Access Online Loan Drawdown

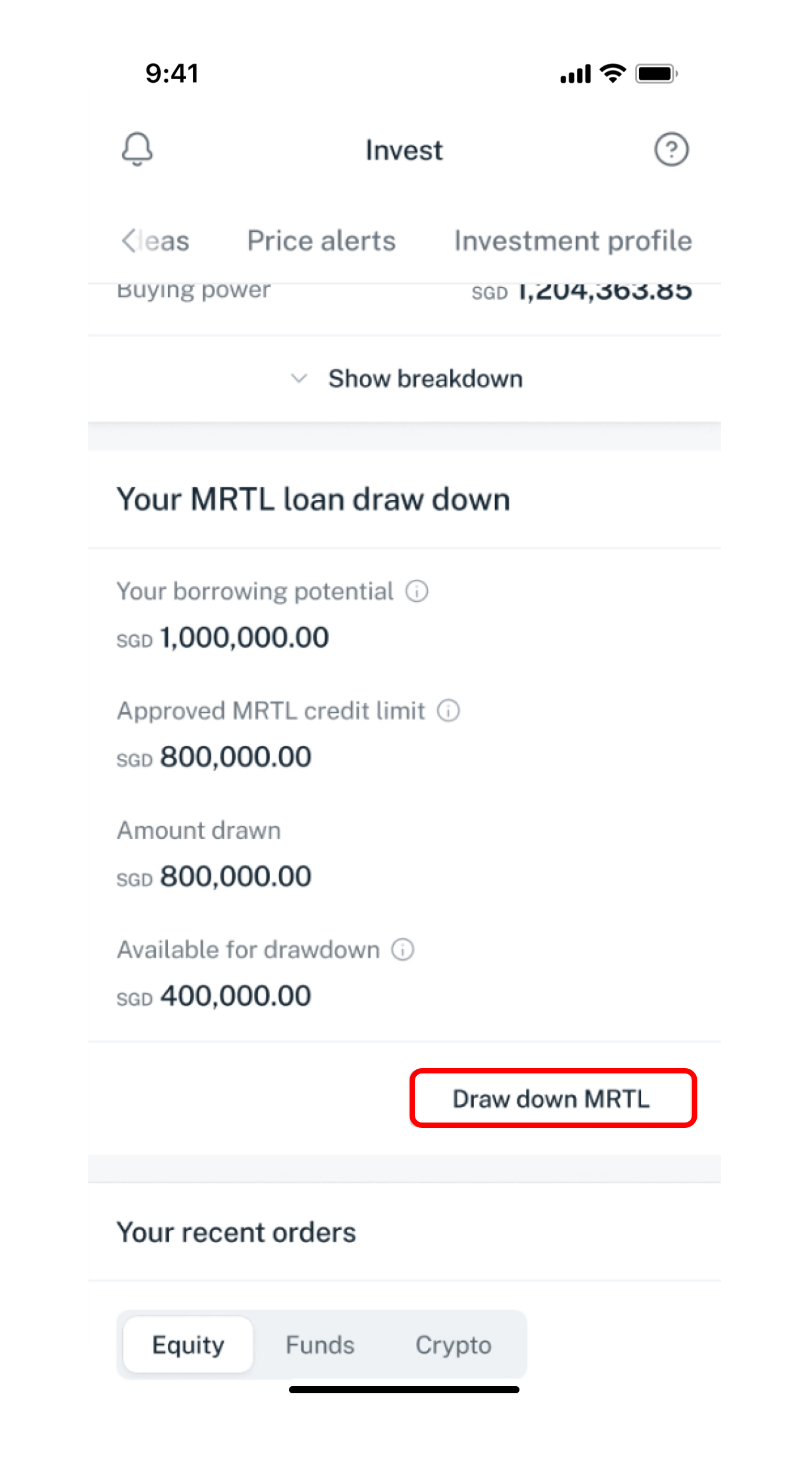

Finance your Investments with ease by performing an Online Loan Drawdown from your approved Multi-Currency Revolving Term Loan (MRTL).

Important information

- Only DBS Treasures clients with approved MRTL-TR Credit Facility, DBS Treasures Private Clients/DBS Private Banking Clients with approved MRTL Express Credit Facility can perform Online Loan Drawdown.

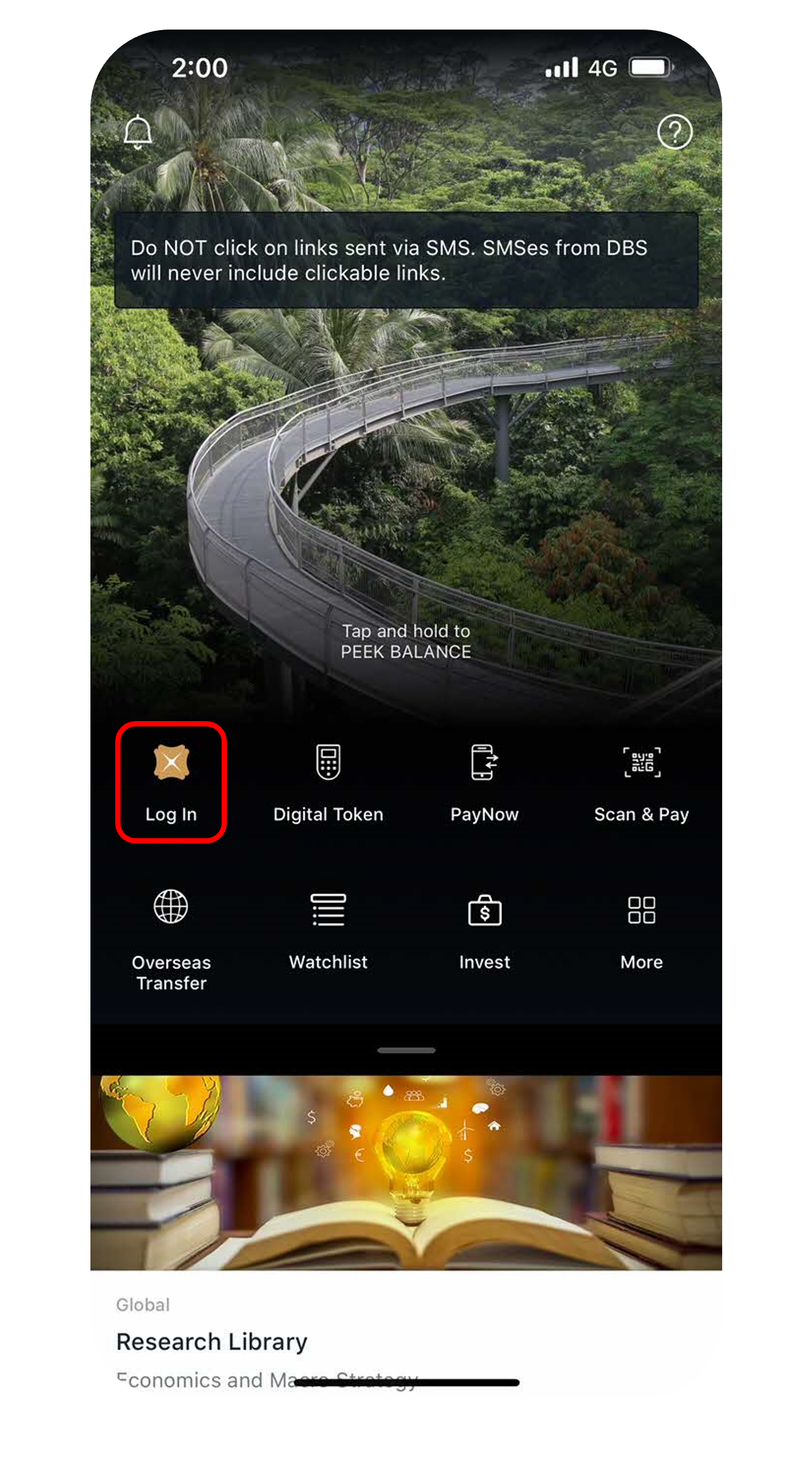

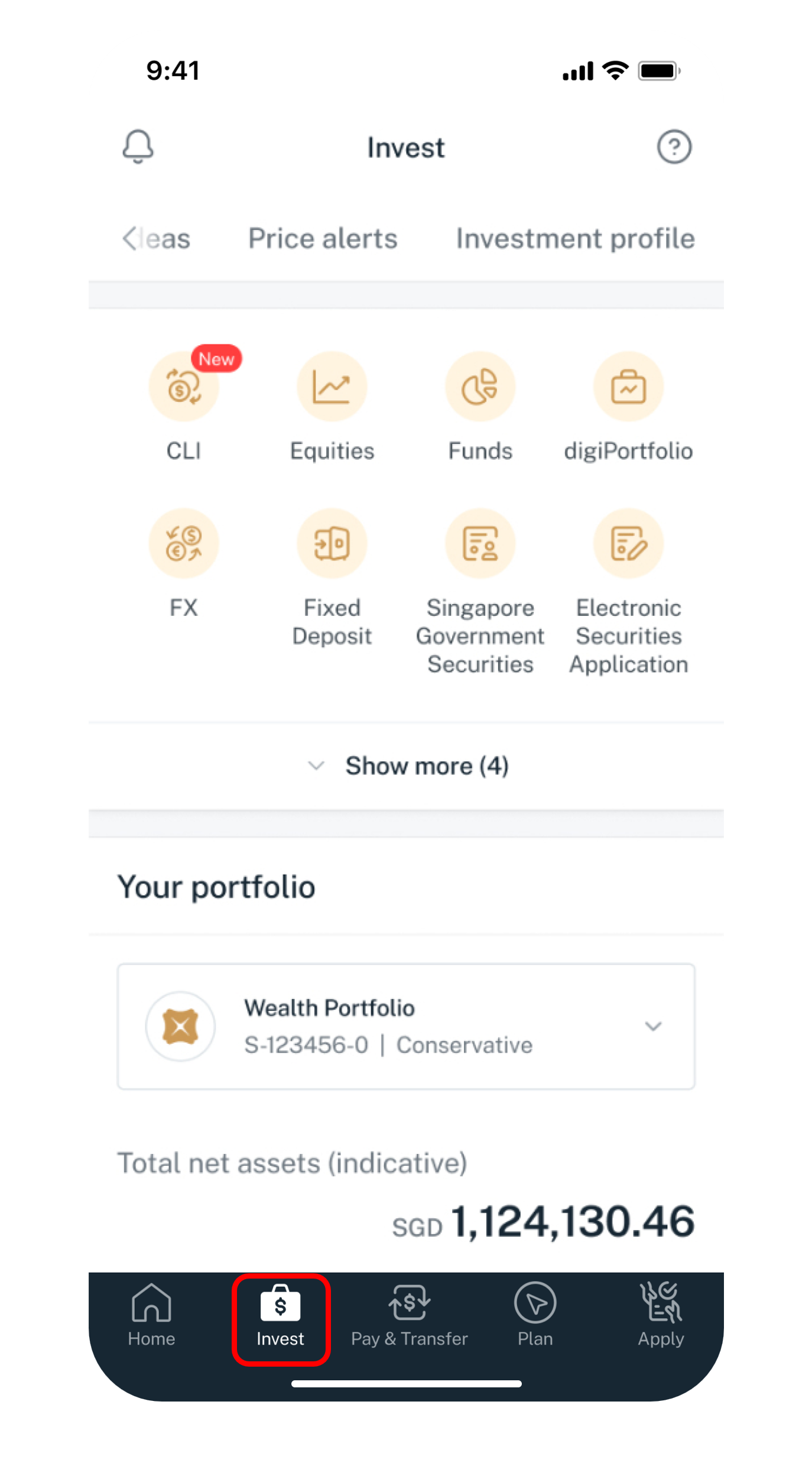

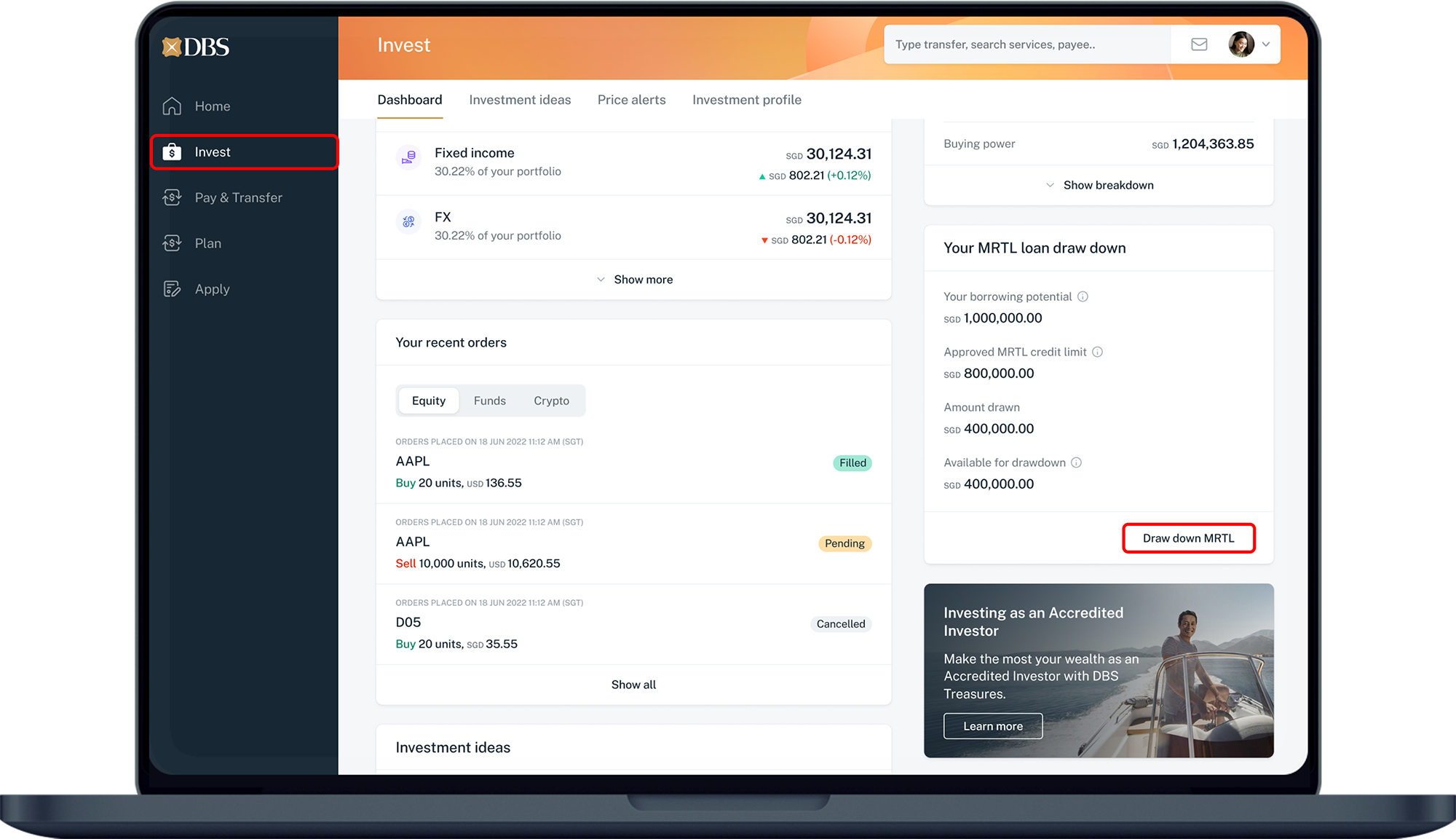

How to access Online Loan Drawdown

There are various channels which you may access Online Loan Drawdown with us. The most convenient method would be via digibank mobile.

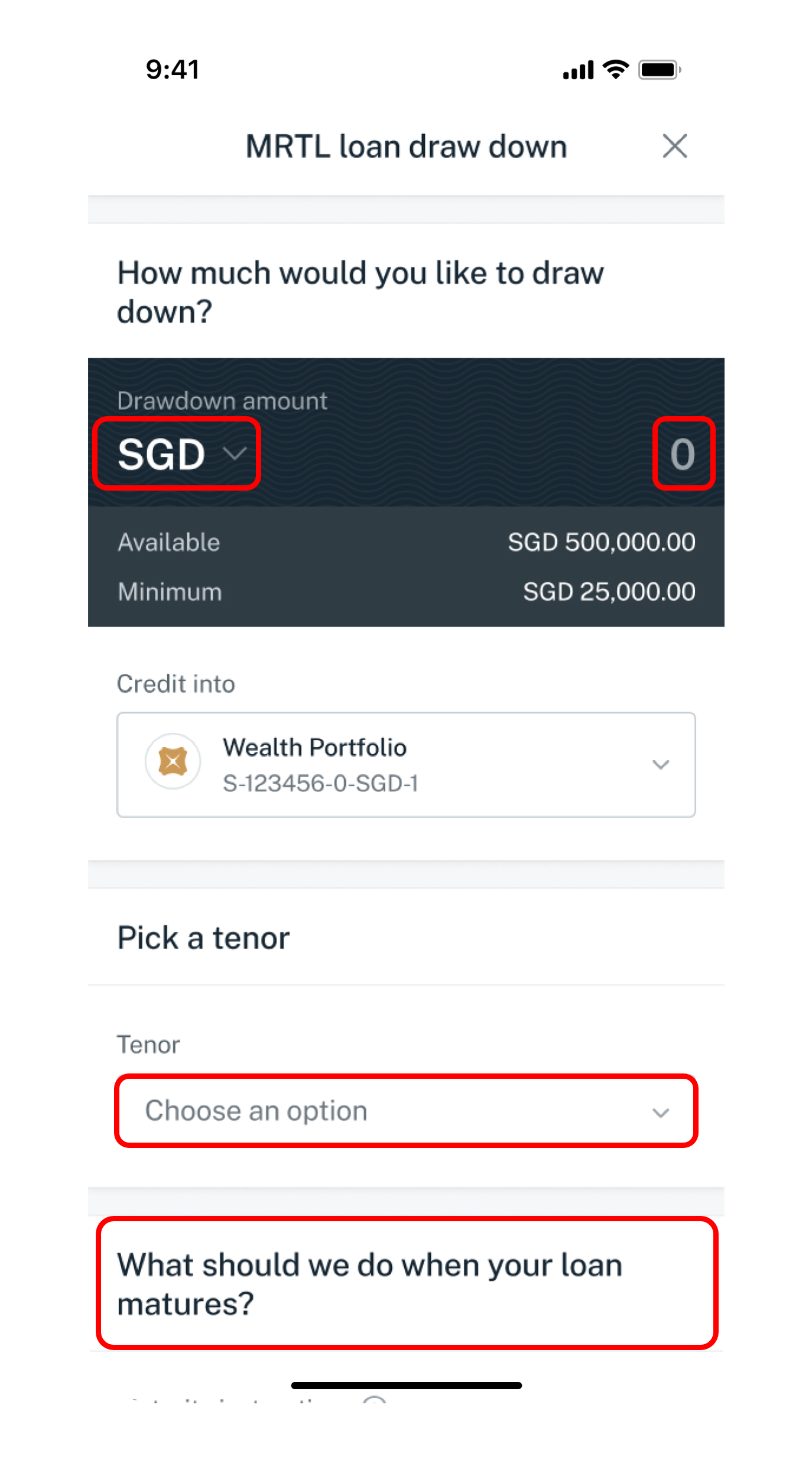

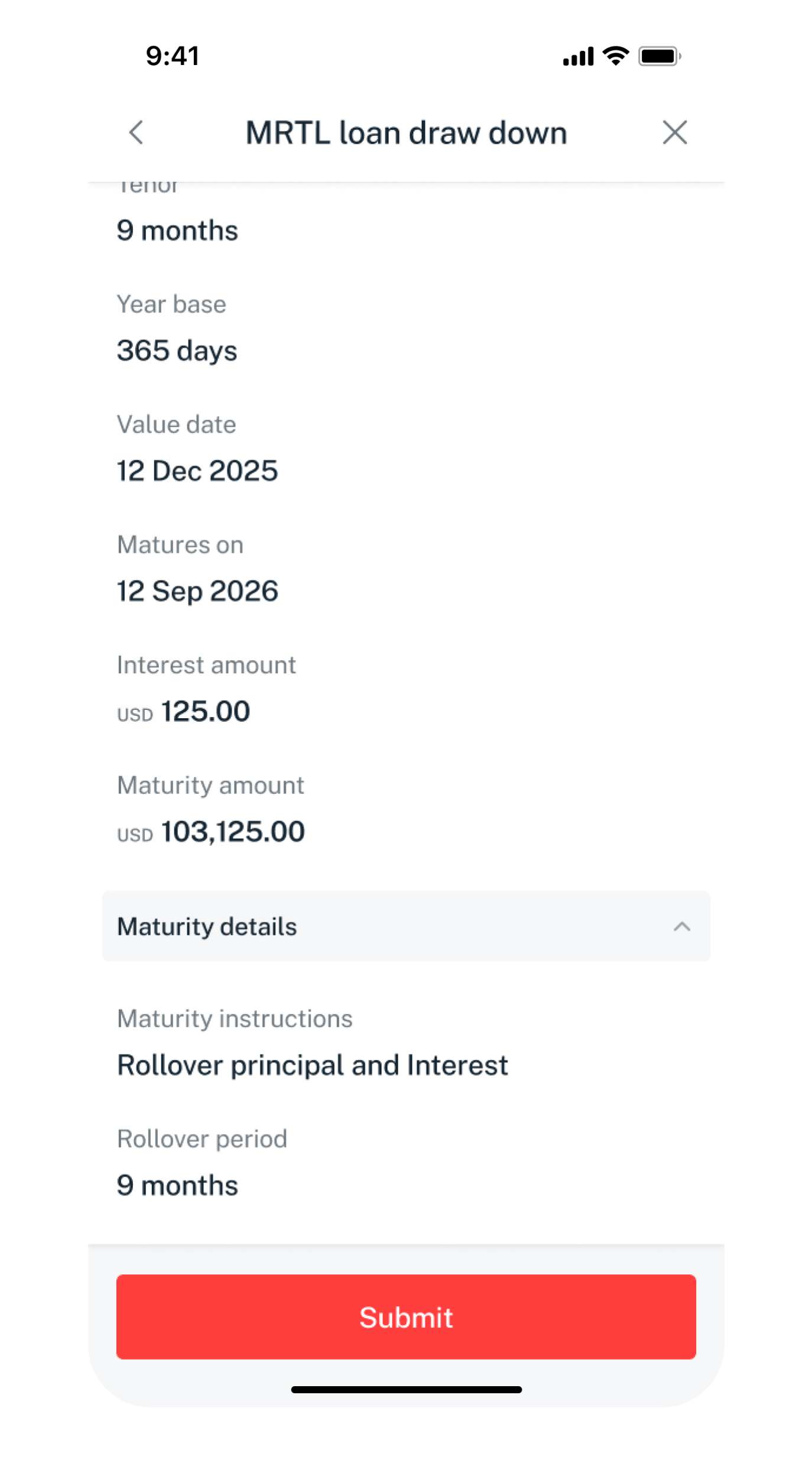

digibank mobile

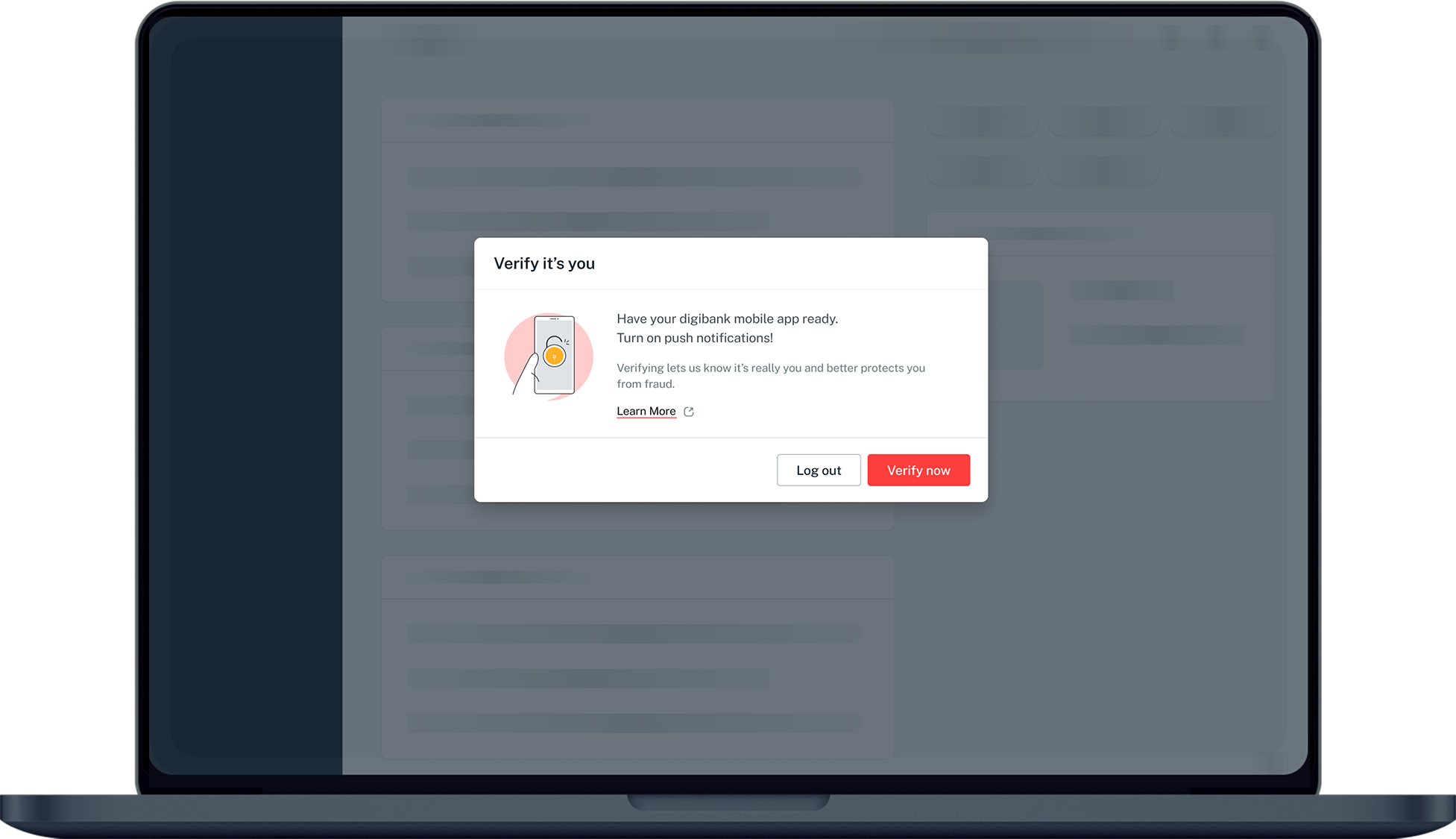

digibank online

More information

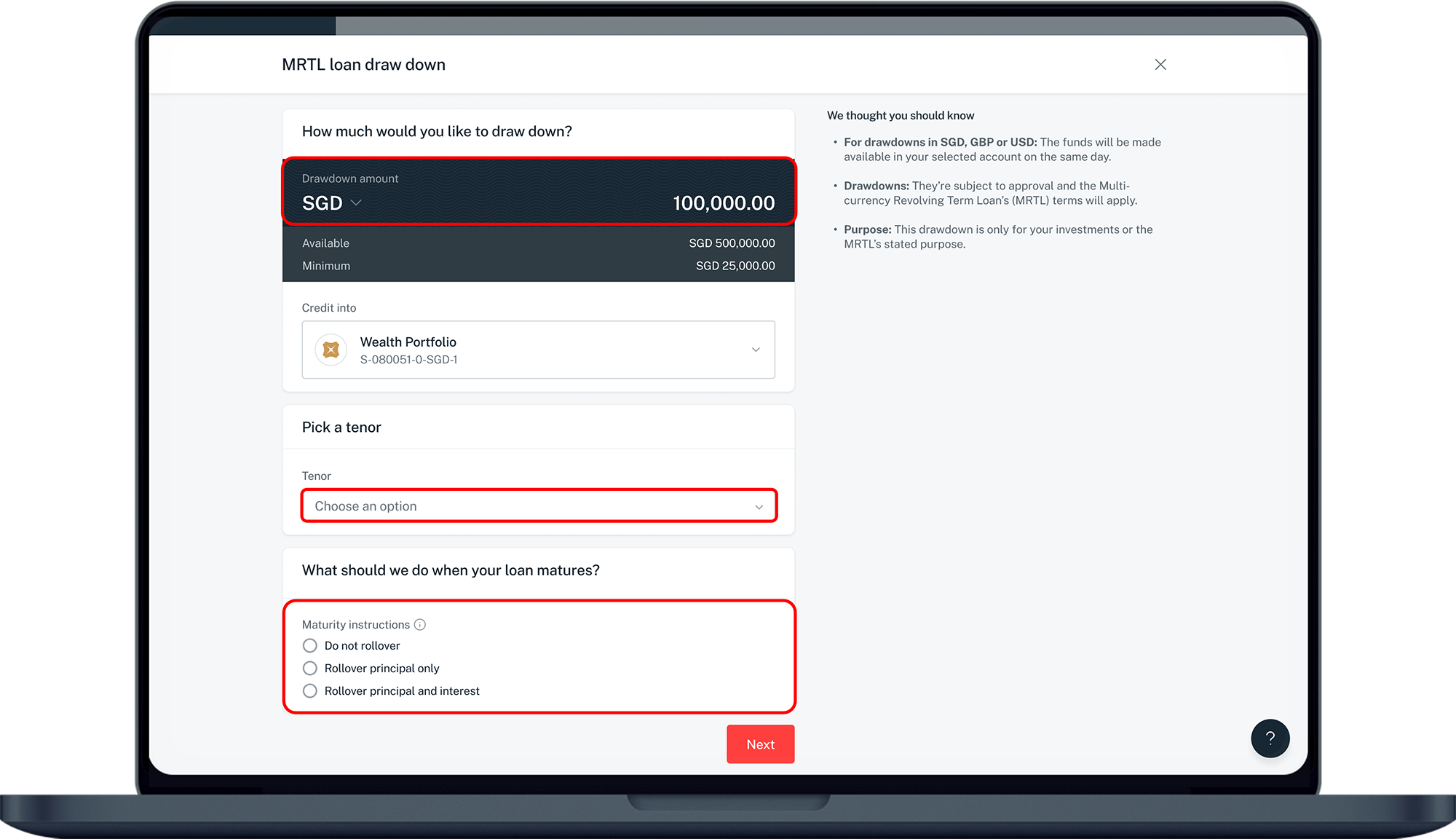

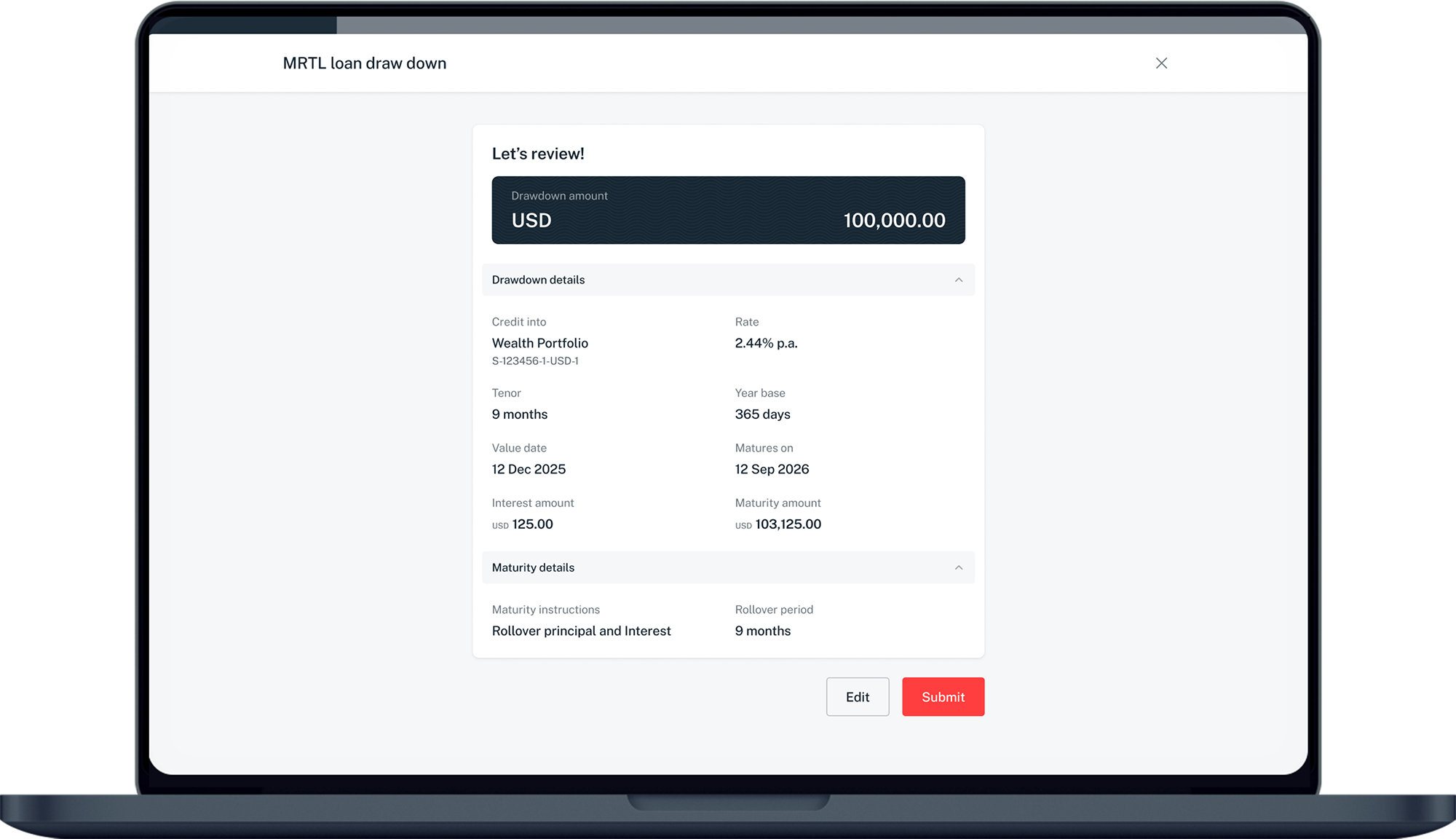

- You can perform Online Loan Drawdown in 10 different currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD and USD.

- Minimum drawdown amount per online MRTL Loan Drawdown request is SGD 25K and equivalent for non-SGD currencies for all segments.

- There are five tenures available for your selection: 1 month, 3 months, 6 months, 9 months and 1 year.

- Available timings for service: 10:00 AM to 11:45 PM from Monday to Friday, Singapore business days only.

- Loan application status will be sent via Email, SMS and Inbox alerts.

Was this information useful?