At the merchant’s site when you select DBS d2pay as your payment mode, you will be asked to key in your digibank User ID (UID) and PIN. Please follow the on-screen Transaction Signing instructions with your digibank Secure Device or digital token to complete the transaction.

We have a good number of merchants who have signed up to use the d2pay service but we will continue to sign up government agencies, online merchants and e-tailers for your online convenience. You can use DBS d2pay whenever you shop online. DBS has signed up a whole range of government agencies, online merchants and e-tailers to ensure that you have fun shopping on the Internet.

Getting Started

Yes, you can deactivate the d2pay service using DBS digibank anytime. Simply follow the steps below:

- Log in to DBS/POSB digibank.

- Tap on “More”, under “Transfer Settings”, select “d2Pay Transfer Limit”

- Set the limit to “0”.

- Select “Next” to review the details and select “Change Daily Limit Now” to complete the change.

The deactivation is immediate. No DBS d2pay payments will be allowed until you re-activate this service in writing using the DBS d2pay Multi-Purpose Form.

You can use the DBS d2pay Multi-Purpose Form to instruct us to change your designated account for DBS d2pay payments or call our customer service hotline.

Customise your transaction limit using your DBS/POSB digibank by simply following the below steps:

To check your limit

- Log in to DBS/POSB digibank.

- Tap on “More”, under “Transfer Settings”, select “d2Pay Transfer Limit” to view your d2Pay transfer limit

To change your limit

- Log in to DBS/POSB digibank.

- Tap on “More”, under “Transfer Settings”, select “d2Pay Transfer Limit”

- Choose the new d2Pay Transfer Limit you wish to set.

- Select “Next” to review the details and select “Change Daily Limit Now” to complete the change.

Making Payment

Select “DBS Bank Ltd” after you have chosen d2pay as the payment option at the merchant's website.

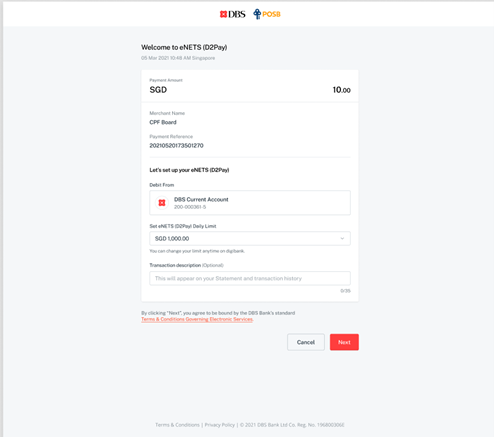

For First Time Users

You will be prompted to perform a one-time DBS d2pay setup process where you designate a DBS or POSB savings or current account as your default debiting account as well as a daily payment limit. The selected account and daily limit will be used for all your future DBS d2pay transaction.

- Select an Account Type.

- Select a d2pay daily limit.

- Enter the transaction description if you wish to

- For Subsequent Users

You will be requested to enter your User ID and PIN to authorise the payment. The amount will be deducted from your designated account and paid to the merchant automatically.

After you have entered your PIN and clicked the 'Submit' button, the money will be debited immediately from your designated account. You will receive an acknowledgement page with a transaction reference if the payment is successful.

The transaction will be rejected. You can transfer funds from another account to your DBS d2pay designated account via DBS digibank before using DBS d2pay again.

An acknowledgement page with a unique transaction reference will be presented to you for all successful payments. You can also check the amount deducted in your Transaction History via DBS/POSB digibank.

You should deactivate the d2pay service immediately using DBS/POSB digibank. Please notify the Bank immediately at 1800-111 1111 (or 65-6327 2265 from overseas) to deactivate your digibank and provide us the necessary details to facilitate investigations.

Configuration

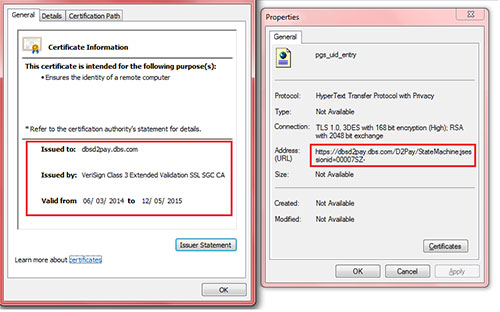

You should ensure that the page prompting you for your PIN has a page certification for "d2pay.dbs.com".

Internet Explorer

To view the certification, do the following:

- Right-click on the page

- Select "Properties" - you should verify that the URL shows https://d2pay.dbs.com/.

- Click on "Certificates" - you should see "Issued to: dbsd2pay.dbs.com" and verify that the date is valid

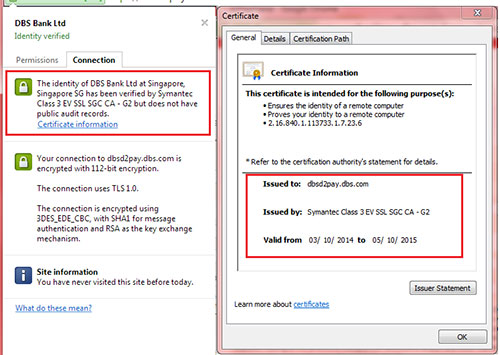

Chrome

To view the certification, do the following:

- Click on the green bar with the security lock, located on the address bar.

- On the dropdown menu, select the “Connection” tab.

- Click on “Certificate information” - you should see "Issued to: dbsd2pay.dbs.com" and verify that the date is valid.

It confirms that you are submitting the information to DBS Bank, that your account information is protected with SSL encryption against unintentional disclosure of information to third parties.