By Navin Sregantan

![]()

If you’ve only got a minute:

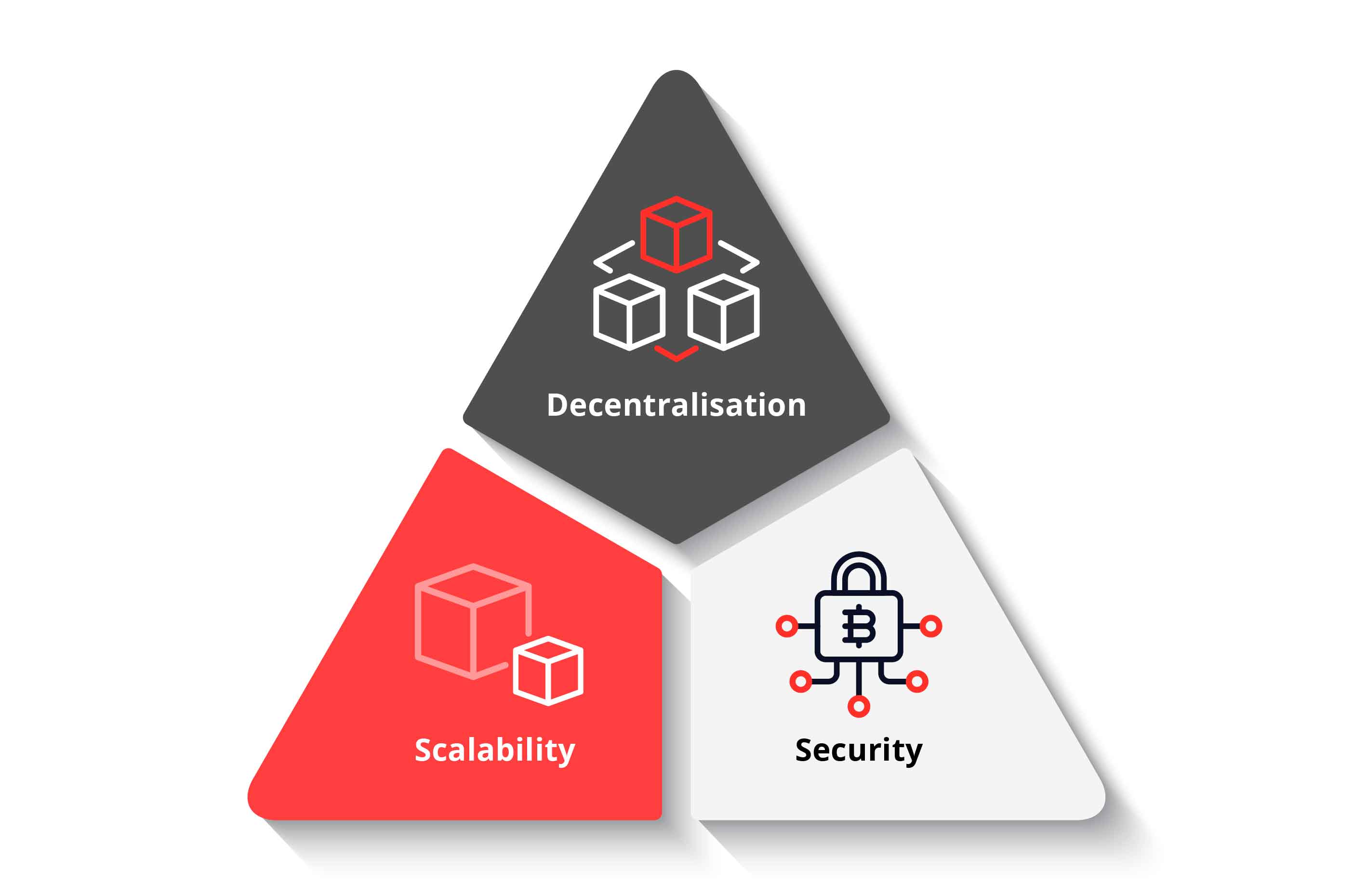

- The Blockchain Trilemma refers to the trade-off between 3 critical aspects of blockchain technology: Security, scalability, and decentralisation.

- Bitcoin and Ethereum run on blockchain networks that prioritise decentralisation and security, but this poses challenges to scalability.

- While it is generally accepted that a public blockchain can only truly achieve 2 of the 3 benefits at any given time, there are efforts to overcome this hurdle.

![]()

Cryptocurrencies may have come off the highs of 2021, but they continue to draw strong interest from both retail and institutional investors despite high levels of price volatility and concerns of risk of loss of cryptocurrency to hacks.

Read more: Beginner’s guide to cryptocurrency

Nonetheless, cryptocurrencies like Bitcoin and Ethereum are mediums of exchange like the US dollar and Singapore dollar but unlike their fiat currency counterparts, requires the use of a blockchain.

A blockchain is a distributed ledger supported by a decentralised network of computers all over the world, which records economic transactions and addresses.

This means multiple copies are maintained across the network and they must all match for it to be valid, making it difficult for a malicious actor to try changing a record within the blockchain.

The popularity of cryptocurrencies has also led some to consider it an alternative asset class. That said, this is a topic that continues to be debated among investment professionals.

However, in order for blockchain technology to be more accepted, it has to be capable of handling more data and at faster speeds while not becoming too slow or expensive to use.

What is the Blockchain Trilemma?

The “Blockchain Trilemma” is one of the larger hurdles for cryptocurrency to achieve mass adoption. It refers to the challenge that confronts a blockchain to achieve optimal levels decentralisation, security, and scalability, simultaneously.

In other words, this means that blockchain developers often have to make trade-offs between decentralisation, security, and scalability. It is generally accepted that a public blockchain can only truly achieve 2 of the 3 benefits at any given time.

Deciding on what to prioritise is the most important decision a blockchain builder has to make. This is why a good understanding of the “Blockchain Trilemma” allows a greater appreciation of the unique value proposition that each blockchain has chosen to anchor in.

Decentralisation

Blockchain networks are decentralised by nature, which means that no one individual or organisation is in control of it.

There is a spectrum of how decentralised blockchain networks are. This is dependent on factors like the number of miners/validators, number of full nodes (participants), node geographical distribution, diversity of node clients and size of active developers base working on code improvement proposals.

Why is it important?

Decentralisation is central to blockchain technology. It acts as a safeguard against control or censorship of blockchain by any one entity or entities acting in concert.

Trade-offs

When a blockchain network involves large number of participants, we can expect any consensus on transactions or upgrades to the blockchain to take time (sacrificing scalability).

Security

Security is the ability of a blockchain to be resistant to tampering by bad actors.

In a centralised system (i.e. one where a single authority has control), security of records is ensured by gatekeeping the access to the system. This easily prevents the problem of double spending (i.e. the risk of being used twice or more) of the same cryptocurrency.

In a decentralised system, avoiding or limiting double spending requires a combination of cryptography and consensus mechanisms for all participants (nodes) to follow the same protocol and arrive at the same state of a ledger without any central coordination.

An example of a consensus mechanism is Bitcoin’s Proof-of-Work (PoW). This is a process where miners are required to expend effort/energy to solve for a mathematical puzzle before they could append a block of validated transactions to the chain.

A bad actor who wants to reverse transactions made by himself/herself or to prevent some transactions from being included in a previously confirmed block would need to garner 51% of the total hash power (i.e., total computing power to solve the mathematical puzzle) and re-expand the energy used up till that point to change the records.

Meanwhile, Ethereum uses a Proof-of-Stake (PoS) consensus mechanism which requires Ethereum validators to put up 32 Ether onto a staking contract in the blockchain before they have a chance to propose the next block to the chain and earn staking rewards.

When a validator fails to act honestly, he/she faces the risk of having the stake slashed by the blockchain protocol.

Reaching consensus means that at least 66% of the nodes on the network agree on the state of the ledger.

Why is it important?

A good blockchain network should be able to resist attacks from malicious entities.

A secure blockchain ensures blockchain records are immutable and it is extremely difficult for a bad entity to defraud the chain by accumulating adequate hash power or stake.

Trade-offs

While increasing hash power in mining under PoW consensus mechanism improves the security of a network, it also increases the cost of mining and may force smaller, less efficient mining set-ups to exit. This has the inadvertent effect of leading to a centralisation of miners, sacrificing decentralisation.

Scalability

Scalability refers to a blockchain’s capability to support high transactional volumes without suffering a degradation on its performance as adoption increases.

Degradation typically leads to 2 key consequences:

- Transactions take a longer time to be confirmed/settled on the blockchain.

- Network participants pay increased fees to get their transactions prioritised ahead of others.

Throughput is the measure of how many transactions a blockchain network can process in a given time, typically 1 second i.e., transactions per second (TPS). Finality refers to the point where a transaction once confirmed and added to the blockchain, becomes irreversible/immutable.

Why is it important?

If blockchain technology is to fulfil its promise and has any chance in challenging and replacing the existing centralised platforms, its performance would at least have to match or be able to handle increased loads that comes with more widespread adoption.

At present, the throughput Bitcoin and Ethereum blockchain networks pale in comparison with global payment networks like Visa and Mastercard. For example, Visa was able to support 24,000 TPS in 2017.

Trade-offs

One way to increase a network’s processing speed and scalability is to reduce the number of network validators vetting the transactions. However, this goes against the ethos of decentralisation and reduces the censorship resistance of the blockchain.

Another way is to reduce the block time which requires the lowering of the consensus protocol’s difficulty. In this case of Bitcoin, this means reducing (e.g., reducing mining difficulty for Bitcoin, lowering the required 66% consensus on the network for Ethereum) which compromises security.

How trade-offs come into play

Bitcoin

Bitcoin is a highly decentralised blockchain network that uses a PoW consensus. While this ensures a high level of security, its design makes scalability challenging to achieve.

In 2017, Bitcoin Cash was created by splitting a new blockchain off from the Bitcoin blockchain in a process called forking. The idea behind this was with the intention to solve Bitcoin’s scalability issue by increasing the block size.

While Bitcoin Cash succeeded in increasing the TPS and tend to have lower transaction fees, it came at a cost. The larger blocks entail a more complex mining process which could only be handled by miners with more computing resources. This increase in miner centralisation lowers the security level of the blockchain.

Ripple

Ripple is a blockchain platform designed for financial institutions, offering fast and efficient cross-border payments. However, Ripple’s network is more centralised than other blockchain networks, making it more susceptible to censorship control.

Ripple tackles the scalability problem by adopting a different consensus mechanism. Unlike Bitcoin or Ethereum, Ripple’s blockchain has a much shorter list of validators that provides transaction verification and confirmation.

For this reason, Ripple is generally viewed as less decentralised that Bitcoin and Ethereum.

What does the future hold?

Even though there is currently no perfect solution to the “Blockchain Trilemma,” developers have come up with a number of innovative solutions though these are still at their infancy.

These solutions can be broadly divided into Layer-1 and Layer-2 solutions.

The fundamental difference between them is that a Layer-1 solution seeks to change the fundamental design of the underlying blockchain network.

On the other hand, Layer-2 solutions are intended to be built on top of an existing network structure or underlying blockchain network.

Layer-1 solutions

A common example explored by Ethereum is sharding. This involves splitting a blockchain into smaller blockchains – called shards – to manage specific data.

Each shard performs its own transactions with main chain handling interactions between these shards.

Layer-2 solutions

Overall, the idea of Layer-2 solutions is to borrow the processing capacity of these off-chains build onto the main blockchain. It’s set up in a way that assets can flow freely between the 2. The processed transactions are then summarised and transmitted back to the main chain.

For example, the Lightning Network is a Layer-2 to Bitcoin while Arbitrum and Optimism are the Layer-2s to Ethereum.

In summary

Given that decentralisation and security are fundamental to blockchain, most of the blockchains built have focused on these aspects ahead of scalability.

As such, a key challenge is how all 3 benefits of a blockchain can be adequately addressed without compromising the other 2 aspects.

With many developers seeking to solve the scalability issue with many innovative solutions that are still at their infancy, we would have to keep an eye on this technological progress as it stands in the way of blockchain realising its full potential.