By Lynette Tan

![]()

If you’ve only got a minute:

- The latest set of cooling measures announced in August 2024 focused on curbing demand for HDB flats by reducing the Loan-to-value(LTV) ratio for HDB loans from 80% to 75%.

- Property measures have been introduced yearly since 2021 to curb rising property demand, including increasing Additional Buyer’s Stamp Duty (ABSD) rates and tightening of the Total Debt Servicing Ratio (TDSR) threshold.

- Affordability is key when buying a property, since it is a long-term financial commitment.

![]()

Property prices have surged close to 50% since a low in 2Q2017 and the Singapore government has introduced property cooling measures every year since 2021 in an attempt to curb soaring prices.

One of the primary drivers behind the increased demand for housing is the low-interest rate environment amid the Covid-19 pandemic. Despite the economic challenges, transaction volumes in both the private housing and HDB resale markets have shown an upward trend.

While many had expected the property prices to stabilise following increased home supply post-Covid and an upward rising interest rate trend, property prices continue to head north.

In response to the evolving property situation, the government has introduced a slew of property measures from 2021 to 2024. Here is a summary.

2024 (New!)

- Reduced LTV limit from 80% to 75% for HDB home loans,

- Increase in Enhanced CPF Housing Grant (EHG) for eligible first-timer families and singles, of up to S$120,000 and S$60,000 respectively.

2023

- Substantial increase in ABSD for foreigners buying properties in Singapore, and increase in ABSD for Singapore Citizens (SC) and Singapore Permanent Residents (SPR) buying more than 1 property

2022

- Increase in interest rate floor calculation for TDSR and Mortgage Servicing Ratio (MSR) by 0.5 percentage point

- 15-month wait for private homeowners after the sale of their home before they can purchase a non-subsidised HDB resale flat

- Reduced LTV limit from 85% to 80% for HDB home loans

2021

- Increase in ABSD for foreigners buying properties in Singapore, and increase in ABSD for Singapore Citizens(SC) and Singapore Permanent Residents(SPR) buying more than 1 property

- TDSR threshold tightened from 60% to 55%

- Reduced LTV limit from 90% to 85% for HDB home loans

The latest cooling measures announced in August 2024 aimed at taming the price increase in the HDB resale market. On the other hand, the increased EHG would make homeownership more affordable for low-to-middle income households and younger couples purchasing their first home. The additional grant amount can partially offset the 5% reduction in loan-to-value (LTV) ratio (from 80% to 75%), depending on the price of the house. This means little to no additional downpayment may be required.

For example, a couple with a household income of S$5,000 looking to purchase a S$400,000 HDB resale flat would need to pay an additional S$20,000 in downpayment due to the lower LTV. However, the S$20,000 EHG increase would offset this additional cost, resulting in no additional outlay. On top of that, the monthly instalment will also be lower due to the smaller loan amount.

However, there are concerns that higher grants could lead to an increase in the selling prices of resale flats, potentially negating the benefits of the grant.

Nevertheless, the government's recent policy adjustment signals its close monitoring of the property market amidst a sustained rally in HDB resale prices and a record number of million-dollar HDB homes.

Many property experts hold the view that we could see a slightly softer HDB resale volume due to the policy adjustment, but do not expect any significant impact on developers or the overall residential market.

Read on to find out about past property cooling measures:

Additional Buyer’s Stamp Duty (ABSD)

ABSD is a tax that's levied on top of the Buyer's Stamp Duty (a tax that property buyers must pay when they buy a property), and it's computed based on the valuation or the selling price of the property, whichever is higher.

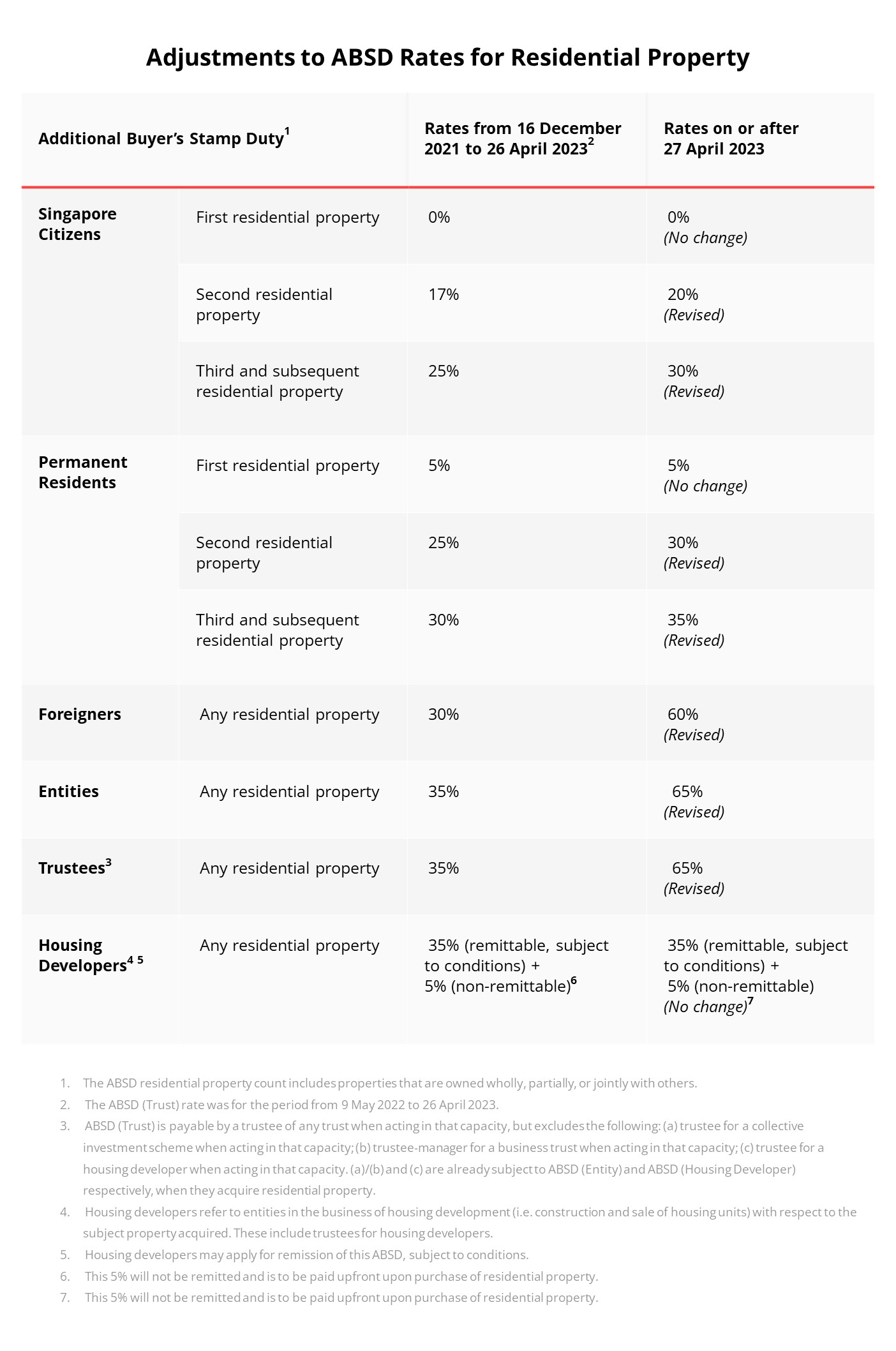

With the cooling measures implemented in 2023, ABSD rates for the purchase of the 1st residential property by Singapore citizens and permanent residents (PRs) remain unchanged at 0% and 5% respectively.

For these 2 groups, purchasing the 2nd or a 3rd and subsequent residential property will incur increased ABSD rates.

Singapore citizens will now pay an ABSD rate of 20% for their 2nd residential property, and 30% for their 3rd and subsequent residential property. This is up from the previous rates of 17% and 25% respectively.

The ABSD rates for permanent residents buying a 2nd or a 3rd and subsequent residential property has been increased to 30% and 35% respectively, up from the previous rates of 25% and 30%.

Foreigners and entities will also incur more ABSD when purchasing any residential property.

Foreigners buying any residential property are subject to an ABSD rate of 60%, up from 30%. Entities, which include companies, are subject to an ABSD rate of 65%, up from 35%.

There is no change to ABSD for housing developers. They will still be subjected to a 35% ABSD rate, of which they can apply for a remission plus an additional 5% ABSD (paid upfront upon property purchase) that cannot be remitted.

Total Debt Servicing Ratio (TDSR)

The TDSR is the portion of a borrower’s gross monthly income that goes towards repaying the monthly debt obligations, including the loan being applied for. In 2022, the TDSR threshold was tightened to 55% from 60% previously.

This means new mortgages cannot cause borrowers’ total monthly loan repayments to exceed 55% of monthly income.

Increase in TDSR and Mortgage Servicing Ratio (MSR) calculation by 0.5 % point

In 2022, the interest rate floor used to compute the TDSR and the MSR was raised by 0.5% point. An interest rate floor of 3% for computing the eligible loan amount for those granted by HDB was also introduced.

Type of Home Loan | Interest rate floor | Actual loan rate |

|---|---|---|

Bank Loan | 4% (previously 3.5%) | Depends on bank |

HDB Loan | 3% | 2.6% (current) |

Do note that the change affects the assumption in interest rate while the actual interest rates charged will continue to be determined by the private financial institutions.

Impact of new interest rate floor on monthly payment calculations

Loan Amount | At 3.5% (before) | At 4% (as of Sept 30 2022) | |||

|---|---|---|---|---|---|

Monthly Payments | Monthly income ceiling before TDSR | Monthly Payments | Monthly income ceiling before TDSR | Difference in monthly income | |

$1 million | $4,490 | $8,164 | $4,774 | $8,680 | $516 |

$2 million | $8,981 | $16,329 | $9,548 | $17,361 | $1,031 |

Source: Straits Times

To borrow S$1 million, home buyers will now need to be earning S$8,680 to qualify for a home loan based on a 0.5 percentage point increase in the interest rate assumption.

Private homeowners will need to wait for 15 months after the sale of their home before they can purchase a non-subsidised HDB resale flat

This 15-month wait-out period will be exempted for seniors aged 55 and above who are moving from their private property to a 4-room or smaller resale flat.

This is meant to be a temporary measure to curb demand for public housing and to ensure that resale flats remain affordable.

Such property owners were previously allowed to buy a HDB resale flat if they sell their private properties within 6 months of the purchase.

The wait-out period for private homeowners who are first-timers and wish to apply for the Central Provident Fund (CPF) Housing Grant and Enhanced CPF Housing Grant for their resale flat purchase remains unchanged at 30 months. The same applies for executive condo owners.

Financial planning is key

The combination of high property prices and an increasing interest rate environment does not bode well for property buyers. It is prudent to do proper due diligence as a property purchase is a big-ticket item and a long-term financial commitment.

Make use of DBS MyHome planning tool to work out your sums carefully and see if you’re able to commit to the mortgage payments over time before making your purchase.

For private home buyers who are looking to buy a HDB flat, you’d need to factor in the 15-month waiting period and factor in your living arrangements.

You may need to rent a place to stay temporarily, which will increase the cash outlay for your overall property transaction.

Assess your home purchase in relation to your financial plan and other investments. This will help to provide more clarity on your overall financial health and enable you to understand how your other goals may be impacted in the short and long term.

In the light of the latest cooling measures, you may wish to consider other instruments instead of relying heavily on property to grow your wealth.

Read more: Should you invest in SG property?