By Navin Sregantan & Jermaine Koh

![]()

If you’ve only got a minute:

- Backed by the Singapore Government, SGS investments are ideal for preserving capital, generating stable income, and managing short-term liquidity.

- SSBs provide flexible, step-up interest, T-bills suit short-term cash parking and SGS Bonds offer longer tenures and tradability in the secondary market.

- While crucial for stability, balance SGS with growth assets like equities to ensure long-term financial growth, outpace inflation, and meet retirement goals effectively.

![]()

Singapore Government Securities (SGS) offer safety and predictable returns, making them particularly appealing for long-term goals like retirement planning and capital preservation, especially for those with a lower risk tolerance.

Issued by the Monetary Authority of Singapore (MAS), these debt instruments are backed by the Singapore Government, which has a "AAA" credit rating. This reflects strong creditworthiness and a minimal probability of default.

While often favoured by risk-averse investors, SGS investments also play a crucial role in diversified portfolios for those seeking growth.

In recent years, there has been more interest in SGS. Between 2022 and 2023, amidst rising inflation and increasing interest rates, demand for Singapore Savings Bonds (SSBs) saw a jump, which then extended to other SGS investments like Treasury Bills (T-Bills).

This became a topic of discussion as this was the first time in many years where such competitive yields were consistently seen.

However, with interest rates now on the decline, the decision on whether to invest in SGS depends on a number of factors, such as your individual financial goals, risk appetite, and time horizon.

Types of SGS

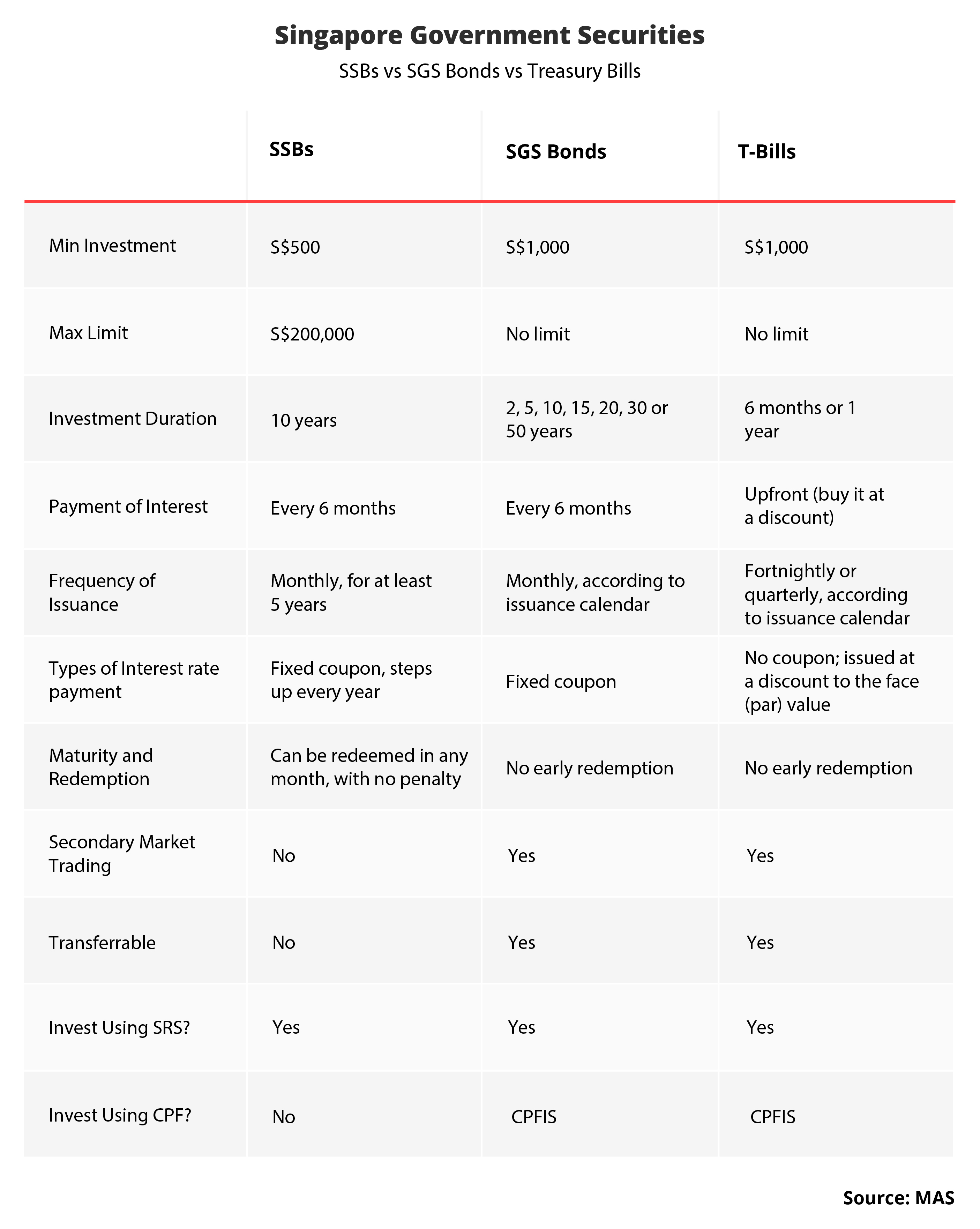

There are 3 main types of SGS available for investment. They are SSBs, T-Bills, and SGS Bonds. These offer maturities varying from 6 months to as long as 50 years.

Funds raised from these issuances are primarily used to finance specific infrastructure projects or to develop Singapore's debt markets.

Since each instrument boasts different features, the product that’s right for you will depend largely on your investment amount, time horizon, and needs.

SSBs

SSBs are 10-year government bonds that offer a unique step-up interest feature, meaning the interest rate increases annually to maturity. This interest is paid out half-yearly.

This characteristic makes SSBs particularly popular among individuals, especially retirees, who prioritise flexibility, liquidity, and a reliable stream of recurring income.

With a maximum individual holding of S$200,000, SSBs can serve as a complement to other savings and investments, providing a secure avenue for long-term savings.

The October 2025 SSB tranche offered an average 10-year interest of 1.93% per annum (p.a.), with the first year alone providing a 1.56% interest rate.

Investors can also redeem their SSBs at any time before maturity without penalty, receiving their principal along with any accrued interest.

SGS Bonds

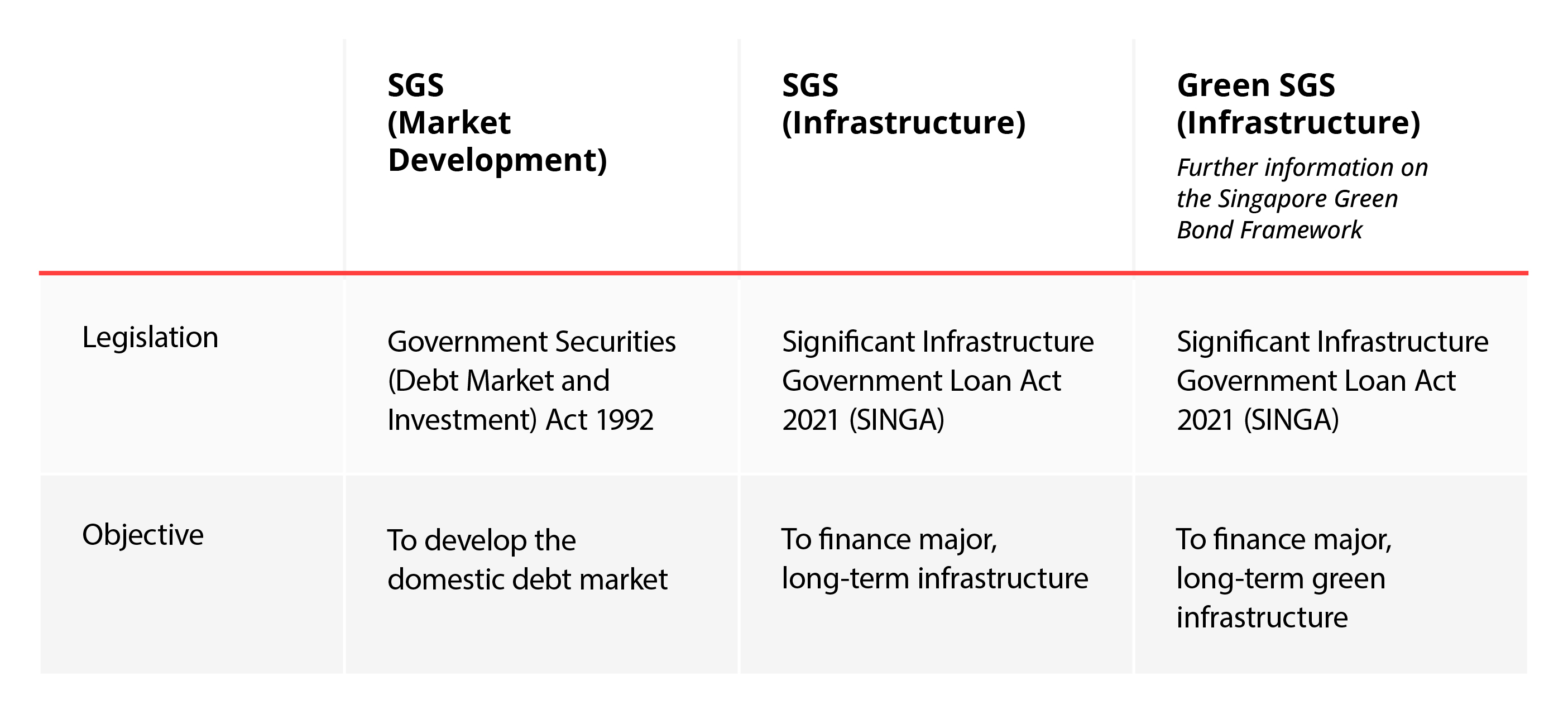

SGS Bonds are tradeable government debt securities offering fixed coupon payments every 6 months. These bonds typically feature longer tenures, ranging from 2 to 50 years. There are 3 types of SGS Bonds: SGS (Market Development), SGS (Infrastructure), and Green SGS (Infrastructure).

For example, investing S$10,000 in a 50-year Green SGS bond with a coupon rate of 3% per annum (p.a.) would mean receiving S$300 in coupon payments annually, distributed as 2 payments of S$150 each, every 6 months until the bond matures.

Unlike SSBs, SGS Bonds do not offer early redemption. Should you wish to exit your investment before maturity, you must sell the bond in the secondary market. It is crucial to understand that the price of the bond in the secondary market can fluctuate due to prevailing interest rates and market conditions.

If interest rates rise, the bond's market price may fall, potentially leading to a capital loss if sold prematurely. Therefore, liquidity and market conditions are key considerations for investors.

T-bills

T-bills are the shortest-term government securities available, typically offered with maturities of 6 months or 1 year. Unlike SSBs and SGS Bonds, T-bills are zero-coupon bonds and as such, do not pay regular coupons.

Instead, T-bills are issued at a discount to their face value. Investors receive the full face value upon maturity, with the difference between the discounted purchase price and the face value representing their return. For instance, if you invest S$10,000 in a 1-year T-bill with a 2.99% per annum yield, you would pay approximately S$9,701 upfront and receive the full S$10,000 at maturity.

T-bills are particularly useful for investors seeking very short-term investments (6 months to 1 year) with minimal investment risk. They offer an avenue to park and grow spare cash in the short term and can even be utilised as part of an emergency fund.

It's important to note that the cut-off yield for T-bills is determined by supply and demand at each auction, meaning there is no guaranteed expected yield at the point of subscription. A sudden surge in demand, for example, could result in a lower cut-off yield than anticipated.

Comparing the different types of SGS

While the various SGS investments offer a high degree of safety, their features vary significantly. Understanding these differences is crucial for selecting the instrument that best aligns with your financial objectives.

How can SGS fit into your financial plan?

SGS are undeniably valuable tools for specific financial objectives due to their high safety and predictable returns. They can play a crucial role in building a resilient financial plan, particularly for:

Capital Preservation: For funds you cannot afford to lose, such as emergency savings or money needed in the short to medium term for a down payment or major purchase, SGS offer a secure place to park your capital.

Income Generation: SSBs and SGS Bonds provide regular coupon payments, which can be particularly attractive for retirees or those seeking a stable income stream to supplement living expenses.

Diversification: Even for investors with a higher risk tolerance, including SGS in a portfolio can help reduce overall volatility and protect against market downturns, balancing out riskier growth-oriented assets.

Short-term Liquidity: T-bills offer a highly liquid option for managing short-term cash needs while earning a modest return, often better than traditional savings accounts.

Long-term Savings (SSBs & SGS Bonds): SSBs with their step-up interest and ease of redemption, and longer-tenured SGS Bonds, can be suitable for parts of your long-term savings where stability is prioritised.

However, it is vital to remember that effective financial planning hinges on a well diversified investment portfolio.

While SGS are excellent for safety and stability, an over-allocation to SGS can pose a risk to your long-term financial goals, particularly for retirement. Relying solely on low-risk, lower-return instruments means you might miss out on the higher growth potential offered by other asset classes like equities.

Over the long run, insufficient growth from a bond-heavy portfolio may lead to your investments not keeping pace with inflation or not generating enough capital to meet your retirement needs.

Therefore, SGS should be strategically integrated as part of a broader, well-diversified portfolio that balances safety with growth, aligning with your individual risk tolerance and time horizon.

In summary

SGS are invaluable tools for building a robust financial plan, offering unparalleled safety and predictable returns across various maturities.

Whether for capital preservation, stable income, or short-term liquidity, SSBs, T-bills, and SGS Bonds provide suitable options.

However, for long-term growth and combating inflation, SGS should be strategically integrated as one component within a broader, diversified portfolio that also includes growth-oriented assets like equities.

Aligning these investments with your individual risk tolerance and time horizon is crucial for achieving your financial objectives.