By Gwendoline Tan

![]()

If you’ve only got a minute:

- Investing is one of the main ways to help preserve the spending power of your savings.

- You can fund your investments using cash savings, CPF, or SRS, via a lump-sum contribution or smaller regular contributions.

- Some common investment products include equities, exchange-traded funds, unit trusts, Reits, bonds, and gold.

![]()

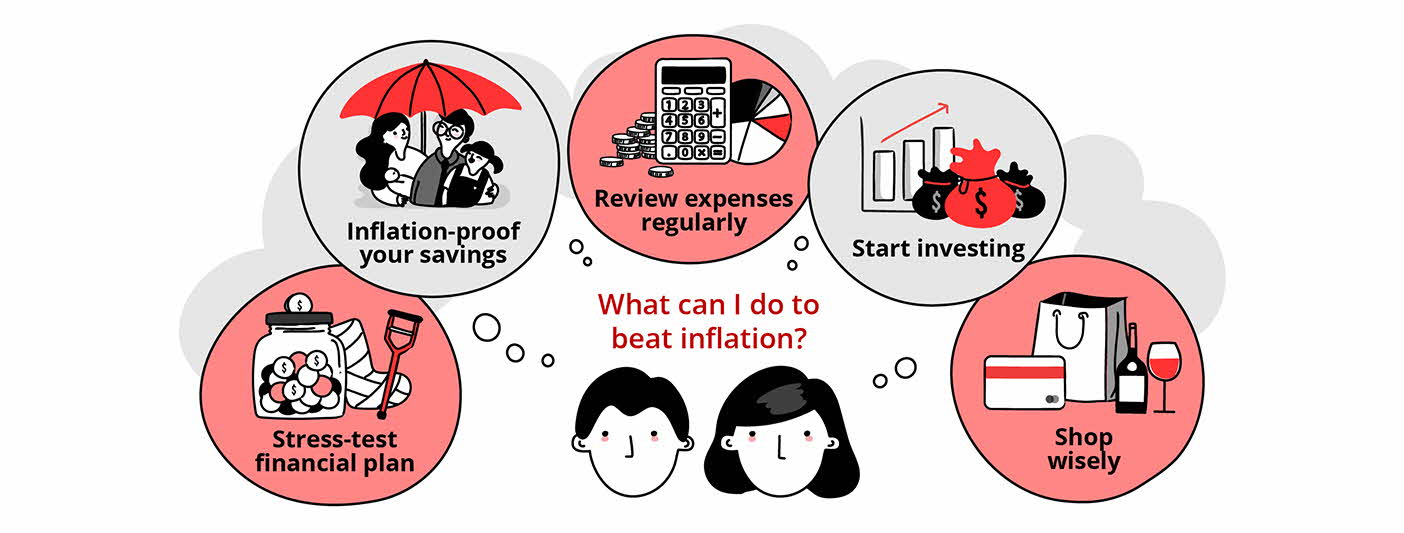

Most of us have felt the effects of inflation over the past few years. Whether in our regular grocery shopping or monthly utility bills, one thing is evident – prices have increased.

Inflation quietly but surely erodes the value of money over time. Even with a core inflation rate of around 2%, which is close to its historical average, a S$100 basket of goods today could cost more than S$120 in a decade. Case in point, simply leaving cash idle is insufficient to help us build a secure financial future.

Here’s where investing comes in. Regardless of your career path or life stage, putting your money to work can help grow your wealth steadily over time. By investing smartly, your savings can outpace inflation or at the very least, minimise its effects.

If you are new to investing, the choices and information available can feel overwhelming. So, here’s a simple introduction to common investment products, funding options, and tools to help you get started with confidence.

Remember, investing should be approached with a long-term perspective. Staying invested allows you to benefit from the power of compounding, and to ride out any short-term market volatility.

Ways to invest

There are several ways to put your money to work, whether using cash, Central Provident Fund (CPF) monies or Supplementary Retirement Scheme (SRS) savings. Deciding which method to use will depend on your financial objectives and risk appetite.

Read more: Why and how to invest CPF and SRS monies

Find out more about: CPF & SRS Investing with DBS

Lump-sum

If you have been saving up for awhile and have a sizeable amount to invest, you might consider making a series of one-time purchases in stocks, bonds, exchange-traded funds (ETFs) and unit trusts. Lump-sum investing can also be done with funds that come in on ad ad-hoc basis (e.g. your annual bonus).

Recurring investments

For those who prefer smaller contributions, you can invest a fixed amount on a regular basis (e.g. monthly) into the same investment. This approach uses dollar-cost averaging (DCA), a strategy where your money buys more units when prices are low, and fewer when prices are high, thus cushioning the impact of market volatility.

Applying DCA to diversified investment products further cushions market volatility by having your risks spread across different geographies and asset classes.

With Invest-Saver, you can start investing on repeat from as little as S$100 a month.

A hybrid approach

Together, the 2 approaches make a strong combination.

DCA helps to consistently build your investment base without you having to time the market and navigate any major fluctuations. Then, as and when market opportunities appear you can then make a tactical decision to invest a lump-sum amount.

Read more: Is lump-sum investing or DCA better for you?

Find out more about: Ride the market steadily with Invest-Saver

Common types of investments

Keeping your financial goals, risk tolerance, and investing time horizon in mind, let’s explore 5 common investments to help you build and diversify your portfolio.

1. Equities

When you buy shares of a company, you become a part owner of it. As a shareholder, you may earn dividends and capital gains if the company performs well. On the flip side, you also face the risk of losses in capital if its share price falls. In such a scenario, your losses would be limited to the amount of money you have invested.

Depending on your goals and risk appetite, you can choose between growth stocks and blue-chip stocks.

Growth stocks tend to offer higher potential returns but usually come with greater risks. On the other hand, blue-chip stocks – shares in established companies with strong track records – may offer lower returns but often pay dividends and have a more stable outlook.

Read more: Beginner’s guide to stock investing

Find out more about: DBS Vickers Online Account

The DBS Vickers Online Trading Account and Young Investor Account both let you trade in 7 key markets. Settlement and dividend crediting are done seamlessly through a linked Multi-Currency Account.

Investing in the US market is made more accessible with fractional trading, which lets you buy or sell fractions of a share. This means you can own a stake in higher-priced stocks with a smaller investment amount.

Read more: Get your slice of the pie with fractional shares

Find out more about: DBS Vickers Young Investor Account

2. Bonds

Bonds are debt instruments through which you lend money to a company or government for a fixed period. In return, you receive regular interest (coupon) payments, and your principal is repaid at maturity. The coupon amount and payment schedule are usually fixed, offering a predictable stream of income.

Read more: 8 things to know before buying bonds

If you lend money to someone, there is always a chance that the borrower might not pay you back. Similarly, different bonds carry different levels of risk depending on the issuer’s credit quality.

For example, Singapore government bonds (e.g. Singapore Savings Bonds) are considered to be safer than corporate bonds as they are backed by a government with a AAA credit rating. It is important to review the issuer’s credit rating before investing.

Bonds can be purchased either when they are first issued through an initial public offering (IPO), or later in the secondary market where previously issued bonds are bought and sold.

Read more: Investing in IPOs

3. Real estate investment trusts (Reits)

Many Singaporeans are well acquainted with the concept of investing into the property market – buy a suitable property, collect rental for the unit and capitalise on price increases by selling it off at the right time. One common barrier to this investment option is the high prices of properties.

Reits offer a practical way to invest in the property market with smaller amounts, while still earning rental income through distributions to unitholders. They are professionally managed collective investment schemes that own and operate income generating assets, such as office buildings, shopping malls, and hotels.

There is also potential for capital gains when real estate prices rise, when the Reit makes acquisitions or if the Reit is managed well. Conversely, should the real estate market take a hit, or if the Reit is poorly managed, your investment could lose its value.

Read more: What you need to know about Reits

4. Gold

Gold has historically offered good returns and is believed to be a good hedge against investment fluctuations and inflation. This is evident amid current political and geographical uncertainties, which have driven gold prices steadily higher, reaching record highs in 2025.

Since it can be tough to store heaps of physical gold, retail investors can gain exposure through gold price-tracking ETFs, unit trusts or robo-advisors.

Another way to gain exposure to gold is through gold mining companies. Ninety One GSF Global Gold Fund is an example of this as it primarily invests in gold miners around the world. This unit trust is also part of the CIO Insights Funds, a list of essential investments curated by DBS experts.

Read more: Investing in gold

Find out more about: Thematic investing with CIO Insights Funds

5. Diversified investment products

These offer you instant diversification across key markets and asset classes without the need for constant monitoring.

This way, you don’t have to spend precious time meticulously stock picking to build your own portfolio. For those who are just starting on their investment journey, it also allows you to start at a lower entry point as buying multiple individual stocks can be very costly.

Read more: Diversify to help manage investment risks

Exchange-traded funds & unit trusts

These are pooled investment instruments that give you exposure to a basket of securities rather than individual stocks.

ETFs are passively managed and aim to mirror the performance of a specific market index or a set of securities, such as the Straits Times Index (STI) for Singapore stocks, or the S&P 500 for US equities.

Unit trusts are actively managed by professional fund managers who perform detailed research before deploying funds into specific investments according to the fund’s investment mandate. Because of this active management, unit trusts generally have higher fees compared to ETFs covering the same market.

To help simplify your decision-making process, investment experts at DBS have curated an essential list of funds called CIO Insights Funds, which form a steady base for building an investment portfolio.

Read more: A beginner’s guide to unit trusts

Find out more about: CIO Insights Funds

Ready-made portfolios

Investing also differs in terms of how much control you want over your portfolio. With a DIY approach, you pick and manage investments yourself, deciding what to buy and when to adjust your holdings.

Ready-made discretionary portfolio solutions like digiPortfolio handle asset allocation and rebalancing for you in accordance with your risk profile. This is ideal for beginners or anyone with limited time, while still giving you the benefits of diversification and professional management

Find out more about: digiPortfolio

What’s next?

You’ve read the articles, figured out your financial objectives and risk profile, set aside your emergency savings, and done your research. Now it’s time to take the first step into your investment journey.

The digital investment tools within digibank offer investment picks customised to your profile. You can also use the Singapore Financial Data Exchange (SGFinDex) to get a consolidated view of your financial assets and liabilities across institutions, providing a holistic picture of your financial wellness.

If you’re still unsure, the best thing to do is to start small, and start now. It is near impossible to pick the perfect moment to enter the market, but maximising your time-in-market will help you grow your wealth steadily for the long-run.

What are you waiting for?