By Lynette Tan

![]()

If you’ve only got a minute:

- Before you start shopping for an EC, find out about your eligibility and work out the affordability first. You can use DBS MyHome Planner to help you work it out.

- While ECs provide a cheaper alternative to a private condominium, they are bound by HDB renting and selling restrictions.

- The Deferred Payment Scheme may look attractive to EC buyers, but understand that you’ll pay more overall compared to the Normal Payment Scheme.

![]()

Executive condominium (ECs) offers a hybrid form of property which is built by private developers but sold as public housing, offering middle-class Singaporeans the best of both worlds - the quality of living in a private estate without the hefty price tag of a private condominium.

With HDB flats and private condominiums becoming more and more expensive, ECs have gained popularity since most of their prices sit somewhere between a resale HDB and a private condominium.

Here’s what you need to know if you are thinking of buying an EC.

Eligibility to buy an Executive Condominium

ECs are developed by private developers and sold at subsidised pricing. Since they are part-public, there are some terms and conditions surrounding the eligibility to purchase an EC.

- Public Scheme

- Fiancé/Fiancée Scheme

- Orphans Scheme

- Joint Singles Scheme

At least one of the applicants needs to be a Singapore Citizen (SC), with the other being a SC or Singapore Permanent Resident, and both applicants need to be a SC if they are making a purchase under the Singles scheme.

The monthly household income must not exceed S$16,000.

Why buy an executive condo?

One of the most obvious benefits of choosing an EC over a private condominium is the price point.

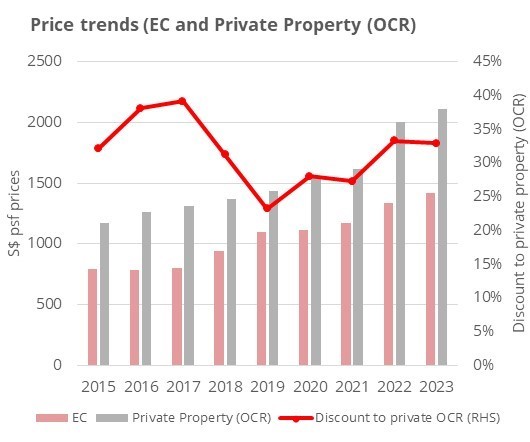

With suburban condominiums reaching new pricing benchmark of S$2,000 psf, the recent DBS Group Research report “Sales to catalyse interest in developers” observed eligible buyers focus their attention on EC as they’re priced more attractively - at up to 25% discount to private property prices mainly due to income limits and tighter affordability ratios placed on buyers.

The report also highlighted the narrowing price gap in the resale market between ECs and private condominiums in the OCR as more ECs reached the 10-year mark post-completion, since first being launched back in early 2000.

The reduced price difference in resale, combined with lower launch prices compared to private condominiums, makes ECs a great choice for qualifying buyers.

In addition, a general improvement in quality and amenities over the years, often rivalling those of private condominiums is observed. This means EC buyers get to enjoy the perks of living in a private property at a subsidised pricing, given that they fulfil all the eligibility conditions.

On top of that, first-time EC buyers may also be eligible for CPF housing grants.

Transaction prices for ECs have also been on a steady uptrend over the years, keeping pace with the increase in suburban condominium pricing in the outside central region (OCR).

Buyers who acquired ECs in 2015 – 2016 for S$800-S$850psf can potentially sell at an average of S$1,300psf, marking a 50-60% financial gain, providing funds for future property investments.

Due to their lower price and the 10-year privatisation rule, many EC buyers also believe that the capital appreciation of the ECs after 10 years might be higher compared to private condominiums. The potential for increased property value over time makes ECs an attractive option.

Furthermore, buyers will be able to sell in the open market to a broader audience, including foreigners, post-MOP, leading to perks such as an expanded buyer pool, improved financial prospects, and potential gains from a more diverse market.

The downside is that owners will need to adhere to the 5-year MOP to either rent out or sell their unit.

There are also restrictions on selling the unit to only eligible buyers before the 10-year period.

The other disadvantage is that ECs are usually situated in non-matured estates to keep costs low and amenities nearby might take time to develop.

Following the success of 2023 EC project Copen Grand (100% sold) and Altura (88% sold), the DBS research report expresses optimism about the prospects of Lumina Grand, a 2024 project by CDL, also the 3rd third EC launched near the upcoming Tengah new town, which first launch saw a sell-through rate of c.53%, a respectable showing, based on DBS Group Research analysis.

Despite the more remote locations of these projects, DBS believes ECs will continue to enjoy brisk sales with its attractive price point to upgraders/new homeowners.

Read the full report here.

Financing an executive condo

Affordability is key when it comes to buying property, and it’s no different when purchasing an EC.

Before you start shopping for an EC, work out the affordability first. You can use DBS MyHome Planner to help you work it out.

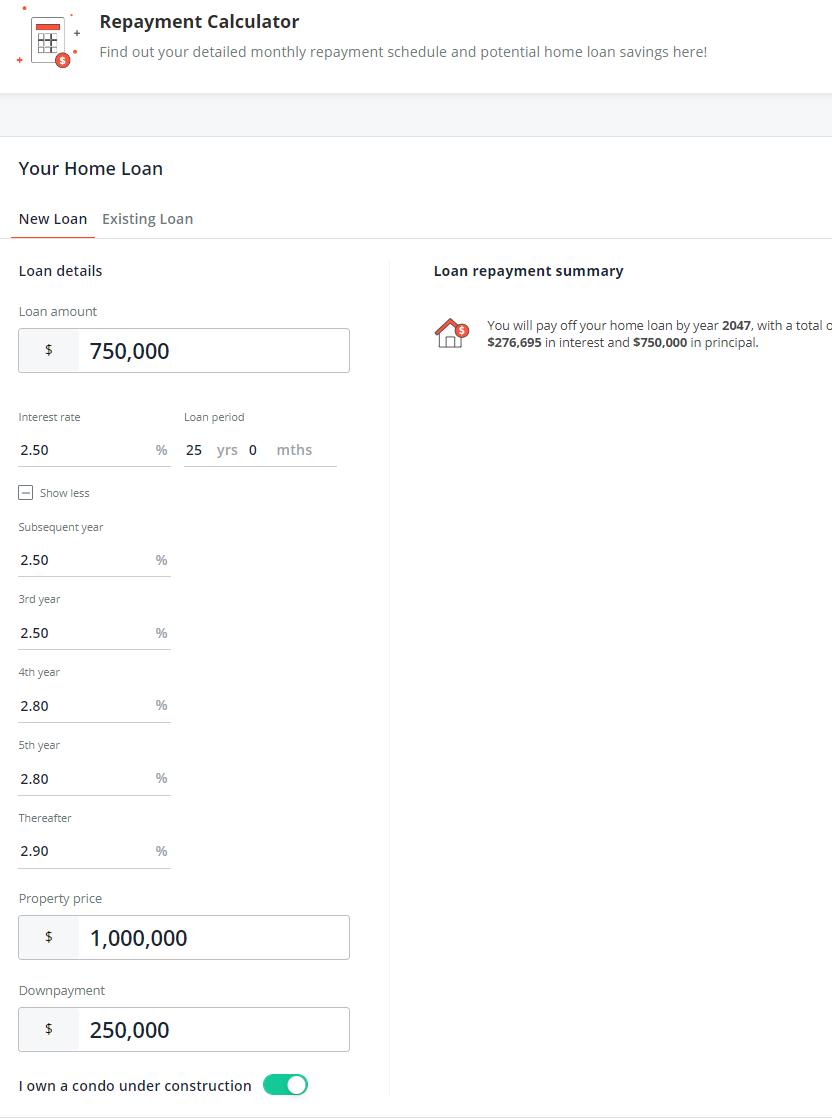

Although in the first 10 years an EC is considered as a HDB property, you will only be allowed to finance it with a bank loan instead of a HDB loan. This means you’ll need to make a downpayment of 25% when buying an EC.

However, you will be subjected to both the prevailing Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) limits, which are currently at 30% and 55% respectively.

DBS Easy Switch home loan gives you the flexibility to begin with a fixed rate for stability during the early stages of your home financing and switch to a floating rate later at no additional cost should the need arise.

Do take into consideration any CPF housing grant that you may be eligible for, as well as the implications of taking up the housing grant. For instance, you will be liable to pay a resale levy of S$55,000 when you sell an EC unit bought with the CPF housing grant and buy or take over ownership of another subsidised HDB flat or an EC.

The resale levy is meant to reduce the housing subsidy on the buyers' second subsidised flat/EC unit from a property developer and ensures a fairer allocation of housing subsidies among home buyers.

If you choose to buy a resale flat or a private residential property instead, you need not pay the resale levy.

Other than the purchase price, you’d need to budget for legal fees of about S$2,000 and valuation fees of about S$200 for a new EC. There is also the Buyer Stamp Duty at top marginal rate of 6% for residential properties.

Executive condo payment schemes

There are 2 types of payment schemes available for EC buyers:

- Normal Payment Scheme (NPS)

- Deferred Payment Scheme (DPS)

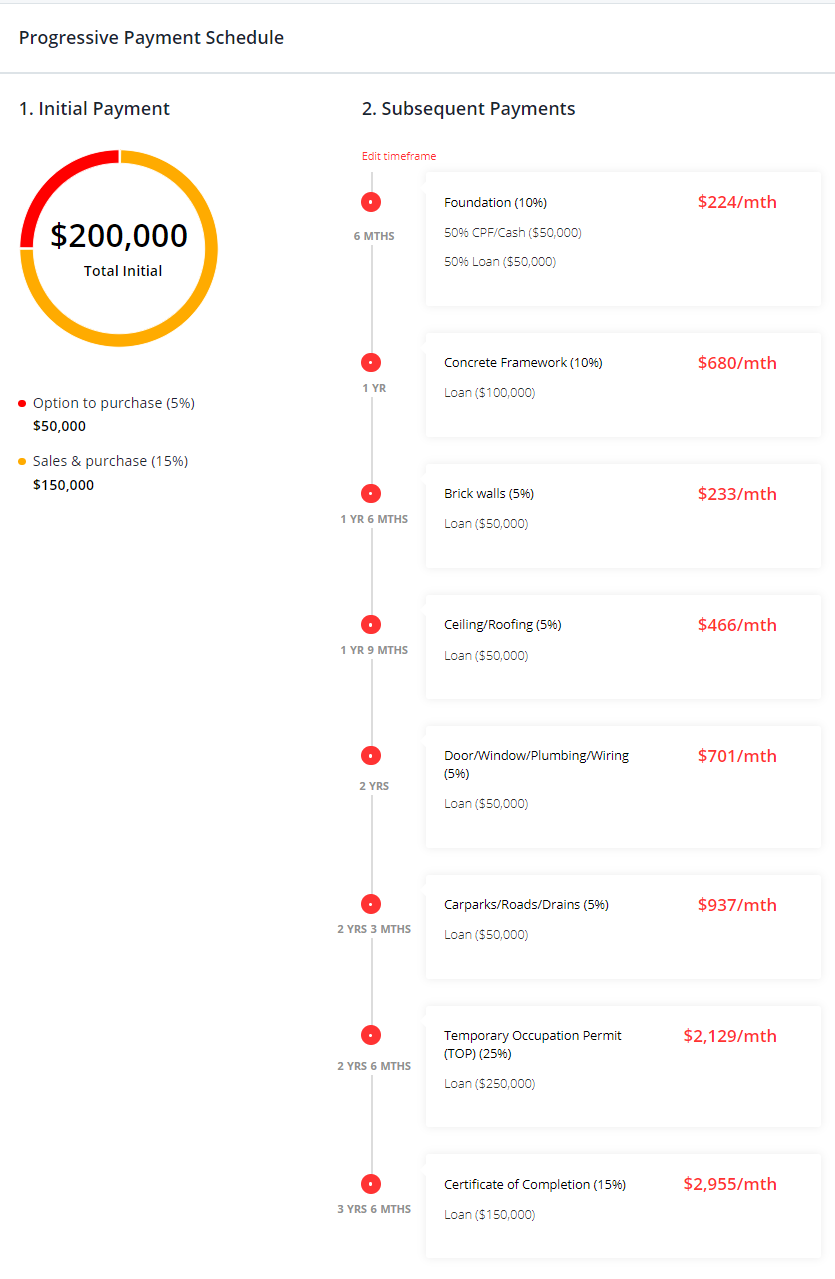

NPS works a little like an instalment scheme where the EC buyers will make payment each time the developer hits certain milestones in construction. This could work out to be a sum of about 5 to 10 percent of the property purchase price every 6 months or so.

You can make use of the DBS Repayment Calculator via DBS Home Marketplace to help you calculate how much your monthly repayments will be so that you can better plan your budget. Alternatively, if you would like a complimentary home loan consultation to understand more, fill in your contact details here and our home advice specialist would contact you.

Under the DPS, buyers pay 20% of the purchase price upfront, while the remaining 80% is paid when the EC receives its Temporary Occupation Permit (TOP) and when you collect the keys.

While the latter might seem more attractive in terms of freeing up your cash flow in the first 2 to 3 years until the project is completed, it comes with a caveat. The DPS scheme usually charges an extra 2 to 3% on the purchase price, which means you pay more for the property overall. Therefore, it is usually better to go with the NPS, unless you are confident that you can put the money to better use in the meantime.

Once you collect your keys, you can commence renovations or move in any time you wish.

Do check out the “Renovation” tab under DBS Home Marketplace to compare and explore various home renovation services by our trusted partners. You’ll find a diverse range of design ideas and cost estimates to help you budget better for your new home.

Whether you're planning to buy a new property or deciding on home loans, renovation loans, home insurance, interior designers, or utility providers, we've got you covered.

DBS Home Marketplace provides essential tools like the MyHome planner, repayment calculator, guides, renovation solutions, insurance plans, and exclusive deals on utilities and furnishings – everything you need to build your dream home, all in one place.

As interest rates fluctuate, it will be good idea to keep an eye out for refinancing promotions when your mortgage is out of the locked-in period to enjoy lower repayments.

Last but not least, congratulations on your new home!