![]()

If you’ve only got a minute:

- Before you venture into the insurance market, set aside an emergency fund of 3 to 6 months of your expenses, or up to 12 months if you are self-employed.

- Safeguard your financial well-being by prioritising essential insurance coverage, including hospitalisation, disability, critical illness, and life insurance, to protect against unforeseen circumstances.

- Make sure that you can afford the premiums for the duration of the policy, as those who surrender their plans prematurely may suffer losses.

![]()

This article was first published on The Straits Times on 28th November 2021.

Insurance is crucial to better prepare for life's uncertainties.

Paradoxically, the wide and complex range of insurance policies could add to anxiety - and uncertainty.

So what to buy and how to decide? But first, why bother?

Get your priorities right

Experts reason that with the right policies, you can:

- Get your money to work harder

- Look after yourself and loved ones should you lose your income from illness, disability or accidents

- Build a bigger nest egg for your retirement

Insurance also protects you against rising healthcare costs and inflation.

And with the uncertainties brought about by the pandemic, more Singaporeans are prioritising their financial well-being.

From January to September, Singapore's life insurance industry recorded $4.11 billion in new sales, up 38 per cent from the same period last year, according to the Life Insurance Association (LIA).

Get your basics right

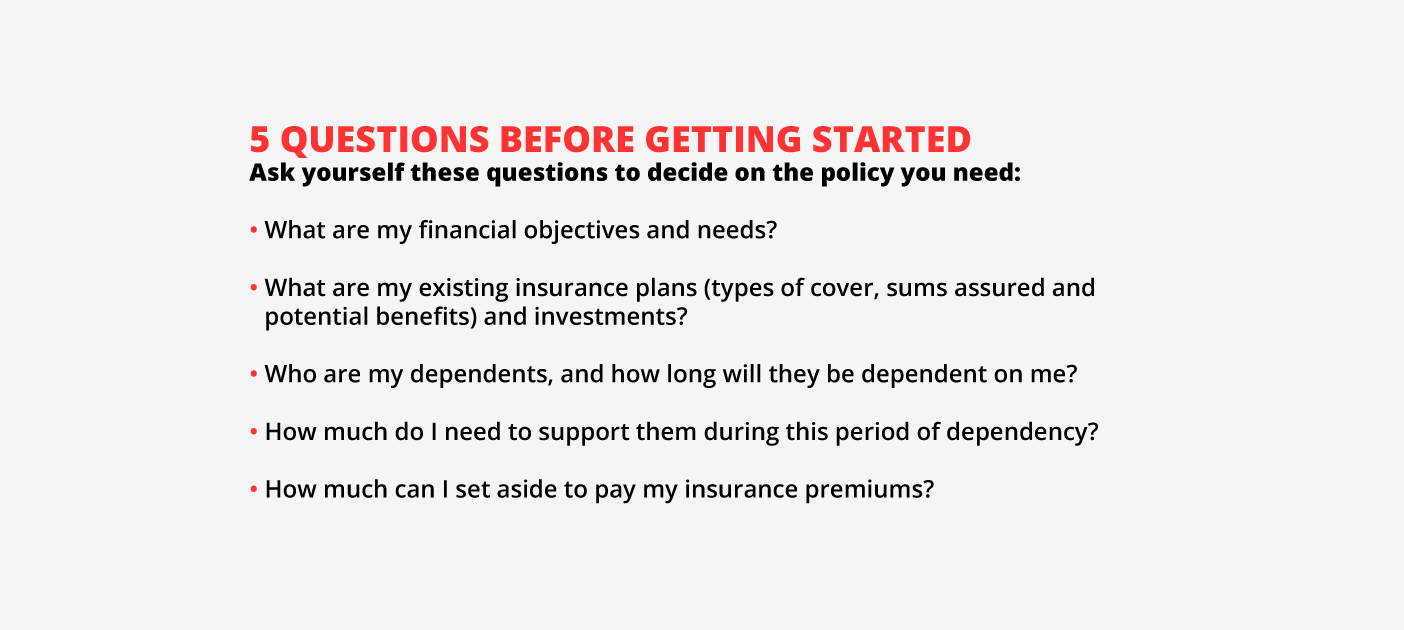

What should you consider when picking policies, and how can you make sure that a policy is right for you?

Ms Evy Wee, DBS Bank's head of financial planning, investment and insurance solutions, has a few tips.

Before you venture into the insurance market, set aside an emergency fund of three to six months of your expenses, or up to 12 months if you are self-employed.

"You should also check whether you have existing policies under your parents, Central Provident Fund savings and deposit savings," says Ms Wee.

Firstly, ask yourself if you have adequate hospitalisation coverage. Every Singaporean and permanent resident is covered under the basic hospital plan MediShield Life - but is it enough for your needs?

She explains: "If you are hospitalised without sufficient coverage, it renders all other plans useless because your funds will all go towards paying your bills."

From January to September, Integrated Shield Plans (IPs) and IP riders - which provide more coverage for hospital bills - made up 82 per cent of all new premiums for individual health insurance in Singapore. The remaining 18 per cent came from other medical plans and riders.

Once you have a hospitalisation plan, you can consider other protection-type policies, including disability insurance, critical illness coverage and life insurance.

The LIA recommends being insured for nine times your annual income in case of death, and five years of expenses when it comes to critical illness coverage, as that is the average amount of time that people need to recover from such illnesses.

"It is critical to identify protection gaps - the shortfall in the amount of cover needed to maintain living standards of dependants - and plug them," says Ms Wee.

"At the same time, you don't want to be over-insured and spend unnecessary money on higher premiums than you need. Where necessary, get professional help to advise you."

After you have taken care of your healthcare needs, there are endowment policies, which focus on savings, and investment-linked policies, which are customisable and enable you to grow your money, subject to market risks.

People should review their policies annually. Ms Wee explains: "Our needs and goals change as we grow older. Consider increasing your insurance coverage gradually to prepare for unexpected health problems that might come as you age.

"Building up your insurance bit by bit will give you more peace of mind. By starting with less coverage, you won't have to fork out too much early on when you have just entered the working world."

From January to September, Integrated Shield Plans (IPs) and IP riders - which provide more coverage for hospital bills - made up 82 per cent of all new premiums for individual health insurance in Singapore. The remaining 18 per cent came from other medical plans and riders.

Once you have a hospitalisation plan, you can consider other protection-type policies, including disability insurance, critical illness coverage and life insurance.

The LIA recommends being insured for nine times your annual income in case of death, and five years of expenses when it comes to critical illness coverage, as that is the average amount of time that people need to recover from such illnesses.

"It is critical to identify protection gaps - the shortfall in the amount of cover needed to maintain living standards of dependants - and plug them," says Ms Wee.

"At the same time, you don't want to be over-insured and spend unnecessary money on higher premiums than you need. Where necessary, get professional help to advise you."

After you have taken care of your healthcare needs, there are endowment policies, which focus on savings, and investment-linked policies, which are customisable and enable you to grow your money, subject to market risks.

People should review their policies annually. Ms Wee explains: "Our needs and goals change as we grow older. Consider increasing your insurance coverage gradually to prepare for unexpected health problems that might come as you age.

"Building up your insurance bit by bit will give you more peace of mind. By starting with less coverage, you won't have to fork out too much early on when you have just entered the working world."

Get your checks right

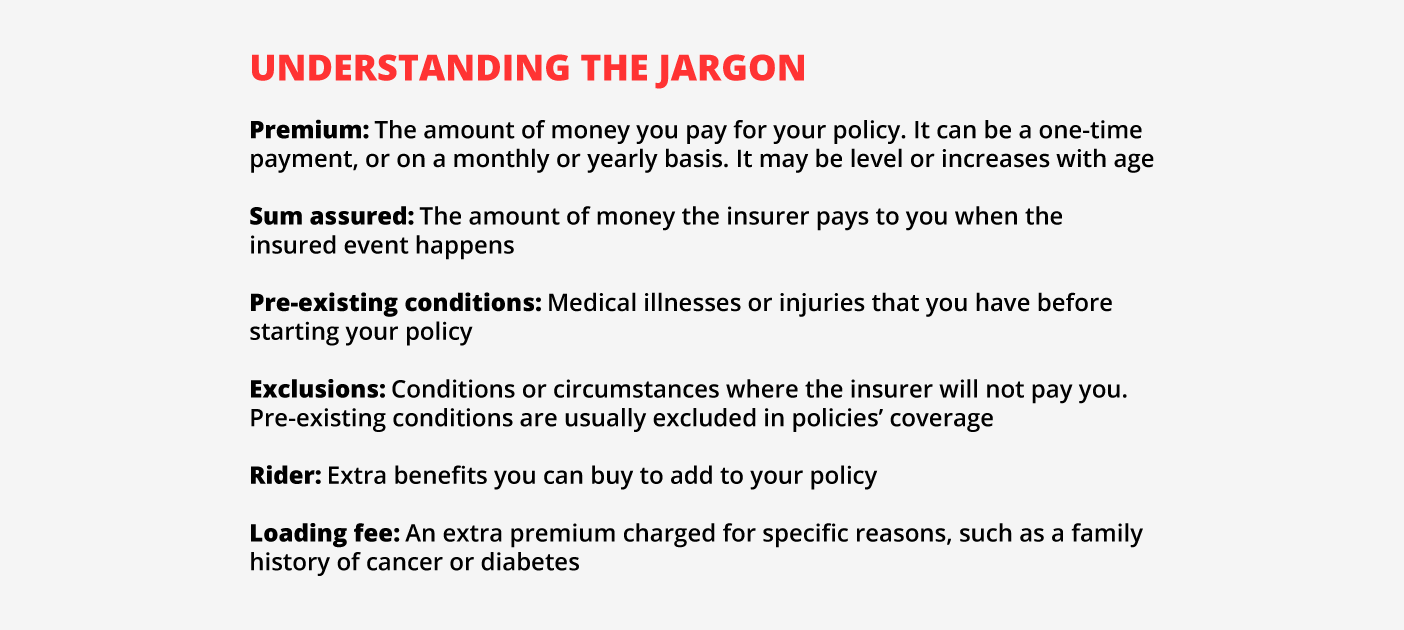

As you explore your options, you will get documents detailing the policies to help you make informed choices. These contain product summaries, benefit illustrations and other information.

Read these carefully, cautions Ms Wee. What do these mean?

- The product summary describes the policy's features, benefits, fees and charges.

- The benefit illustration shows the policy's costs and charges, and the money you could receive if you make a claim, surrender (cancel the policy), or hold it until maturity.

- The benefit illustration sets out both guaranteed and non-guaranteed benefits. One way to assess a policy is to look at the guaranteed benefits, since this is the amount that the insurer must pay. This figure should at least match the total premiums paid.

"You can compare the potential returns of policies with other types of investment products, remembering that every product comes with different risks," says Ms Wee.

"If you do not find the returns attractive, you may want to buy a term plan for protection, and invest your money in other products." A traditional term plan provides life insurance for a specified number of years with no cash value.

Note also that while insurers usually assume two investment returns rates (set by LIA) - currently 3 per cent and 4.25 per cent for endowment policies, and 4 per cent and 8 per cent for investment-linked policies - these are meant as guides.

You may get higher or lower returns depending on the investments' actual performance in future economic conditions.

Given that these are sizeable financial commitments, Singaporeans do have some protections when choosing the right policy for their needs.

When you receive your policy document, you have 14 days to review it, and can get a refund if you decide to cancel it during this "free-look" period.

The Policy Owners' Protection Scheme, administered by the Singapore Deposit Insurance Corporation, also covers some insurance policies if the insurer fails, subject to caps where applicable.

But you should do your sums, and make sure that you can afford the premiums for the duration of the policy. "People who surrender their plans prematurely are likely to suffer losses. In some cases, they may get nothing back," says Ms Wee.

"Insurance is a long-term commitment, so do your due diligence. Be certain that you know exactly what you're getting, and getting into, with each policy."

This is the first of a five-part series on insurance.