Contribution to Supplementary Retirement Scheme (SRS) Account

For customers to be eligible for tax relief in 2026, contributions must be made before 7pm via digibank on Wednesday, 31st December 2025.

Part of: Guides > Your Guide to digibank

Important information

- Ensure that your SRS contribution does not exceed your balance contribution limit available. If the contribution amount exceeds the balance contribution limit available, the entire amount will be refunded to your funding account.

Maximum Annual Contribution Limit

| Singapore Citizens / PRs | S$15,300 |

| Foreigners | S$35,700 |

Annual Foreigner Declaration - Increase your SRS contribution limit

For foreigners, please declare your Foreigner status to update your SRS contribution cap for the year.(Note: This declaration needs to be done yearly as the SRS contribution limit will reset on 1st Jan every year)

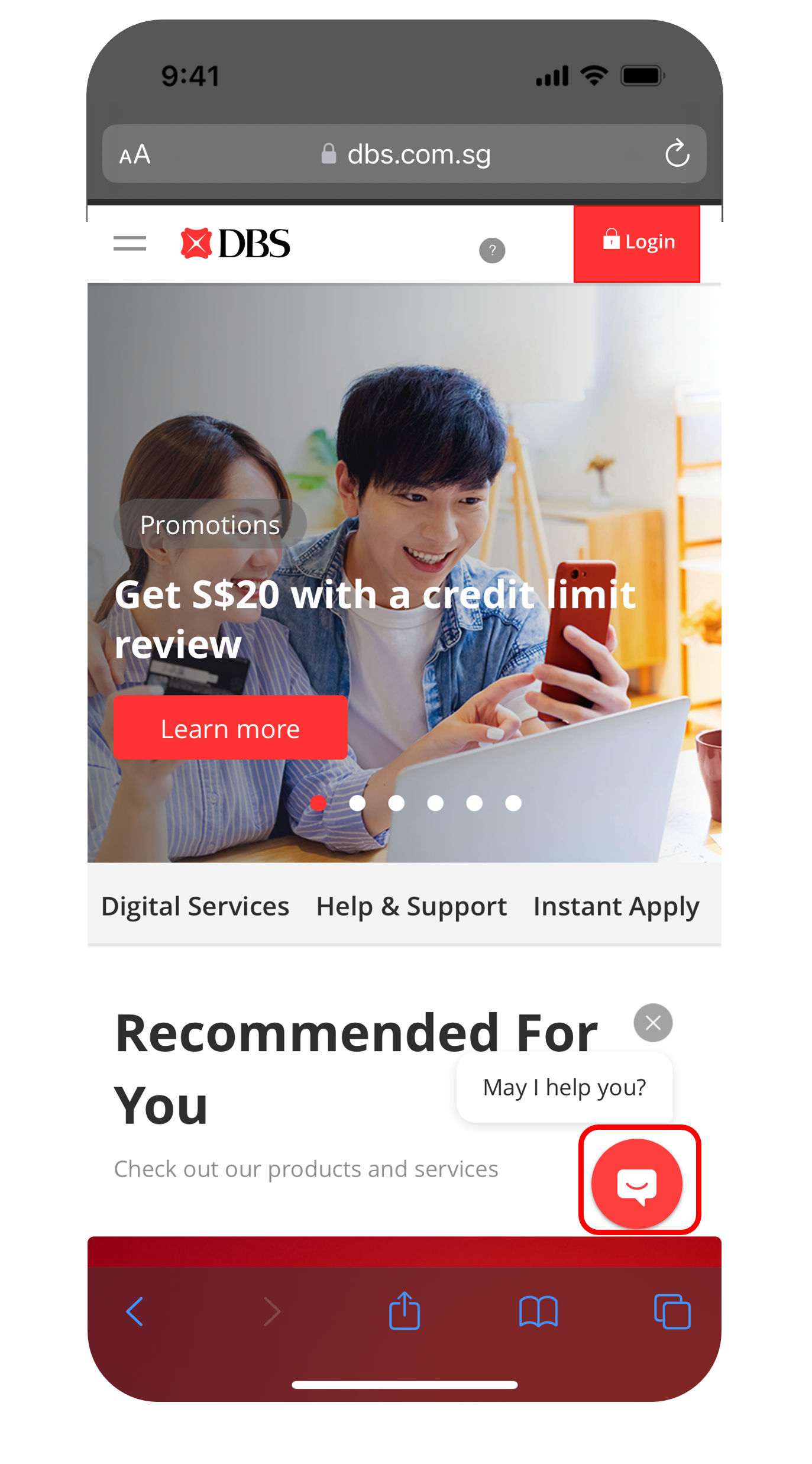

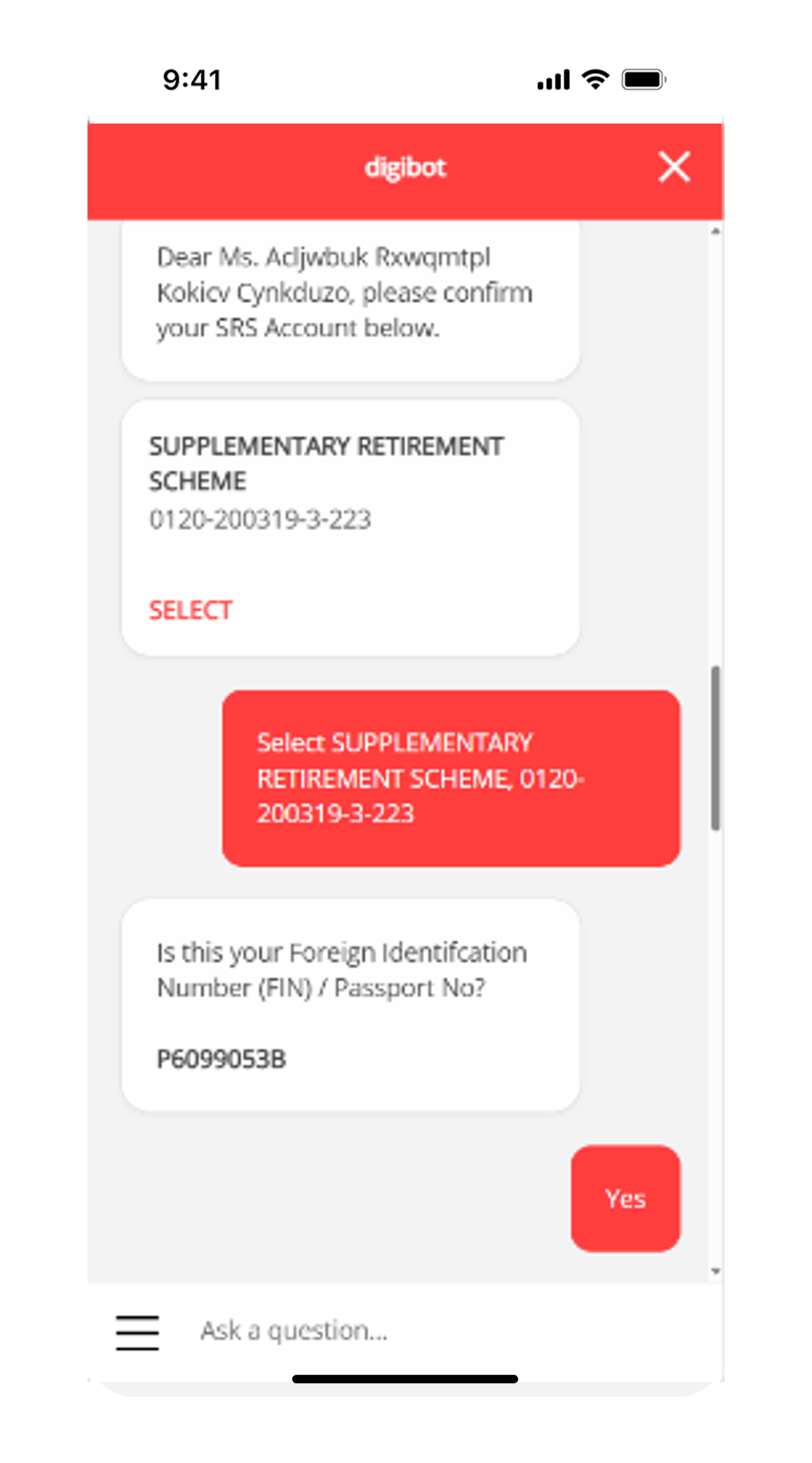

DBS digibot

Click on located at the bottom right.

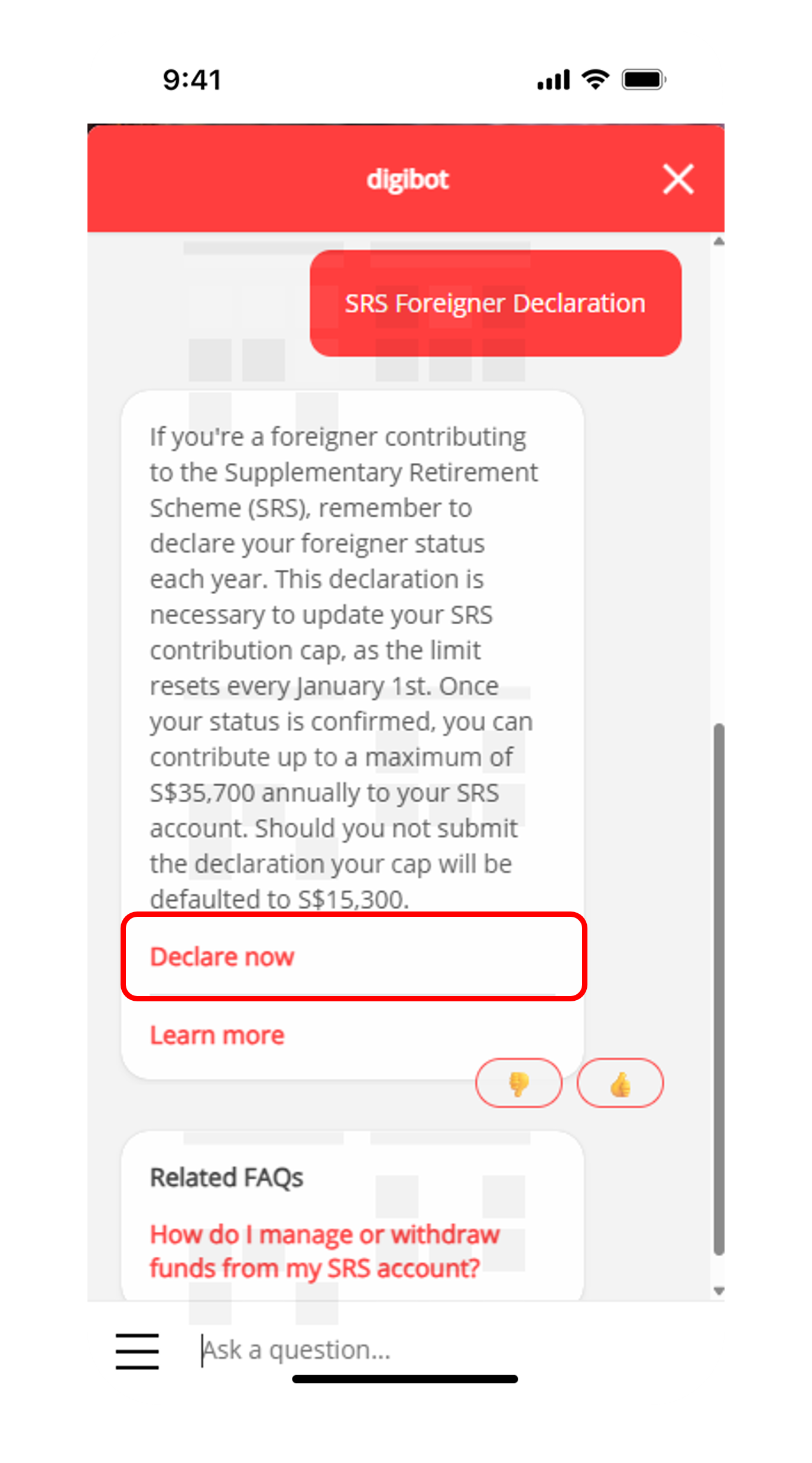

Type SRS Foreigner Declaration into the chat and click Declare now.

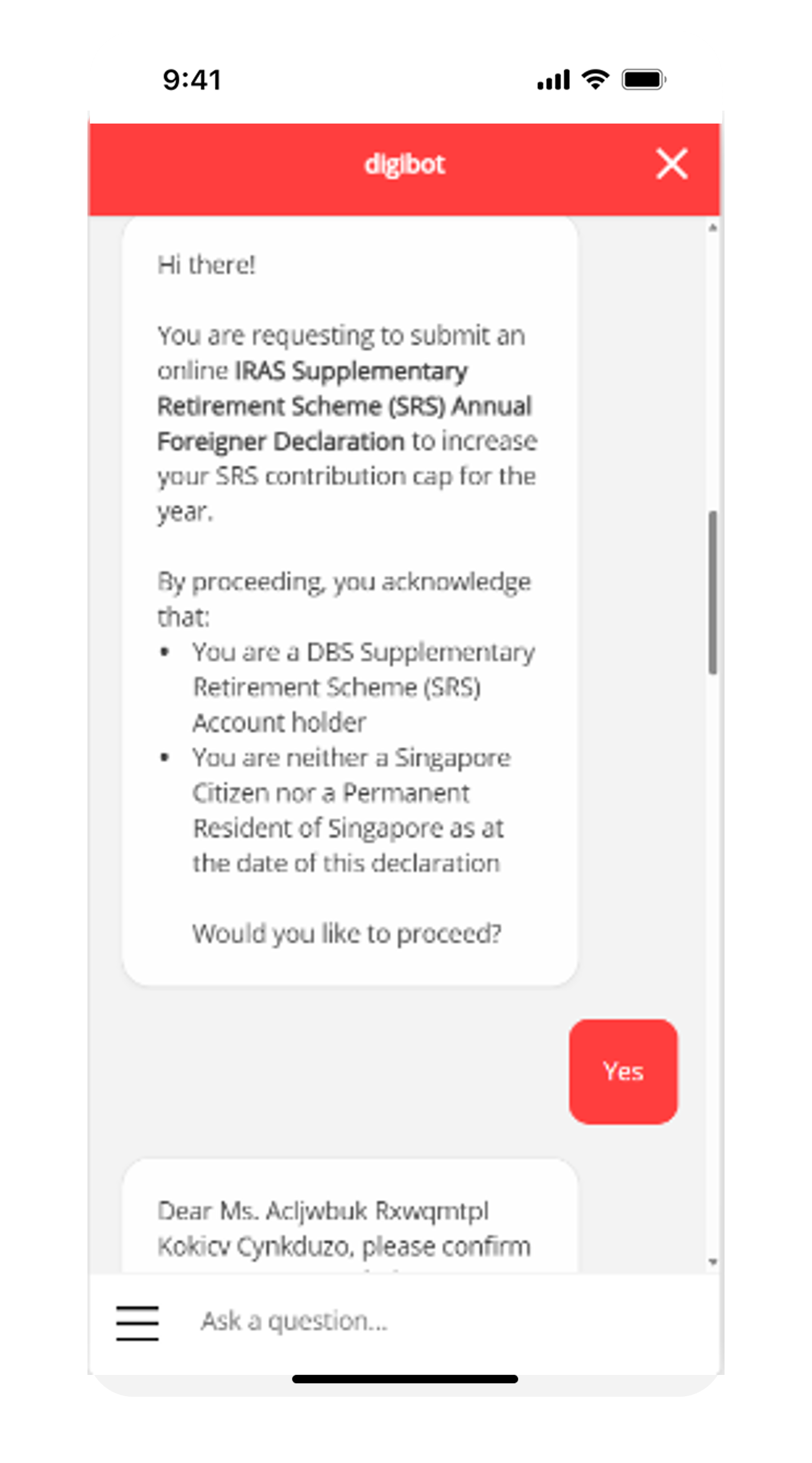

Tap Yes to start SRS Foreigner Declaration request.

Select your Supplementary Retirement Scheme (SRS) Account and confirm your Passport No.

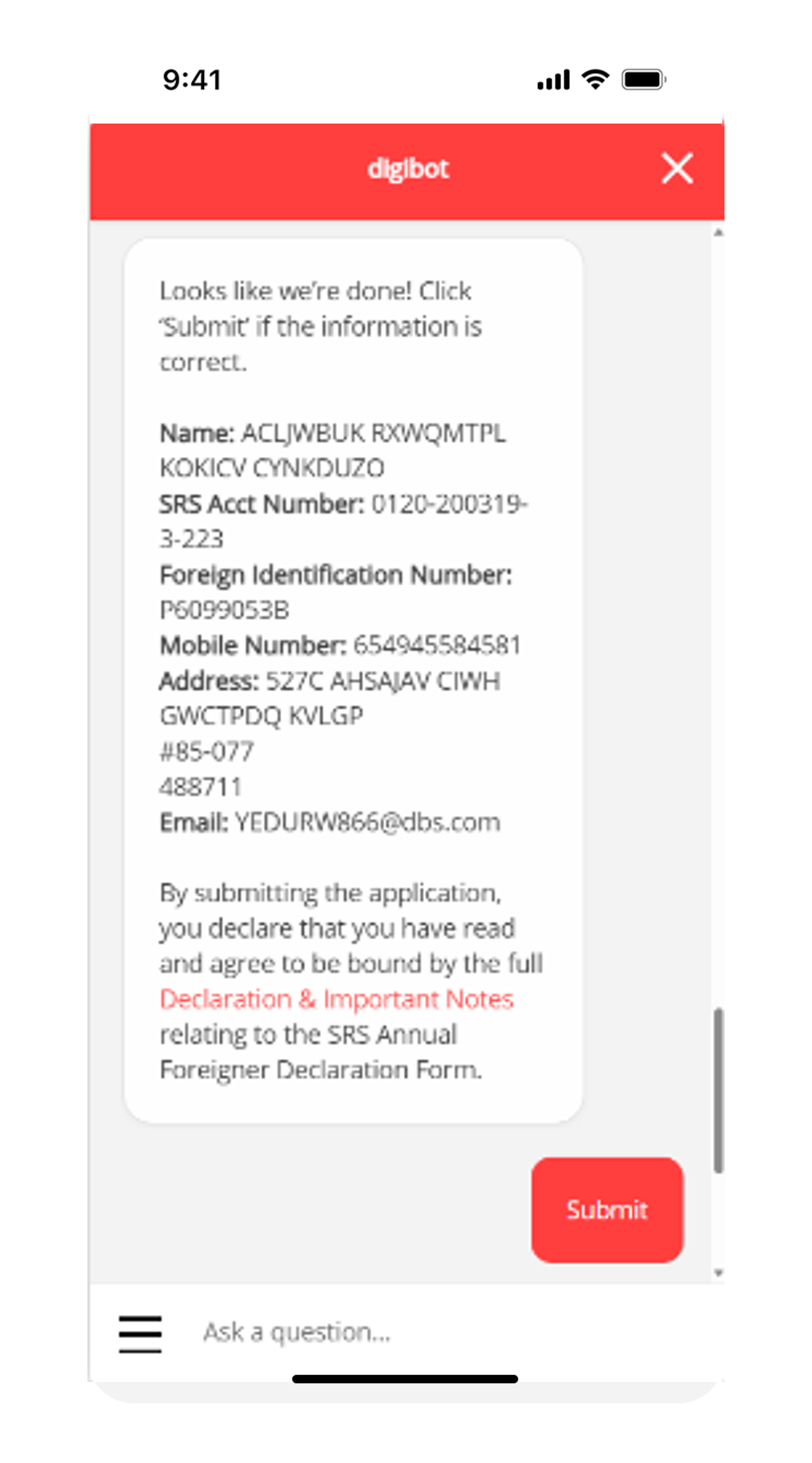

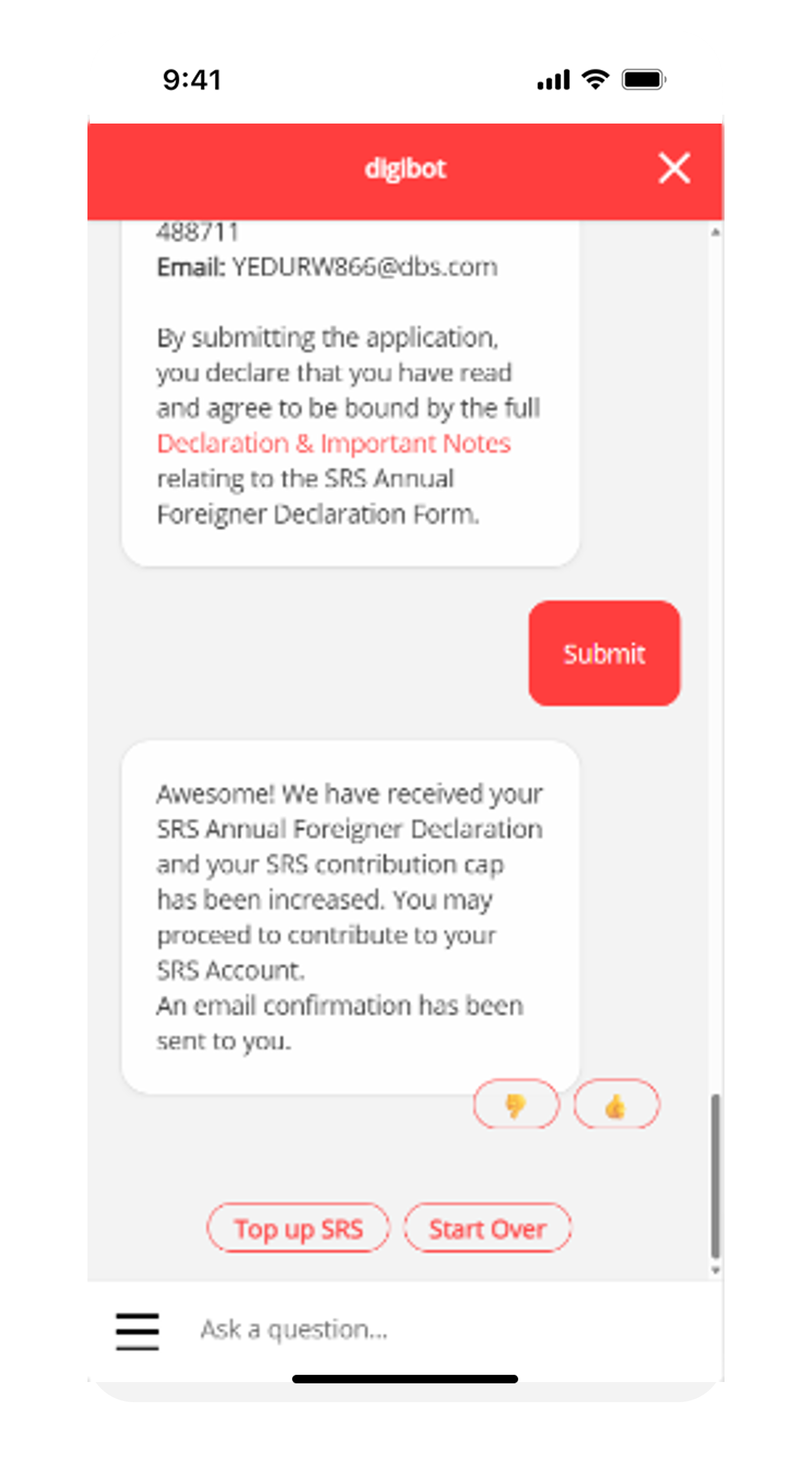

Verify the details and click Submit.

You have successfully increase your SRS contribution cap.

Launch our DBS digibot now!

Branch

-

Identification Document:

- Identification Document:

- Proof of Employment (if you are working in Singapore)

-

Proof of Employment(if you are working in Singapore)

- Valid Employment pass / In Principal Approval (IPA) issued by Ministry of Manpower (To update your Foreign Identification Number)

How to make a contribution to SRS account

There are various channels through which you may make a SRS contribution with us.

Contribution via digibank mobile

Important: For customers to be eligible for tax relief in YA 2026, contributions must be before 7pm on Wednesday, 31st December 2025 via digibank mobile.

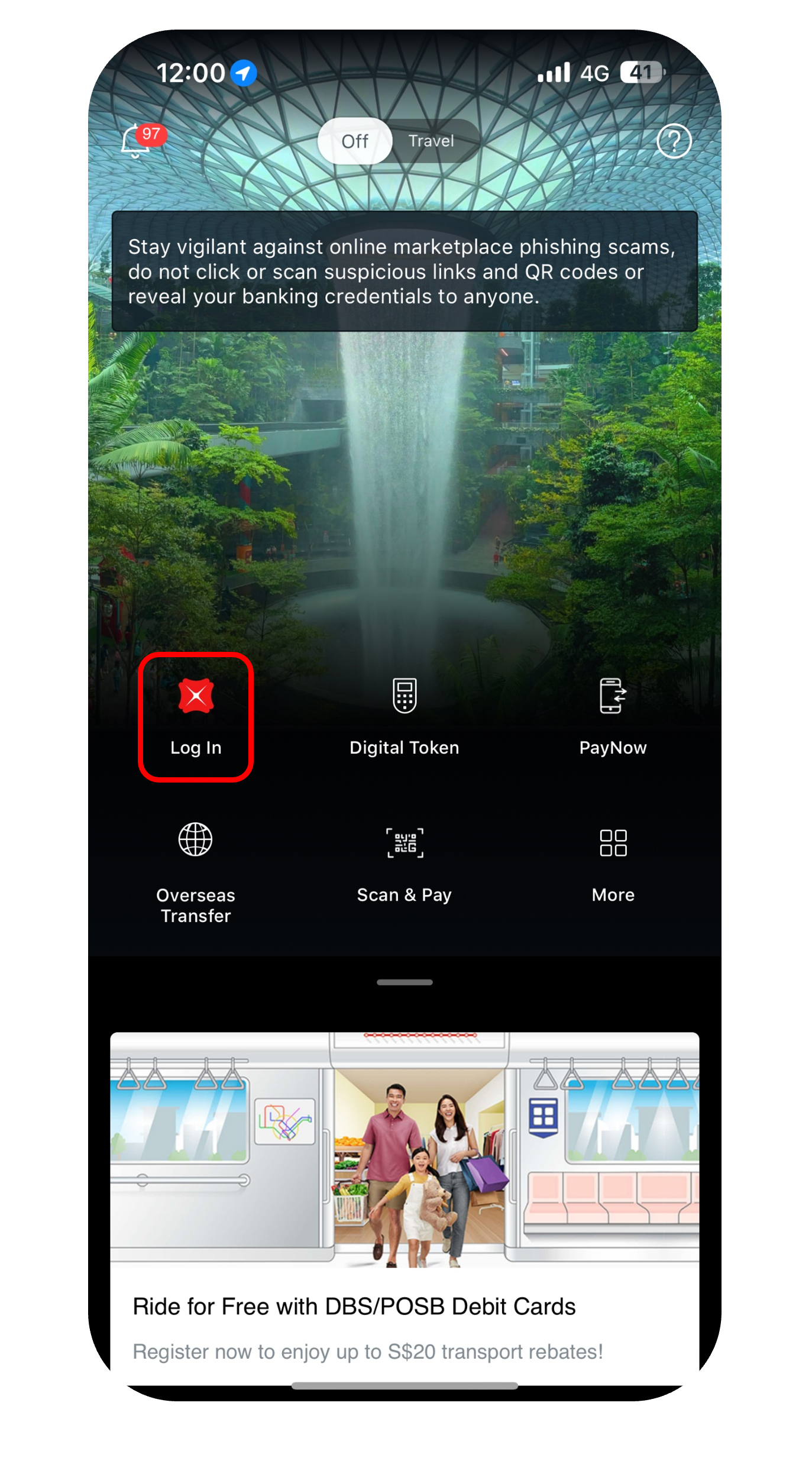

Log in to digibank mobile with your Touch / Face ID or digibank User ID & PIN.

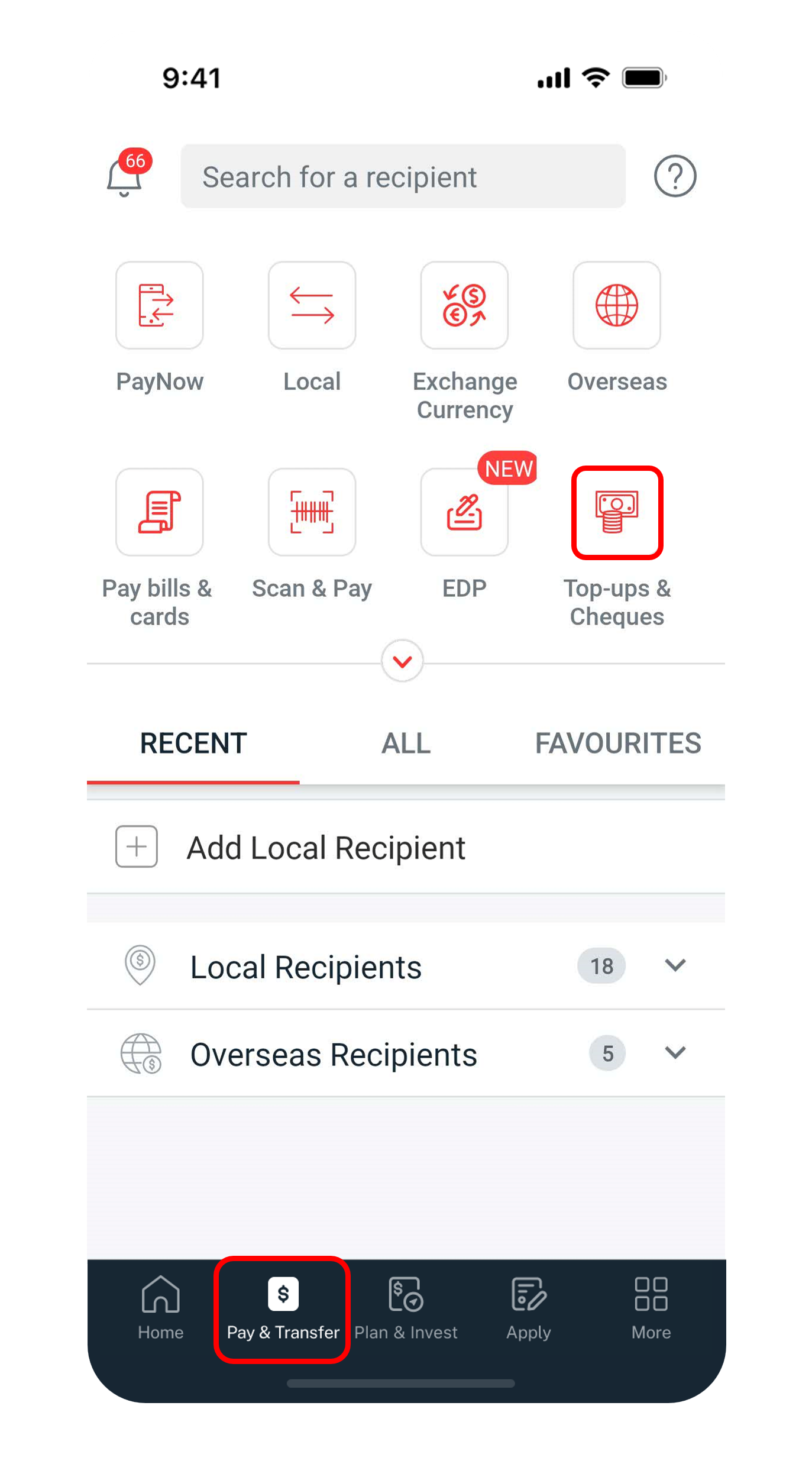

Tap on Pay & Transfer at the bottom and select Top-ups & Cheques.

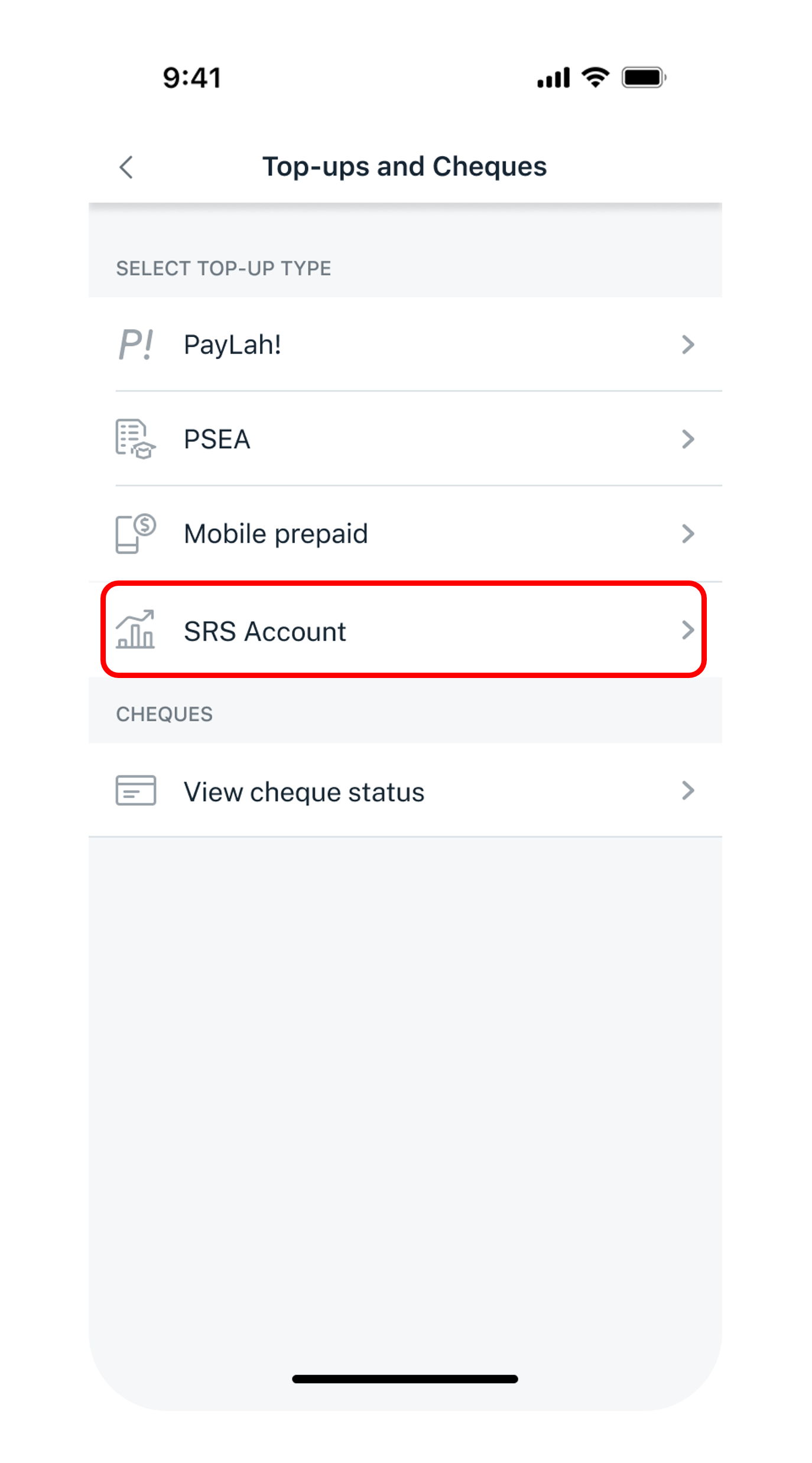

Tap on SRS Account.

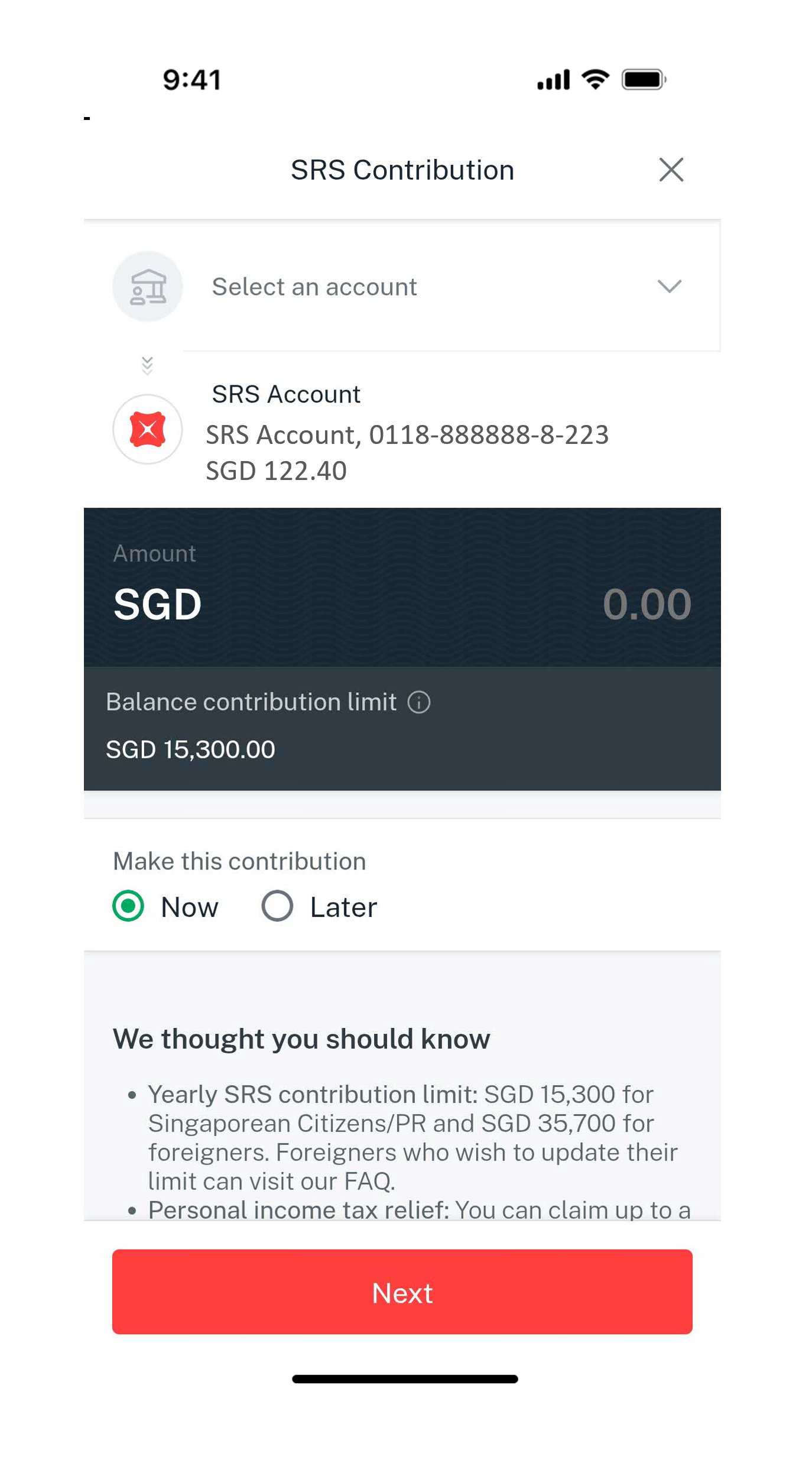

Select the debiting account and enter the amount you wish to contribute. Tap Next.

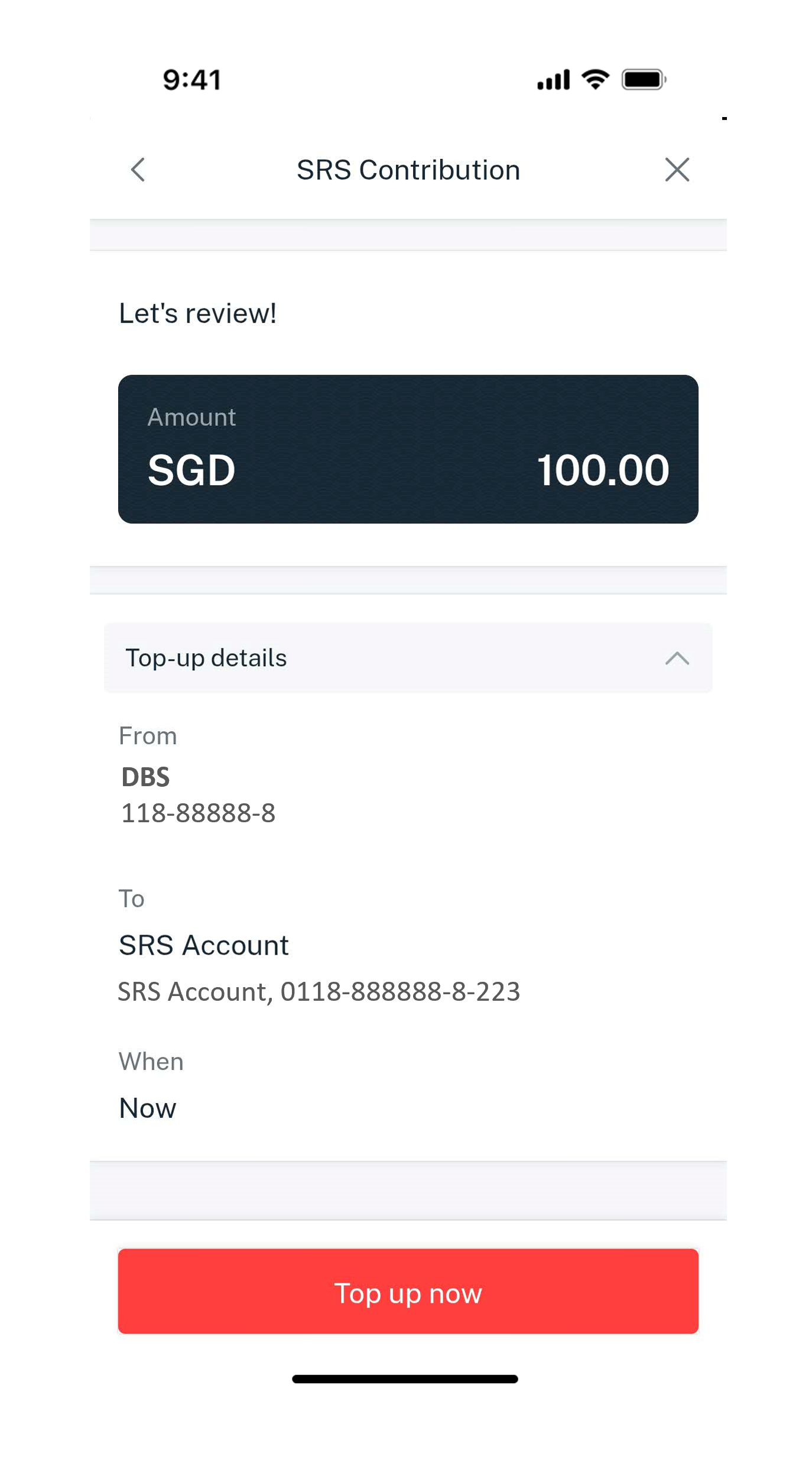

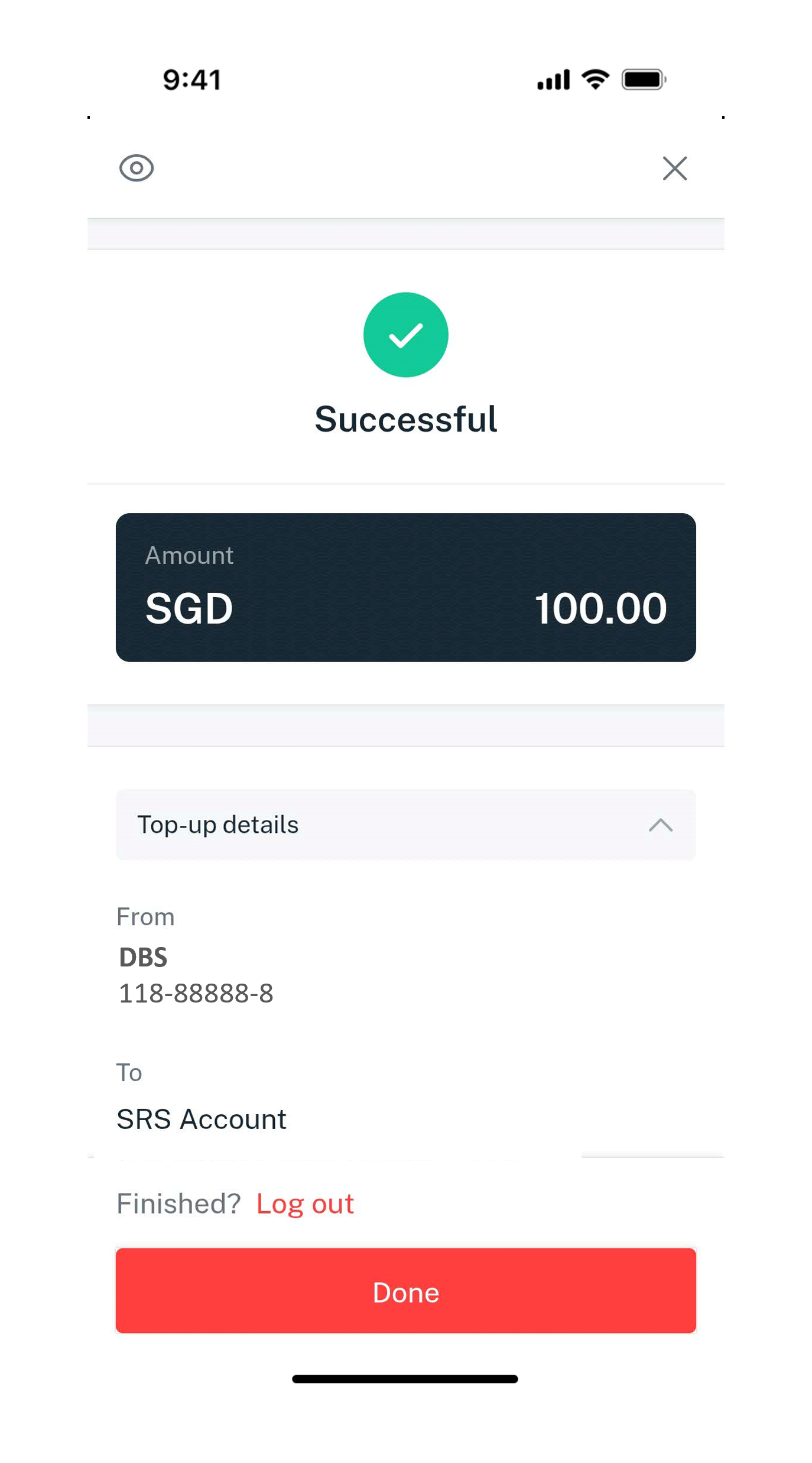

Verify your contribution details and tap Top up now.

You have successfully top up your SRS Account.

Note:

- Ensure SGD - Singapore Dollar is selected as the Currency. We only accept SGD for SRS contributions.

- Service is only available from Monday to Saturday: 7:00am to 10:00pm (excluding public holidays).

Contribution via digibank online

Important: For customers to be eligible for tax relief in YA 2026, contributions must be before 7pm on Wednesday, 31st December 2025 via digibank online.

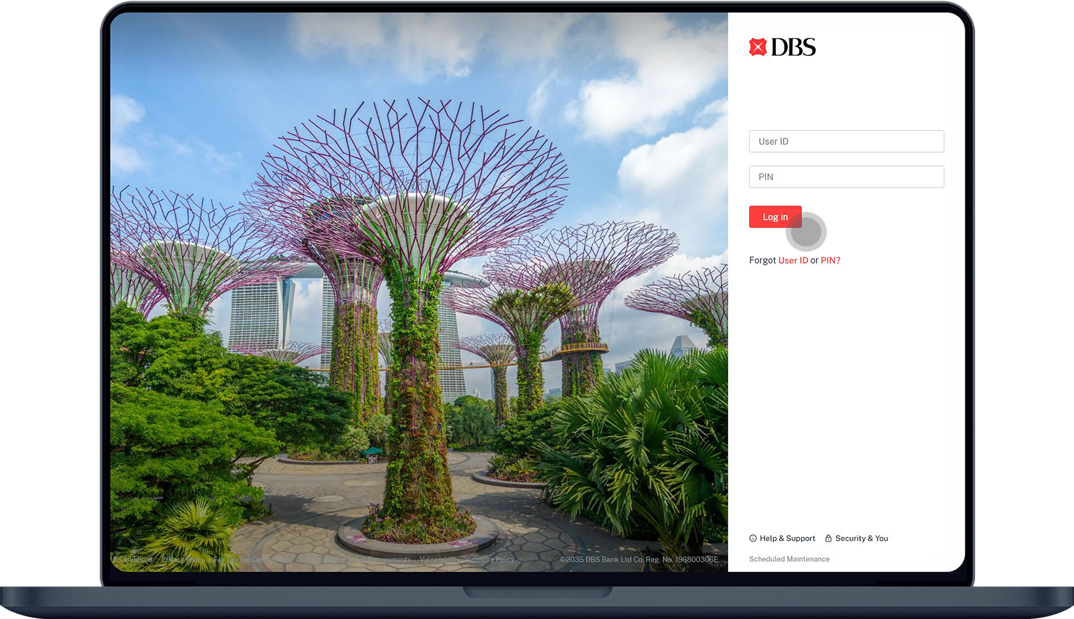

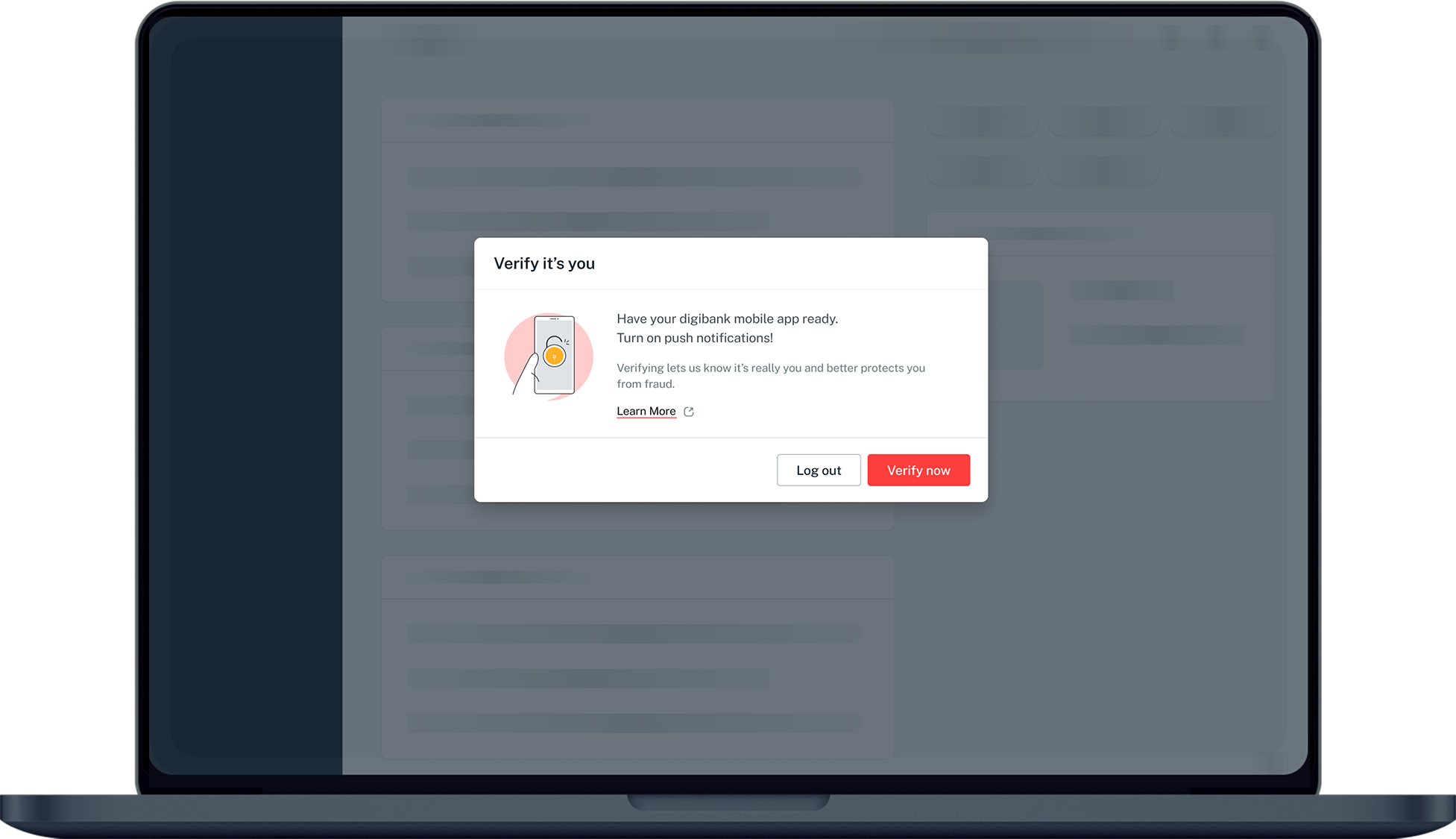

Complete the Authentication Process.

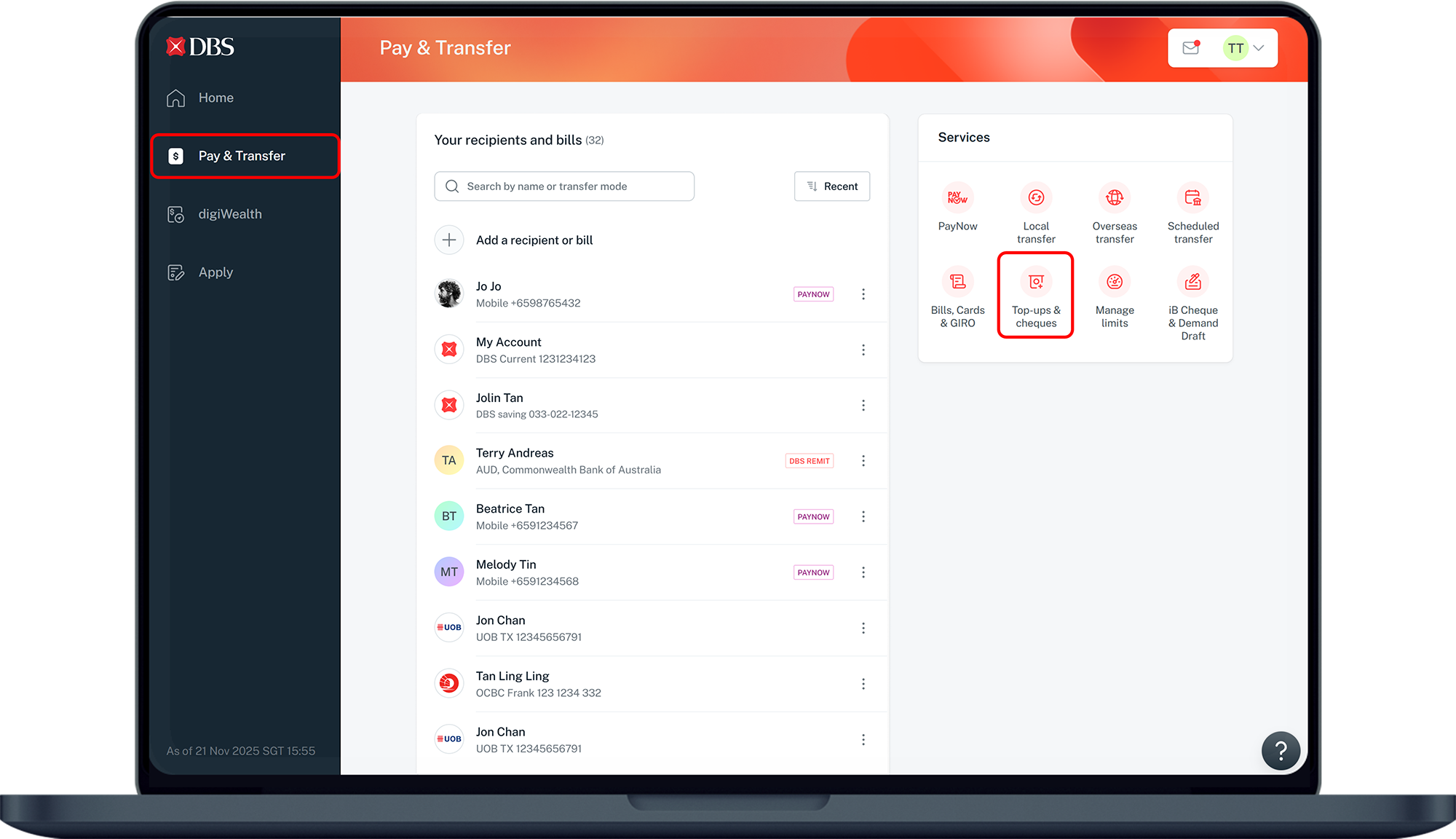

Click on Pay & Transfer on the left and under Services, click Top-ups & cheques.

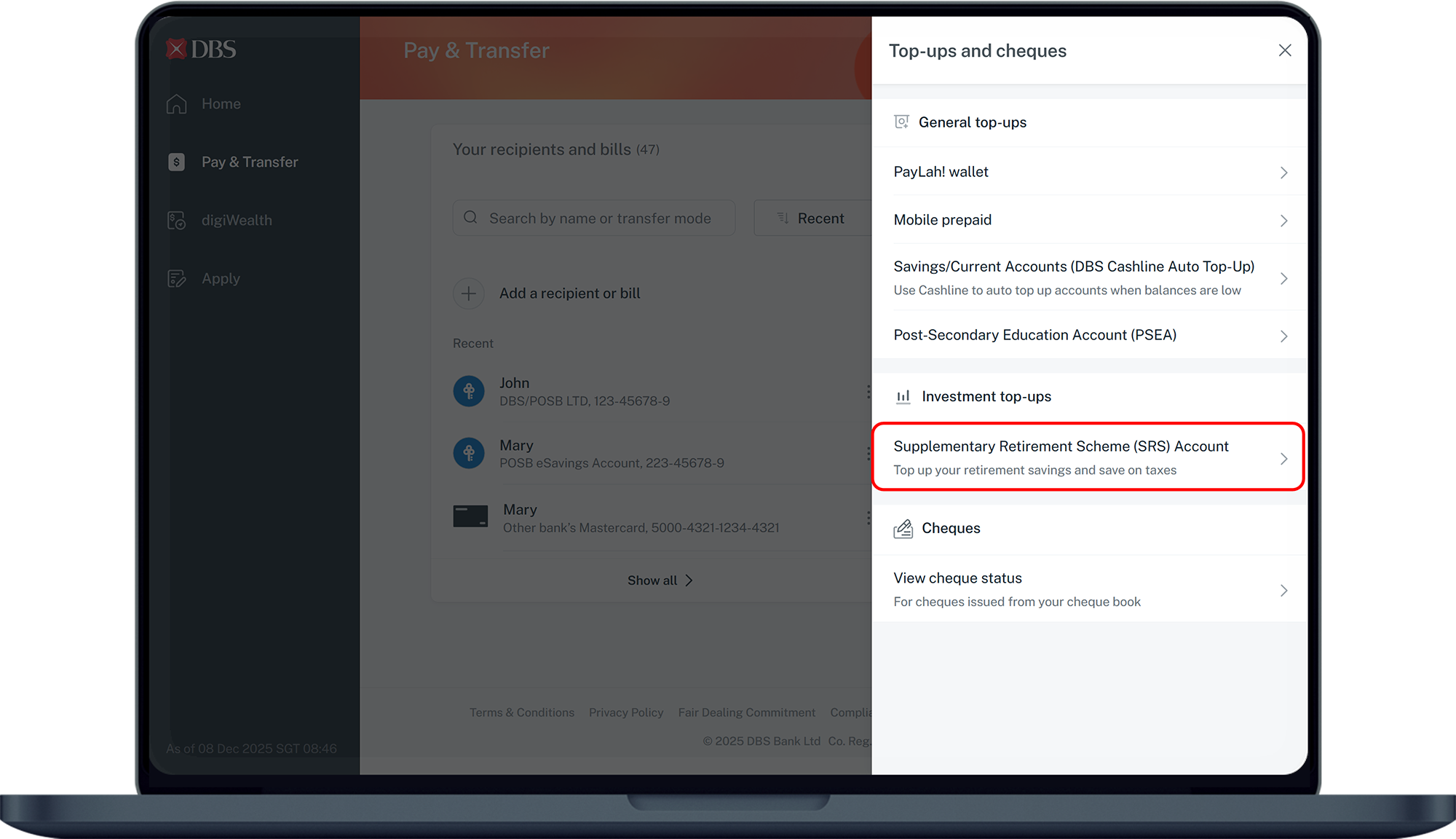

Under Investment top-ups, select Supplementary Retirement Scheme (SRS) Account.

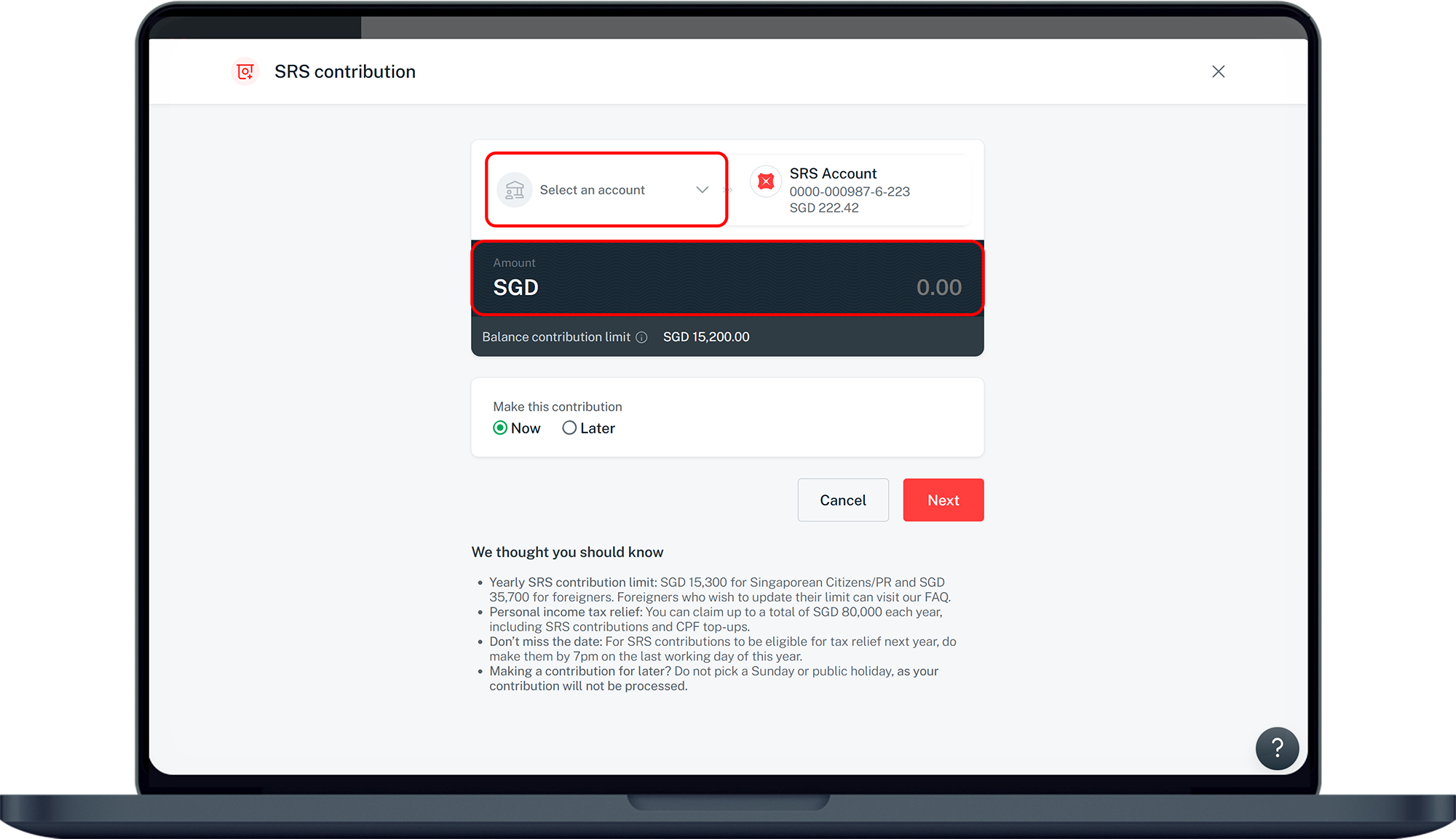

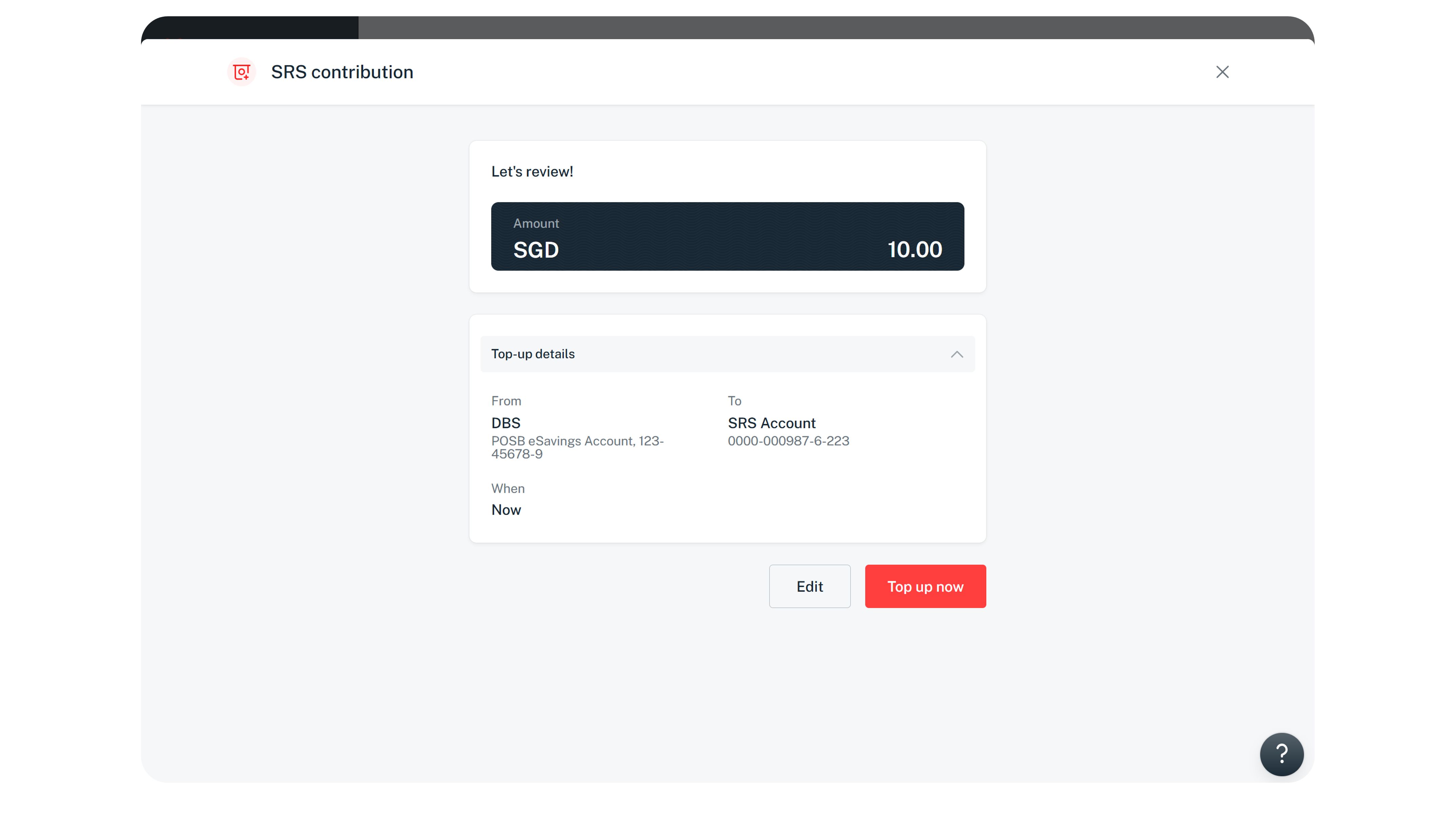

Select your debiting account you want to contribute from, enter the Amount you want to contribute and click Next.

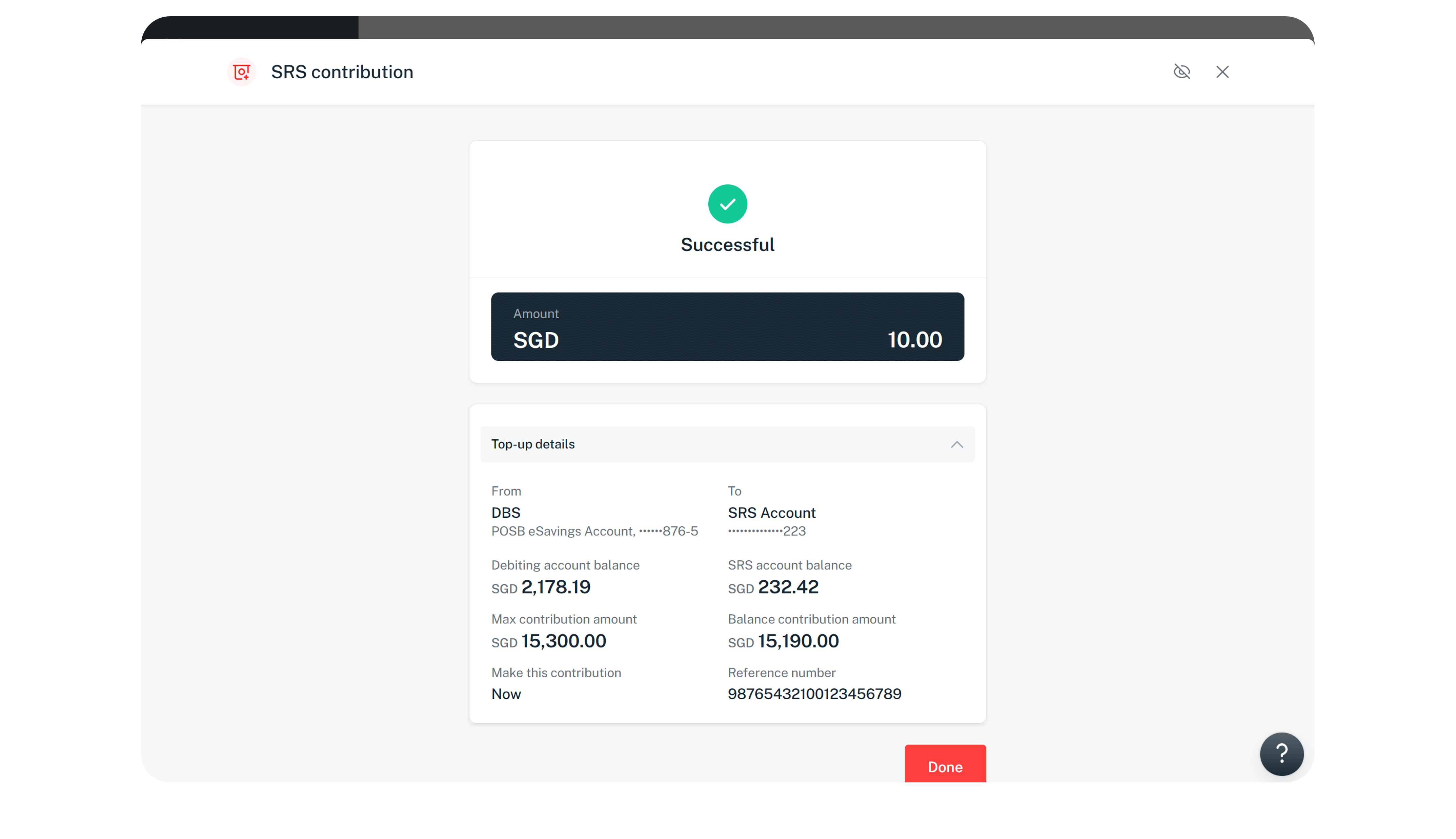

Verify your contribution details and click Top up now.

You have made a contribution your SRS account successfully.

Note:

- Service is only available from Monday to Saturday: 7:00am to 10:00pm (excluding public holidays).

- Ensure SGD - Singapore Dollar is selected as the Currency. We only accept SGD for SRS contributions.

Contribution via Branch

Important: For customers to be eligible for tax relief in YA 2026, contributions must be made before branch closure hours 3:30pm on Wednesday, 31st December 2025 via any DBS/POSB Branches.

- Visit any DBS/POSB Branches with your NRIC/Passport.

- Foreigners must declare their foreigner status at the branch to qualify for the foreigner annual contribution limit for SRS.

Contribution via Cheque

Important: For customers to be eligible for tax relief in YA 2026, contributions must be deposited before 11.30am on Wednesday, 31st December 2025 via cheque. For foreigners, declare your foreigner status at the branch if you have not done so for the year 2025 before depositing the cheque.

- Issue a local cheque in your name.

- Write your SRS Account no. at the back of the cheque.

- Deposit your cheque at any DBS/POSB Branches or Cheque Deposit Box located islandwide.

More information

- Terms and Conditions Governing SRS

- Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.