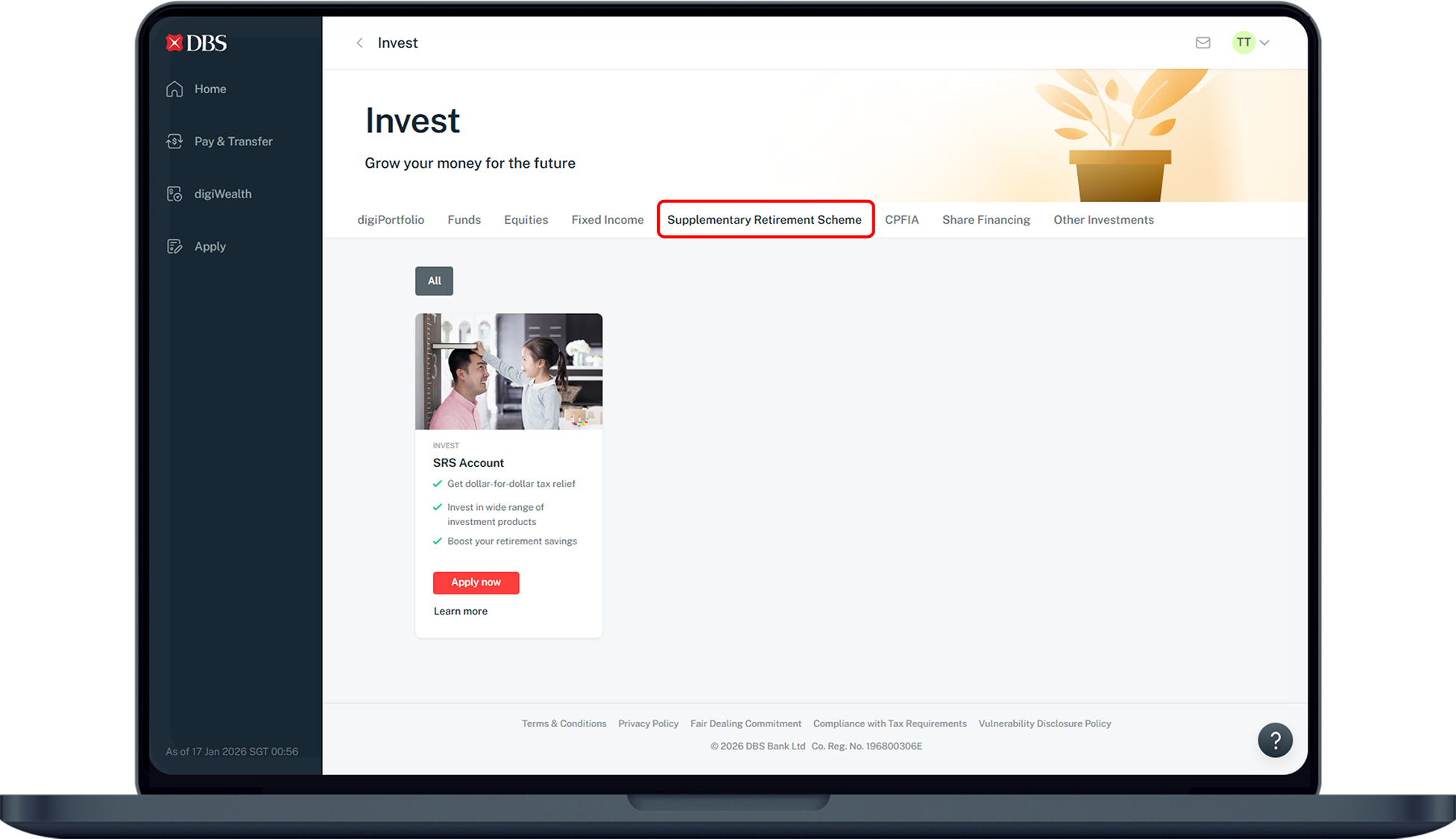

Open a Supplementary Retirement Scheme (SRS) Account

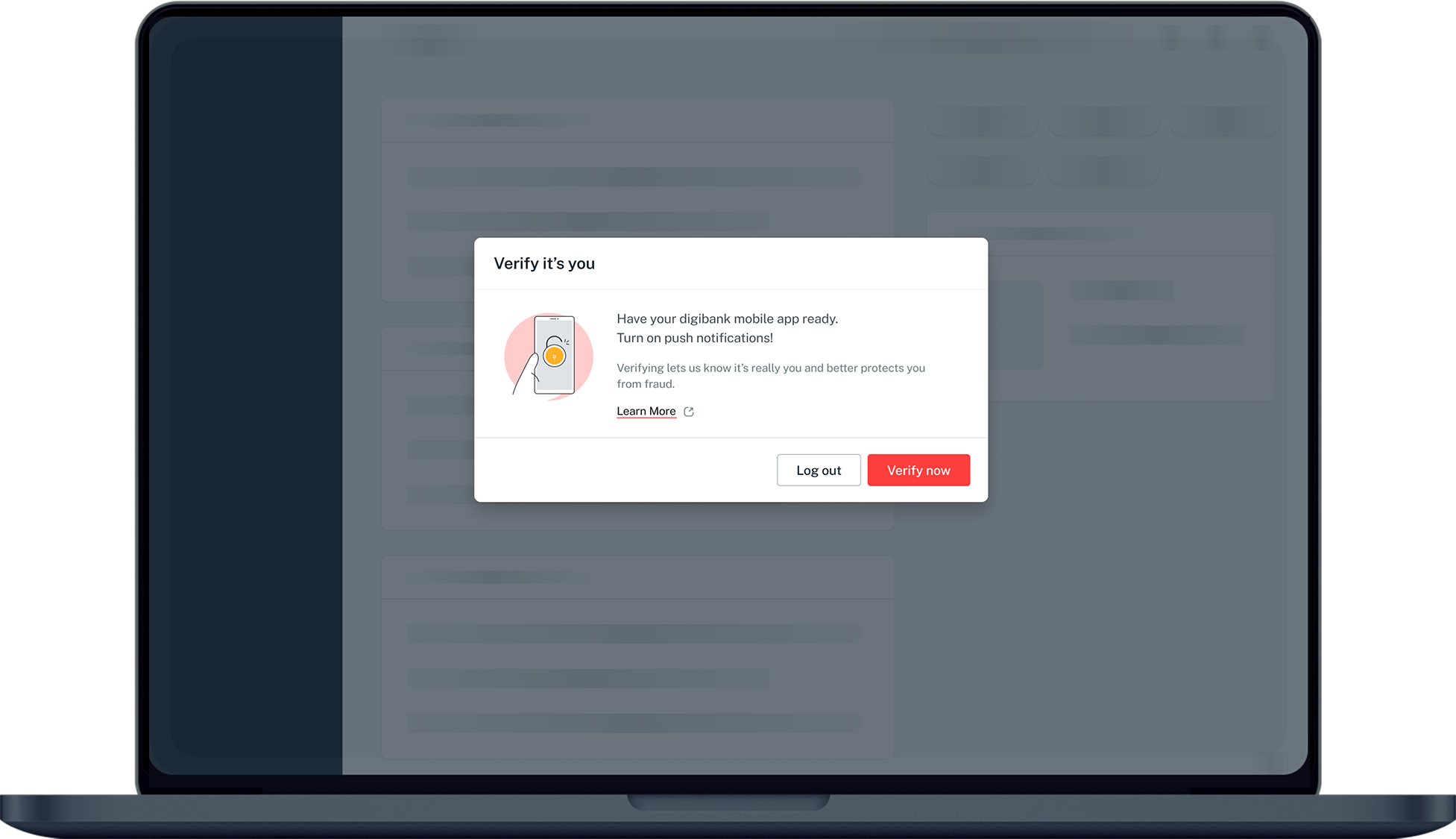

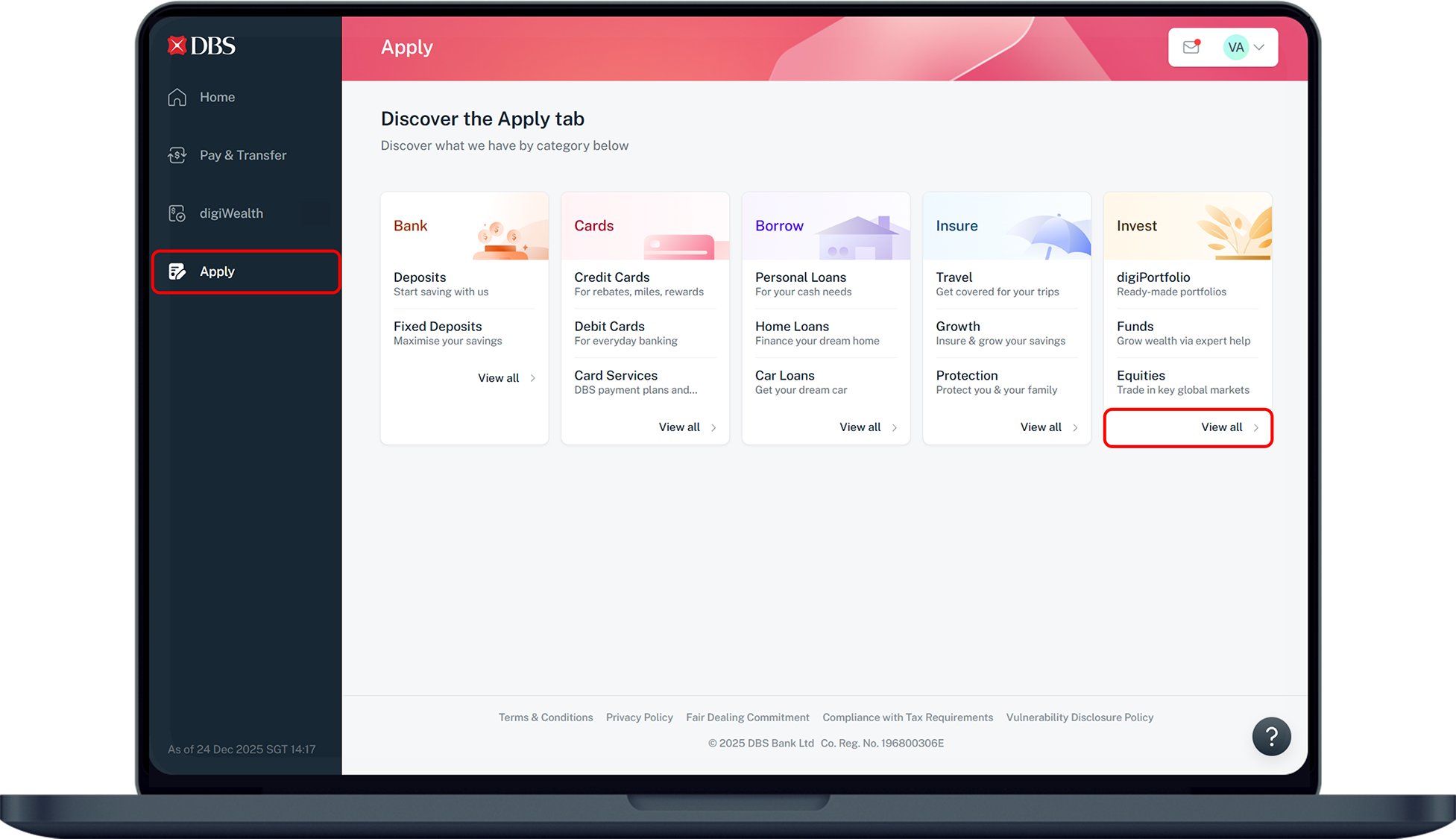

Apply for your Supplementary Retirement Scheme (SRS) Account instantly via digibank online.

Part of: Guides > Your Guide to digibank online, Your Guide to DBS Vickers Online Trading Account

Important information

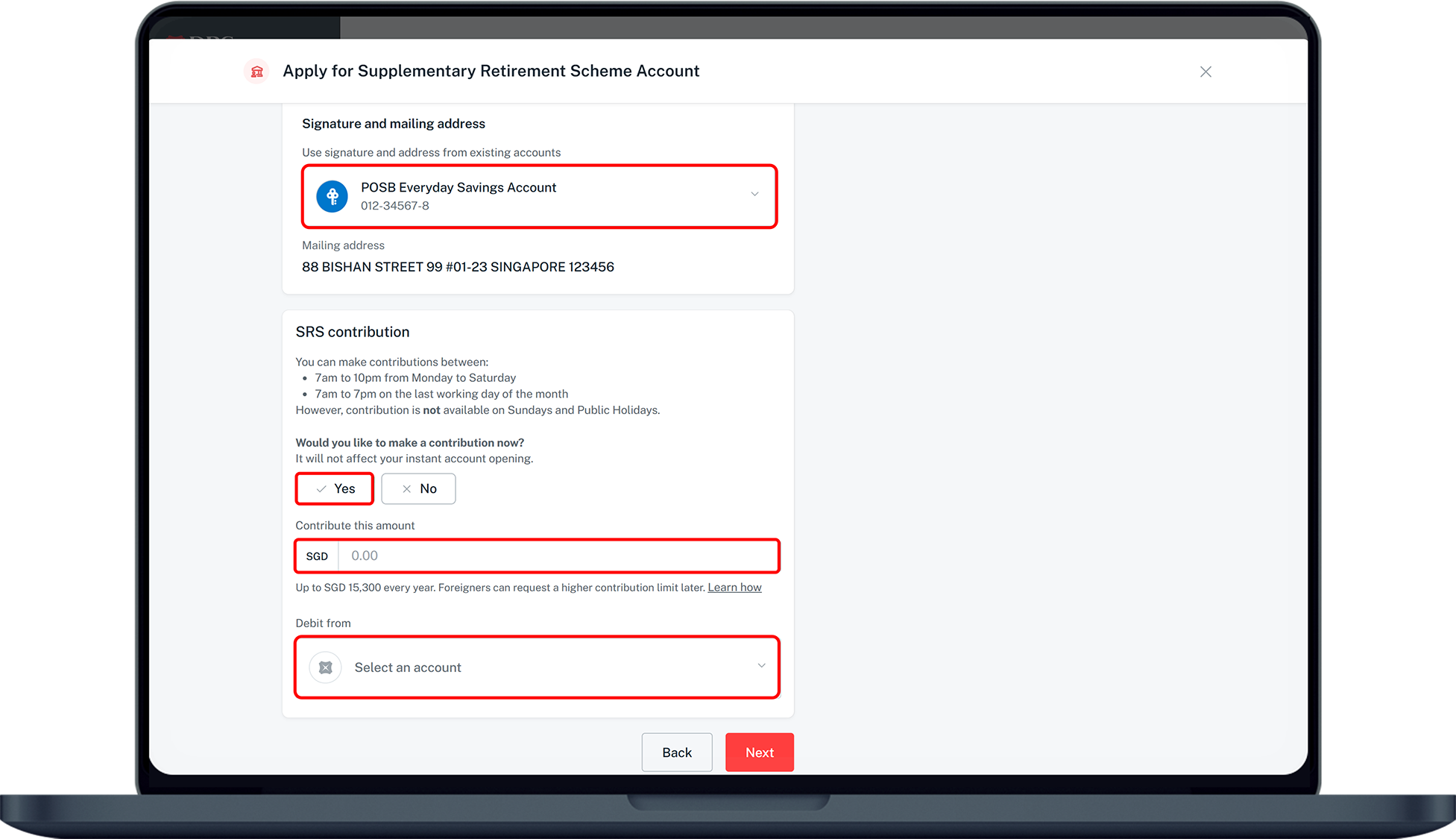

- For Foreigners, please declare your Foreigner status at the branch to update your SRS contribution cap for the year.

(Note: This declaration needs to be done yearly as the SRS contribution limit will reset on 1st Jan every year.)

How to open a Supplementary Retirement Scheme (SRS) Account

digibank online

Branch

- Alternatively, you may visit any DBS/POSB Branches with your NRIC/Passport to open your SRS Account.

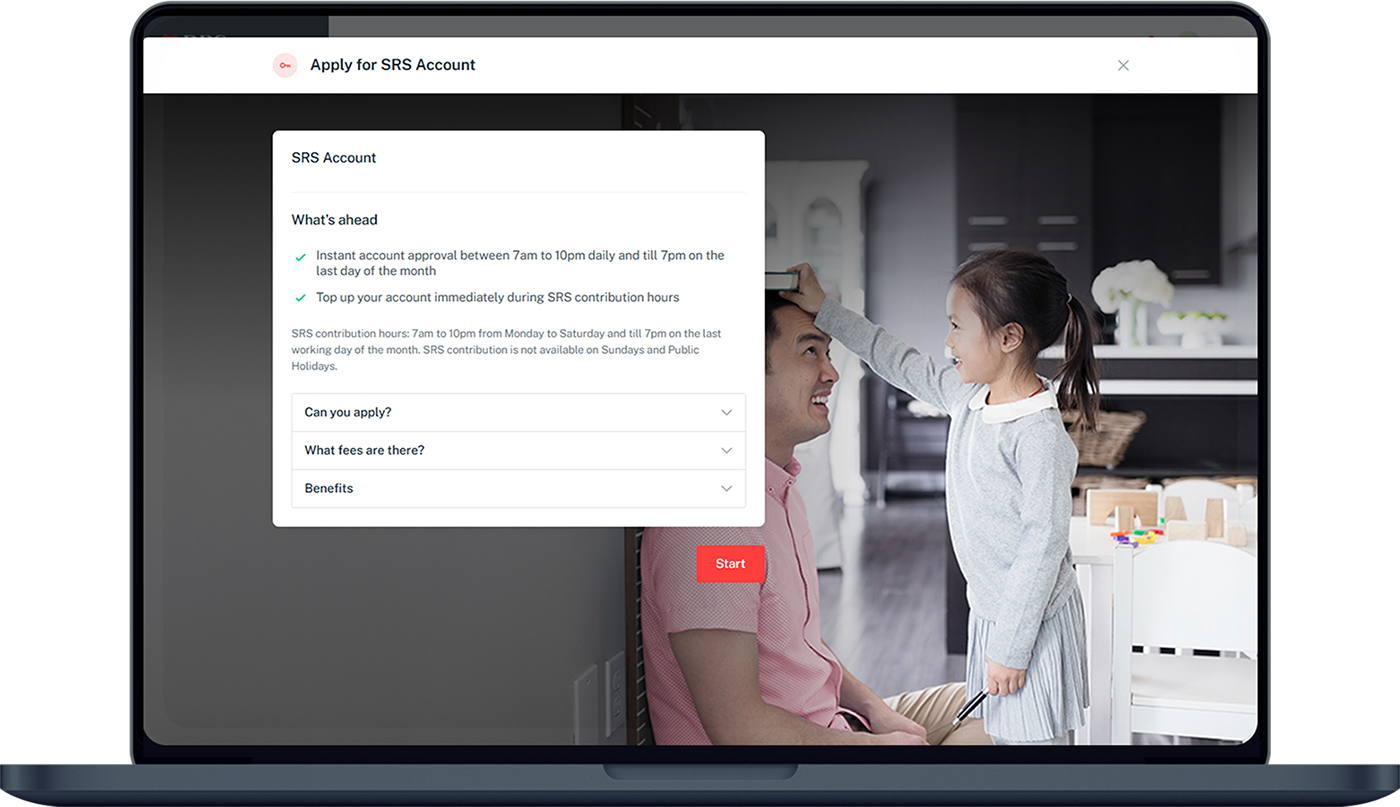

More information

- If you apply via digibank online between 0700hr to 2200hr (Daily) and 0700hr to 1900hr (Last business day of the month), your account will be opened instantly.

- Account Opening Requirements:

- All Singaporeans, Permanent Residents (PRs) or foreigners at least 18 years old and not a bankrupt.

- No existing SRS account or SRS account opening application with another bank.

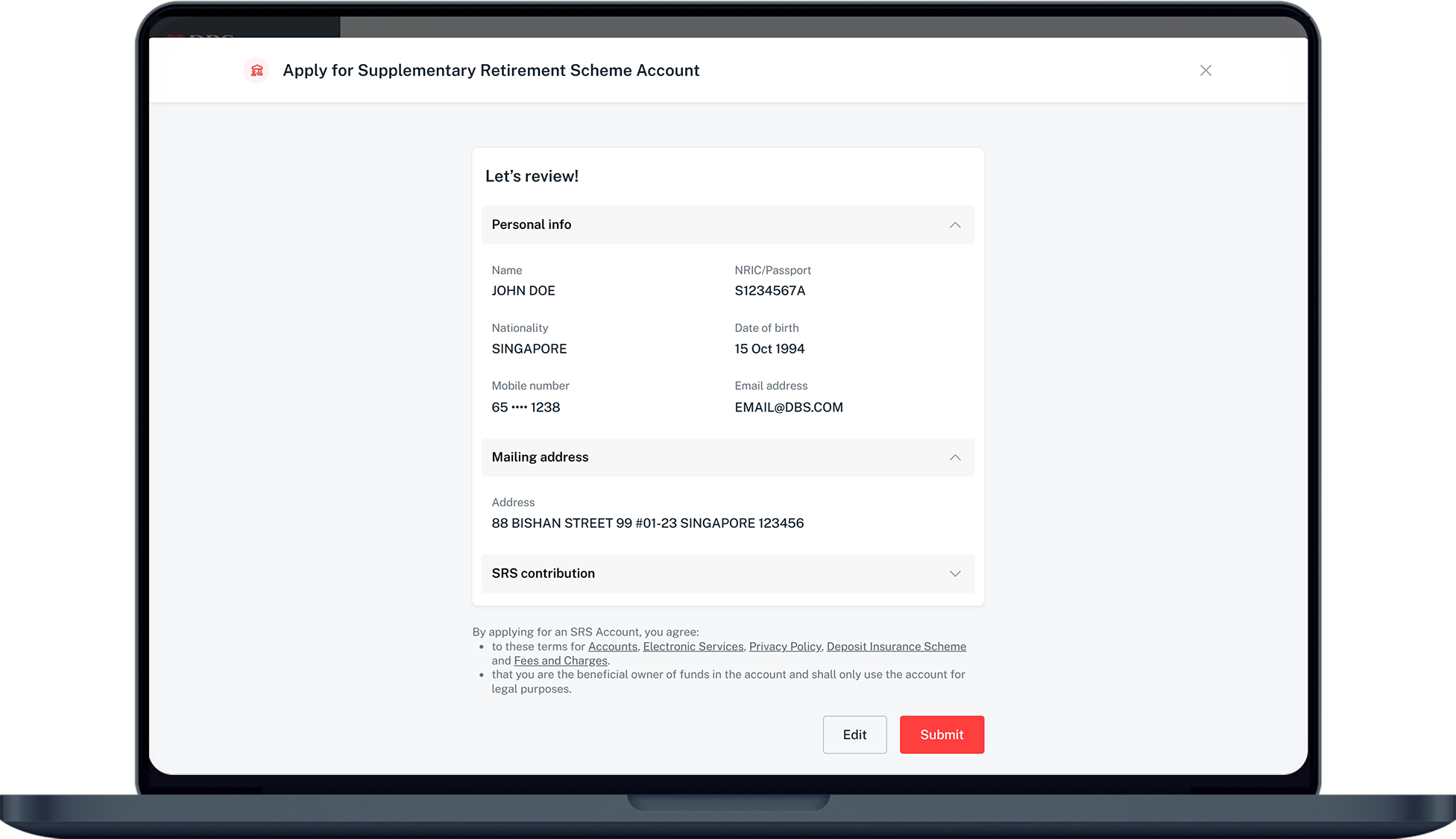

- Terms and Conditions Governing SRS

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Was this information useful?