![]()

If you’ve only got a minute:

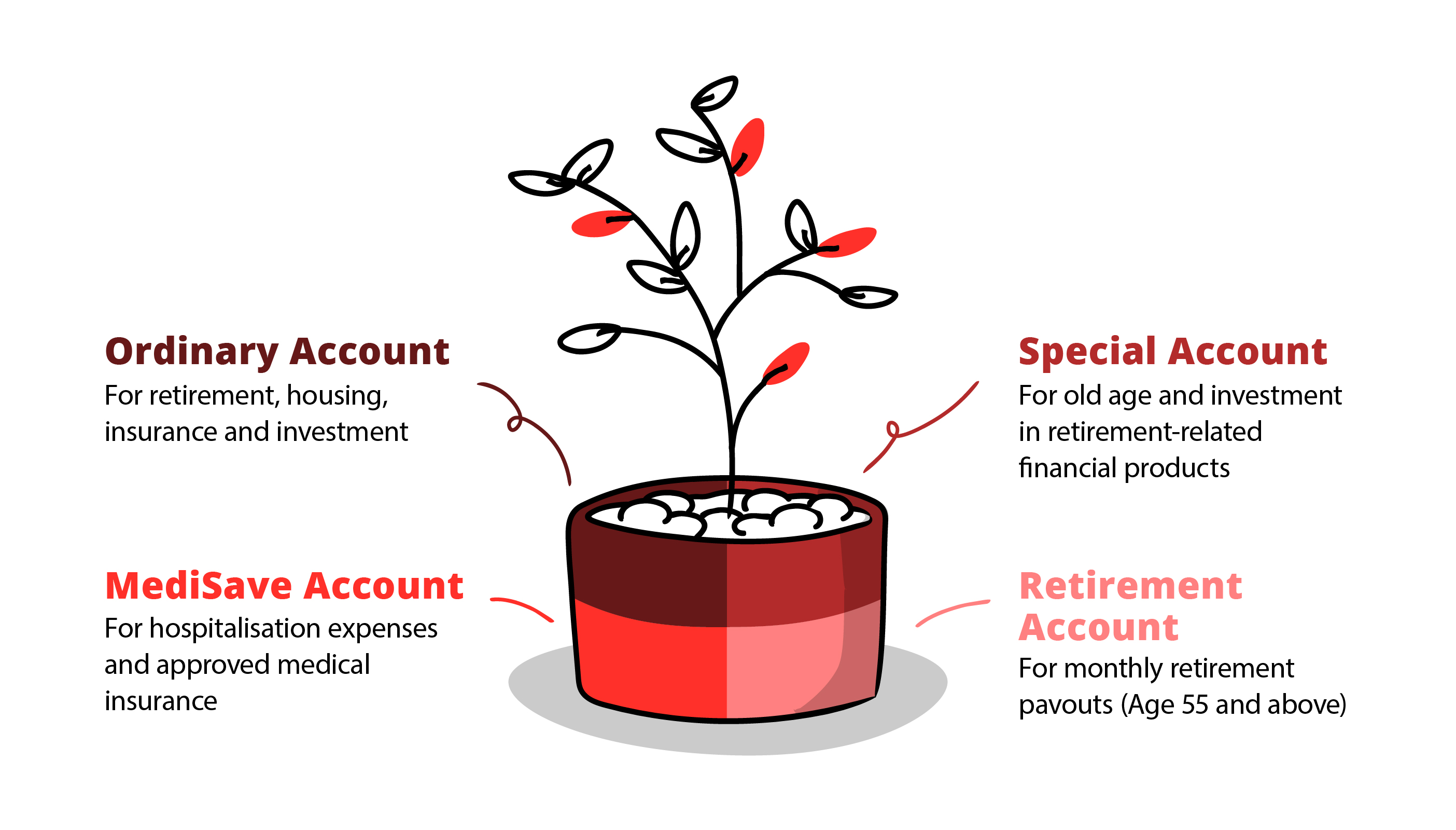

- Your CPF contributions are split into 3 accounts: Ordinary Account (OA), Special Account (SA), and MediSave Account (MA), with the fourth, Retirement Account (RA) created when you turn age 55.

- Top up your CPF accounts to earn higher interest and enjoy up to S$16,000 in tax relief annually.

- Use cash instead of your OA to fund mortgage repayments.

- SRS contributions are eligible for tax relief and can be invested for potentially higher returns.

![]()

The Central Provident Fund (CPF) is a comprehensive social security system for working Singaporeans and Permanent Residents (PRs) to set aside funds for retirement, housing and healthcare. If you are an employee, you would be required to contribute to your CPF account.

There are 4 separate CPF accounts, and they all play different roles in helping you reach financial security. Find out how you can leverage CPF as an alternative savings pot.

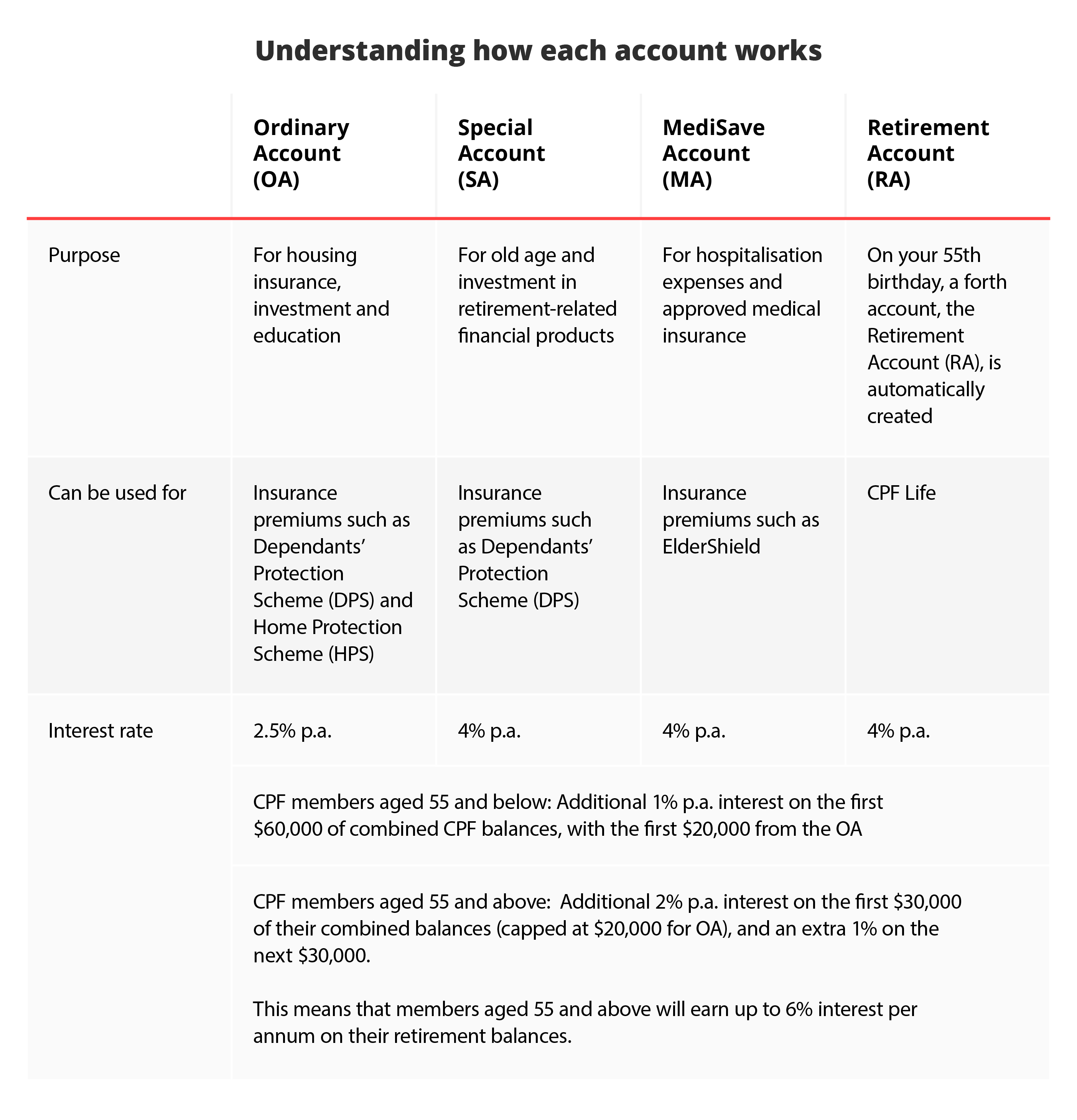

Understanding how each account works

As you work and make CPF contributions, you accumulate savings in these 3 accounts: your OA, MA, and SA. At age 55, a RA is created for you.

CPF contribution rates 2024

Ordinary Account (OA): Insurance premiums for Dependants’ Protection Scheme (DPS), Home Protection Scheme (HPS) and investing under CPF Investment Scheme (CPFIS).

Special Account (SA): Retirement savings and investing under CPF Investment Scheme (CPFIS).

MediSave Account (MA): Hospitalisation expenses and approved medical insurance such as MediShield Life.

Retirement Account (RA): Formed after age 55 with funds from your OA and SA.

What can these CPF accounts monies be used for?

CPF contribution rates refer to the percentage of wages that you and your employer have to contribute toward your CPF account.

If you are 55 and below, 20% of your salary (capped at S$6,800/month) will be contributed to CPF, while your employer contributes an additional 17%. If you are 55 and above, the CPF contribution rates are lower.

To enhance the retirement savings of senior workers, the Tripartite Workgroup on Older Workers proposed in 2019, to gradually raise CPF contribution rates for those aged 55 to 70. The initial increments were implemented on January 1, 2022, and January 1, 2023.

The Government is extending these increases in 2024, aiming to complete the full adjustment by 2030[1].

Here are the revised CPF contribution rates effective from 1 January 2025:

The following table summarises the current contribution rates for Singaporeans and SPRs (from third year and onwards) across the different age groups

Employee's age (years) | 2024 | CPF Contribution Rates from 1 Jan 2025 | ||

|---|---|---|---|---|

Total | Total | By employer | By employee | |

(% of wage) | (% of wage) | (% of wage) | (% of wage) | |

55 and below | 37 | 37 | 17 | 20 |

Above 55 to 60 | 31 | 32.5 (+1.5) | 15.5 (+0.5) | 17 (+1) |

Above 60 to 65 | 22 | 23.5 (+1.5) | 12 (+0.5) | 11.5 (+1) |

Above 65 to 70 | 16.5 | 16.5 | 9 | 7.5 |

Above 70 | 12.5 | 12.5 | 7.5 | 5 |

Source: CPF

You and your employer contribute towards your CPF. What’s next?

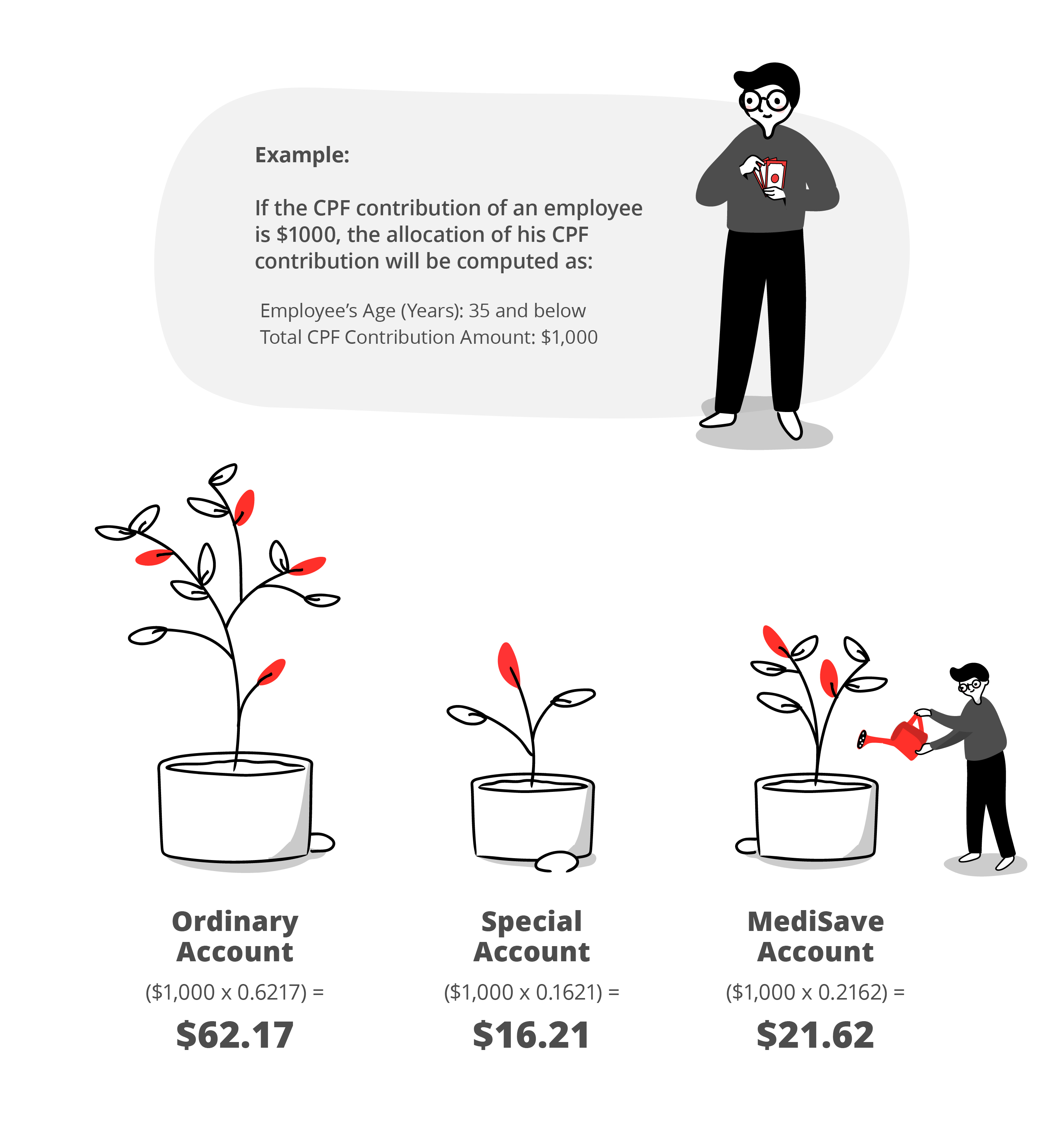

This contribution will be allocated into your Ordinary Account (OA), Special Account (SA) and MediSave Account (MA). Here are the current allocation rates:

CPF Allocation Rates 2025 Private Sector / Non-Pensionable Employees (Ministries, Statutory Bodies & Aided Schools) | |||

|---|---|---|---|

Employee’s Age (Years) | Allocated to | ||

Ordinary Account (Ratio of Contribution) | Special Account1 (Ratio of Contribution) | MediSave Account (Ratio of Contribution) | |

35 & below | 0.6217 | 0.1621 | 0.2162 |

Above 35 – 45 | 0.5677 | 0.1891 | 0.2432 |

Above 45 – 50 | 0.5136 | 0.2162 | 0.2702 |

Above 50 – 55 | 0.4055 | 0.3108 | 0.2837 |

| Ordinary Account (Ratio of Contribution) | Retirement Account1 (Ratio of Contribution) | MediSave Account (Ratio of Contribution) |

Above 55 – 60 | 0.3694 | 0.3076 | 0.3230 |

Above 60 – 65 | 0.149 | 0.4042 | 0.4468 |

Above 65 – 70 | 0.0607 | 0.303 | 0.6363 |

Above 70 | 0.08 | 0.08 | 0.84 |

1 Upon the closure of Special Account, the contributions for members aged 55 and above will be fully allocated to the Retirement Account (RA), up to the Full Retirement Sum (FRS). If members have set aside the FRS in their RA, these contributions will be channelled to their Ordinary Account.

Note: The CPF allocation is first computed for the MediSave Account, followed by the Special/Retirement Account. The remainder will be allocated to the Ordinary Account.

For example, if you are aged 35 and below and if your monthly total CPF contribution S$1,000, the allocation of your CPF contribution will be computed as:

Note: The Ordinary Wage Ceiling is a CPF contribution cap on your monthly salary and is capped at S$6,800. This means that the first S$6,800 of your monthly salary is subjected to CPF contributions. Any amount above that won’t have a portion deducted for CPF.

For example, if an employee’s Ordinary Wages for a calendar month is S$7,300, his/her contribution would be computed based on S$6,800. That means CPF contributions are not required on the remaining S$500.

How to save more with CPF and SRS

1. Cash top-ups to your SA or that of your loved ones’

Making cash top-ups or CPF transfers to your SA or RA (age 55 above) can help you grow your retirement savings.

Besides benefiting from compounding interest and higher monthly payouts when you retire, you can enjoy tax relief for cash top-ups made in each calendar year of up to:

- S$8,000 when you top up to your own SA/RA and/or MA; and

- An additional S$8,000 when you top up your loved ones’ SA/RA and/or MA.

That’s up to S$16,000 of potential tax savings.

Log in with your Singpass to find out how much cash top-ups and CPF transfers you can make to yourself and your loved ones.

2. Transfer your OA savings or do cash top-ups to your SA or RA to earn higher interest

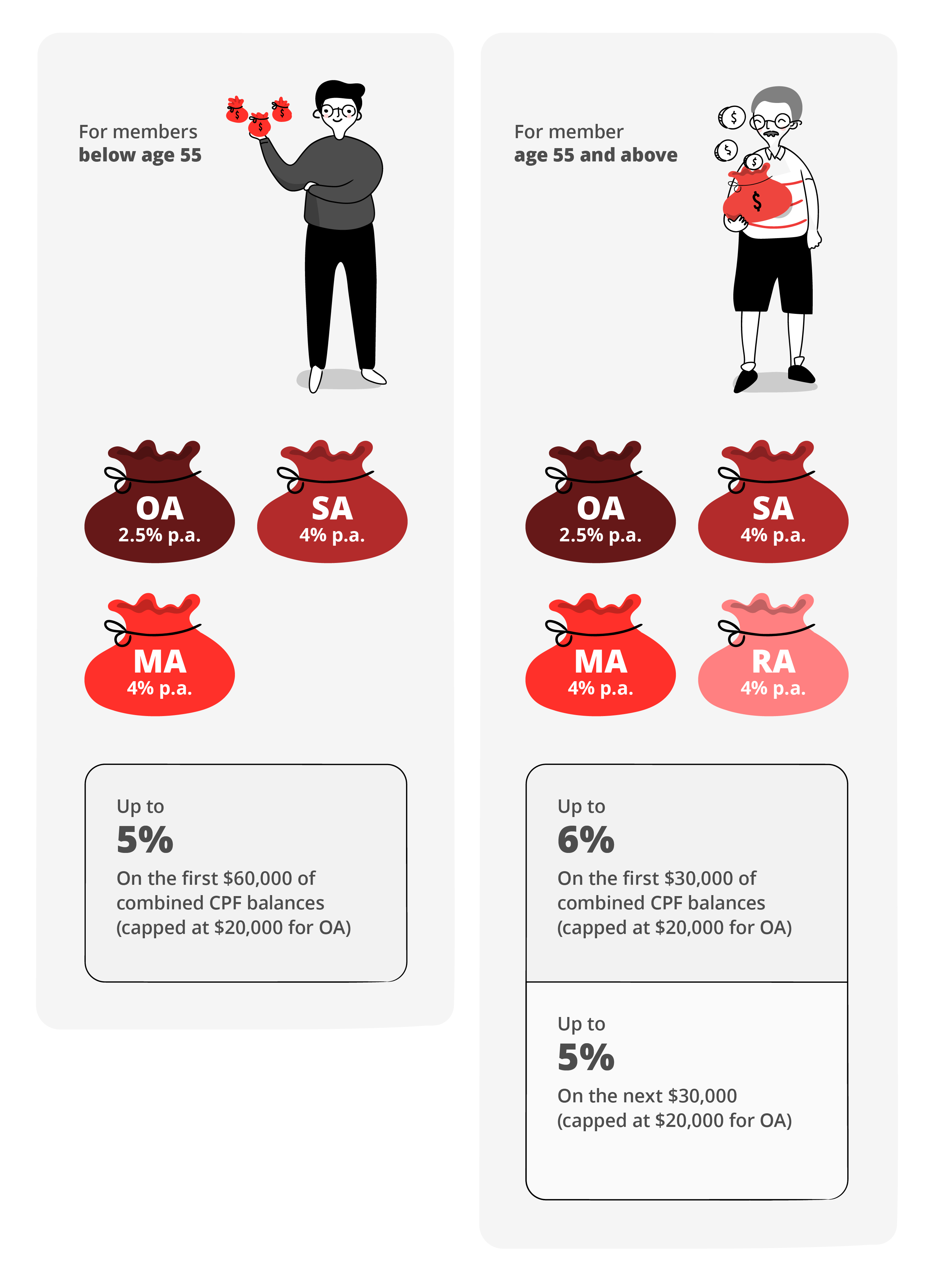

To help boost retirement savings, the Government pays extra interest on the first S$60,000 of your combined CPF balances, which is capped at S$20,000 for OA.

The amount of extra interest paid to you would depend on your combined CPF balances and age.

For those below age 55, you will earn an extra interest of 1% p.a. (up to 5%) on the first S$60,000 of your combined CPF balances (capped at S$20,000 for OA).

For those above age 55, you will earn an extra interest of 2% p.a. on the first S$30,000 (up to 6%) and 1% p.a. (up to 5%) on the next S$30,000 of your combined CPF balances (capped at S$20,000 for OA).

If you have used OA funds to service your home loans, you can consider making a voluntary housing refund. You will need to refund less and get to receive more cash proceeds when selling your property.

If you are deciding between cash or OA savings to pay your downpayment and monthly loan instalments, you can consider setting aside some cash to make those payments instead of fully using your OA savings. This allows you to have more funds in your OA to take advantage of CPF’s interest.

Since your OA is generating 2.5% interest p.a., you will earn a higher interest of 4% p.a. if you transfer your OA amount to SA.

3. Use Supplementary Retirement Scheme (SRS) as alternative savings

Besides using CPF to save, consider the SRS. It is a voluntary scheme that helps you boost your savings for your golden years, while giving you tax relief.

Key Benefits of SRS:

- Tax savings for every dollar saved into the account

Get a dollar-for-dollar tax discount on the amount saved to your SRS account. The more you contribute, the more you save on taxes, up to the maximum yearly contribution applicable to you:

✓S$15,300 for Singaporeans and PRs

✓S$35,700 for foreigners.

- Accumulate tax-free gains from investing SRS funds

Enjoy tax-free returns on your investments before withdrawal.

- Freedom to invest SRS to boost retirement savings

Leaving your SRS balance idle earns you 0.05% interest p.a. By investing it, you can potentially earn higher interest.

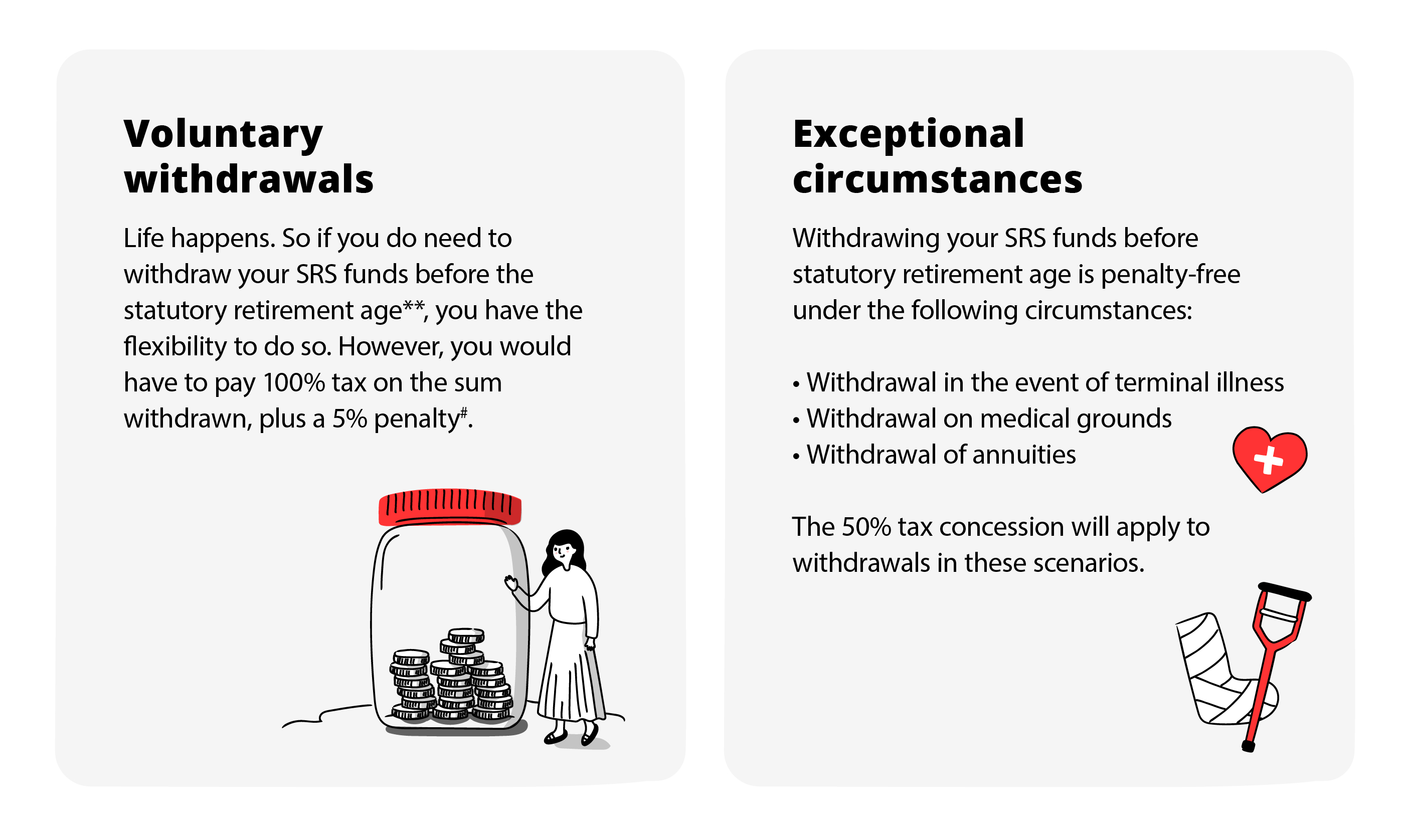

- Flexibility to withdraw funds anytime*

- 50% tax concession on withdrawals*

*Withdrawals before applicable statutory retirement age is subject to 100% tax, plus 5% penalty. 50% tax concession only applies to withdrawals from the statutory retirement age.

Do bear in mind that there is an overall personal income tax relief cap of S$80,000 per person.