![]()

If you’ve only got a minute:

- Plan early, be extra prudent and productive during the earlier years of your working career to save for a larger nest egg to fund the longer years in retirement.

- Find out how much of your monthly expenses are an absolute need and are essential for survival, and which items are wants, that is, nice to include but are not a necessity.

- CPF LIFE is a national longevity insurance annuity scheme that provides you with monthly lifelong payouts starting from age 65 to 70.

- FIRE is short for Financial Independence, Retire Early, a lifestyle movement defined by frugality, extreme savings and investing to enjoy financial freedom earlier.

![]()

Early retirement is a major life goal for many people. It means having the luxury to choose whether to work before the statutory retirement age. The minimum statutory retirement age in Singapore is 63 years.

To work towards an early retirement, you’d need to plan early, be extra prudent and productive during the earlier years of your working career. Without proper planning, this places additional stress on your retirement plan and you risk not having sufficient funds to fund your retirement.

Here are some key considerations if you are planning for an early retirement:

How much do you need for early retirement?

The life expectancy of Singaporeans is amongst the highest in the world at 82 for men and 86 for women.

To retire early, you’ll likely need a larger nest egg to supplement your longer years in unemployment. In addition, factors such as lifestyle, desired monthly payouts, retirement age and the number of years you expect to receive those monthly payouts must be considered to determine your retirement sum.

Lumpsum retirement sum vs multiple passive income flows

Perhaps you have been told that by using this formula, you can get a ballpark estimate of much you’ll need to retire early.

Desired monthly retirement payouts x Years in retirement = Retirement sum needed

(S$2,500 X 12) X (86 – 50) = S$1,080,000

For example, Jane, a 25-year old working professional will need to save about S$1.10 million to retire at 50 with a monthly retirement payout of S$2,500 for 36 years, assuming she lives till age 86.

However, the above approach is not realistic nor sustainable. This is because it does not account for market factors like inflation, investment returns and other unexpected expenses that may arise during retirement.

Tip: To mitigate against longevity and inflation risks, we need to build multiple sources of passive income.

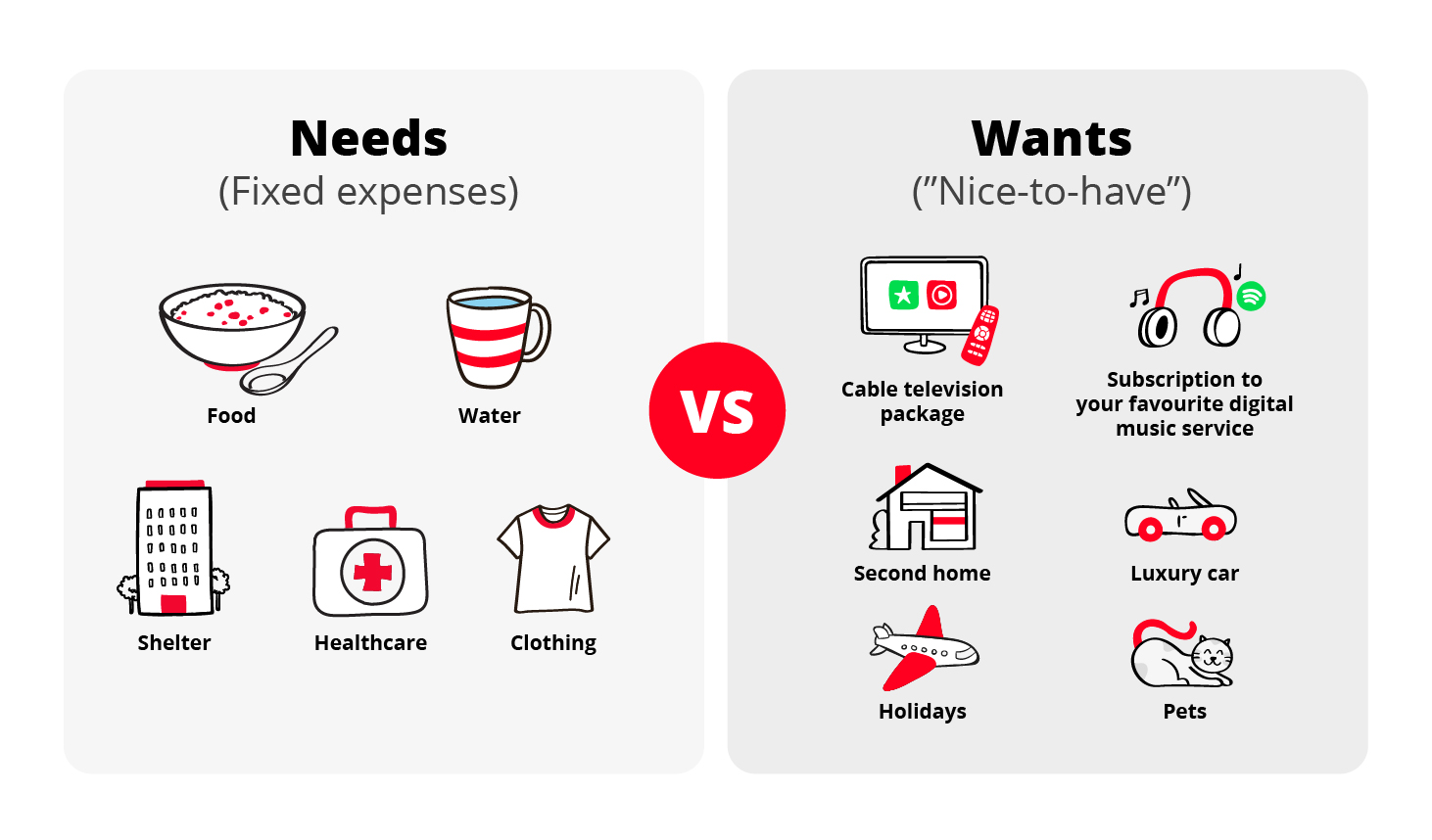

Quantifying needs vs wants

Needs are non-negotiable or fixed expenses that are necessary for ensuring your survival and wellbeing. Conversely, wants are variable expenses spent on non-necessities and luxuries. Wants are determined by lifestyle, whereas needs determine your lifestyle. As a result, accounting for your needs should be a priority before even considering or trying to afford any wants.

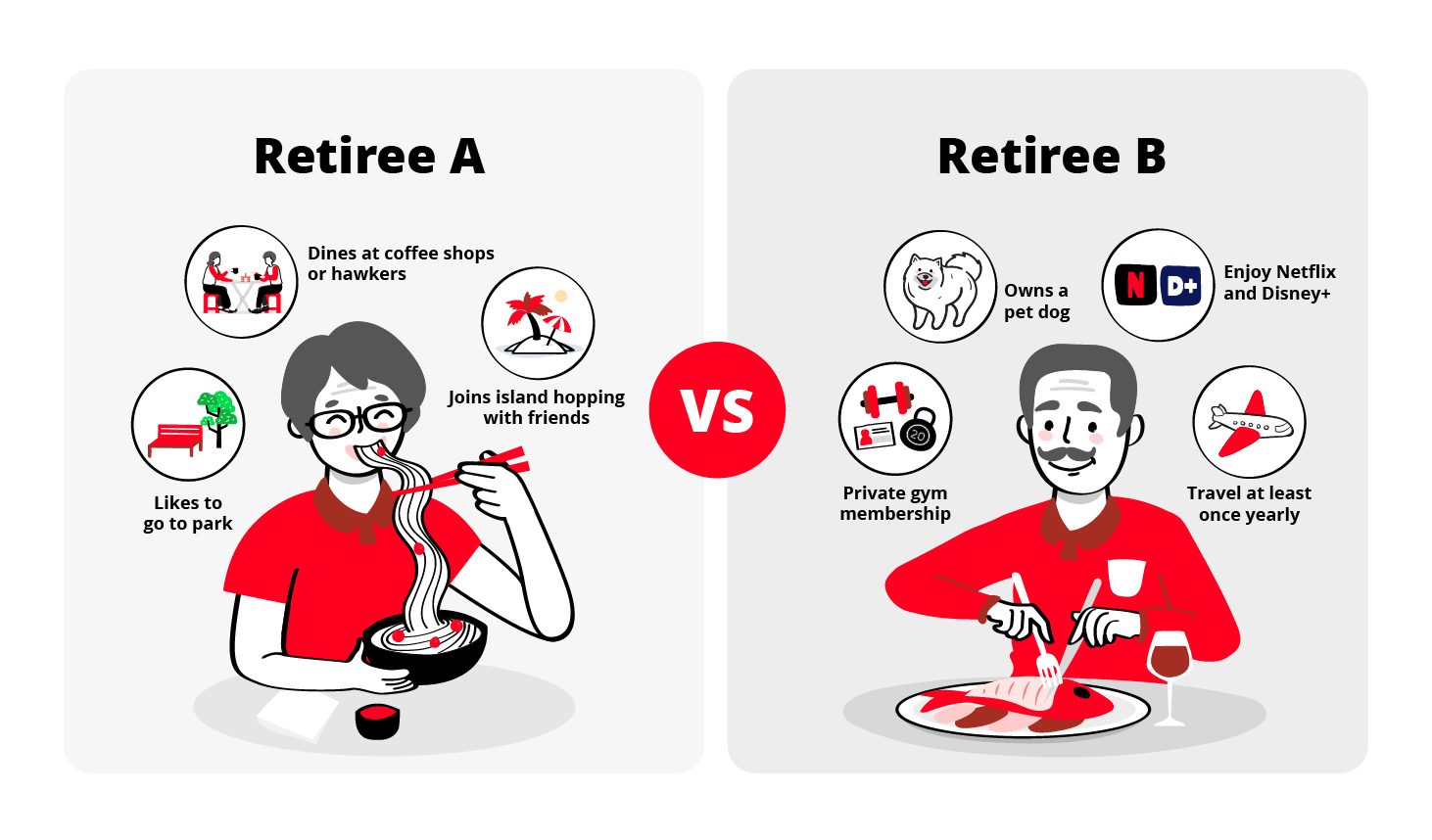

Here's an example:

Retiree B will need a larger nest egg than Retiree A.

Tip: Start by visualising your desired retirement lifestyle and draw up a retirement to-do list. Knowing how much money to save for your activities in retirement can help you achieve your retirement sum. Also factor in unexpected expenses such as healthcare costs, caring for your ageing parents and spouse if you are married and providing for your child’s education expenses and fees

How can CPF Lifelong Income For the Elderly (LIFE) support your retirement?

Launched in 2009, CPF LIFE is a national longevity insurance annuity scheme that provides you with monthly lifelong payouts starting anytime from age 65 to 70. This is to ensure that you will not run out of retirement savings during your golden years, even if you live to a ripe old age.

The CPF Retirement Sums indicate how much of your CPF savings you should set aside in order to have your desired lifelong monthly payouts during your retirement years. There are 3 CPF Retirement Sums: Basic Retirement Sum (BRS), Full Retirement Sum (FRS) and Enhanced Retirement Sum (ERS).

*Based on those who turn 55 in 2023.

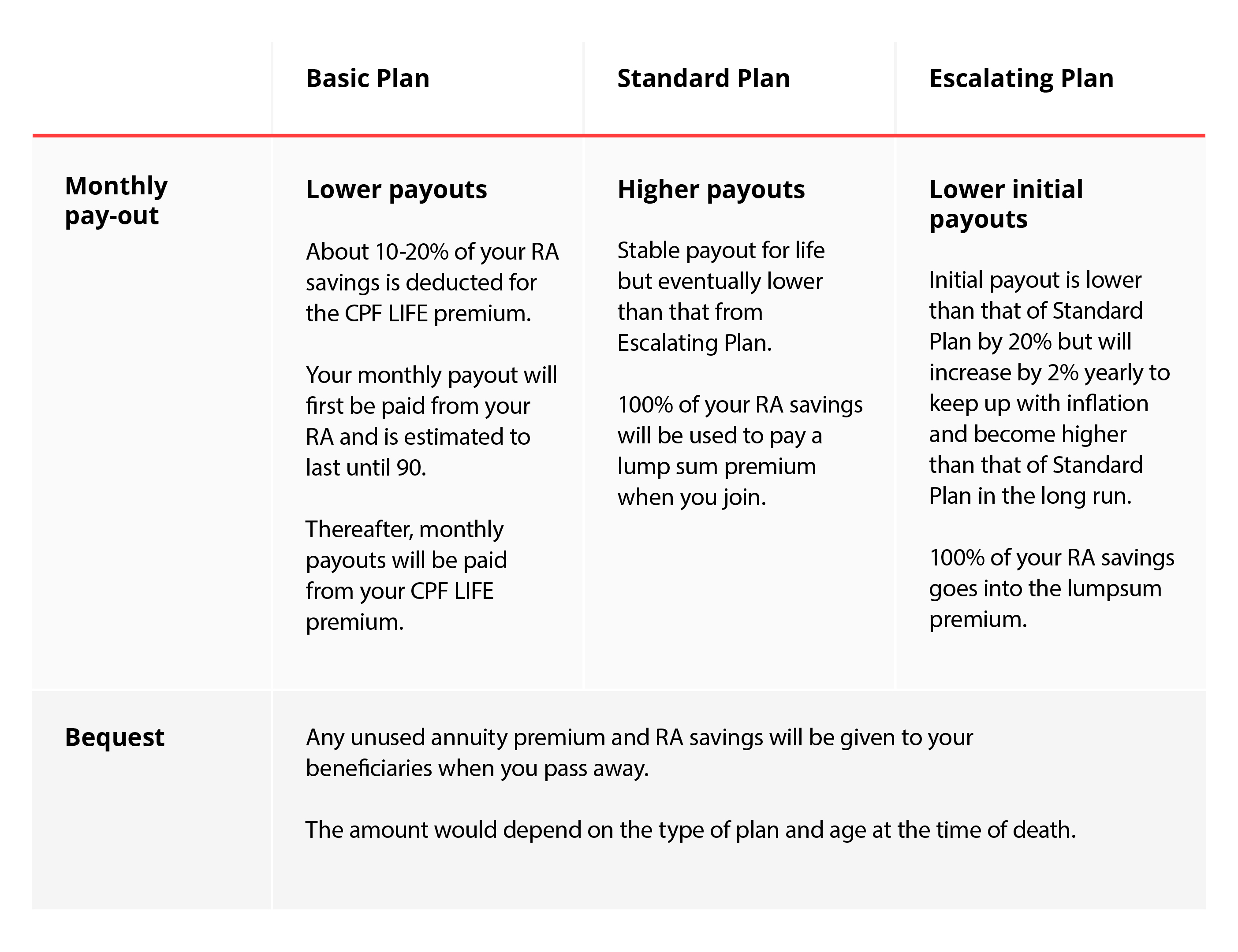

You will also have the flexibility to choose among 3 CPF LIFE plans that is best suited to your desired retirement lifestyle and amount of monthly payouts you wish to receive during the period.

If you’re planning for an early retirement, you will not be able to rely on CPF LIFE as the earliest payout starts from age 65. Additionally, if you prefer a more comfortable retirement, you will likely need to supplement your CPF LIFE payouts with other solutions such as Supplementary Retirement Scheme (withdrawals can start from age 63), retirement income insurance plans, and investments.

What is FIRE?

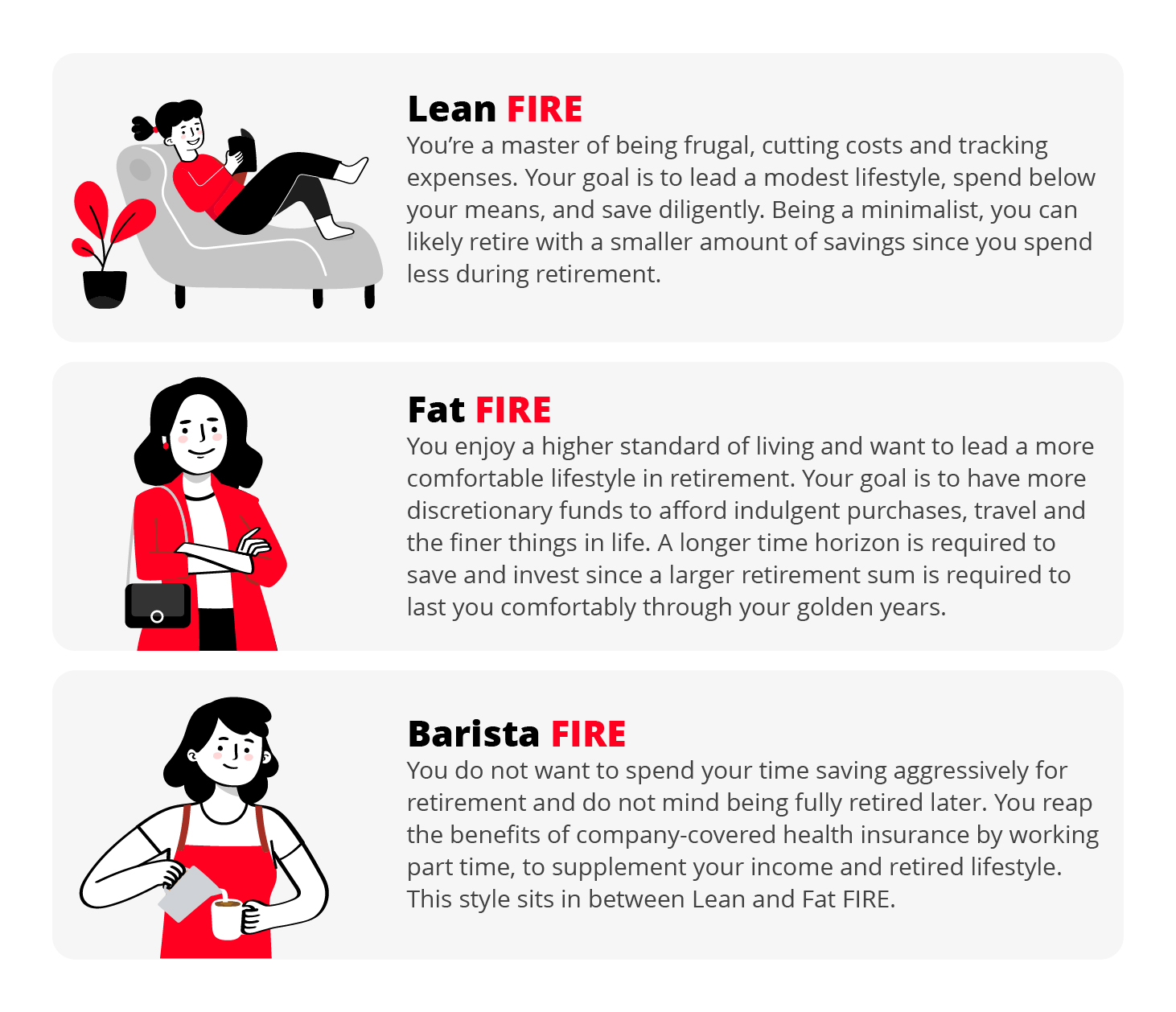

FIRE is short for Financial Independence, Retire Early. It is a lifestyle movement defined by frugality, extreme savings and investing in hopes of having a happy early retirement without any financial woes. Essentially, the main idea behind FIRE is to save a lot of money during your working years to enjoy financial freedom earlier.

Depending on your preferred type of lifestyle and savings habits, you can achieve FIRE via 3 different methods.

Detailed planning, financial discipline and long-term investing are key components in achieving FIRE. To have ample funds to retire, you must build multiple income streams before you can stop working either by boosting your income, decreasing your expenditure and investing.

Here are 3 simple tips to help you along.

Tip 1: Having side hustles

Consider adding additional income streams to increase your total salary. If you are willing to stretch your working hours now, a secondary stream of income, such as a side hustle, can greatly increase how much you earn.

Monetise skills like baking, cooking, driving, floral arrangement, photography or walk your neighbours’ pets for a fee.

Tip 2: Reduce discretionary spend

With increased earnings, you will have more to save. This can also be complemented by aggressively cutting unnecessary expenses (nice-to-have) to achieve surplus savings.

Cut excess spending by taking public transport instead of owning a car, have home-cooked meals instead of dining out or give up travelling altogether.

The money you saved should include an emergency fund of at least 3 to 6 months’ worth of monthly expenses to take care of any unforeseen circumstances. Rather than keeping it idle, consider stashing it in a higher interest savings account such as DBS Multiplier.

Tip 3: Investing

Besides savings, make your money work harder for you by channelling portion of your funds into investments to achieve higher returns on your money. There is no one-size-fits-all when it comes to choosing which financial instruments to invest in.

Based on your investment horizon, risk tolerance, desired tenure, preference for flexibility and liquidity, find an investment strategy that best suits you.

By starting to invest and planning for retirement early, you can naturally take on more risk and potentially gain more rewards and be a step closer to gaining financial freedom.

Implications of retiring early

No matter how well you plan, there are a variety of risks that pre-retirees and retirees will likely face. They include longevity, inflation, high healthcare costs, and insufficient long-term market returns.

Unexpected expenditures

Life might throw a curveball at you that can change everything. For example, if you or your loved ones fall ill and require significant cash expenditure, your financial resources may dwindle to the point of derailing your retirement.

Longevity

With increasing life expectancy and medical advancement, it is possible that you may outlive your retirement nest egg. Worse still if you only realise this after you have started drawing down on your nest egg. This works against you as the last thing you want is to look for employment after being out of the workforce and possibly in ill-health in your later years.

Inflation

In addition, there is a chance that you may have miscalculated how much you require for a comfortable retirement as inflation can potentially outpace your savings, reducing the purchasing power of your nest egg.

Market volatility

Likewise, if you are pinning your hopes on dividends from stocks you've invested in, or perhaps rental income from an investment property, an economic recession may set you back and reduce your monthly passive income.

Your savings need to stretch for longer and you will be at the mercy of inflation, unexpected expenses and market volatility, leaving you short on funds when you need it most. Bear in mind that, in the absence of a regular pay cheque from employment to act as a buffer against these eventualities, your nest egg will be all you can rely on.

Retire happy when you’re ready

The FIRE approach may not work for everyone. And early retirement doesn't have to be a binary decision between earning a full-time wage and surviving solely off your savings.

To ease yourself into retirement, opt for a part-time role or go freelance. Not only can you free up some extra time for leisure, loved ones and travel, it helps you maintain a source of active income. The extra money could give you more time before you start drawing down on your nest egg too.

As the saying goes, a little goes a long way. Start by increasing your earnings, reduce your discretionary spend, and make your surplus savings grow harder today. This allows more time for your money to grow, which will help you enjoy your later years.