By Lorna Tan

![]()

If you’ve only got a minute:

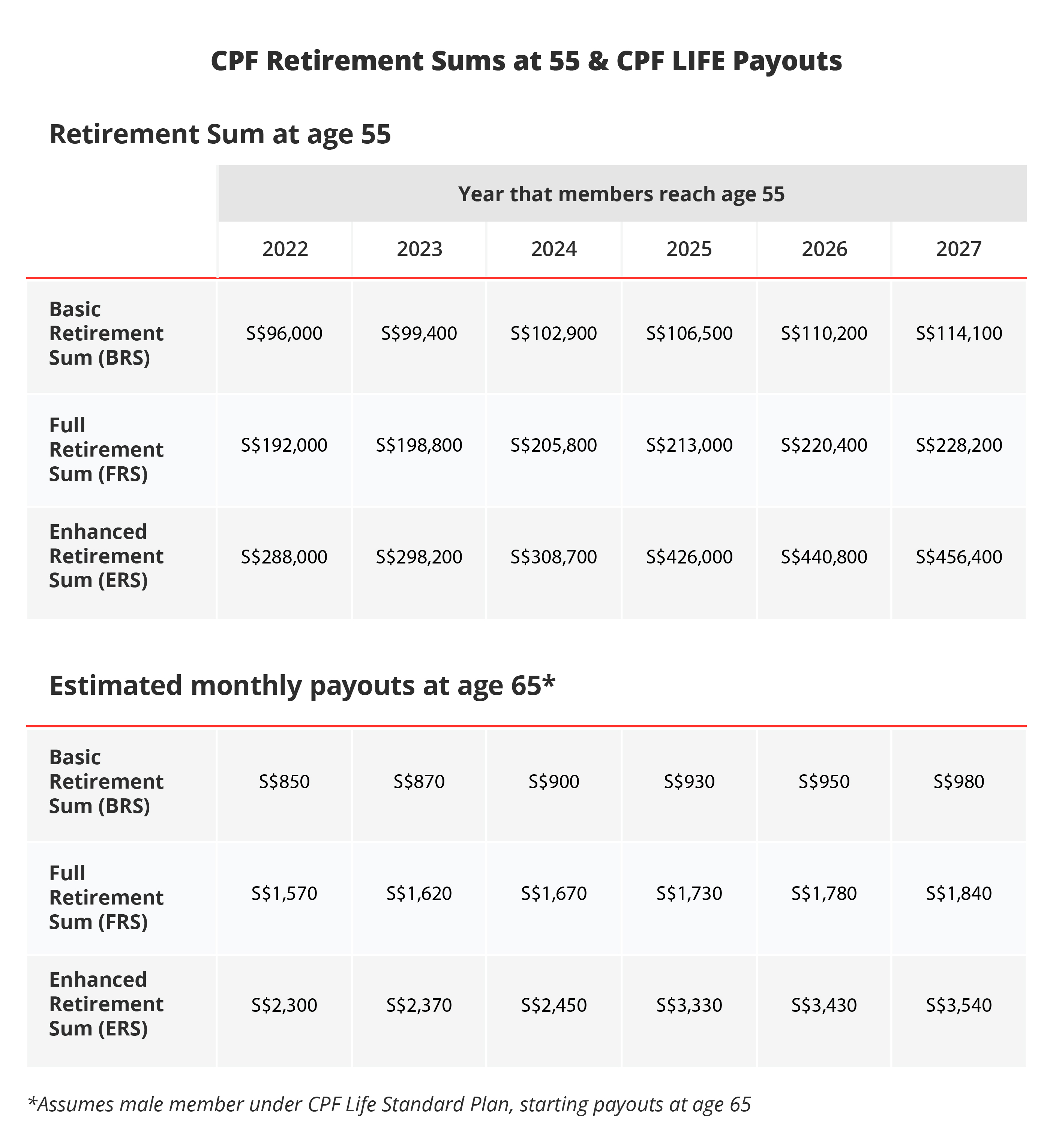

- From 2025, the revised Enhanced Retirement Sum of 4 times of Basic Retirement Sum will boost retirement adequacy for all as they can look forward to higher risk-free monthly payouts for life.

- Instead of focusing on maximising the returns, CPF LIFE should be seen as supporting members’ retirement through monthly lifelong payouts and to hedge against longevity risk.

- I would pick the CPF LIFE plan that offers the desirable payout required to fund my retirement lifestyle and not be overly concerned about maximising the yields and bequest.

![]()

The closure of CPF Special Account (SA) on 19 January for those 55 & above, has thrown a spanner in the retirement plans of some CPF members. They are likely to be “CPF-rich” and would have planned to enjoy the attractive and risk-free interest of 4% pa and the flexibility of making withdrawals anytime from their SA, having set aside the Full Retirement Sum (FRS) or the Basic Retirement Sum (BRS) plus property pledge in their Retirement Account (RA).

SA Shielding Strategy

Some of them managed to retain substantial amounts of SA balances because they have shielded them – by investing the money in excess of S$40,000 in their SA - before their RA was created at age 55. After turning 55, the investment was subsequently liquidated and the principal plus profit (if any) returned to their SA to enjoy the minimum 4% pa interest. With the closure of SA for those age 55 & above, it also marks the end of the use of the SA Shielding strategy for that purpose, from 2025.

I recalled the excitement of performing the SA Shielding strategy back in 2019 when I turned 55. In a Straits Times article that was published in late 2019, I explained that I desired to have substantial savings in both my SA and RA which attract decent returns of at least 4% pa each. Thanks to the power of compounding at the SA interest of at least 4% pa as well as mandatory CPF contributions, I have more than S$300,000 in my SA this year.

Part of my retirement plan was to treat my SA as a fixed deposit and withdraw the interest amount (about S$12,000) every year without touching the principal amount, when I retire. Meanwhile, I have been topping up my RA up to the prevailing Enhanced Retirement Sum (ERS) each year. As such, I had expected to have S$2,300 in CPF LIFE monthly payouts for life. Coupled with the monthly withdrawals of S$1,000 interest from my SA, both payouts would be the foundation tier of guaranteed income flows to fund my retirement needs. The other income flows will come from an annuity plan that I bought in my 40s, the Supplementary Retirement Scheme, and other investments like bonds, income funds, Real Estate Investment Trusts, and equities.

What’s next?

The government has decided to plug the “loophole” of retaining substantial SA balances through shielding by rationalising the CPF system with this “principle of interest rate” explanation - that short-term savings should only enjoy short-term (lower) rates while long-term savings attract long-term (higher) rates.

It’s a sound rationale.

Along with “impacted” CPF members, I will move on and take this as an opportunity to review my retirement plan and how I can optimise my CPF nestegg, along with other financial resources.

With this change, SA and OA savings up to the FRS will be transferred to the newly created RA when a member turns 55. As the SA will be closed, any SA balance will be transferred to the OA and earn the lower interest of at least 2.5% pa. Future employer and employee CPF contributions will be channelled into OA, RA, and Medisave Account (MA). If the RA has reached FRS and/or the MA has reached the Basic Healthcare Sum (S$75,500 in 2025), the excess contributions will go to OA. Any SA monies invested before age 55 will also be transferred to the OA, if the FRS in RA has been met.

On the bright side, CPF members can top up their RA up to the ERS of 4 times of BRS from (S$426,000 in 2025) from this year. ERS was 3 times of BRS previously.

The revised ERS will boost retirement adequacy for all as they can look forward to higher risk-free monthly payouts for life.

Here are 5 tips on what CPF members aged 55 & above can consider.

- Transfer OA savings to RA up to the new ERS amount to enjoy higher monthly CPF LIFE payouts.

- Keep the money in OA and use it as a fixed deposit, enjoying the 2.5% pa interest.

- Invest OA monies under the CPF Investment Scheme (CPFIS) in unit trusts (zero sales charge), T-bills, fixed deposits, insurance plans, and so on. When the investment is liquidated, the proceeds will return to the OA.

- Withdraw savings (beyond the FRS) for investments and/or insurance that are not covered under CPFIS.

- Withdraw savings (beyond the FRS) for immediate needs, if required.

Before my SA was closed, I used S$117,300 of my SA savings to top up my RA to the ERS of S$426,000. I plan to continue topping up to the prevailing ERS each year till age 65. CPF Board has worked out that I can expect monthly payouts of about S$3,200 under the CPF LIFE Standard Plan from age 65. This is a higher payout than the S$2,300 payout I was expecting if ERS had remained at 3 times of BRS.

The remaining SA savings of about S$230,000 was transferred to my OA, at a “loss” of 1.5% (4% minus 2.5%) pa interest. As I have no pressing liquidity needs, I intend to keep them in my OA and invest some of it under CPFIS to earn potentially higher returns than the OA interest of 2.5% pa. If I find viable investment options outside of CPFIS, I will withdraw a portion of my OA.

The interest rate environment has softened so it is more challenging to find risk-free products that can yield 3% pa to 4% pa. Do consider your financial situation, liquidity needs, time horizon and risk profile before investing your CPF savings in products that you understand. After all, you will be enjoying risk-free interest of at least 2.5% on your CPF savings by doing nothing.

De-mystifying CPF LIFE Plans

There has been some noise as to which year a person should “ideally” kick the bucket so as to maximise the yields of the CPF LIFE plan. However, do be mindful that CPF LIFE is an insurance product and not an investment product.

Instead of focusing on maximising the returns, CPF LIFE should be seen as supporting members’ retirement through monthly lifelong payouts and to hedge against longevity risk. As life expectancy increases with medical advancement, no one can accurately predict how long he or she will live. Those who live longer will receive more than their CPF LIFE premiums.

Having said that, there will be greater clarity if CPF Board can reinstate information on the bequest amounts in the CPF LIFE Estimator calculator. This information was provided previously but has been removed since 2021, likely because CPF Board would prefer to have members focus on payouts than bequest amounts. Since CPF LIFE is an annuity, bequest information should be provided like other life insurance plans.

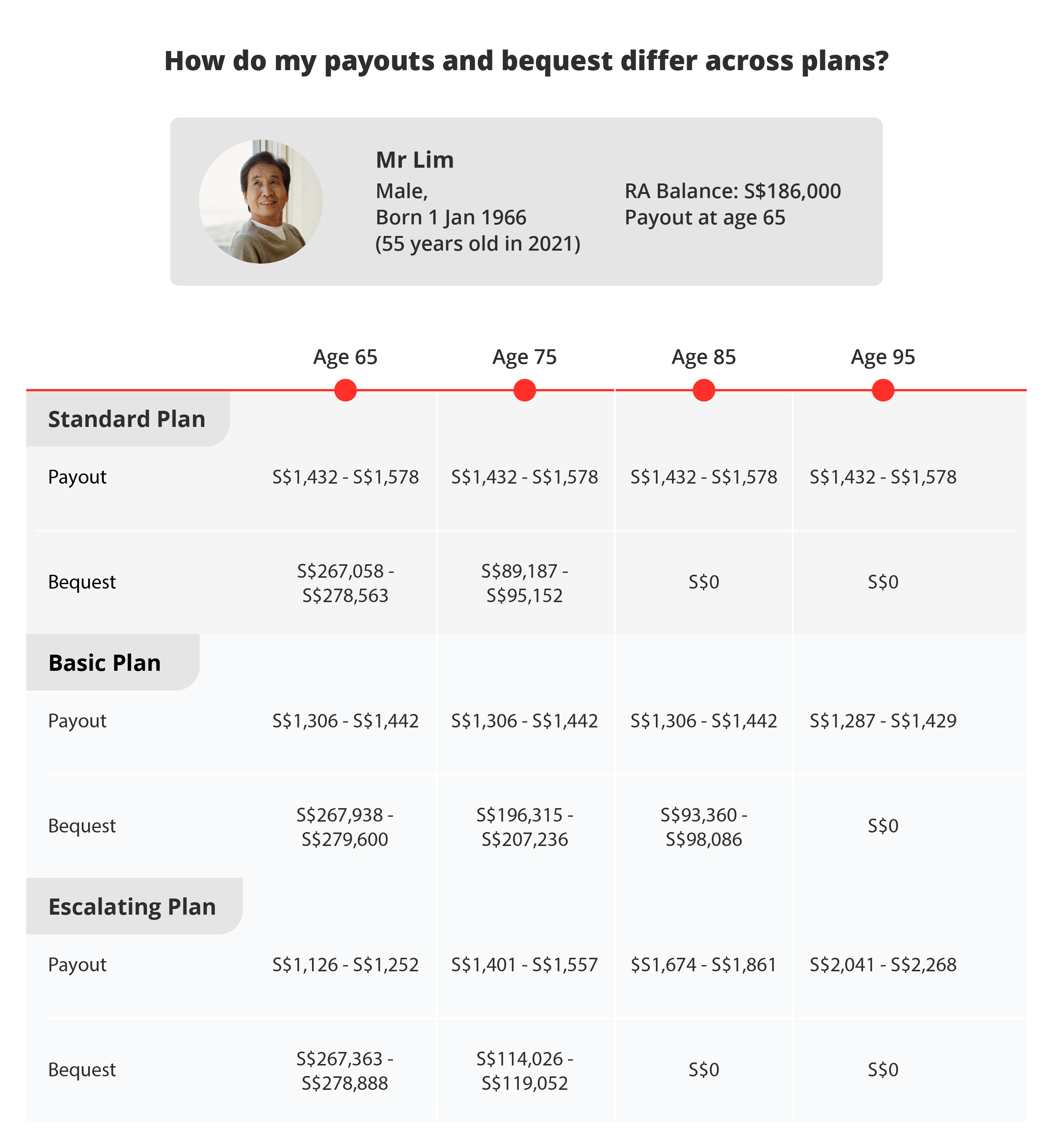

Here is a table that I generated from the CPF LIFE estimator in Dec 2020, before the bequest information was removed.

When we reach our payout eligibility age of 65 at the earliest, we get to select 1 of 3 CPF LIFE plans. Here are some considerations.

- For the CPF LIFE Escalating Plan, the initial monthly payouts are lower than that of the Standard Plan by 20% and they rise by 2% each year, thereafter. It will take about 23-25 years for the cumulative payouts of the Escalating Plan to catch up with that of the Standard Plan.

- CPF LIFE Basic Plan’s monthly payouts are relatively lower than that of the Standard Plan while its bequest amounts are higher but up to a certain age. This is because the Basic Plan is structured in such a way that only 10-20% of your RA savings will be deducted as CPF LIFE annuity premium when you join the scheme. Under the Basic Plan, your monthly payouts will be paid out from your RA till it is depleted at about age 90, after which the payouts will come from the CPF LIFE pool.

- For the Standard and Escalating Plans, 100% of your RA savings will be deducted as CPF LIFE annuity premium when you join CPF LIFE.

- For all 3 plans, when you pass away, your beneficiaries will receive your CPF LIFE annuity premium balance and this will exclude any interest earned. The interest earned on CPF LIFE annuity premium along with the premiums of other CPF LIFE members, ensures that we can continue receiving payouts no matter how long we live, even if our CPF LIFE premium balance is depleted.

- Beyond 90+ age, there is no bequest under the 3 CPF LIFE Plans. This means that for those who live to their 90s and beyond, they would be better off choosing the Standard or Escalating Plan to enjoy the higher monthly payouts.

To maximise the CPF LIFE scheme, I will need to live a very long (ideally healthy too) life. To guide my choice, I would pick the CPF LIFE plan that offers the desirable payout required to fund my retirement lifestyle and not be overly concerned about maximising the yields and bequest. For members who opt for a plan with lower monthly payouts, consider if they are adequate.

The changes to the CPF system are a wake-up call for everyone to empower themselves with financial knowledge, understand the need to invest, their risk profile and the wide range of investment options. In addition to leveraging government schemes to grow your nest egg, do reach out to professional wealth planning managers to help close your gaps and boost financial resilience.

Ready to start?

Start planning for retirement by viewing your cashflow projection on digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.