If you’ve only got a minute:

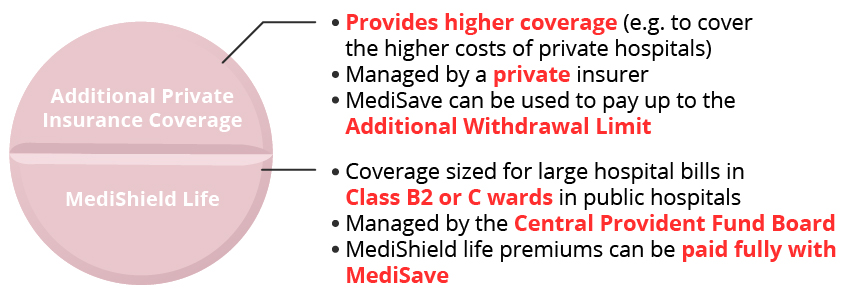

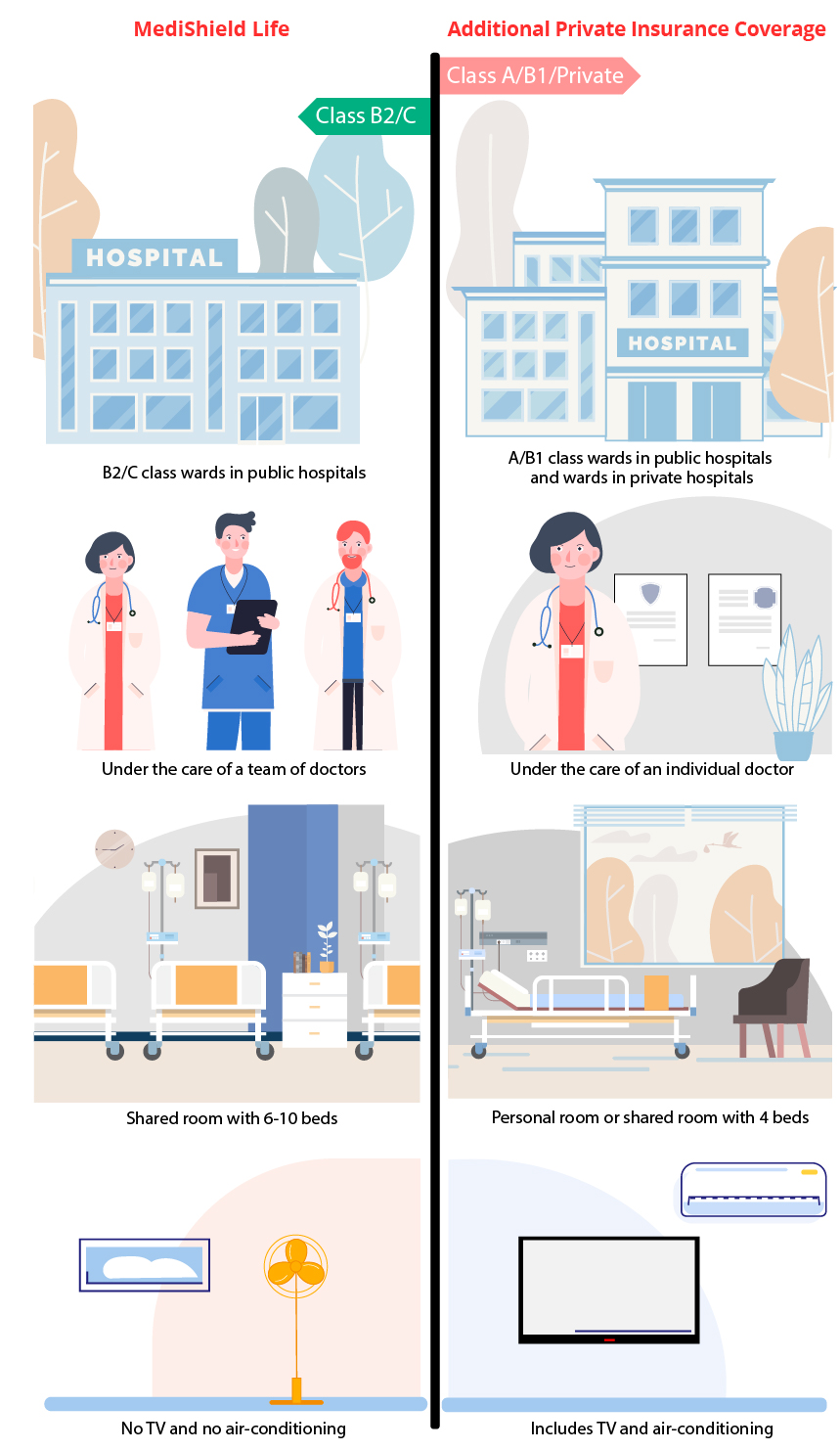

- MediShield Life (MSHL) is a basic health insurance plan with coverage targeted at B2/C wards at public hospitals. An Integrated Shield Plan offers additional coverage for A/B1-wards in public hospitals and private hospitals.

- MSHL covers hospitalisation and surgeries, but lacks coverage for pre- and post-hospitalisation costs. IPs help bridge that gap.

- With rising healthcare costs in Singapore, MSHL’s claim limit of S$150,000 p.a. may be insufficient. IP offers higher annual claim limits.

- There is a choice of private specialist doctors and hospitals with an IP.

![]()

As the saying goes, health is wealth. Getting adequate health insurance coverage is crucial as it helps pay for your healthcare costs if you get hospitalised due to an injury or sickness. Having health insurance can cushion some of the financial strain from hefty medical bills.

MediShield Life

MediShield Life (MSHL) is a basic national health insurance scheme that provides lifelong coverage for all Singapore Citizens and Permanent Residents (PRs). It pays for larger hospital bills in subsidised Class B2/C wards and is meant for selected specialist outpatient treatments and day surgeries in public hospitals.

MSHL premiums can be fully paid by Medisave.

If you choose to stay in a Class A/B1 ward or a private hospital, you will still be covered by MSHL, but expect to incur larger out-of-pocket expenses as the payouts are pegged to Class B2/C wards.

Consider opting for an Integrated Shield Plan (IP) as an add-on to enhance your medical coverage.

Read more: Guide to Health Insurance in Singapore: MediShield and more

What is an Integrated Shield Plan (IP)?

IPs are optional health coverage provided by private insurers that complements MSHL with higher coverage benefits. They offer more comprehensive coverage in public and private hospitals, but they also cost more.

The protection can be enhanced to provide higher coverage for areas such as hospitalisation benefits, claim limits and coverage for private hospitals and public hospitals (A/B1 wards).

Co-payment and deductibles

From 1 April 2021, under the new Ministry of Health (MOH) guidelines, all IP riders will require a minimum 5% co-payment, including renewals of existing IPs with full riders.

Deductibles represent a fixed amount that you are required to pay towards your medical expenses before your insurance provider starts payment of any benefits under the IP policy.

Co-payment refers to a predetermined percentage of the overall medical expenses that you need to pay after meeting the deductible.

Under MSHL, the deductible is S$1,500 for C Class and S$2,000 for B2 Class wards and above for those aged 80 and below. The co-payment starts at 10% and decreases as the claimable amount increases.

For IPs, deductibles are up to S$3,500 per annum and co-payment is at 10% of the medical bill.

Key considerations before you get an IP

1. What is your healthcare preference?

Data on the Central Provident Fund (CPF) Board’s healthcare financing website shows that from 2020 to 2022, 57% of Singaporeans and permanent residents (PRs) who had paid for higher coverage with IPs chose subsidised wards.

If you decide to purchase an IP but choose to stay in B2/C wards in public hospitals, it’s worth re-evaluating whether you should get additional private insurance.

Consider what you need based on the hospital ward and choice of hospitals you want to stay in to avoid paying for insurance that you might not need.

2. What coverage do you currently have?

Next, evaluate the existing insurance coverage you have. Find out the network of hospitals and panel of specialists/doctors associated with your current plan and ensure it includes the facilities you prefer, and whether the policy allows you to pay from your Medisave or cash.

If you have corporate insurance coverage through your employer, understand the extent of coverage it provides and find out if there are any specific medical conditions, treatments or situations that are excluded. Doing so allows you to be aware of the potential gaps in coverage.

Note: Corporate health protection ceases when you leave the company. If you are relying largely on your company’s insurance, it may be a good time to re-evaluate your coverage.

Find out the maximum amount the policy will pay out per year, and ensure it meets your potential healthcare expenses. Some IPs have lifetime claim limits, so consider this for long-term coverage.

Check if there are any riders or add-ons with your current coverage as they could provide options for higher ward classes, critical illness coverage, maternity benefits, dental coverage and/or alternative treatments like Traditional Chinese Medicine (TCM).

Remember to consider factors like age, existing medical conditions, and any potential future health concerns. For example, is there a history of cancer in your family? How about diabetes, high cholesterol and stroke? Do you exercise often, do you drink and smoke?

Understanding your medical history and lifestyle can help you gauge how comprehensive your health insurance coverage ought to be.

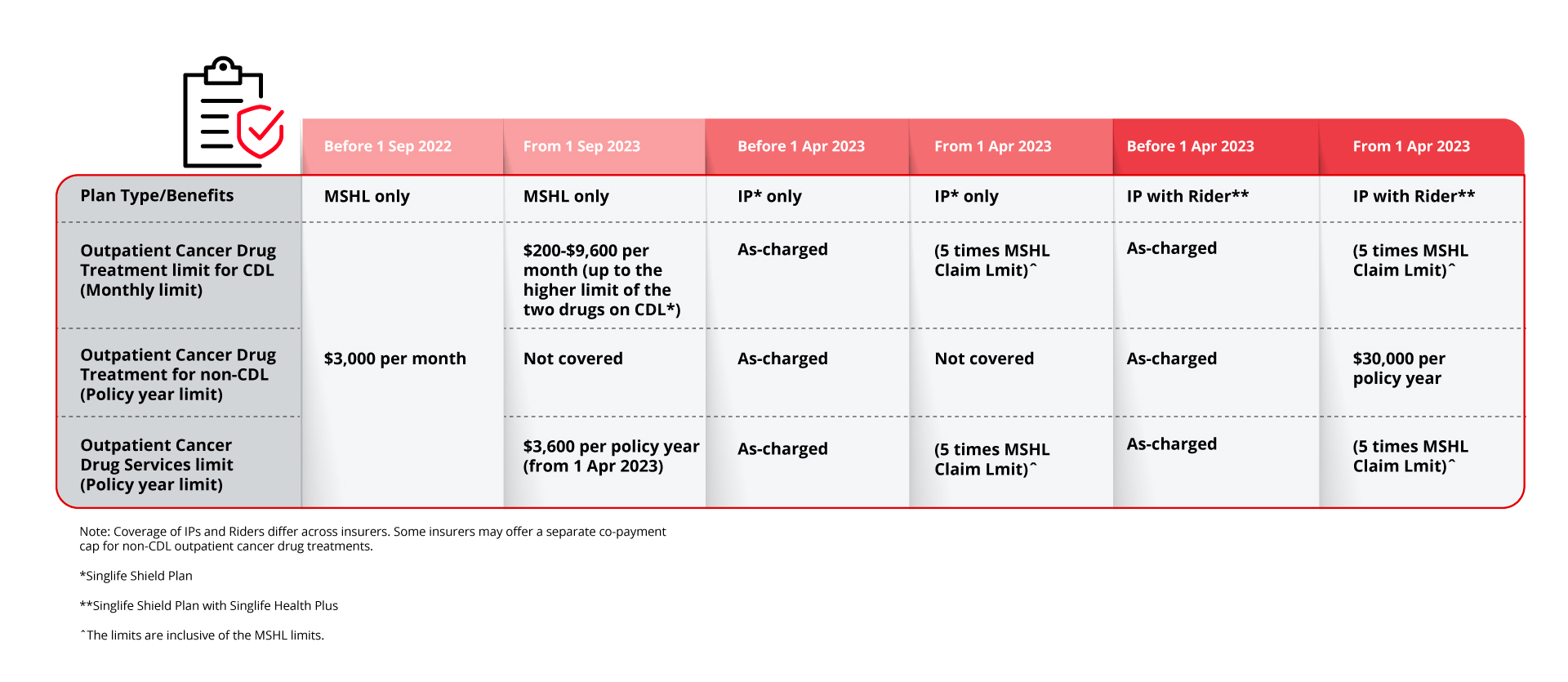

Since 1 September 2022, MSHL and Medisave only cover treatments that are on the Cancer Drug List (CDL), followed by changes of cancer coverage of IPs on 1 April 2023. Check if your current plan provides adequate coverage for cancer-related treatments, including chemotherapy, radiation therapy, and surgical procedures.

Consider enhancing your cancer coverage by upgrading to a suitable rider on your IP that provides non-CDL outpatient cancer drug treatment.

3. Do you need additional coverage?

While MSHL primarily covers inpatient hospitalisation, IPs often include additional benefits for pre- (consultations, tests and treatments prior to hospital stay) and post-hospitalisation (follow-up treatments, medications and rehabilitation) expenses.

For instance, physiotherapy sessions are often necessary for comprehensive rehabilitation and can extend over months and incur significant costs.

Without sufficient coverage, you may have to dip into savings to cover these expenses, which can potentially strain your financial resources and disrupt your long-term financial planning.

An IP also allows you to customise your plan by adding various riders according to your preference and needs, adding extra protection against specific medical conditions or treatments.

With an IP and suitable riders, your out-of-pocket expenses, including deductibles and co-insurance, can also be significantly reduced or eliminated.

4. Affordability

It's crucial to consider the long-term affordability of IP premiums, especially as they tend to increase significantly with age. Many opt for IPs at a younger age due to lower premiums, often not giving it much thought until they approach an age where they may need to supplement the premiums with cash.

Evaluate the coverage that you need and your financial sustainability before committing to one. To provide context, if you have an IP covering private hospital care, you could end up paying around S$187,000 in premiums over your lifetime.1

In contrast, by sticking with just MediShield Life, you'd pay less than a third in premiums, approximately S$56,000 over your lifetime.

It's imperative to ensure you can still afford the premiums, particularly as you age and retire eventually.

Also, consider if using your MediSave for IP premiums is the best use of your savings, as any amount beyond the Basic Healthcare Sum (BHS) in the current year gets transferred to your Retirement Account (RA) which earns an attractive 4% interest rate for future medical and retirement needs.

Read more: 6 ways to optimise your CPF for retirement

If you find that the premiums are becoming too expensive as you age, you might want to re-think about downgrading your plan. Keep in mind that it can be more challenging to upgrade from a lower tier plan to a higher one as you get older, due to medical underwriting requirements and potential pre-existing illnesses.

Do not switch your IP if your current plan covers pre-existing conditions as a new plan will require medical underwriting and a new policy may exclude pre-existing conditions.

Read more: Navigating healthcare costs

To sum up

While IPs and riders are optional, they offer valuable advantages and extra coverage for those looking for enhanced healthcare protection.

It’s important to carefully assess your healthcare needs, financial situation, and consider factors such as cost, coverage, and potential premium increases over time.

Sources:

1Salma Khalik, “More than half who buy IPs for private healthcare opt for subsidised wards when hospitalised”.

The Straits Times. Retrieved 23 Nov 2023.