All you need to

succeed in life’s firsts

succeed in life’s firsts

you grow with DBS

succeed in life’s firsts

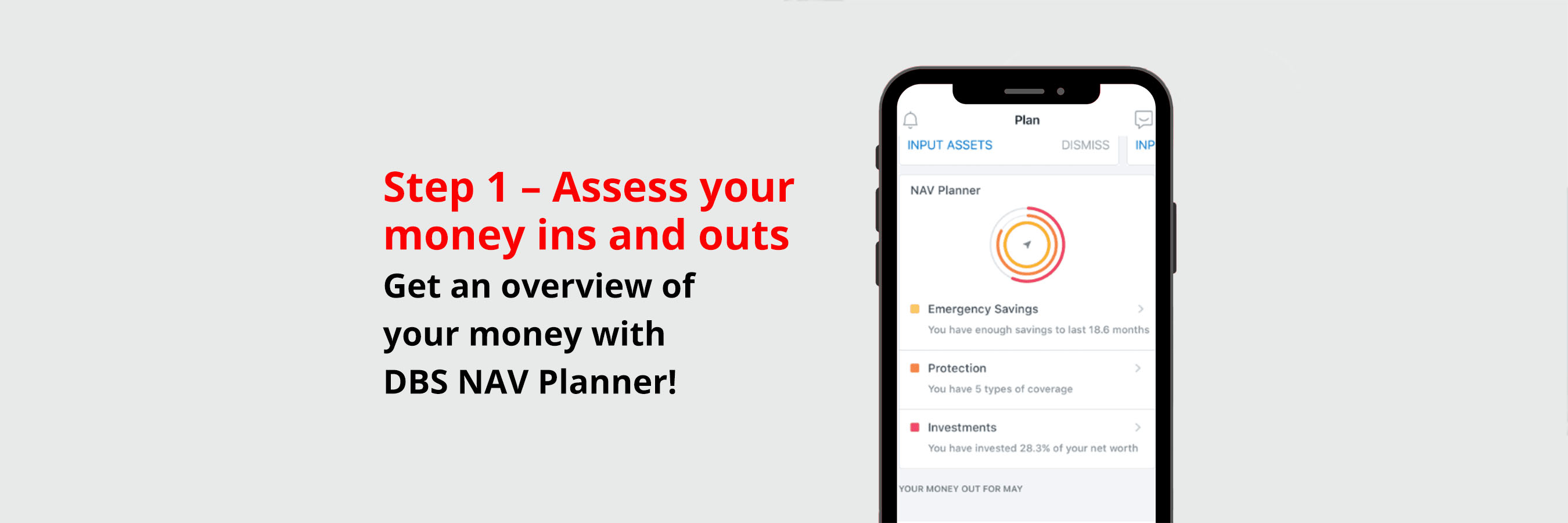

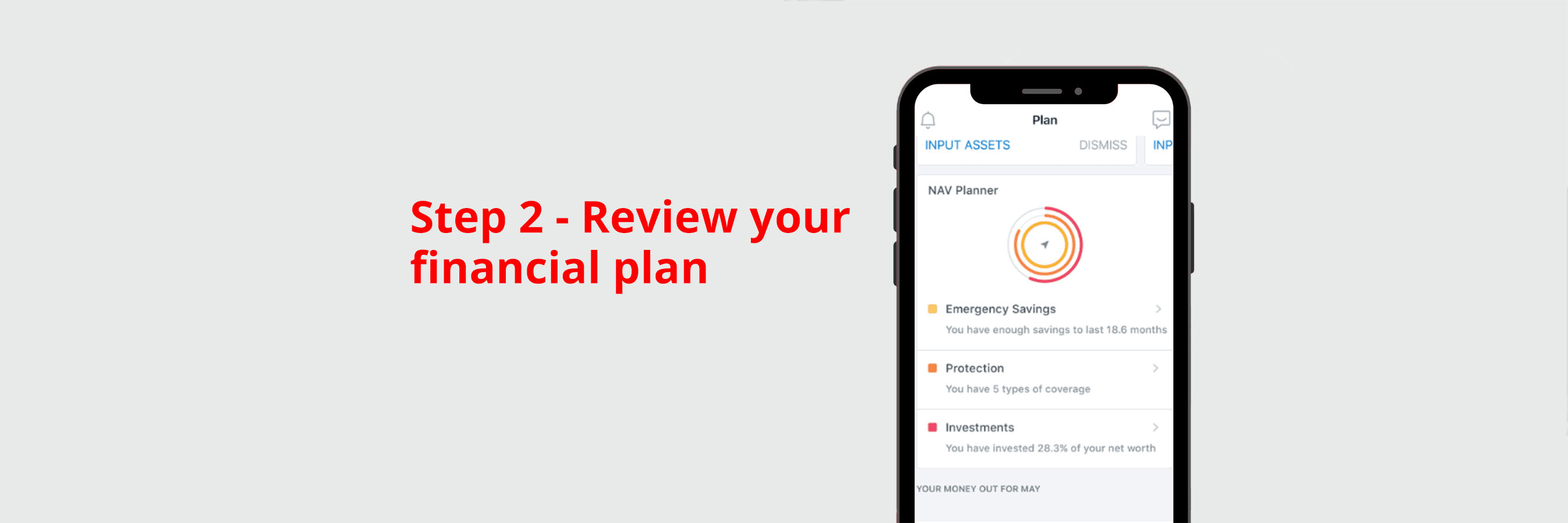

Find out if you have enough emergency savings and healthy cashflow based on your spending every month.

Discover if you’re sufficiently covered with Plan & Invest tab in digibank and find out which insurance you should prioritise.

Assess your risk profile and investment knowledge level with Plan & Invest tab in digibank to get recommendations on the right investments for you.

Find ready-made portfolios for as little as S$1000.

Avoid the hassle of timing the market and invest from as little as S$100/mth.

Kickstart your trading journey effortlessly with DBS Vickers. Fund your trades seamlessly using DBS/POSB accounts, use the Stock Comparer feature in the DBS Vickers app to uncover new global stocks and equip yourself with investment know-how from industry experts. Sign up now.

Give it a boost of up to 4.1% interest p.a. with a Multiplier Account!

Protect yourself with insurance plans designed just for you.

Build your financial future with personalised investment recommendations that are right for you with Plan & Invest tab in digibank.

Review your loan eligibility and find out what your repayments might look like with DBS Property Marketplace.

Use Plan & Invest tab in digibank and see if the cost of your dream home falls within your budget and is achievable alongside your other financial goals.

If all’s well, apply for a DBS Home Loan and enjoy attractive interest rates!

Enjoy dollar-for-dollar matching from the government, and up to 2% interest p.a., when you save for your child.

Enjoy lower premiums when your kids are younger and enjoy peace of mind that they’re protected.

Enjoy full coverage for unforeseen circumstances before you even take off with TravellerShield Plus. Plus, get automatically covered for COVID-19.

Find the best hotels and flights deals on DBS Travel Marketplace, while earning yourself rewards like DBS points.

With DBS Travel Mode, you can exchange money on the go, keep an eye on your overseas spending, and find updates on COVID-19 regulations wherever you are.