![]()

If you’ve only got a minute:

- The Lease Buyback Scheme (LBS) allows you to sell the tail-end of your flat’s lease to HDB and receive a bonus.

- The LBS proceeds will be used to top up your CPF Retirement Account (RA).

- Your full RA savings will be used to buy a CPF LIFE plan if you have at least S$60,000 in your RA after the top-up.

- Alternatives to the LBS includes rightsizing your flat, selling your property or renting out extra rooms for an income stream.

![]()

The Singapore government provides 2 schemes to help retirees monetise their property for retirement – the Lease Buyback Scheme (LBS) and right-sizing with the Silver Housing Bonus Scheme (SHBS).

In 2022, around 2,860 seniors used the LBS and SHBS, an increase from 2,790 in 2021. Evidently, more seniors are converting their HDB flats to enhance their CPF savings and receive additional retirement income1.

What is the Lease Buyback scheme?

The LBS is a national initiative designed for seniors aged 65 and older living in HDB flats to sell part of their flat’s lease back to HDB in 5-year increments, while retaining lease lengths from 15 to 35 years (based on the age of the youngest owner).

This helps elderly homeowners convert part of their home’s value into a retirement income.

The proceeds from selling part of the flat’s lease (less any outstanding mortgage loans), will be used to top up your CPF Retirement Account (RA). Any excess cash over the top-up limit (CPF RA), will be paid out in cash (up to a maximum of S$100,000 per household).

The CPF RA savings can be used to join CPF LIFE, which will provide monthly retirement income for life.

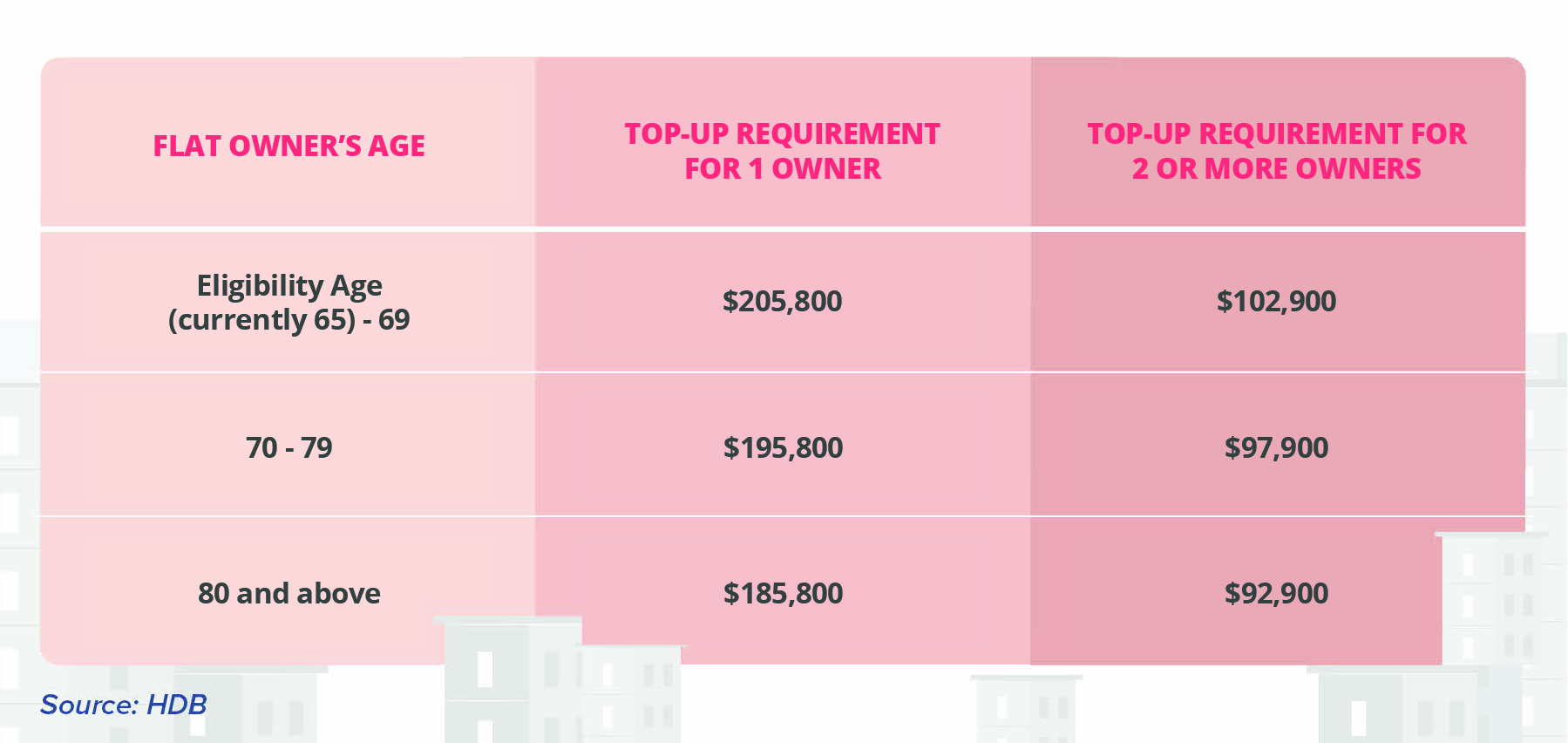

For applications received from 1 Jan 2024:

For households with 1 owner, the proceeds will be used to top up the RA to the current age-adjusted Full Retirement Sum (FRS).

For households with 2 or more owners, each owner will have to use their proceeds to top up their respective RA to the current age-adjusted Basic Retirement Sum (BRS).

The LBS bonus

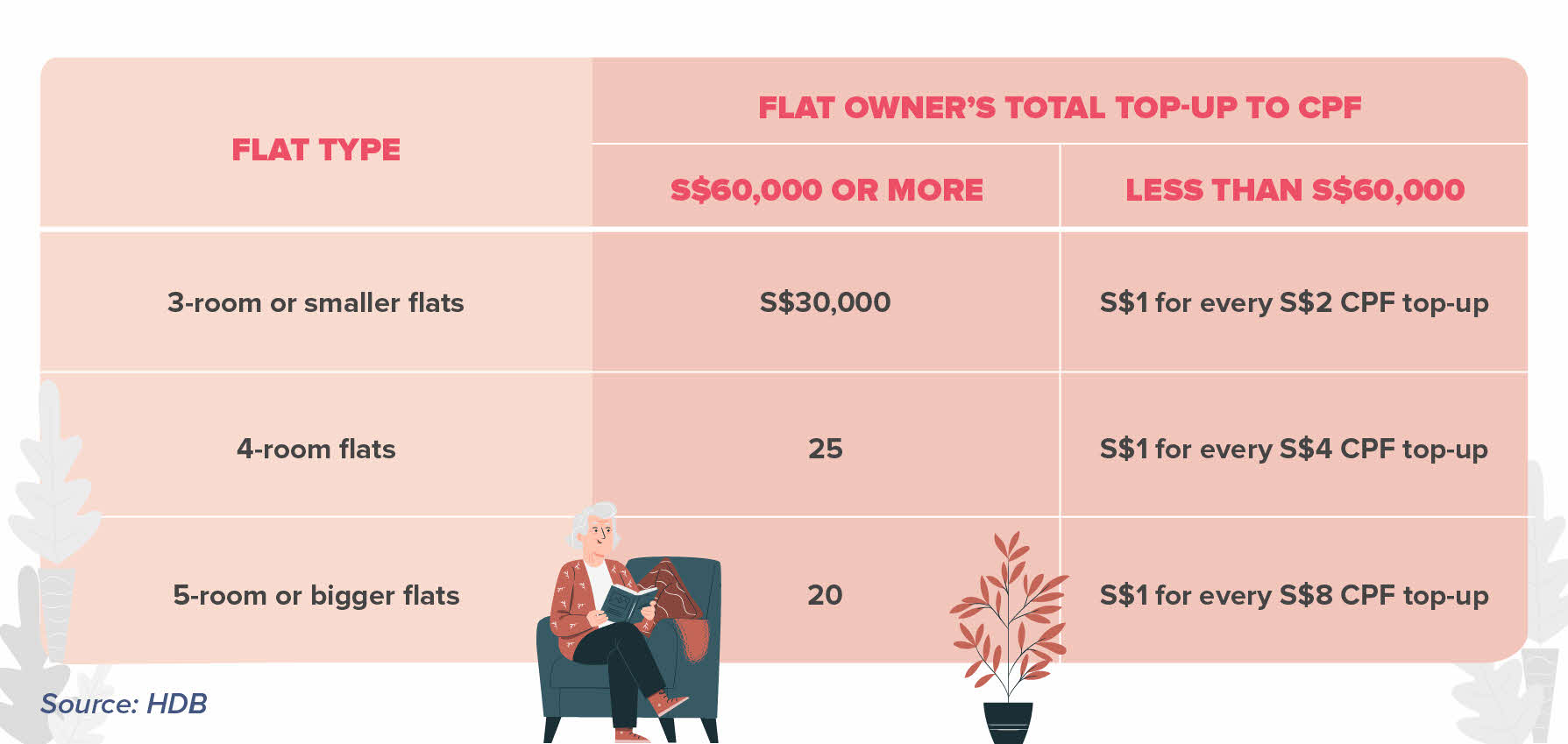

To make the LBS more attractive, the Government offers a cash bonus (up to S$30,000) to participants. The amount depends on the flat type and the remaining lease sold back.

This incentive encourages people to consider the scheme as a viable option for supplementing their retirement savings.

The household will get the full LBS bonus (S$30,000) if the total CPF top-up to the flat owners' CPF-RA meets S$60,000 (3-room or smaller flats).

If the CPF RA top-up falls below S$60,000, a partial bonus will be given (S$1 for every S$2 of CPF top-up).

Here’s the breakdown:

Do note that no bonus is given if all owners reached the FRS before joining LBS and have no CPF top-up requirement.

CPF LIFE

The full RA savings will be used to buy a CPF LIFE plan if there is at least S$60,000 in the RA after the top-up. Those aged 80 and above will not be eligible to join CPF LIFE.

Eligibility

- The current eligibility age is 65 years old

- At least 1 flat owner must be a Singapore Citizen

- Gross monthly household income must not exceed S$14,000

- No 2nd property ownership

- All owners have been living in the flat for at least 5 years (Minimum Occupation Period)

- Current flat must have a remaining lease of at least 20 years of lease to sell back to HDB

- All HDB flat types are accepted, except short-lease flats, HUDC flats and Executive Condominiums

An example of how the LBS works

Mrs Lee is a retiree (age 65) and lives alone in her 4-room HDB flat. Her 2 children have moved out and her husband has passed on. As she has 55 years of lease left on her flat she decides to sell 30 years of her lease and keep the remaining 25.

She receives a total of S$150,000 from the LBS, including a S$10,000 LBS bonus.

However, Mrs Lee will not get to keep all the net proceeds in cash. She will have to use the proceeds to top up her CPF RA before retaining any leftover proceeds in cash.

As Mrs Lee is the sole property owner, she needs to top up to the CPF FRS, which is S$205,800 (as of 2024). Currently, she has S$81,000 in her CPF RA. After topping up her CPF RA with S$124,800, her cash proceeds amounts to S$25,200 (S$150,000 – S$124,800).

Limitations

The LBS is a great scheme to help retirees grow their CPF RA by monetising their property. However, as with all other types of financial schemes, there are some downsides to consider:

1. You don’t get to keep the full proceeds in cash

As mentioned in the example above, you might need to use the proceeds of the lease buyback to top up your CPF RA first.

Since the FRS increases every year, there might be a chance you end up with zero cash proceeds after topping up your RA.

2. You can’t sell your flat once you sign up for the LBS

If you decide to use the LBS to monetise your flat, you will not be able to sell your flat even if someone is willing to pay a high price for it. In other words, once the sale of the lease is completed (to HDB), you lose ownership of the flat.

In addition, you will not be able to rent out the whole flat or transfer ownership to your children when you pass on.

3. There’s a possibility of outliving the lease

According to HDB, you will not be left homeless if you outlive the lease of your flat. HDB will look into your circumstances such as family support, health condition, and financial status, and work out an appropriate housing arrangement with you and your family members2.

However, there is little certainty on the sort of alternative living accommodation that will be provided.

Here’s a scenario:

Jane sold 40 years of her HDB lease back to HDB under the LBS scheme when she was age 65 and chose a 30 year lease on her flat. She outlives the 30 year lease on her 95th birthday. This means she has to move out of her flat (lease expired) since it’s now HDB’s property.

At this point, Jane will need to arrange for alternative housing with the funds she has left and some of these options may include:

- Renting a room or small apartment using her remaining CPF funds and cash (But rental rates might be very high 30 years later).

- Move in with her children if possible but keep in mind that they may not have space or ability to provide care.

- Apply for assisted/subsidised housing like for elderly but availability may be limited.

- Purchase a private property if her savings are not depleted yet.

It is clear that outliving the lease can put one in a difficult position for housing. To mitigate this, careful financial planning is crucial before committing to the scheme.

Alternatives to LBS

The LBS is just 1 way in which you can monetise your property for retirement.

Some alternatives include selling your existing HDB in the resale market, especially if you own a larger flat and wish to downsize to a smaller one. You can potentially get more from a sale under such circumstances since the HDB valuation of your remaining lease may not be as favourable.

The Silver Housing Bonus (SHB) Scheme is another way you can look at to monetise your home. If you are selling your current flat or private housing with an annual value not exceeding S$13,000 and buying a 3-room or smaller flat, you can supplement your retirement income through the Silver Housing Bonus (SHB) scheme.

Read more: Lease Buyback VS Rightsizing

Another way to monetise your current property is to rent out any spare rooms you have for an income stream. This method presents a lower risk compared to the LBS and may be more attractive if you prefer to receive cash rather than CPF top-ups.

Need help with retirement planning? Check out our step-by-step guide here.