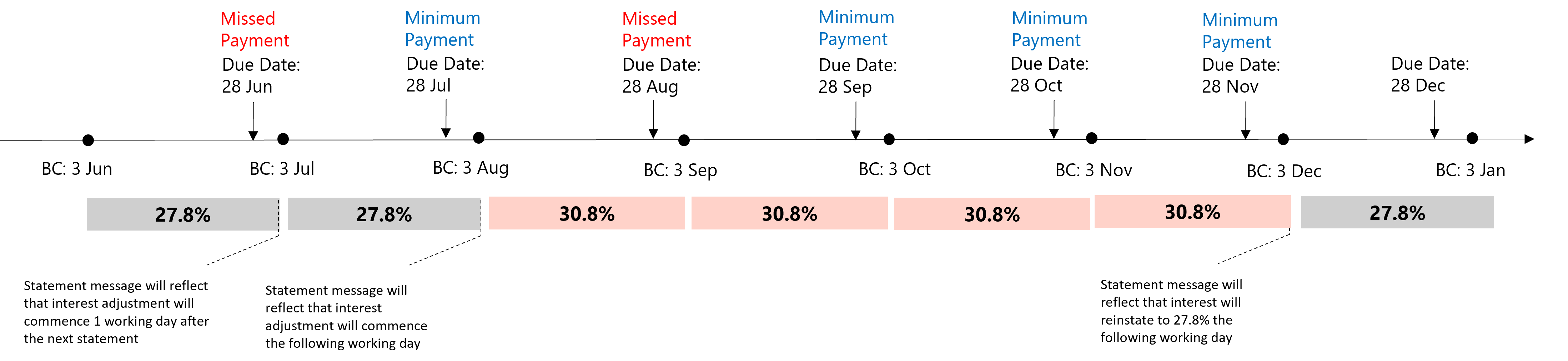

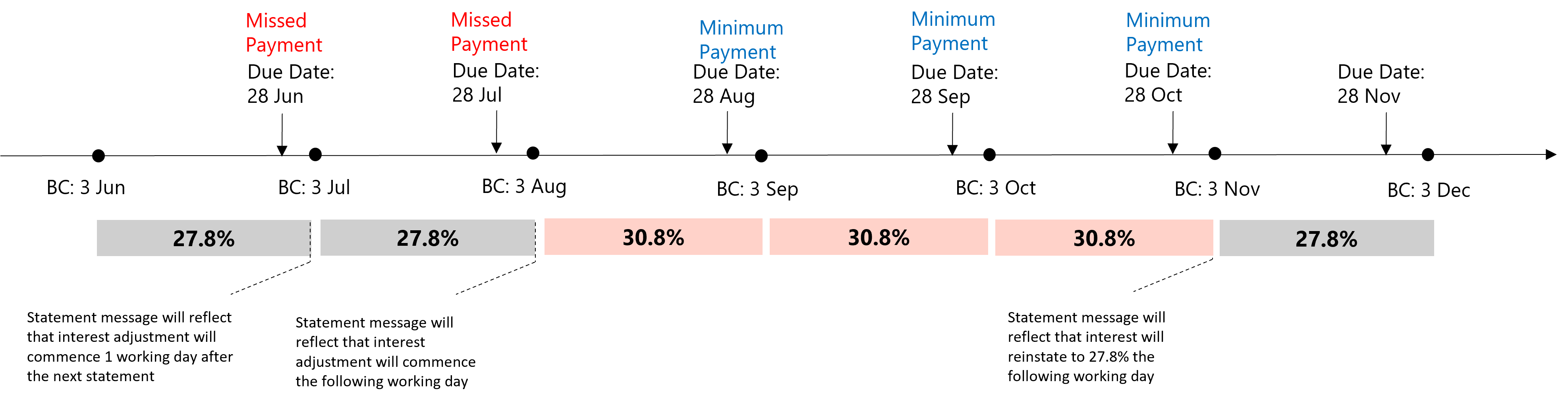

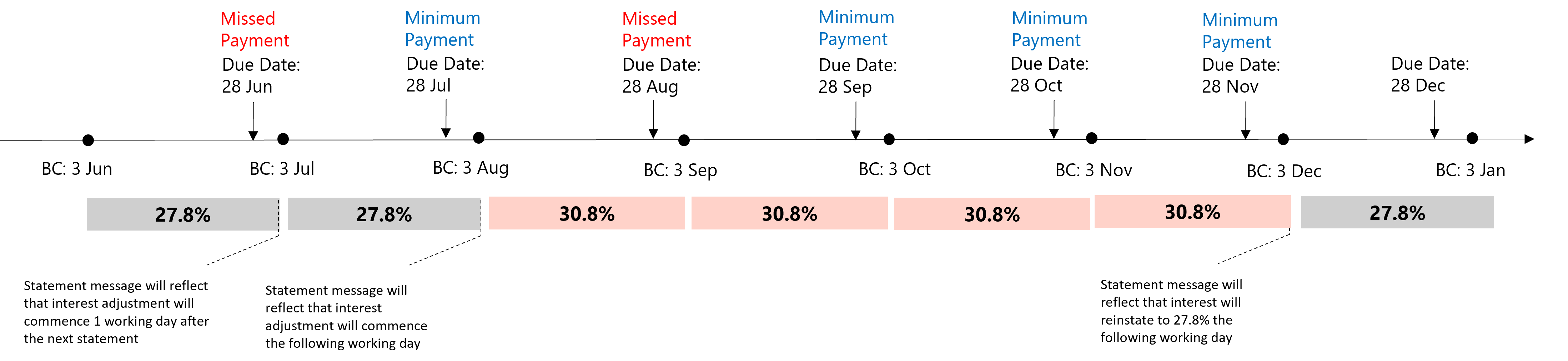

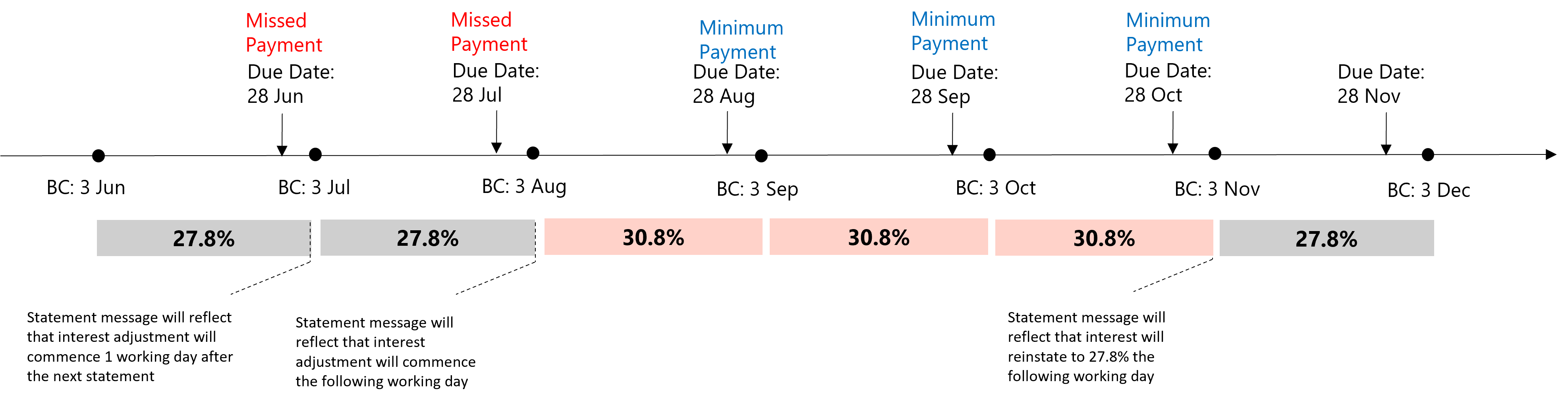

If you have not made the minimum payment by the payment due date, an increased interest rate of

30.80% per annum will be applied to your outstanding balance in your credit card account from the first working day of the following month after your next Credit Card Statement is generated.

Interest rates will be reinstated to

27.80% per annum once three (3) consecutive minimum payment for your Card Account have been made by the payment due date of the next subsequent Credit Card Statement.

Example 1 - 3 consecutive minimum payment made by the payment due date of the next subsequent Credit Card Statement

Example 2 - Minimum payment skipped by the payment due date of the next subsequent Credit Card Statement