FAQs

This retirement forecasting tool is available for DBS consumer banking customers born after 1958.

To access Map Your Money,

- Log in to digibank mobile or digibank online

- Go to the “Plan & Invest” at the bottom navigation bar

- Look for "Retire” at the top navigation bar.

There are two charts to help you visualise your retirement forecast. One is a projection of your monthly cashflow, the other is a projection of your total assets.

Monthly cashflow chart

The monthly cashflow chart shows how you will draw down from your projected assets at retirement age to meet your retirement expenses. It consists of the following components:

Your retirement expenses:

- Represented by two upward sloping lines.

- The lines are upward sloping to represent the increase in expenses each year due to inflation.

- The solid line represents your basic expenses and the dotted line above it represents your lifestyle expenses.

- If the line is black, it means you have enough money to meet your retirement expenses.

- If the line is red, it means that you are unable to meet your retirement expenses.

We’ll use the desired retirement expenses you provided during onboarding for the projection. Once you’re past your desired retirement age, we’ll project it based on the expenses seen in your Money Out.

Your retirement income layers:

- CPF LIFE payout refers your CPF LIFE monthly payout after 65 years old

- SRS payout refers to a straight-line withdrawal of your SRS balances over 10 years from 62 or 63 years old, depending on when you made your first SRS contribution.

- Income stream plan payouts refers to regular payouts from your income stream plans. Lump sum proceeds are not reflected

- Rental Income refers to any rental income received from your tenants monthly, up to your life expectancy age

- Cash refers to cash savings which goes into covering shortfalls, if any, and retirement expenses as needed

- Excess CPF OA and SA refers to your excess CPF balances after setting aside money into your RA.

- Investmentsrefers to how we will draw down on your investments during your retirement years, starting from the lower risk investments before the higher risk ones.

Every time you access this retirement forecasting tool, your projection is refreshed to start from the upcoming month.

Total assets chart

The total assets chart displays your assets at three key milestones:

- Total assets today - How much you currently have today based on what data we have on you.

- Total assets at retirement age - How much you are projected to have when you reach your retirement age. This is calculated by assuming your assets increase in value based on their respective projection rates.

- Total assets at live-till age - How much you have left over after meeting all your retirement needs.

- Cash refers to the total value of your cash balances and investments

- Selected investments refer to the total value of your investments that are factored into the projection. They consist of the following asset classes:

- Unit trusts

- Exchanged traded funds

- Equities

- Managed portfolios

- Investment-linked plans

- Wealth portfolios

- SRS refers to the total value of cash balances and investments in your SRS account

- CPF refers to the total value of cash balances and investments across all your CPF accounts

Your desired retirement age is the age at which you want to retire. You would have provided this during onboarding. For purposes of our projections, we count it starting from the beginning of the year.

Your life expectancy age, or end of life age, is also something you would have provided during onboarding. For our projection, we count it at the end of the year.

Your Plan & Invest tab has a section called Money In/Out, which shows transactions across your deposit accounts. This includes any current, savings, personal, and joints accounts you may have with DBS.

Money In shows incoming transactions, or money you receive. We use data from here to derive your monthly income.

Money Out shows outgoing transactions from your deposit accounts, and charges to your credit cards. We use data from here to derive your monthly expenses.

You can adjust the values in this section, such as adding in money in and money out items not with DBS to make the projections more accurate.

For our forecast, we’ll calculate an average of your past 12 months’ salary and take this to be your monthly income (what you’ll have) before retirement.

Salary

If you don’t credit salary to a DBS account and haven’t input one manually, we’ll prompt you to enter your monthly salary. This will be taken as your net salary, or take-home pay.

We assume you’ll continue to draw this monthly salary and will start your projection from the upcoming month till one year before your retirement age. We will also apply a growth rate of 3.3% p.a. to your monthly salary for the entire projection period, taking the annualised change in nominal wages from 2015 to 2020 as a guide. (Source: Ministry of Manpower, 2021). You can adjust the rates used under “Plan settings”.

Rental income

If you have a monthly rental income, we assume that you’ll draw the same amount throughout the years, from the upcoming month till end of life. No growth rate is applied.

For our forecast, we’ll calculate an average of your past 12 months’ Money Out transactions excluding those categorised under cash, transfer, investments, and housing. We’ll take this amount as your monthly expenses (what you’ll spend) before retirement.

If you have a DBS housing loan, we’ll count the cash portion of your monthly instalment as part of your expenses till the year your loan matures. Similarly, the CPF portion of your monthly instalments will be deducted from your CPF-OA. If you do not have sufficient balances in your CPF-OA, we will draw down on your cash balances instead.

We assume you’ll continue to incur these monthly expenses and will start your projection from the upcoming month till one year before your financial freedom age. Housing loan instalments aside, an inflation rate of 3.5% p.a. is applied, in line with the proposed 3.5% p.a. increase in the Full Retirement Sum. (Source: CPF). You can adjust the rates used under “Plan settings”.

Your assets forecast is derived using data in your Assets & Liabilities. This includes what you hold with DBS/POSB along with data that you’ve manually input or synced from other banks and government agencies like SGFindex. To make sure your forecast is up-to-date, we refresh your data every time you visit the forecasting tool.

Here’s what goes into your asset forecast:

- Cash

- Selected Investments

- Supplementary Retirement Scheme (SRS)

- Central Provident Fund (CPF)

Our projection is based on the total balance of your accounts seen in your Assets & Liabilities. This includes savings and fixed deposits in Singapore Dollar and foreign currencies across your personal and joint accounts.

If you have a positive monthly cashflow, we’ll add the net amount to your cash balance. Conversely, if you have a negative cashflow, we’ll assume there’s no savings added to your cash balances that month.

By default, your cash balance grows at the deposit interest rate of 0.05% p.a. from today till your end of life. You can adjust the rate used by going to Plan settings.

Our projection is based on selected personal and joint investments as seen in your Assets & Liabilities.

For the following, these fixed rates of returns are applied from today till you reach retirement:

- Unit trusts: 3.37% p.a.

- Equities: 6% p.a.

- Exchange traded funds: 3.37% p.a.

- Managed portfolios: 3.70% p.a.

- DBS Wealth portfolios: 6% p.a.

- ILPs: 3.88% p.a.

Cash - This is based on the DBS deposit interest rate of 0.05% p.a.

Equities - This is based on the average of the investment rates of returns of 4% p.a. and 8% p.a. Thereafter, cost is deducted. For equities, we assume that your holdings are listed on SGX and do not incur holding costs.

Investment-linked policies - This is based on the average returns over 15 years for the profile of a 40-year old non-smoker male, provided by Manulife (Singapore). It takes into account deduction of policy admin fees, cost of insurance and fund management charges.

ETFs and unit trusts - This is based on the 5-year annualised returns of SGD-denominated funds.

Managed portfolios - This is based on the 5-year annualised returns of underlying funds within the Asia-focused digiPortfolios.

DBS Wealth portfolios - Portfolios in a DBS Wealth Management Account (WMA) may comprise assets of different classes. For a start, we're using an illustrated rate of returns of 6% p.a.

CPF Investment Scheme Ordinary Account (CPFIS-OA) - We’re using the same rate of returns on CPFIS–OA that we use for unit trusts. See above.

Supplementary Retirement Scheme (SRS) investments - We’re using the same rate of returns on SRS investments that we use for unit trusts. See above.

You can adjust the rates used by going to Plan settings.

The projected total maturity value is added to cash in December of the policy maturity year.

For Manulife endowment policies bought through DBS, our projection works like this: if your maturity date takes place

- Before you turn 99 years old—We use the projected maturity value of your policy at maturity year. This value is estimated based on bonus rates declared in the last Annual Participating Fund Update.(1)

- After you turn 99 years old—We use your policy’s projected cash surrender value at the point you turn 65 years old. This value is projected using the bonus rates declared in the last Annual Participating Fund Update.(2)

The values above are used for purposes of financial planning with DBS only. It does not take into account outstanding premiums nor loans, and may not be the actual amount that the policy owner receives from Manulife upon policy maturity or surrender of policy at age 65.

(1) For policyholders of Signature Income / Signature Income (II) / ManuIncome Plus who have opted for coupon accumulation: The maturity value used in the projection is estimated assuming that interest is compounded annually. This is different from the actual computation where interest is compounded monthly.

(2) For policyholders of ReadyBuilder, the estimated value does not take into account the change to the policy value when you exercise Premium Freeze option on your policy.

Income stream payouts on your projection follow the start and end dates on your policy. You can see them under “Income stream payout” in your cashflow chart.

There are some exceptions:

- For policyholders of Manulife ReadyIncome and ReadyLife Income, only monthly payouts are included in the projection. The projected maturity value is excluded.

The Supplementary Retirement Scheme (SRS) is a voluntary scheme designed to complement CPF in helping you save for retirement. Singaporeans can contribute up to SGD 15,300 a year, and a SGD 80,000 personal income tax relief cap applies.

The following rates of returns are applied from today till you’re 1 year before the statutory retirement age. You can adjust the rates used by going to Plan settings.

- SRS cash balance: 0.05% p.a.

- SRS investments: 3.37% p.a.

We’re using the same rate of returns on SRS investments that we use for unit trusts and ETFs.

We assume you’ll start your SRS withdrawals when you reach the statutory retirement age, which is currently 62. The total projected value of your SRS cash and investments at that point is divided evenly across the withdrawal period which changes depending on how old you are:

- If you’re under 62—We apply the maximum withdrawal period of 10 years.

- If you’re 62 and above—We calculate the total numbers of months from the upcoming month till you turn 72.

The withdrawal amount is deducted month by month, leaving whatever remains to continue growing at the same rate of returns.

Things work a little differently once you hit 72. We assume that you’ve passed the 10-year withdrawal period, and instead of dividing your SRS balances over a payout period, we’ll add the amount to your cash balance.

Learn more about SRS.The Central Provident Fund (CPF) is a compulsory savings scheme designed to help Singapore citizens and permanent residents (PRs) set aside funds for retirement.

The CPF Board has different schemes and rules in place that work together to help members optimise retirement savings. These can be complex to navigate and understand. For the purposes of our forecast, we’ve applied a selection of CPF rules and added some of our own assumptions.

Everyone starts with 3 accounts:

- Ordinary Account (OA)

- Special Account (SA)

- MediSave Account (MA)

On top of that, there are another 2 accounts:

- Retirement Account (RA)—Created automatically when you turn 55

- Investment Account (CPFIA)—Only if you apply for one

Our projection is based on everything you have in all your CPF accounts as seen under your Assets & Liabilities, with relevant CPF rules and a few assumptions applied.

There are some basic CPF rules that every CPF member has to follow. We’ve applied these to your forecast, assuming you’re a Singapore citizen or PR, private or public sector non-pensionable employee.

- CPF monthly contribution capped at an ordinary wage ceiling of SGD 6,000, which will be increased incrementally to SGD 8,000 by 1 Jan 2026.

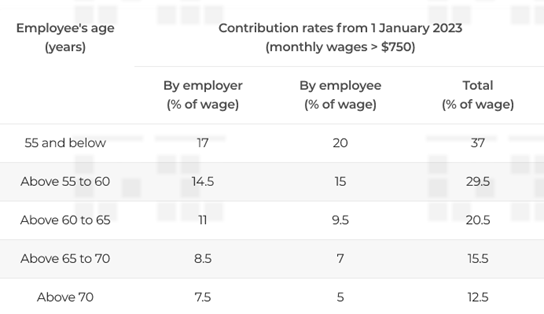

- CPF contribution rates by age

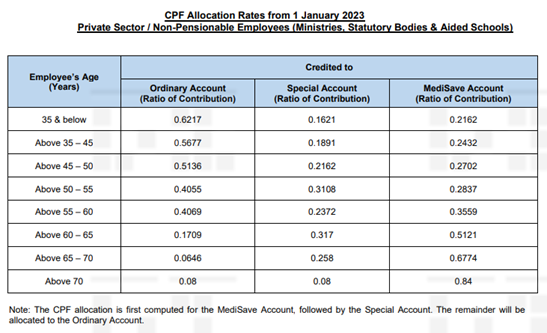

- Allocation rates of CPF contribution to OA, SA and MA by age

There’s a maximum balance you can have in your MA, also known as the Basic Healthcare Sum (BHS). Once you reach this amount, your MA contributions will flow to your SA or Retirement Account (RA). When you hit the limit on these accounts, it’ll go to your OA. - There’s a maximum balance you can have in your MA, also known as the Basic Healthcare Sum (BHS). Once you reach this amount, your MA contributions will flow to your SA or Retirement Account (RA). When you hit the limit on these accounts, it’ll go to your OA.

- Base interest, additional interest and extra additional interest on OA, SA, MA and RA

- Interest is computed monthly and credited annually

- SA limit, or Full Retirement Sum (FRS). For those turning 55 in 2023, it’s SGD 198,800

- MA limit, or Basic Healthcare Sum (BHS). For those turning 65 in 2023, it’s SGD 68,500

- Your RA is created for you when you turn 55. Savings from your SA and OA, up to the FRS, are transferred to your RA. If you don’t have enough to meet the FRS, another transfer is made 6 months before you turn 65. The total balance in your RA is then used to join CPF LIFE.

A combination of CPF rules and our own assumptions form the basis of our projection. For purposes of our forecast, we assume

On CPF Life Scheme

- You’re under the CPF LIFE Scheme

- Your CPF LIFE payout starts at age 65

- You’ve opted for the Full Retirement Sum (FRS) Scheme.

On interest earned

- Monthly interest is computed based on the month’s opening balance

- From age 65, you only earn extra interest and additional extra interest on your CPF LIFE balance, where applicable.

On CPFIA rate of returns

Our projection is based on the cash balance and value of investments in your CPFIA account as seen in your Assets & Liabilities. Your CPFIA investments may include fixed deposits, unit trusts, Exchange Traded Funds (ETFs), equities, retail bonds, Singapore Savings Bonds, T-Bills, SGS Bonds, managed portfolios, warrants and structured products—whatever you’ve bought using your CPFIA monies.

The following rates of returns are applied on your CPFIA balances. You can adjust the rates used by going to Plan settings.

- CPFIA cash balance: 0.05% p.a.

- CPFIA investments: 3.37% p.a.

We’re using the same rate of returns on CPFIA investments that we use for unit trusts. See how it’s derived.

On additions and deductions from OA, SA & MA

- Additions to your OA come from monthly contributions and annual interest crediting

- Additions to your SA come from monthly contributions and annual interest crediting. No deductions are made

- Additions to your MA come from monthly contributions and annual interest crediting. No deductions are made

- Monthly repayments for housing loans come out of your OA. For DBS loan holders, we’ll use the repayment by CPF amount on our record, which includes all joint borrowers’ portions.

On account limits

- Full Retirement Sum (FRS) increases by 3.5% every year

- Basic Healthcare Sum (BHS) increases by 5% every year.

On what happens when you reach your retirement age or age 55, whichever is later

- The balance in your CPFIA, if any, is moved to your OA at your retirement age, or at age 55 if your desired retirement is before 55

- If you’re using your OA to service your home loan, we continue to set aside your repayment amount till the year your loan matures, assuming it’s within the CPF housing limits applicable to you. Any remaining balance is used to meet the FRS

- If you haven’t met the FRS by your desired retirement age, we continue to set aside money in your SA and OA to meet the FRS shortfall. This is then moved to your RA to join CPF LIFE 6 months before you turn 65. However, if your desired retirement age is above 65, the amount remains in your SA and OA and is counted as part of your assets

- If there’s any projected balance in your RA due to interest credited after the transfer of your RA funds to CPF LIFE, we’ll count it as part of your assets

- If there’s any projected balance in your SA and/or OA due to interest credited after the CPF Savings withdrawal is made at retirement age, we’ll count it as part of your assets

On deriving your RA balance at 55 years old (only applicable for those > 55)

- If you’re currently above 55 years old and already have an RA, we work backwards in our calculations:

- Taking your current RA balance, we deduct a basic interest of 4% p.a. for the period from now to when you were 55

- If the derived balance is below SGD 60,000, we assume this is the amount transferred from your SA and OA to meet FRS when you were 55. If the derived balance is above SGD 60,000, we assume you received SGD 900 in extra and additional extra interest per year and will deduct it accordingly

- We assume there’s no overflow from your MA to your RA.

On whether there’s a minimum sum to join CPF LIFE

- While you’ll need at least $60,000 in RA savings to be automatically enrolled into CPF LIFE, there is no minimum sum required to join the scheme.

- You can join the scheme regardless of how much (or how little) CPF savings you have. However, note that the less savings you have in your CPF accounts and RA, the smaller the payouts will be as well.

On what can be withdrawn from age 55 and 65

- If you haven’t met the FRS by 55, CPF lets you withdraw up to SGD 5,000 from your SA/OA. We assume that you won’t make a withdrawal but will keep the amount to meet your FRS

- At 65, you have the option of withdrawing up to 20% of your RA savings. We assume that you won’t make a withdrawal but will use the amount to join CPF LIFE.

Your projected CPF payouts start in the birth month of your retirement age, and may comprise of payouts from your CPF LIFE and CPF withdrawal savings.

1. Payout from CPF LIFE

The payout amount is derived from the total projected balance in your RA 6 months before you turn 65. We follow the calculations seen on the CPF LIFE Estimator, but our results may differ slightly as our calculations run on our own engine.

2. Payout from CPF withdrawal savingsIf you have balance left in your SA and OA after fulfilling the FRS, CPF Board lets you make withdrawals from age 55. For our forecast, instead of lump sum withdrawals, we’ll work your balance into monthly payouts.

We’ll activate this balance when you reach your desired retirement age, or the payout eligibility age of 55 if your desired retirement age is before 55.

Taking the total projected value in your SA and OA, we divide it evenly across the total number of months between the start of your withdrawal and your end of life into monthly payouts. Payouts are taken out of the balance one year at a time, leaving whatever remains to continue growing at the same rate of returns.

You can learn about CPF LIFE and CPF Schemes at the CPF website.