By Lynette Tan

![]()

If you’ve only got a minute:

- Property prices are forecasted to be divergent – private properties in the central region will likely see tempered demand while executive condominiums could be a bright spot in the market this year.

- Although real income has not matched up to increases in property prices, younger home buyers could be benefitting from parental help in affording their first home.

- As home purchases have a long-term impact on our personal finances, buyers need to exercise prudence when making a decision.

Are you planning to buy a property this year? Contrary to market fears of a property price drop off in 2024, the DBS Research team forecasts a “calming down” in the Singapore property price index.

While the luxury end of the property market will likely see lower demand especially from foreign buyers, other properties such as resale HDBs, suburban condominiums and executive condominiums (ECs) are likely to see support from upgraders.

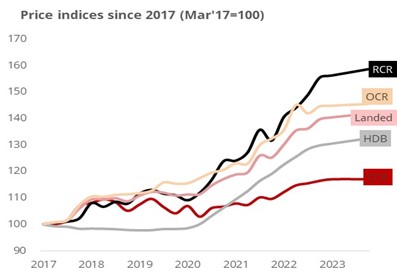

Divergent property price trends

High property prices and mortgage rates are likely to continue to put a lid on demands for new homes. In the first half of 2023, property cooling measures were introduced to ensure prudence in borrowing. This includes higher Additional Buyer Stamp Duty (ABSD) rates to temper investment demand for homes, especially those from foreign investors.

Looking ahead, a slowdown in transaction volumes for investment properties is likely to continue, as seen in 2023. This slowdown will be most keenly felt in properties in the core central region (CCR) where foreigners contribute 10% or more in transactions, compared to homes in the Rest of Central Region (RCR) and Outside Central Region (OCR) homes, where foreigners historically contributed just 1% to 5% in overall transactions.

Our property price projection for 2024

On the other hand, locals will remain the key driver for home purchases, with overall resale volumes set to rise. We see a price growth of 2-3% for resale HDB due to limited supply outlook.

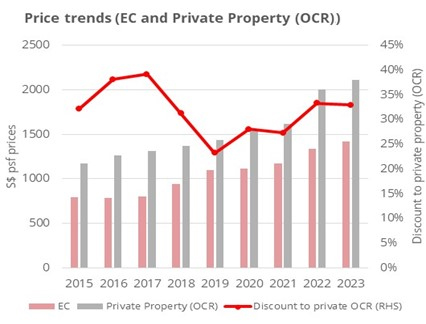

ECs, out of the other property types, are likely to be a bright spot this year. With suburban condominiums hitting a new pricing benchmark of $2,000 per square feet (psf) in recent months, buyers that qualify have focused their attention on ECs, which are priced more attractively compared to suburban private condominiums.

Currently, ECs are going for about 25% cheaper than private properties. This is mainly due to eligibility criteria, income limits and tighter affordability ratios placed on buyers. As such, past EC projects launched in 2022-2023 have seen robust sales rates with about 88% to 100% sold within 2 to 3 months of launch.

ECs are likely to continue appealing to eligible buyers, particularly those belonging to the middle-income bracket. These individuals seek to acquire a home but find themselves ineligible for a Build-To-Order (BTO) HDB flat due to the monthly household income ceiling of $14,000, yet private properties could be out of reach financially.

The DBS research team observes an increasing popularity of ECs, attributing it to their potential for price appreciation. Despite being situated in suburban locations, these condos gain attractiveness through the government's strategic plan to provide essential amenities such as supermarkets and schools in proximity.

Looking ahead in 2024, the research team anticipates new private property launch prices to remain around $2,050 psf, with EC prices ranging between $1,400 and $1,450 psf. The persistent high prices in new launches are attributed to the substantial costs associated with land acquisition, rising construction expenses, and elevated interest costs borne by developers.

Despite a potentially moderating economic outlook, the team expects property prices to remain resilient in 2024, establishing a new benchmark for the medium-term pricing landscape.

Read more: Is an Executive Condo worth buying?

Are homes still affordable?

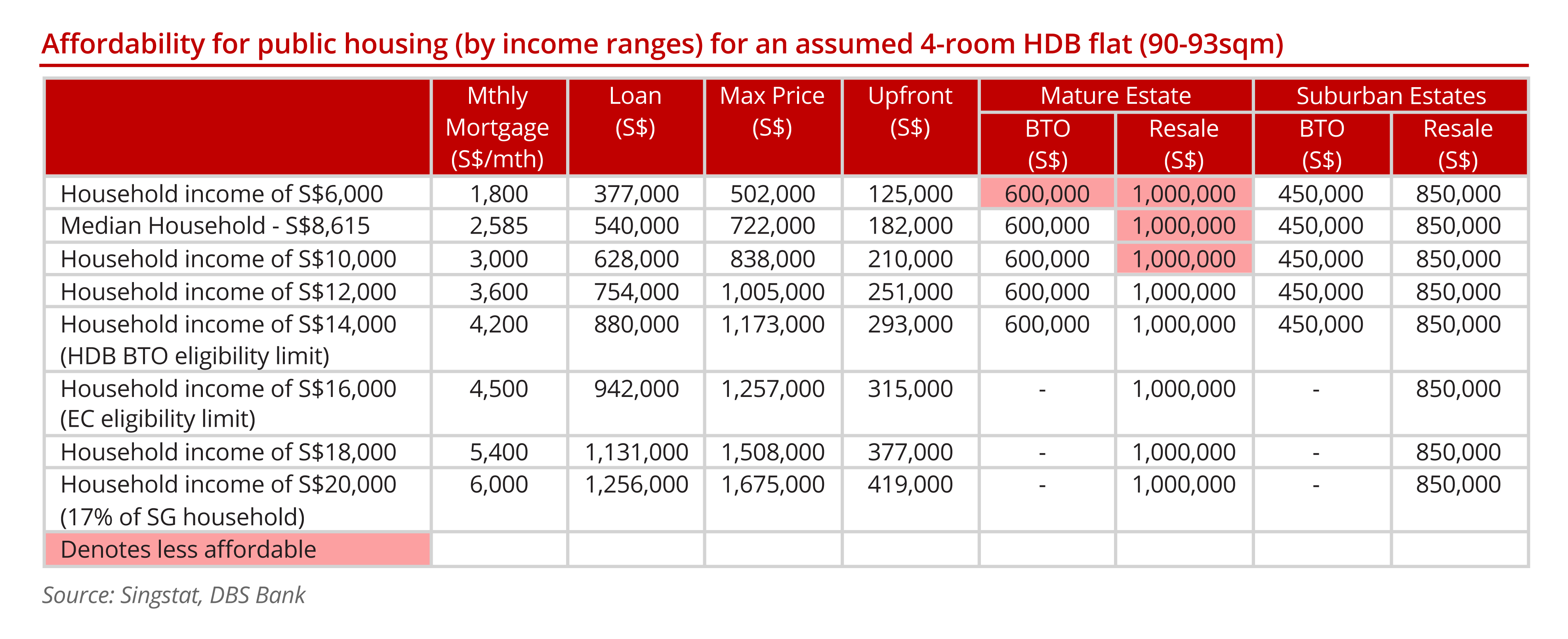

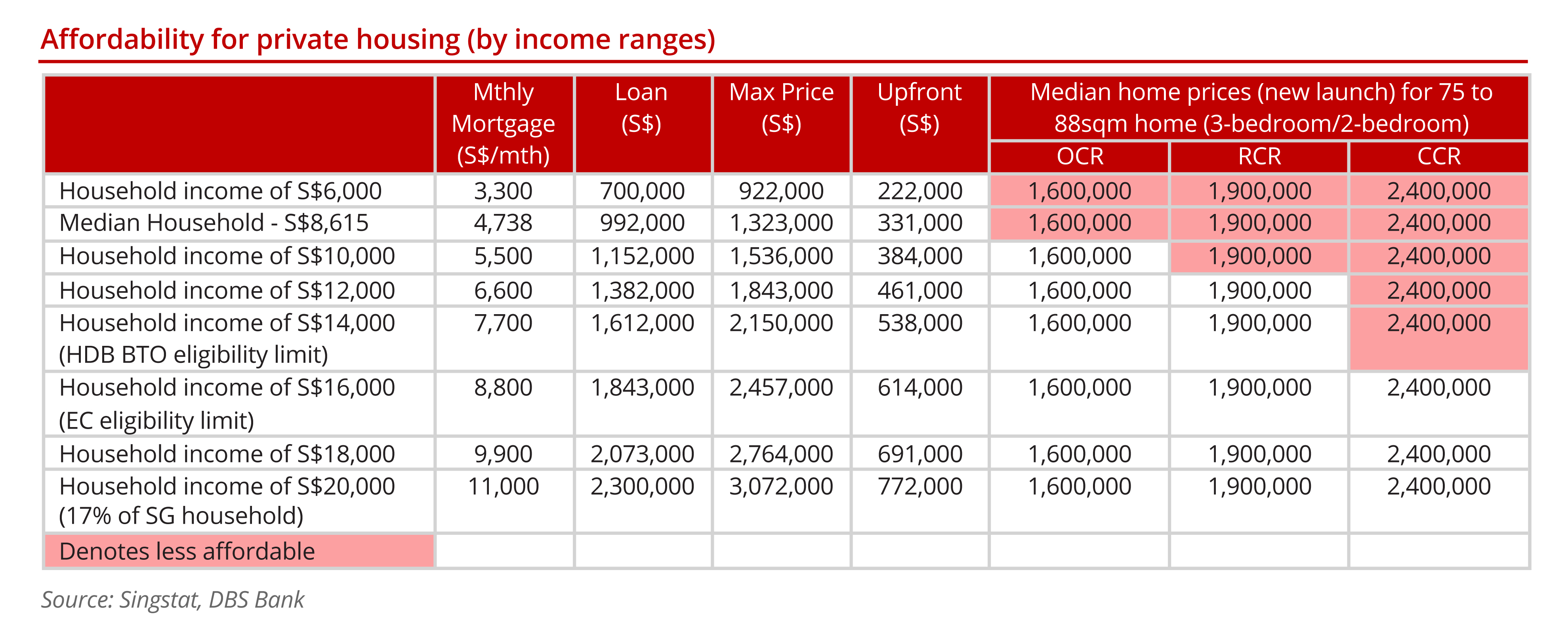

With higher-than-average inflation in the last 2 years, we saw that real incomes fell 2.3% in 2023.

On the other hand, home prices seem to be hitting a new normal. While Singapore continues to maintain a notably high level of home ownership nearing 90%, the landscape shifted significantly during the pandemic as construction delays and shortage in housing supply resulted in a surge in both public and private home prices.

We noted 3 key trends in the last 2 years: 1) more ‘million-dollar’ resale HDB flats, 2) ECs launching at new highs; and 3) new private launches, even in the OCR, exceeding $2,000 psf.

Based on estimates across household income ranges from $6,000 to $20,000 per month, we noted that BTO and resale HDB homes (4-room) are - $2.4m, prices are generally within affordability from households with income from $14,000 onwards, according to our estimates.

That said, the upfront downpayment ranges between 21 months (around 2 years) and 38 months of salary (around 3 years) for public and private property, meaning that aspiring buyers need to save at least 5-7 years at (50% savings rate) before being able to afford a home.

Tip: Use the DBS Home Planner to help with planning your home-related finances

The implication here is that for new and younger homebuyers, they need to plan on a realistic home budget, how much they need to save and come up with an action plan.

Read more: Steps to finding your perfect home

With property prices outpacing income growth over the past 2 years, concerns on home affordability have surfaced repeatedly. Despite that, demographics of homebuyers with hefty downpayments at new launches are relatively young. According to media reports, close to 41% of buyers for Blossoms by the Park (average price of $2,423 psf) are aged between 31-40 years, while 22% are between 21-30 years old, implying that some form of parental help are likely given to meet downpayment needs.

While it is a generous gesture for parents to assist their children in buying a new home, it is crucial, particularly for those who are approaching or already in retirement, to ensure they meet their own retirement adequacy. Investing in property often entails a long-term commitment, and it is imperative for homebuyers to exercise caution in their decisions and elderly parents to prioritise building sufficient retirement funds such that they do not need to rely financially on their adult children.

Read more: Your guide to home affordability in Singapore

Rental market peaking but remains above pre-pandemic levels

While the rental market has been doing well since the pandemic, we're starting to notice a slowdown. The growth in the rental index for non-landed properties has been slowing down every quarter since 3Q2022, almost levelling off with a 0.2% increase in 3Q2023. This slowdown is probably due to the number of completed private residential units more than doubled in 2023 compared to the previous year. This increase in supply led to less demand for rentals from people who were waiting for their new homes to be completed.

In 2024, we expect rents to face some downward pressure because the gap between supply and demand is getting smaller. However, we think rental rates will still be higher than they were before the pandemic. This is because a significant number of people looking for rentals are foreigners who may be unwilling to pay the 60% ABSD to buy a property, as well as private homeowners who need to observe a 15-month wait-out period before being eligible to acquire a resale HDB.

Property prices will likely continue to be resilient in 2024 overall, supported by home-occupier demands. As home purchases are large expenses, it will benefit consumers to be prudent in their purchases, especially since prices are hitting a new higher normal, and interest rates continue to be elevated. Setting a realistic budget and savings plan will serve homebuyers well in the long term for their home financing journey.

You can make use of the DBS Repayment Calculator via DBS Home Marketplace to help you calculate how much your monthly repayments will be so that you can better plan your budget. If you would like a complimentary home loan consultation to assist in your home financing journey, fill in your contact details here and our home advice specialist would reach out to you.