If you’ve only a minute:

- CareShield Life offers enhanced benefits compared to ElderShield, including higher monthly payouts and longer payouts.

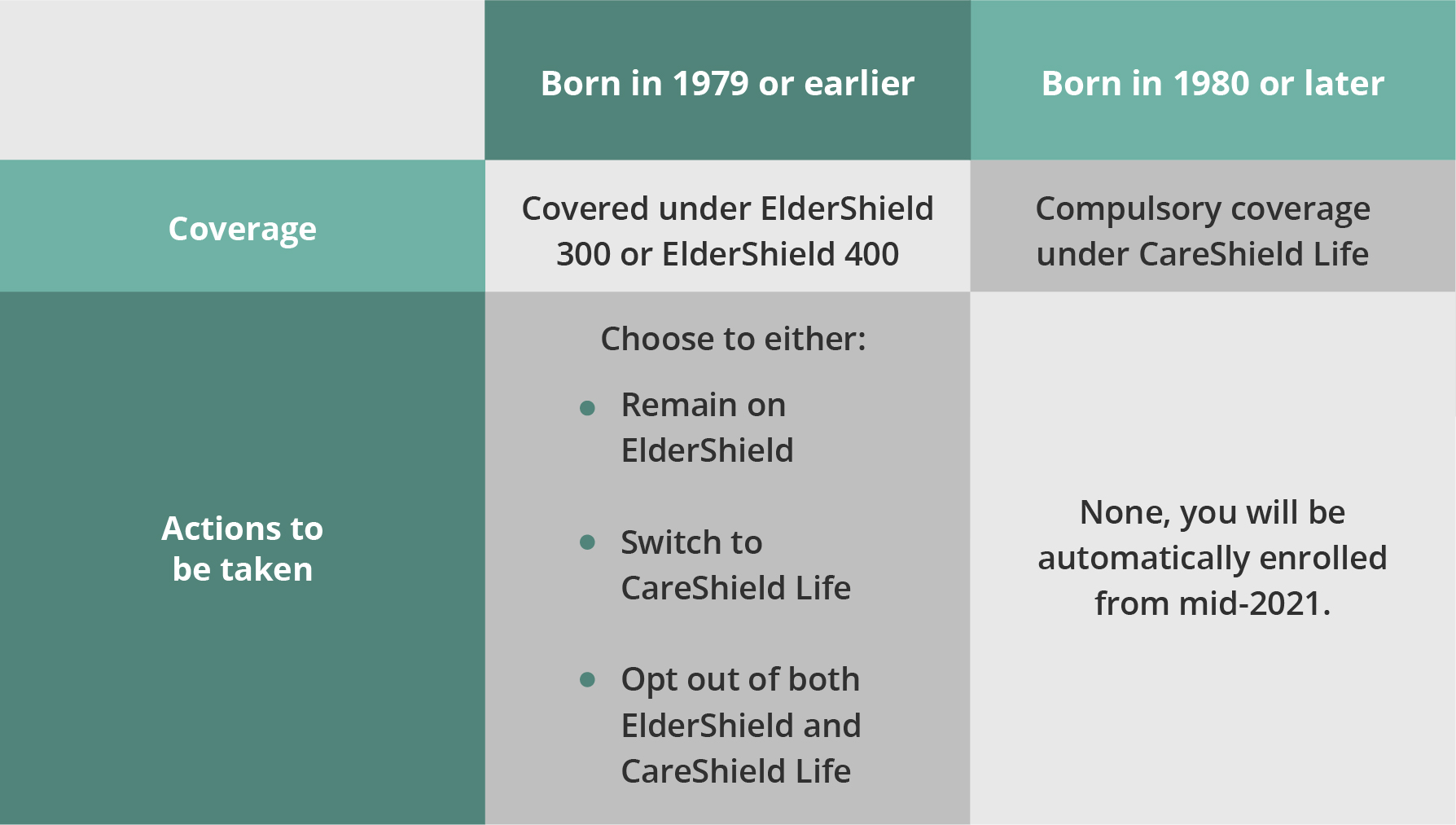

- Those born in 1979 or earlier are covered under ElderShield, while those born in 1980 or later will automatically be enrolled into CareShield Life.

- Those covered under ElderShield can choose to remain on ElderShield, switch to CareShield Life, or opt out completely.

In Singapore, the need for robust long-term care coverage has been a growing concern, given the aging population and increasing life expectancy.

The Ministry of Health (MOH) stated that 1 in 2 Singaporeans who are healthy at age 65 face risks of developing severe disability later.[1]

The government has introduced 2 key insurance schemes aimed at providing financial support for long-term care needs: ElderShield in 2002 and CareShield Life in 2020.

While both schemes share the common goal of assisting individuals in coping with the financial burdens associated with long-term care, they differ in various aspects. Here is the breakdown.

What is ElderShield?

ElderShield, introduced in 2002, was Singapore's first national long-term care insurance scheme aimed at providing basic financial support for individuals in the event of severe disability during old age. It was offered to eligible Singaporeans and Permanent Residents (PRs) who has a MediSave Account (MA) when they turned age 40 in 2019 or earlier.

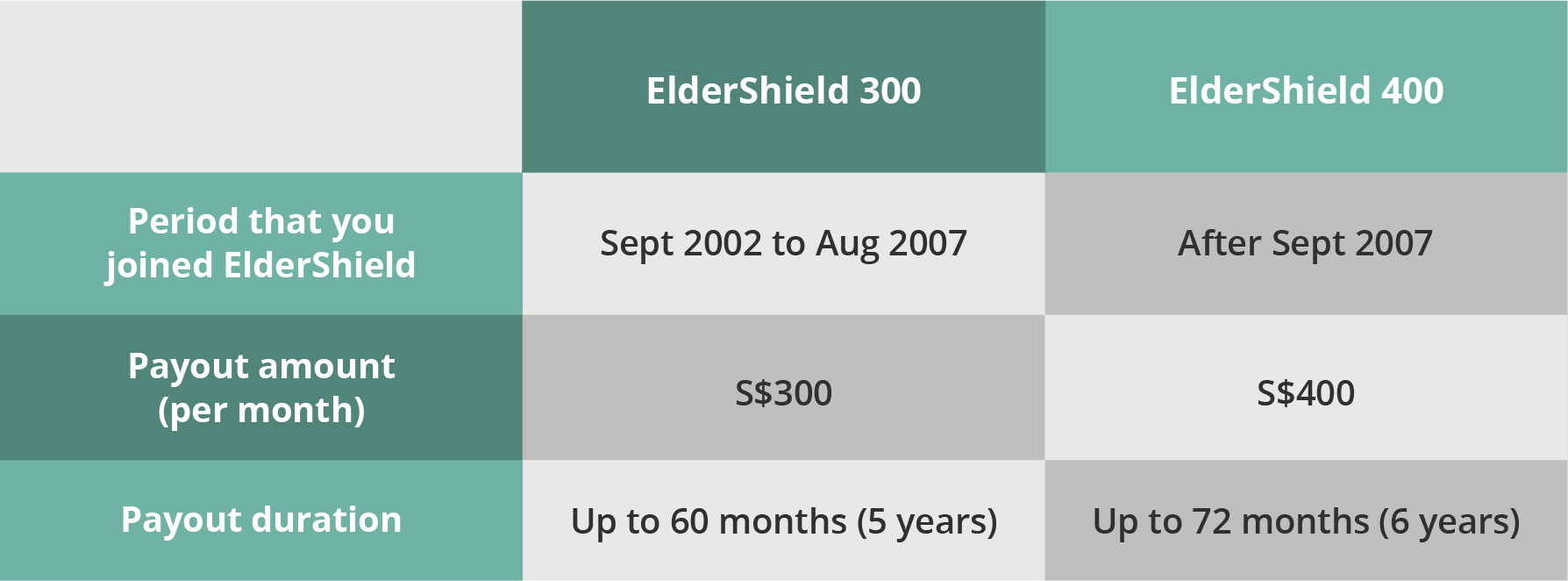

In the event of severe disability, ElderShield provided payouts of S$300/month for up to 5 years upon severe disability. It was subsequently reviewed in 2007 to provide better benefits of S$400/month for up to 6 years, after which the coverage ceases.

ElderShield will continue to operate for existing cohorts who are already enrolled and choose to continue with the plan (those born in 1979 and earlier).

What is CareShield Life?

CareShield Life was launched in 2020 to replace ElderShield. All Singaporeans and PRs born in and after 1980 are automatically enrolled into the scheme, regardless of pre-existing conditions.

This is to ensure that everyone will have access to basic protection for long-term care needs.

Unlike ElderShield, which had a maximum payout duration of 6 years, CareShield Life offers continuous lifelong payouts for as long as you remain severely disabled, regardless of age. If you are born in 1979 or earlier and not severely disabled, you can sign up for CareShield Life.

Find out more: CareShield Life in a summary

ElderShield or CareShield Life?

For both ElderShield and Careshield Life, you must prove that you are not able to perform at least 3 of the 6 Activities of Daily Living (ADL) to be considered severely disabled.

You will need to undergo a severe disability assessment by a MOH-accredited severe disability assessor or a qualified healthcare professional (doctor, occupational therapists, physiotherapists, and registered nurses).

Both schemes are also fully payable by MediSave. Your family members can also help to pay your premiums with their MediSave, or top up your MediSave with cash.

| Eating | Bathing | Dressing |

| Toileting | Transferring | Mobility |

For CareShield Life, monthly payouts started at S$600/month in 2020 and have been increasing at 2% per year. The monthly payout is S$649 in 2024 and will increase yearly until age 67 or when a successful claim is made, whichever is earlier.

On the other hand, ElderShield 300 provided fixed payouts of S$300/month for up to 5 years upon severe disability. It was subsequently reviewed in 2007 to provide better benefits of S$400/month (ElderShield 400) for up to 6 years, after which the coverage ceases.

To illustrate, Jane (aged 30) joined CareShield Life in 2020, developed severe disability and made a claim in 2024. She will receive S$649 monthly, for the entire duration of severe disability.

If she develops severe disability at age 67 or later, and makes a claim then, she can potentially receive S$1,300 monthly.

However, if she was born in 1954 and earlier (joined the scheme at age 67 or after), her monthly payout will be fixed at S$612 monthly should she become severely disabled.

In terms of coverage, CareShield Life provides higher monthly payouts, however, at a greater cost.

You will need to top up your premiums to replace your ElderShield plan should you decide to switch schemes. It is important to note that you will not be able to join CareShield Life if you are already severely disabled.

If you choose to remain as an ElderShield policyholder (not upgrade to CareShield Life), your ElderShield coverage (along with any supplements) will not be affected and you will continue to enjoy the benefits of it.

If you decide to join the scheme and are covered between 1 January 2024 to 31 December 2024, you will receive participation incentives of up to S$1,875 (S$187.50/year).

Additional participation incentives of S$1,125 (S$112.50/year) will be provided to Merdeka (born in the 1950s) and Pioneer Generation (born in 1949 or earlier) citizens.

The Government will also provide means-tested premium subsidies and Additional Premium Support (APS) to those who join CareShield Life, so that no one loses coverage due to financial difficulties.

You may access the CareShield Life Premium Checker e-Service with your Singpass to find out more information on your personalised premiums and premium support.

Comparing ElderShield and CareShield Life

| ElderShield | CareShield Life | |

| Payout per month | S$300 or S$400 | S$600 onwards |

| Payout Increment | Payout remains the same | Payout increases until age 67 or when a claim is made, whichever is earlier |

| Payout duration | 60 or 72 months | Covered for life, even when you stop paying premiums from age 67 |

| Who is covered? | Excludes individuals with pre-existing disabilities | Compulsory for all, includes individuals with pre-existing disabilities |

| Annual Premium amount* | S$175 (men) S$218 (women) | S$206 (men) S$253 (women) This amount increase by 2% every year. Click here for more information |

| Coverage and premium payment start age | Age 40 | Age 30 |

| Premium payment ends | Until age 65 | Until age 67 |

| Premium payment methods | Fully payable by MediSave | Fully payable by MediSave |

| Government Subsidy | No | Yes |

| Disability check up fee | S$50 - S$150 | First assessment is free |

| Administrator | Aviva / Great Eastern / NTUC Income | Singapore Government |

*Assuming you start at age 40 for ElderShield and 30 for CareShield Life.

If you have a severe disability (inability to perform at least 3 ADLs) at the entry age of 30, you will only have to pay the first premium to qualify for lifetime payouts.