![]()

If you’ve only got a minute:

- Your CPF Retirement Account (RA) is created when you turn age 55.

- Your savings from your CPF Special Account (SA) and then Ordinary Account (OA) will be transferred to your RA up to the Full Retirement Sum (FRS).

- You can top-up your RA to the Enhanced Retirement Sum (ERS) from age 55.

![]()

Reaching 55 is a significant milestone. It means you are one step closer to retirement. Here are some things you should know about your Central Provident Fund (CPF) to help you plan better.

Creation of RA and closure of SA

When you turn 55, a Retirement Account (RA) will be created for you. The savings in your RA is meant to provide you with regular monthly lifetime payouts in retirement.

Your SA savings will be transferred first to make up the Full Retirement Sum (FRS) in your RA. If your SA is insufficient, your Ordinary Account (OA) savings will then be transferred to make up the FRS. Your SA will subsequently be closed.

You do not need to top up your RA if you do not have enough savings to make up your FRS. Instead, if you have used CPF savings for your property, your CPF savings withdrawn for your property (including accrued interest) will be used to meet your FRS. When you sell your property, you will have to restore your RA up to your FRS with your sales proceeds.

If you have S$60,000 or more in your RA nearing the age of 65, you will automatically be placed under CPF LIFE, our national annuity scheme that provides you with a monthly payout for as long as you live. The monthly payouts you receive depends on the retirement sum you have set aside in your RA. The more you set aside in your RA, the higher your payouts.

Retirement sums at age 55

Before age 55, you can top up your SA to the prevailing FRS. Once you turn 55, and your RA is opened, you can top up your RA up to the prevailing ERS.

The BRS is meant to provide you with monthly payouts in retirement that cover basic living expenses. If you own a property in Singapore with a remaining lease that can last you to at least 95 years old, you can set aside the BRS in your Retirement Account and withdraw the amount in excess of the BRS.

The FRS is two times of BRS, and is meant to provide you with higher monthly payouts that cover rental expenses as well. If you don't own a property, or wish to receive the full monthly payouts, you can set aside the FRS.

The ERS is 4 times of BRS. If you wish to receive even higher payouts, you can choose to set aside the ERS by making a top-up.

CPF Retirement Sums and estimated CPF LIFE payouts

RA at age 55 | CPF LIFE monthly payout at age 65 | |

|---|---|---|

Basic Retirement Sum (BRS) | S$106,500 | S$840-S$900 |

Full Retirement Sum (FRS) | S$213,000 | S$1,590-S$1,710 |

Enhanced Retirement Sum (ERS) | S$426,000 | S$3,080-S$3,310 |

Thinking of not withdrawing your CPF savings?

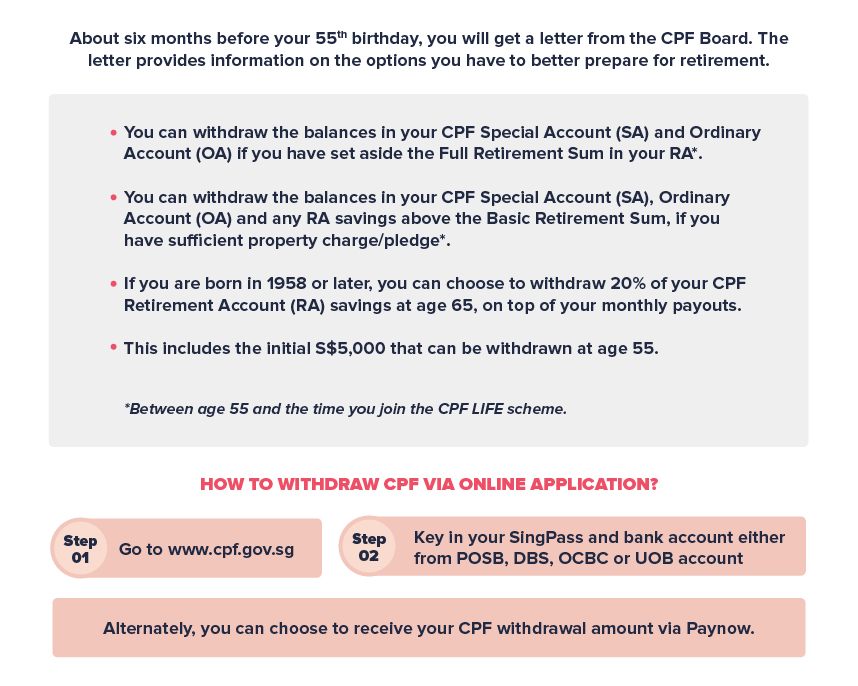

You are allowed to make your first CPF withdrawal when you turn 55. Generally, you can withdraw at least S$5,000 or any amount in excess after setting aside your FRS from 55. You can withdraw your CPF monies at any time, whether in full or partially, and as frequently as you like. However, the main disadvantage of withdrawing your CPF savings at age 55 is that you would be forgoing the risk-free interest you would otherwise earn if you were to leave it in your CPF accounts.

Interest rates for your respective CPF accounts are:

OA: 2.5% p.a.

SA: 4% p.a.

RA: 4% p.a.

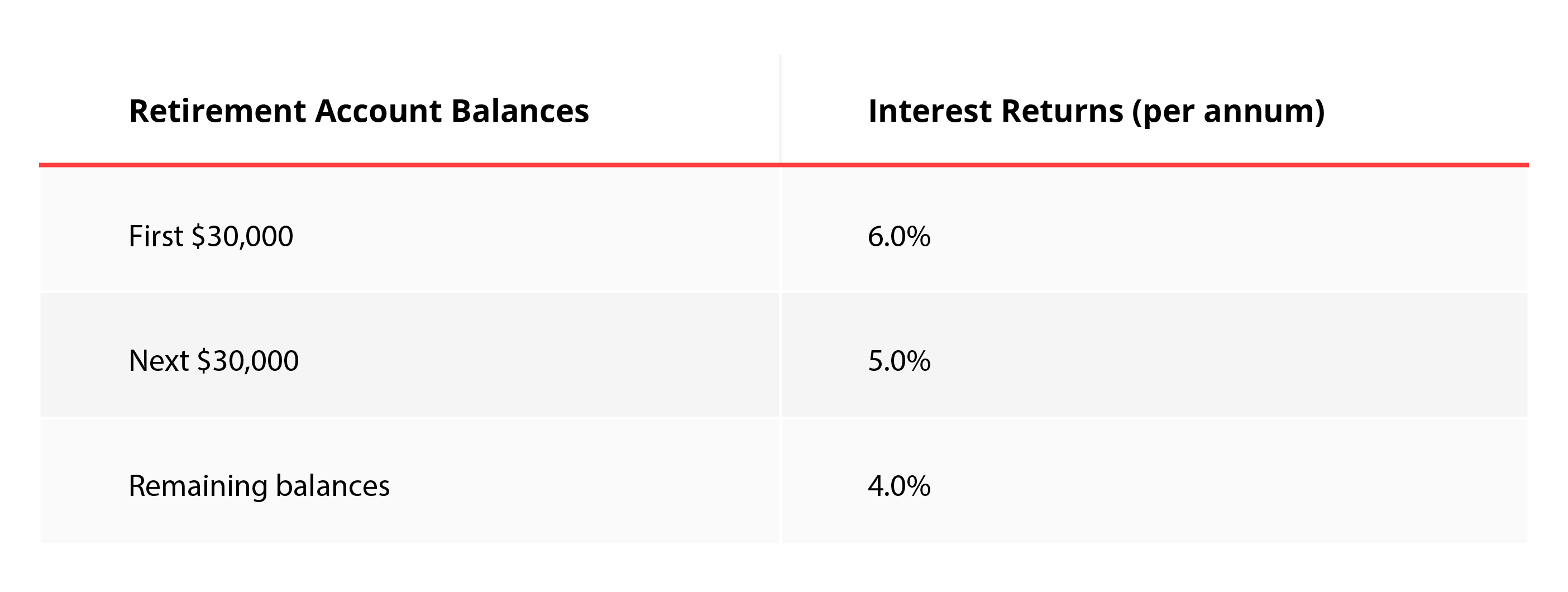

Your CPF monies in your CPF RA can earn interest rates of up to 6% p.a.

For those age 55 and above, you will earn an extra interest of 2% p.a. on the first S$30,000 (up to 6%) of combined CPF balances (capped at S$20,000 for OA) and additional 1% p.a. (up to 5%) on the next S$30,000.

If you have no pressing need for the money, you can leave it in CPF to continue enjoying a risk-free interest rate of at least 2.5% (OA). Before withdrawing your CPF savings, ensure that proper planning is done to avoid spending your retirement funds unnecessarily.

Thinking of using your CPF for housing repayments after 55?

When you reach 55, savings from your SA, followed by savings from your OA, will be transferred to create your RA to fill up to the FRS.

Any balance that remains in your OA can be used for your housing loan repayments. If you continue to work after 55, you can use the monthly contributions that go to the OA to service your mortgage, even if you have not met your applicable Retirement Sum.

However, housing limits set by CPF may apply. This is a safeguard against overspending on housing loan repayments at the expense of your retirement savings. Consider keeping some savings to earn attractive CPF interest rates and use them to boost your monthly payouts in retirement.

If you need to continue using your OA for your housing payments after age 55, you may apply to reserve your OA savings for this purpose before they are transferred to your RA. However, this means the retirement sum set aside in your RA will also be lower.