![]()

If you’ve only got a minute:

- The Supplementary Retirement Scheme (SRS) is a voluntary scheme that can complement your Central Provident Fund (CPF) savings to better prepare you for your golden years.

- Receive tax relief for every dollar contributed to your SRS. The total personal income tax relief claimable in a year is S$80,000.

- Invest your SRS savings to achieve potentially higher returns for your retirement.

The life expectancy of Singaporeans is among the highest in the world at 83.5 in 2024.

Having a longer lifespan means requiring a longer stream of income to supplement your retirement years. However, there are risks that comes along with it such as overspending, inflation and healthcare.

CPF is a key pillar of Singapore’s social security system that helps Singaporeans and Permanent residents (PRs) set aside funds to build a strong foundation for retirement. Your CPF savings can also be utilised for housing and healthcare needs. While it is easy to project your retirement savings, it is not possible to predict your own life expectancy. That is why we have CPF LIFE, a longevity insurance annuity scheme that provides us with a steady stream of lifelong retirement income starting as early from age 65 (for members born in or after 1958).

There are 3 types of CPF LIFE plans you can choose from:

- Standard Plan: Offers level monthly payouts for life.

- Basic Plan: Payouts start low, and fall when your CPF balances drop below S$60,000.

- Escalating Plan: Payouts start lower initially but grow by 2% yearly to protect you against inflation.

Build an additional retirement pot

The SRS is a voluntary savings scheme that complements your CPF savings for retirement. With SRS, you can build greater savings on top of your CPF.

Here are 5 key points to know about the SRS.

1. You can contribute any amount, as many times as you wish throughout the year

You can make your annual SRS contributions by:

- Depositing to your SRS account in a lump-sum

- Topping up as and when your cashflow allows, up to the cap, or

- Setting aside S$1,275 monthly to make full S$15,300 by the cut-off time required by your SRS operator,

Do note that the contributions are subject to a cap of S$15,300 for Singaporeans and PRs, and S$35,700 for foreigners. Foreigners have a higher SRS contribution limit as they do not receive tax relief from CPF contributions.

Tip: The SRS is a useful retirement savings tool, particularly if you are a foreigner/non-PR, as you do not have CPF contributions. Your employer can also contribute voluntarily to your SRS.

2. Enjoy tax relief

The SRS offers attractive tax benefits. Every dollar you contribute to SRS is eligible for tax relief. However, your SRS contributions are subject to a cap on personal income tax relief of S$80,000 yearly. The cap is a limit on the total amount of tax reliefs you can claim and it applies to the total amount of all tax reliefs claimed. All SRS contributions must be made by 31 Dec of the year or as required by your SRS operator, to be eligible for SRS tax relief in the following Year of Assessment following the year of contribution.

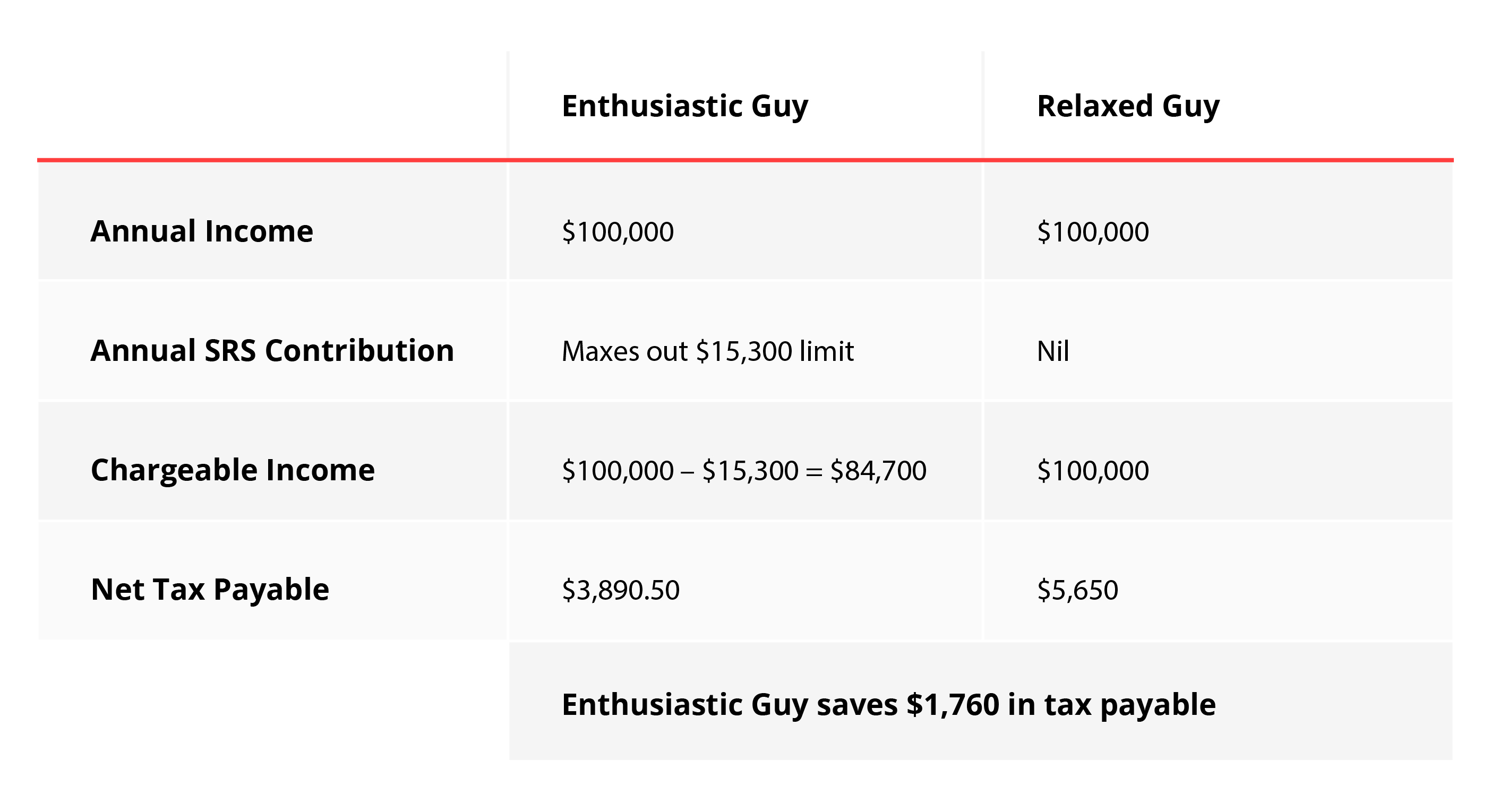

Here’s an example of how SRS can help you save on taxes2:

3. Investing your SRS funds

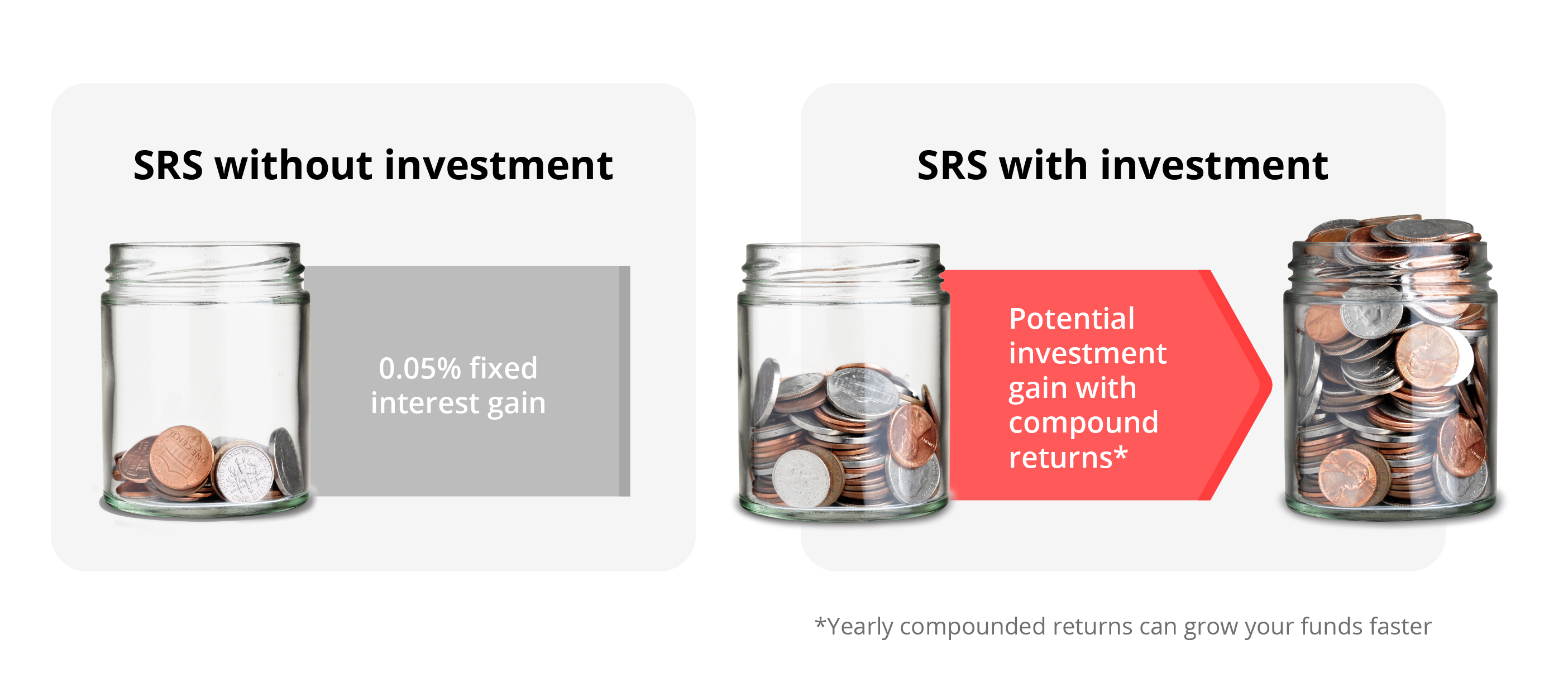

Unlike your CPF savings, your SRS monies cannot be utilised for housing and medical needs. Savings in your SRS account earn you 0.05% interest p.a.

Rather than leaving your SRS funds idle, consider investing them to enjoy potentially higher returns. The investments accumulate tax-free returns as well.

Make your SRS monies work harder for you by investing them in endowment plans, shares, exchange traded funds, real estate investment trusts, fixed deposits, Singapore Savings Bonds, and unit trusts.

4. Long-term savings with SRS

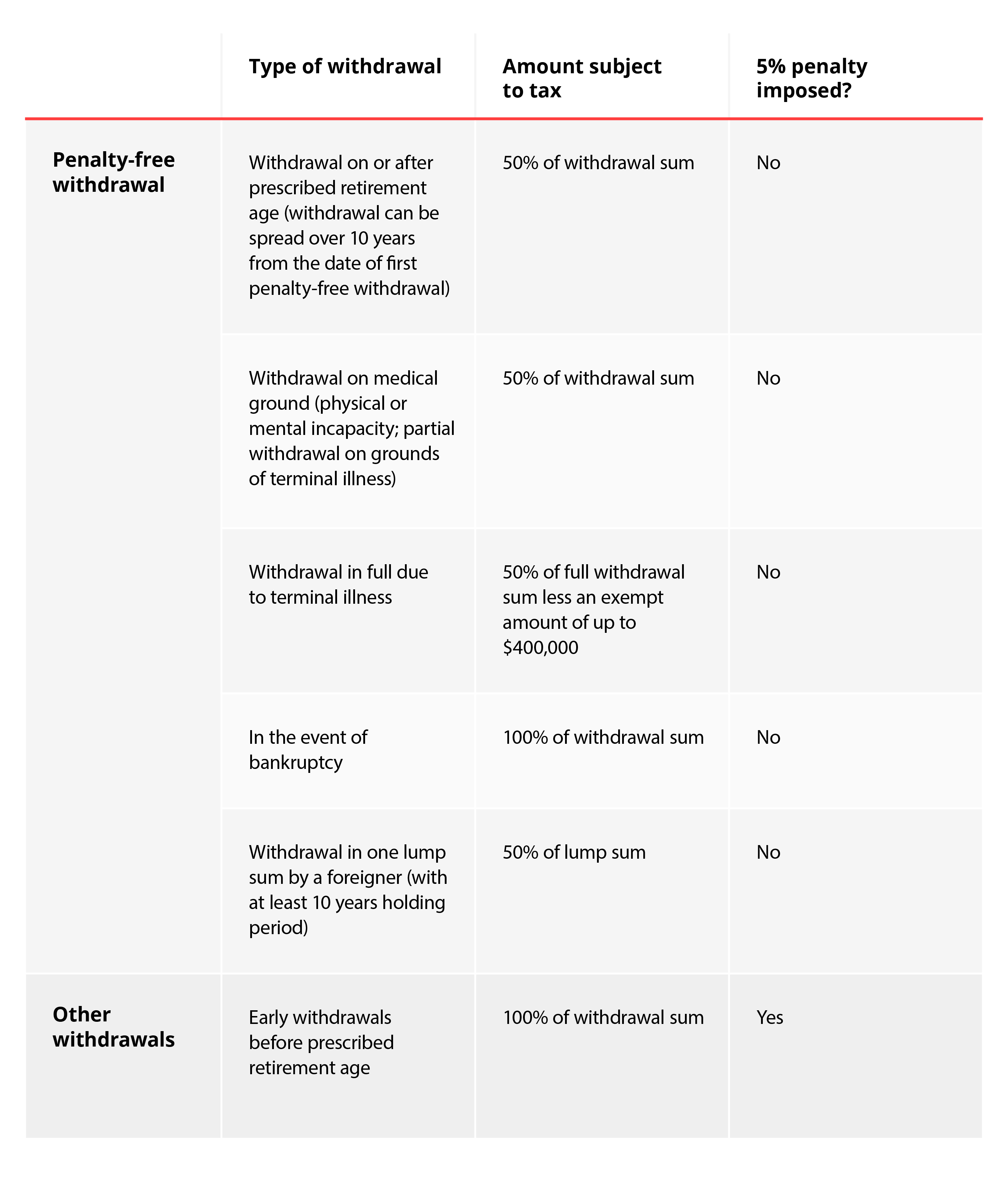

Since SRS is a voluntary scheme to encourage individuals to save for retirement, you need to have a long-time horizon when setting your monies aside. Therefore, any withdrawals made before the statutory retirement age when you made your first SRS contribution (currently age 63, effective from 1 July 2022) will incur a 5% withdrawal penalty, and 100% of the amount withdrawn will be subject to tax.

The penalty will only be waived under certain circumstances including death, medical grounds, and bankruptcy.

If you have already opened an SRS account and made your first contribution, any subsequent changes in the statutory retirement age (e.g. up to age 65) will not affect you. When you withdraw at retirement, only 50% of the sum will be subject to tax. You can spread your withdrawals over a period of up to 10 years to potentially enjoy tax savings.

Tip: Evaluate your personal financial situation before making any SRS contributions. Ensure that these are funds that you can set aside for the long-term.

5. Opening an SRS Account

All Singaporeans, PRs, and foreigners who derive any form of income can make SRS contributions in the current year. You must be:

- At least 18 years of age

- Not an undischarged bankrupt

- Not having a mental disorder

- Capable of managing yourself and your affairs