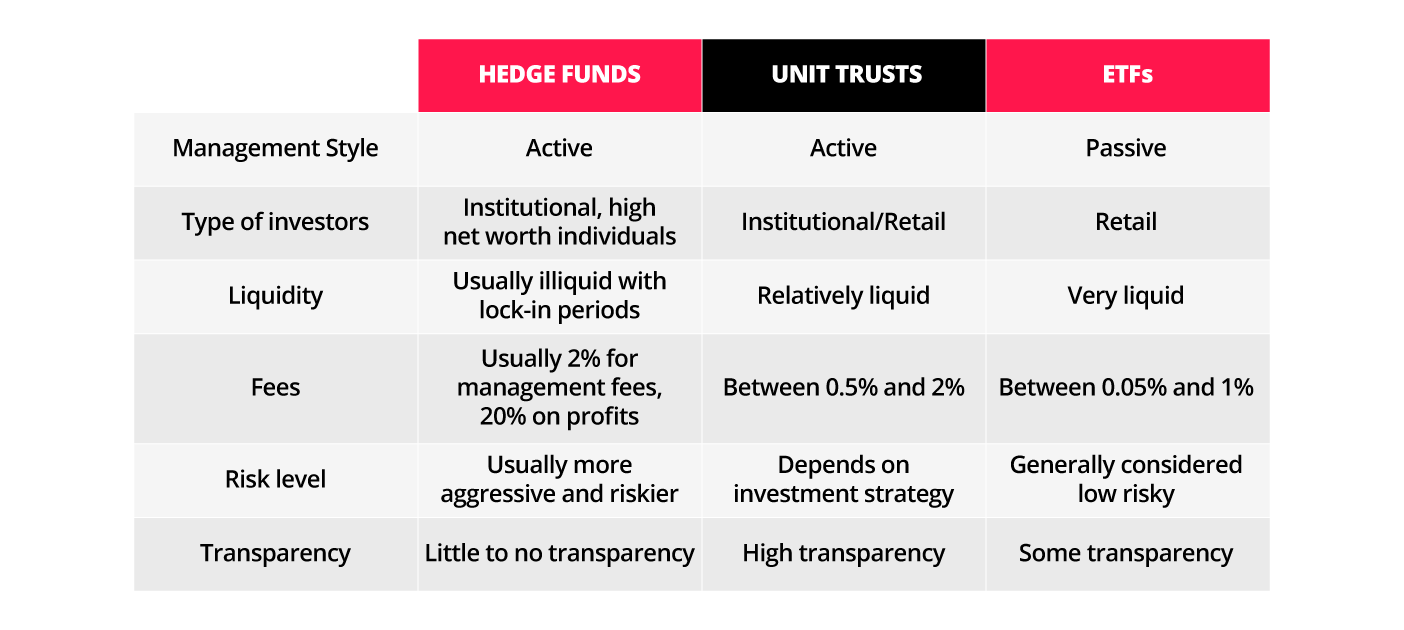

Hedge funds vs unit trusts vs ETFs

Source: DBS Bank

Hedge funds as part of an investment portfolio

Due to their use of sophisticated strategies that include the use of short selling, leverage, and derivatives, hedge funds are considered alternative investments.

In balanced investment portfolios, alternative investments tend not to make up more than 15% of the total portfolio. Of this, most of the allocation to alternatives is invested in gold with the rest in hedge funds.

As such, those who can invest in hedge funds often do not have a large proportion of their investable funds in it. That said, the proportion invested in hedge funds tends to rise, the more aggressive a portfolio.

Hedge fund strategies

There are a variety of strategies that hedge funds use to produce returns for investors that beat the market average.

For example, there are hedge funds that only go long or short on equities and others that concentrate on leveraging investment opportunities when 2 or more companies merge.

These strategies can focus solely on commodities, real estate, derivatives, or currencies.

A hedge fund manager oversees the buying and selling of fund investments and can utilise one or more hedge fund strategies.

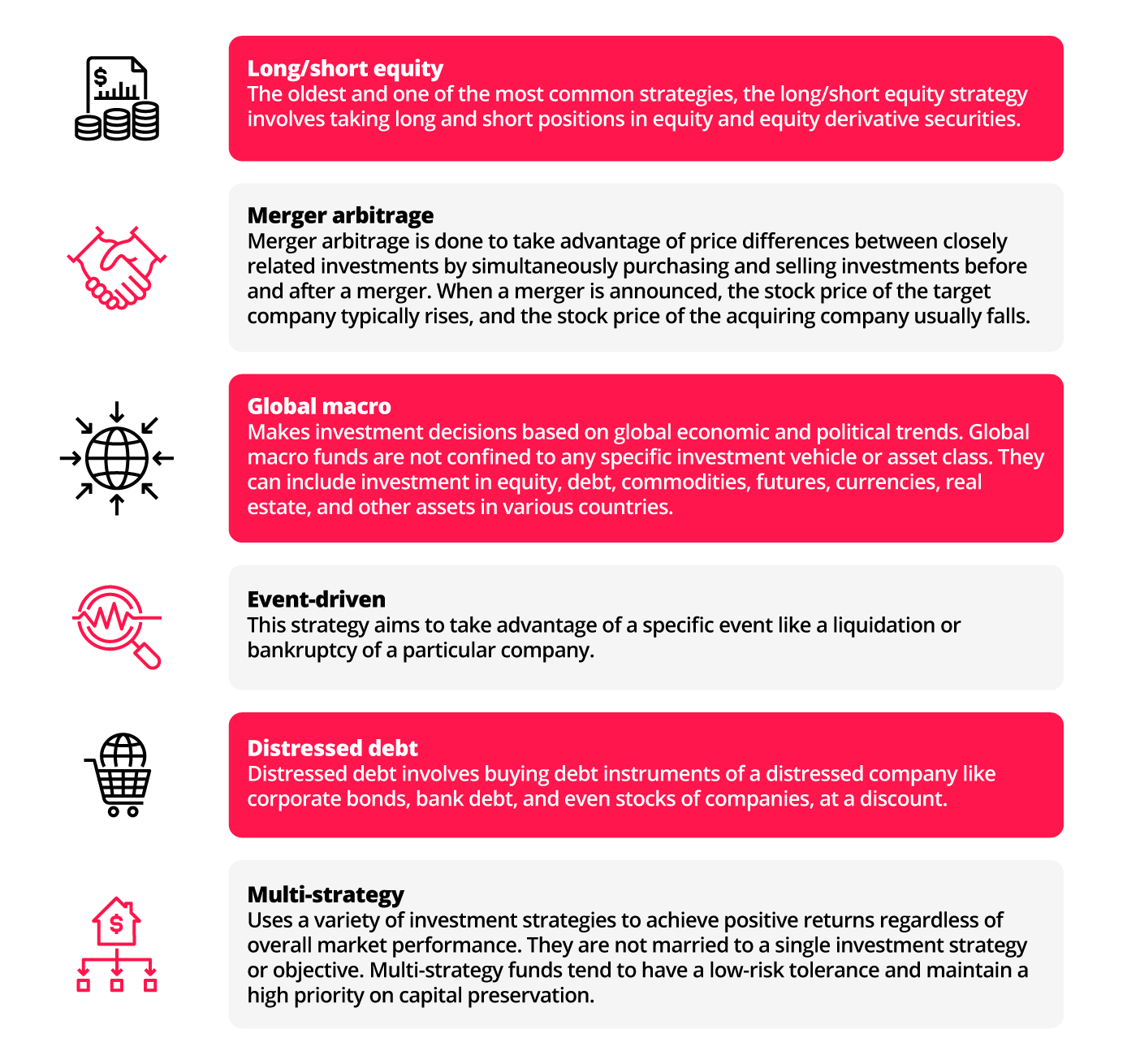

Some common hedge fund strategies include:

Can retail investors invest in hedge funds?

Even though investing directly in hedge funds is limited to institutional investors and high net worth individuals, there are now ETFs that aim to mimic such investment strategies.

In other words, hedge funds are now more accessible to retail investors who want to gain exposure to this alternative asset class.

Hedge fund ETFs aim to replicate the trading activity and investment strategy of a hedge fund to creating returns similar to those of investors of a regular hedge fund.

This can be done in 2 ways:

Indexing

Like traditional ETFs, a hedge fund ETF can also track the performance of a particular hedge fund benchmark. Hedge fund ETFs that follow this strategy do not aim to beat the benchmark but provide similar returns.

Directly mirroring hedge funds

As hedge funds publish reports on their holdings, ETF managers can replicate investment or trading decisions undertaken by a particular hedge fund.

It is especially important for retail investors to do their due diligence when considering whether to add hedge fund ETFs to their investment portfolio as hedge fund strategies come with their own unique set of pros and cons.

Pros of hedge fund ETFs

Hedge funds often require high minimum investment sums but with an ETF, it is possible to gain exposure to hedge funds for much less.

As such, hedge fund ETFs make it possible for a wider number of investors to realise gains from hedge fund strategies.

Given hedge funds are riskier investments than financial instruments using traditional strategies, there is the possibility of generating better-than-average returns for your portfolio.

The other upside of hedge fund ETFs is the potential to generate above-average returns in your portfolio if those strategies pay off.

You can find hedge fund ETFs offered through online brokerages, including DBS Vickers.

Cons of hedge fund ETFs

While there is the potential for the hedge fund strategies you invest in to record large gains, hedge fund ETFs are riskier and price movements could be more volatile compared to traditional index ETFs or unit trusts. This also means that your losses could be greater if the hedge fund strategy the ETF invests in does not work out.

As such, it is prudent to limit the portion of your portfolio allocated to hedge fund ETFs.

Compared to traditional index ETFs, hedge fund ETFs do cost more. Much of the reason behind this is that hedge funds have active management strategies, which in turn, results in hedge fund ETFs having more active management than traditional index ETFs.

In summary

Hedge funds employ investment strategies that include the use of short selling, leverage, and derivatives. This is why they are often limited to institutional investors and high net worth individuals.

Hedge fund ETFs can be an investment alternative for retail investors to consider.

When selecting which hedge fund ETFs to invest in, you should first take the time to understand the various strategies that hedge funds employ. Only then, will you be able to better considerations regarding which strategies or individual ETFs to invest in.

Also, consider the fund’s track record and performance as well as its fees to help you narrow down the list.