![]()

If you’ve only got a minute:

- HDB flats are priced lower than condos, making them a more affordable option for homebuyers who are on a budget.

- HDB flats are also eligible for government subsidies, such as the Housing Grant and the Central Provident Fund (CPF) Housing Grant, which can help to reduce the cost of the flat further.

- Condos typically offer more facilities and amenities than HDB flats, such as swimming pools, gyms, and security services, however, these amenities come with a cost, therefore, resulting in higher maintenance fees.

- When choosing between an HDB flat or a condo, location is an important factor to consider as it can affect the resale value.

![]()

Singapore has one of the highest percentage of homeownership in the world. Over 80% of Singapore residents live in HDB flats as they are generally more affordable due to government subsidies like the CPF Housing Grants.

In comparison, condominiums (condos for short) typically offer more amenities and luxury features such as gyms and enhanced security, but comes at a higher price point.

Here are 4 essential questions you should ask yourself before deciding on whether you should purchase a condo or an HDB flat.

1. What is your long-term goal?

Buying a home is a long term commitment so it is crucial to know your goals and how long you're willing to work towards them.

For instance, you might begin with an HDB flat as your first home based on your current financial situation/affordability but have plans to upgrade to a condo in the next 5 to 10 years.

Do ensure that you're financially stable and that the property aligns with your budget by taking into account potential future expenses such as maintenance, renovations, and property taxes.

Carefully assess your individual circumstances, preferences, and long-term goals before making a decision about buying a home. This will help ensure that your choice of property type is aligned with your vision for the future.

2. What are the rules of engagement?

It's important to know the current regulations that govern your eligibility to purchase either a HDB flat or a private condo, and the extra costs that you may be subjected to.

Minimum Occupancy Period (MOP) for new HDB Build-to-Order (BTO) flats

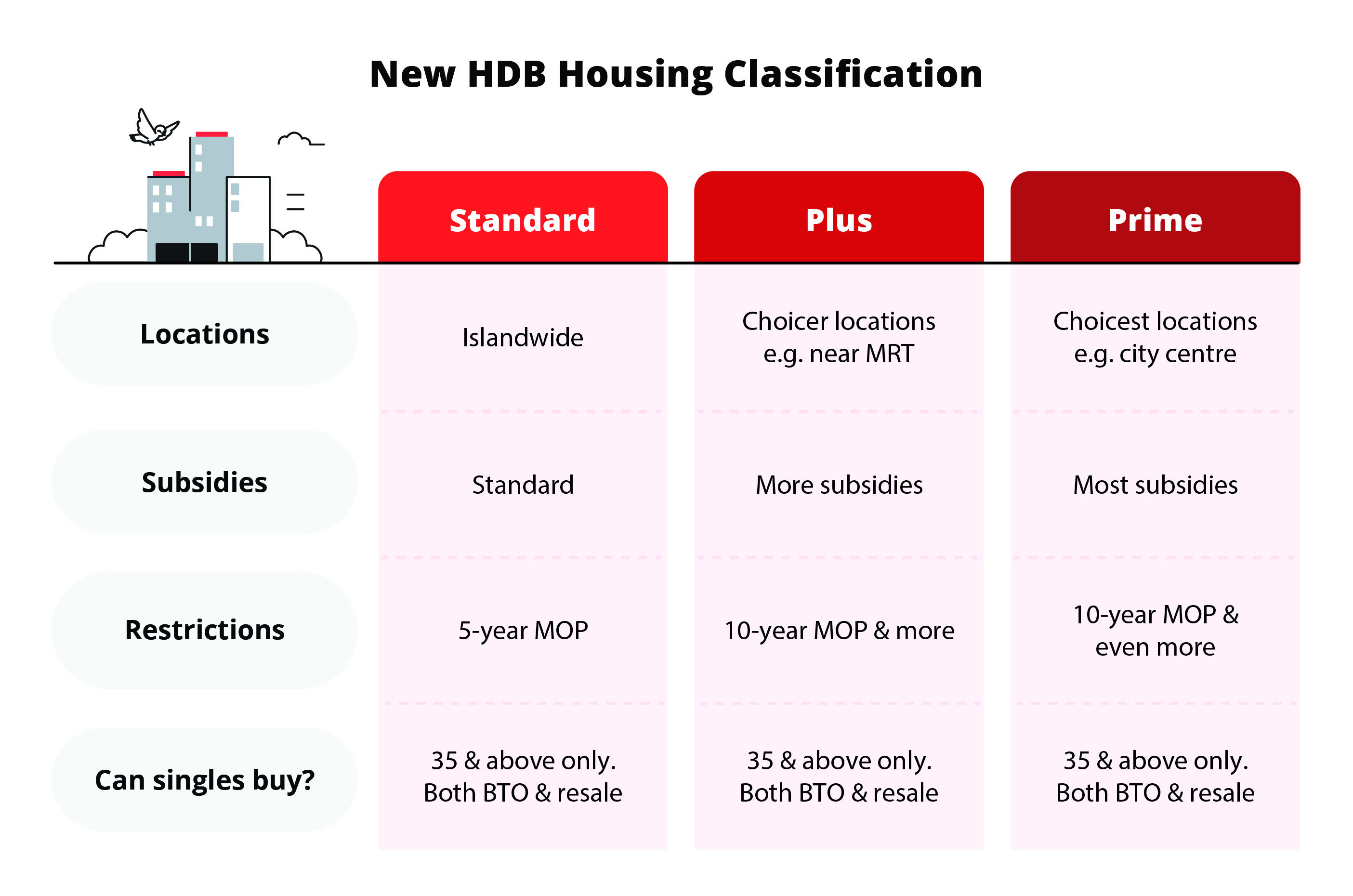

The new classification of HDB BTO flats introduces 3 distinct categories: Standard, Plus and Prime - set to take effect from 2H2024.

For Plus and Prime flats, the MOP is twice as long and owners will need to occupy their flats for minimally 10 years before they can sell their flats in the open market.

For Plus and Prime flats, the MOP is twice as long (10 years) and owners will need to occupy their flats for minimally 10 years before they can sell their flats in the open market.

The idea behind this model is meant to discourage property speculation and encourage long-term investment as prime location properties are often higher in demand, and their prices can appreciate rapidly. There will also be tighter restrictions on resale and renting compared to Standard flats.

As for private housing, there are no such restrictions except that you will be subjected to Seller’s Stamp duty which ranges from 4% to 12% of the actual price or market value of the property if you sell it within 3 years from the date of purchase/acquisition.

In other words, should the market present a good opportunity to sell at a good price, it is not possible to do so for a HDB flat that is still within the MOP.

Stamp Duties

To reduce excessive speculation, the Singapore government has enacted measures which may affect your decision between a HDB flat and a private condo. Regardless of your citizenship or residency, you are required to pay a buyer’s stamp duty.

Buyer's stamp duty is payable on the acceptance of an option to purchase agreement or sale and purchase agreement. Previously, buyers of residential properties paid a 1 to 3 % stamp duty that was tiered.

On 14th Feb 2023, the government has announced that it will increase the top marginal Buyer's Stamp Duty (BSD) rates for residential and non-residential properties to make the BSD regime more progressive. The new rates will apply to properties purchased on or after 15 Feb 2023.

For residential properties, the portion of the property's value above $1.5 million and up to $3 million will now be taxed at 5%, while anything above $3 million will be taxed at 6%. This is an increase from the previous rate of 4%.

For non-residential properties, the portion of the property's value above $1 million and up to $1.5 million will be taxed at 4%, while anything above $1.5 million will be taxed at 5%. This is an increase from the previous rate of 3%.

There is also an additional buyer’s stamp duty (ABSD) that varies with your status. For Singapore Citizens, ABSD is not levied on your first property purchase. However, should you purchase subsequent properties, you are subjected to 20% for the 2nd property and higher ABSD (30% for 3rd and subsequent property) thereafter.

What about minimum down payments and loan financing?

If you are buying a HDB flat, you have the option of financing it with either a HDB concessionary loan or a bank loan. If you go with a bank loan at the point of purchase, you will not be eligible to switch to a HDB loan subsequently.

Effective 20 Aug 2024, the loan-to-value (LTV) limit for HDB housing loans was reduced from 80% to 75%. This change lowers your maximum borrowing amount and aligns HDB loans with the existing 75% limit for bank loans.

Put simply, you can now only borrow up to 75% of the flat’s value (HDB loan), down from the previous 80% limit. The 25% downpayment can be paid fully using your CPFOA, with cash, or a combination of both.

For bank loan, you will still have to pay 25% of your flat (purchase price), of which 5% is payable in cash while the remaining 20% can be paid with cash and/or CPF savings.

Another point to consider is the interest rate. The interest rate on the HDB loan is pegged at 0.1% above the prevailing CPF-OA rate. This has been unchanged at 2.6% for some time.

For bank loans, the interest rate can be fixed for a few years and then they can adjust according to market conditions.

Usage of CPF monies

Other than the downpayment, you will also need to consider how you plan to service the mortgage.

The good news is that you can tap on your CPF Ordinary Account (OA). But note there are restrictions on how much of your cash flow can go towards servicing your mortgage.

The Total Debt Service Ratio (TDSR) was introduced by the Singapore Government in 2013 as part of property cooling measures. There is also the Mortgage Service Ratio (MSR).

What is Total Debt Servicing Ratio (TDSR)?

The TDSR sets a cap on how much loan you can borrow by ensuring your monthly debt repayments and other financial obligations do not exceed 55% of your gross monthly income which includes:

Its purpose is to make sure you don't take on more debt than you can manage, and to encourage responsible lending by financial institutions.

Do note that the interest rate – based on a medium-term rate of 4.65% - used to calculate your monthly debt obligations is not the prevailing interest rate but a reference rate set by the Singapore authorities. The rationale behind this is so you can service the loans even if interest rate rises in the future.

Your total gross income used to assess the TDSR can also be affected:

This means that if you are prudent and have fully repaid assets, or have cash built up but do not wish to commit to your HDB or private condo down-payment, they can be used to boost your income used for calculation.

If you fail to meet the requirements of the TDSR, you may have to borrow less and increase the down-payment.

What is Mortgage Service Ratio (MSR)?

Mortgage Service Ratio (MSR) is the proportion of your monthly gross income that is spent on mortgage repayment. This includes debt obligation secured by properties. The current limit is 30%.

MSR is applicable to:

The main difference between the MSR and TDSR is that the former mainly affects HDB and EC purchases, and considers the mortgage loan you are applying for.

It does not affect your outstanding loan because if you own a private property, you will not be able to buy a HDB flat or a EC.

3. What may be the value of the property in future?

From a capital appreciation angle, you may be thinking that a property’s value will only go up in land-scarce Singapore. Property can indeed hold value better than some other asset classes.

1. Some property sizes fare better in particular locations as compared to others. For example, a 2 bedroom flat and a studio apartment might be more suitable if your plan is to purchase and rent it out subsequently.

4. What other needs do you have?

For some home buyers, finances may take a backseat due to other important factors.

For example, you might find it appealing to buy a condo unit in the same estate as your parents so that they can look after or spend time with their grandchildren anytime.

Alternatively, you might prefer a resale unit right next to the school where your child is enrolled for convenience. If you and your spouse have no plans for kids, a cosier and smaller place might be preferable. Another key consideration could be proximity to your workplace.

Assessing and prioritising these factors can empower you to make a well-informed decision.

What we do suggest is:

In conclusion, there are numerous factors you should consider before deciding between a HDB flat or a private condo unit. You may wish to list down what you want and the trade-offs you are willing to take.

After that is done, work out whether your cash flow allows you to comfortably service the loan in the future.