![]()

If you’ve only got a minute:

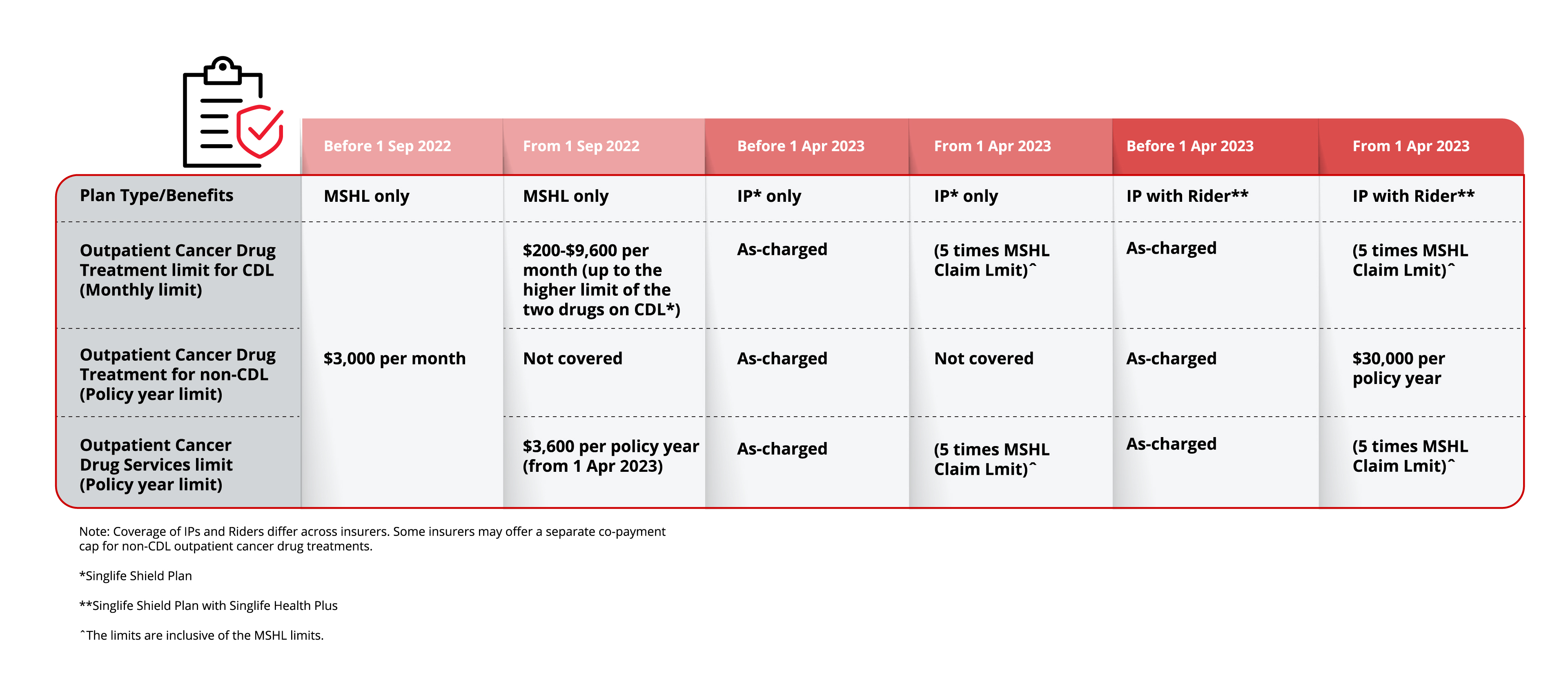

- Cancer coverage of IPs will change from 1 Apr 2023.

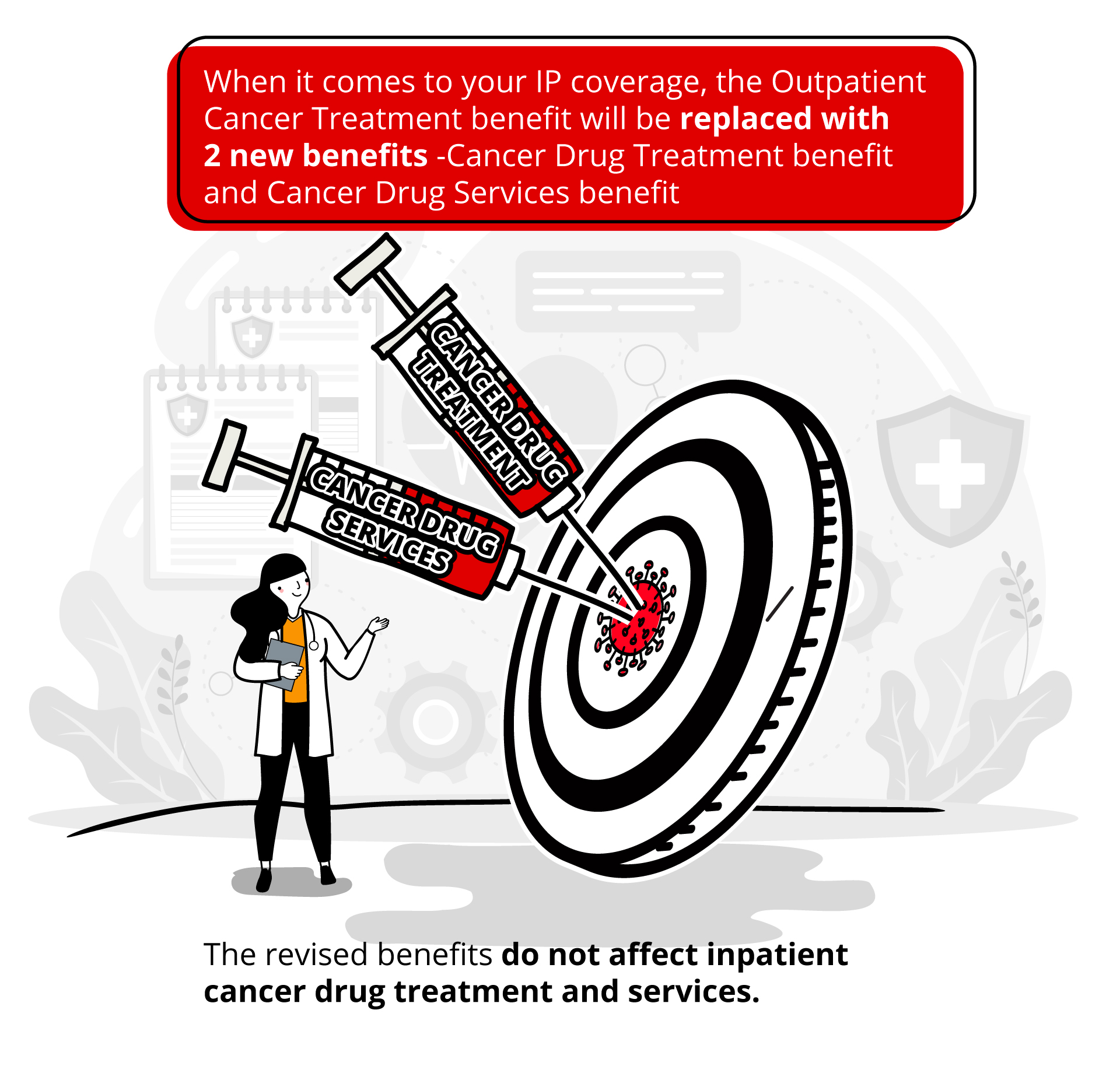

- Outpatient Cancer Treatment benefit will be replaced with 2 new benefits: Cancer Drug Treatment benefit and Cancer Drug Services benefit. There is no longer “as-charged” cancer coverage benefits for IPs.

- Only CDL cancer drug treatments can be claimable under your IP. Selected non-CDL cancer drug treatments will be claimable under IP’s riders.

![]()

With projections that 1 in 4 people may develop cancer in their lifetime and with an average of 44 people being diagnosed with cancer every day (Singapore Cancer Society), it is vital to understand your insurance coverage for cancer.

From 1 Apr 2023, cancer coverage of Integrated Shield Plans (IPs) will change. This change follows the changes for MediShield Life (MSHL) and MediSave since 1 Sep 2022 where only treatments that are listed on the Cancer Drug List (CDL) are covered. And on 30 Sep 2023, the six-month extension of insurance coverage for patients with IPs who are undergoing cancer treatments not on the CDL ended.

This is part of the Ministry of Health (MOH) efforts to reduce the cost of cancer drug treatment and keep premiums sustainable in the long term as cancer drug spending grew by 20% per year from 2016 to 2019.

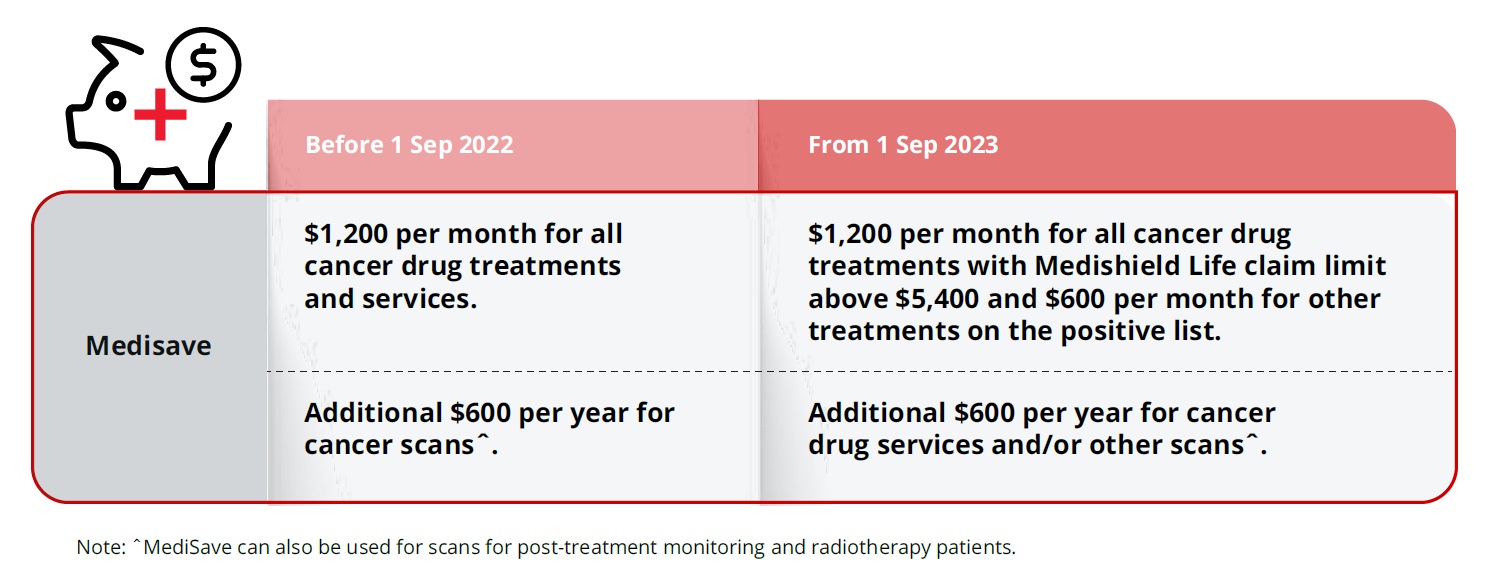

MediSave Cancer Coverage Changes

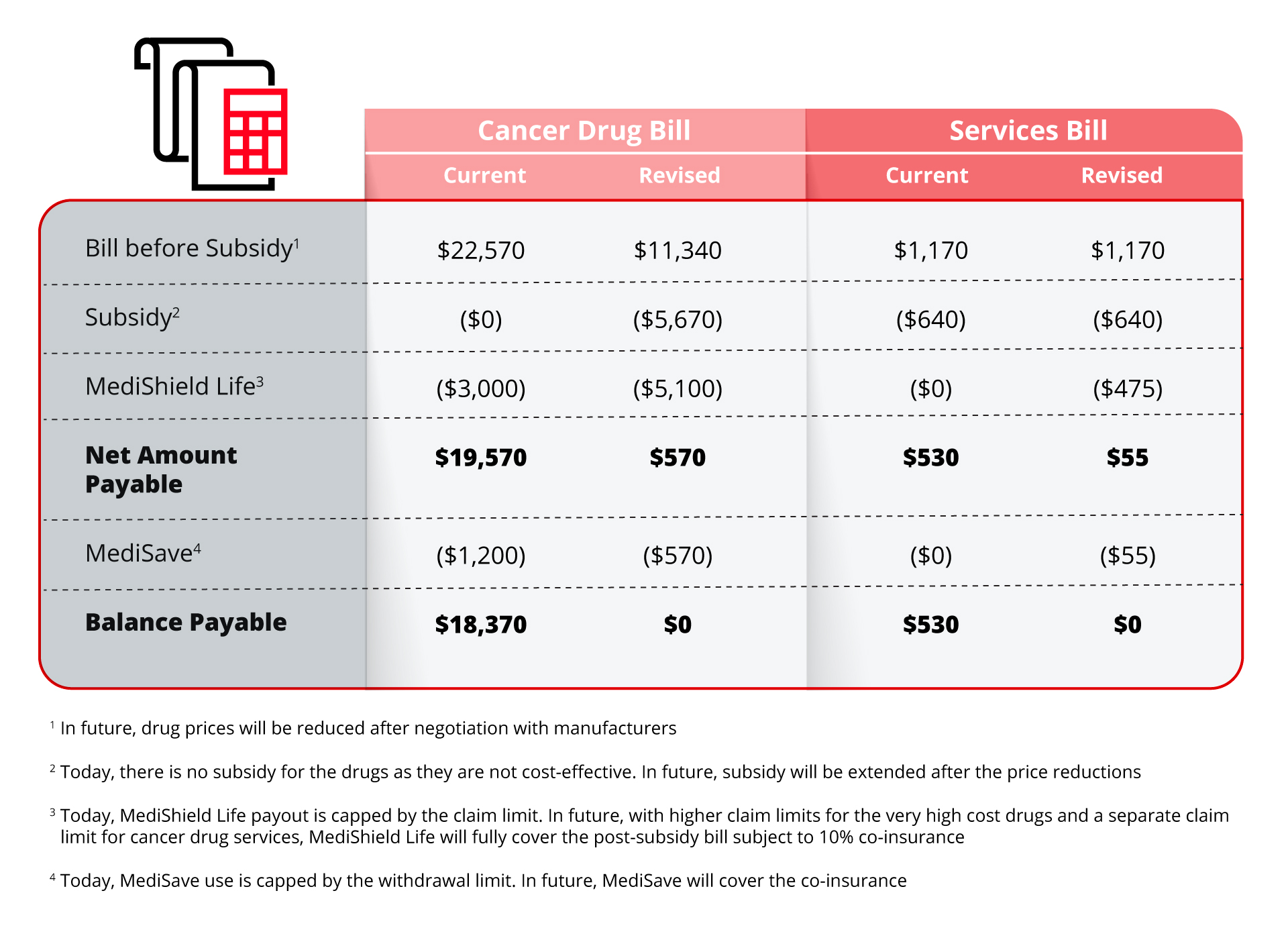

Illustration of improved affordability using Actual Bills

Patient: Middle-income Singaporean with kidney cancer

Cancer drug regimen: Very high-cost drugs

Services: Consumables, facility fees, consultation fees and lab investigation fees

Source: Ministry of Health

Previously, Outpatient Cancer Treatment benefits (Eg. Chemotherapy, Radiotherapy and Immunotherapy) of IPs were mostly “As Charged”. This meant that all associated costs would be covered by IPs so long as the ward you stayed in matched the coverage of your plan. Such a design meant that drug companies had no incentive to charge lower prices for less costly drug treatments.

Note: For policies renewed or purchased on or after 1 Apr 2023

MOH said that since the new policy was announced in August 2021, procurement prices have been reduced by an average of 30%, and up to 65% for some drugs. Currently, more than 90% of Health Sciences Authority-approved cancer treatments and over 200 approved drugs are already on the CDL. Learn about MOH’s updated CDL.

As a result, cancer patients will pay less for clinically proven and cost-effective cancer drug treatments.

1. Cancer Drug Treatment benefit

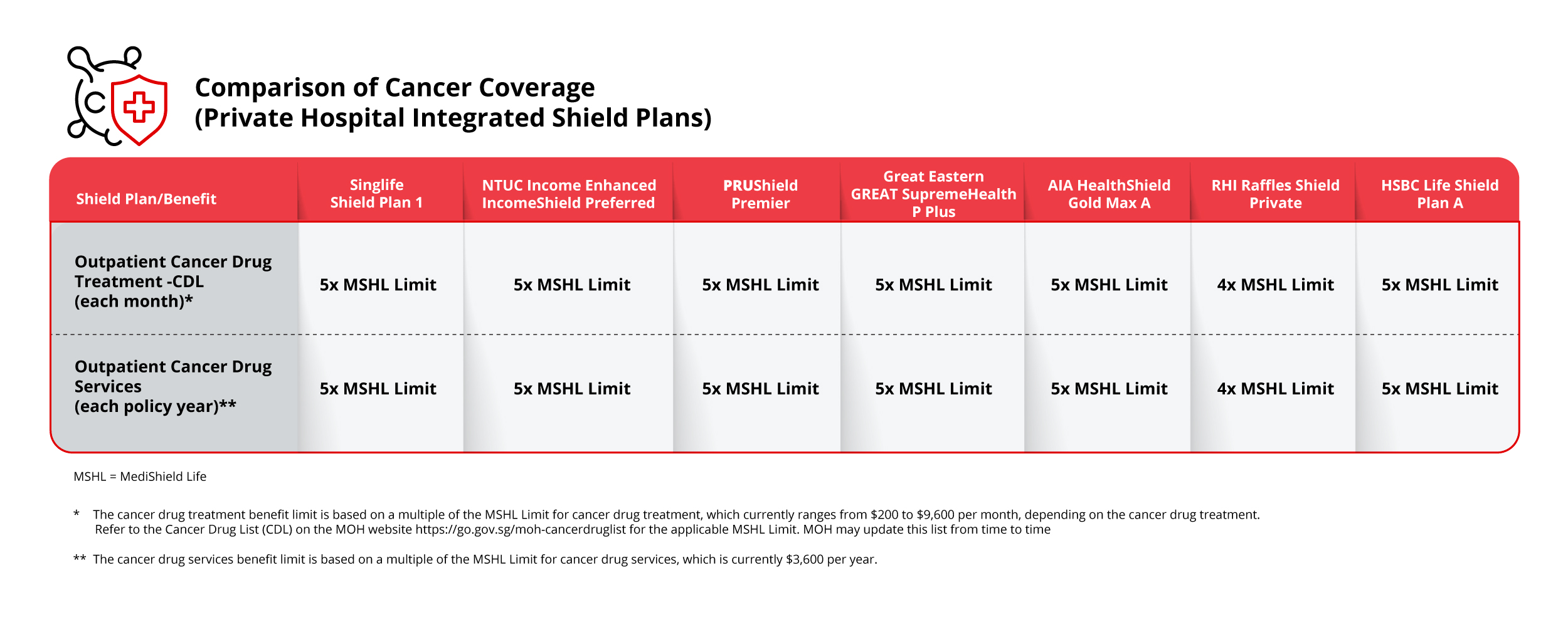

Only CDL cancer drug treatments can be claimable under your IP. The coverage under IPs is usually set as a multiple of the MSHL limits (depending on specific treatment limits).

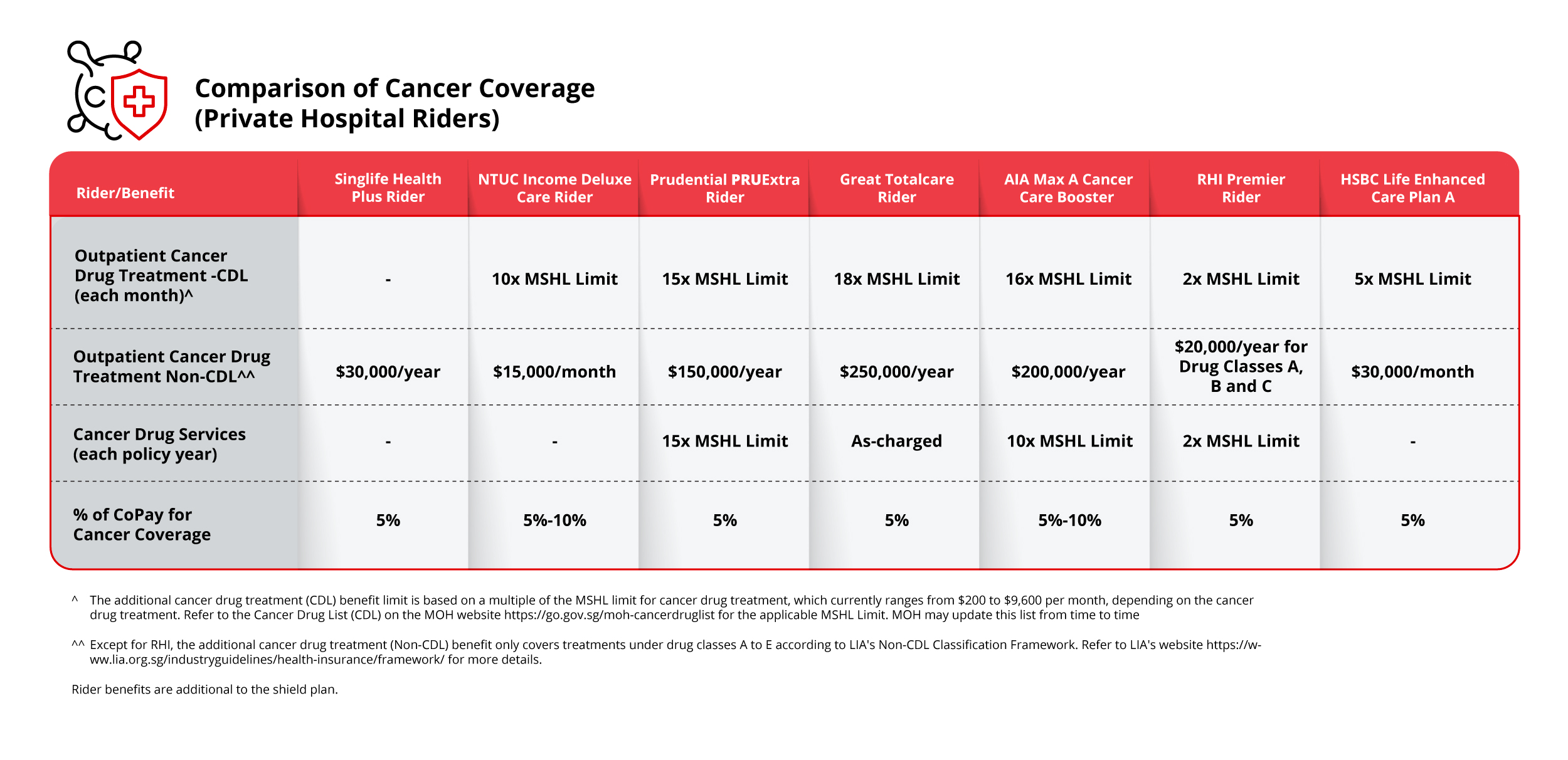

Selected non-CDL cancer drug treatments will be claimable under IP riders (up to policy year limit). Only non-CDL treatments under drug classes A to E of the Life Insurance Association, Singapore’s (LIA’s) Non-CDL Classification Framework are covered under riders. Class F treatments are not covered. Some insurers may impose a co-payment of up to 20% for non-CDL treatments.

2. Cancer Drug Services benefit

Services that are part of a cancer drug treatment (including treatments not on the CDL). IP coverage will be usually set as a multiple of the MSHL limits.

Services include consultations, scans, lab investigations, treatment preparation and administration, supportive care drugs and blood transfusions.

Examples of how your medical insurance coverage may change:

How are you affected if you are currently undergoing cancer treatment?

1. Is there any support if I am undergoing cancer drug treatment that is not on the CDL when the changes kicked in?

Do discuss with your doctor if there are suitable alternatives on the CDL that are subsidised and covered by insurance. However, if switching treatments is not feasible, there is support to help existing patients see through their current course of treatment:

MOH will provide additional financial support for all Public Healthcare Institution (PHI) patients without an Integrated Shield Plan (IP), and who had started treatments that are unsubsidised or not on the CDL before 1 Sep 2022. If you are a subsidised patient and still face difficulties affording your bills, you can approach a Medical Social Worker (MSW) in your PHI for financial assistance such as MediFund.

If you are a private patient, you can also approach your doctor to refer to subsidised care in a PHI, where you can apply for financial assistance. The PHI's medical team will review your treatment plan and provide financial counselling (e.g., eligibility for subsidies) before you decide whether to transfer to a PHI.

IP riders may also cover selected treatments beyond the CDL, though the extend of coverage may vary. You may wish to check with your insurer should you have further queries on your IP and rider coverage.

2. I have an IP and my current treatment is on CDL.

All IP insurers have committed to providing transitional support to IP policyholders undergoing cancer drug treatments beyond 1 Apr 2023.

Cancer patients who are receiving private care and need further financial assistance may request to be directly referred to subsidised specialist care at Public Healthcare Institutions, where your treatment plan will be reviewed and you can apply for additional financial support.

3. I am on multiple cancer drug treatments.

Patients who need more than 1 cancer drug treatment on the CDL in a month may claim up to the higher of the MediShield Life, MediSave, and IP claim limits applicable for the individual treatments, if they are prescribed according to the indications listed on the CDL.

However, if multiple cancer treatments are used but not according to the indications on the CDL, none of the treatments will be claimable, even if the individual treatments are listed on the CDL.

4. I have just been diagnosed with cancer.

Together with your oncologist, you should consider treatment options on the CDL, which are clinically proven and more cost-effective, before considering alternatives.

Are you sufficiently insured?

Having a cancer diagnosis can be a traumatic experience. It may even put one out of job for an extended period.

For critical illness insurance, consider getting 5 years of your gross income covered, as that is typically the amount of time the average person needs to recuperate from a critical illness or for cancer to go into remission.

If you would like to enhance your cancer coverage, consider the following

1 .Upgrading to a suitable rider on your IP which provides outpatient cancer drug treatment that is not on the CDL. The rider is payable by cash only.

2. Enhancing your critical illness insurance coverage which pays out a lump sum upon diagnosis of critical illness including cancer. For example, eCriticalCare protects you against 37 critical illnesses and CancerCare protects you against significant financial costs of cancer treatment with 100% payout at any stage.

Having sufficient coverage can go a long way in providing peace of mind and reducing the financial burden of your loved ones.