Frequently Asked Questions on DBS Online Equity Trading (OET)

General

What does DBS Online Equity Trading (OET) offer?

OET allows DBS Private Bank, DBS Treasures Private Client and DBS Treasures Client the capability to trade and manage their trading portfolio online for the following markets – Singapore, Hong Kong, the United States of America, Canada, United Kingdom, Australia and Japan. You can log on to our secure online platform to obtain quotes, place orders, change orders and review your account status and balance – anytime, anywhere.

What are the benefits of using DBS Online Equity Trading (OET)?

With our OET services, you can:

- Use one single set of User ID and password to login to an integrated trading platform and trade in Singapore, Hong Kong, U.S., Canada, UK, Australia and Japan stocks online.

- Manage and review your account information in multi-currency.

- Obtain real-time updates on balances, credit limits and order statuses.

- Manage your account by being able to view all your account holding details of the online- and offline-traded products

Does DBS Online Equity Trading provide investment advice?

DBS Online Equity Trading offers services for self-directed investors, including access to a comprehensive selection of products and services. To help you make informed investment decisions, we offer you professional research reports from world-class research firms.

Account Opening

How do I open an account with DBS Online Equity Trading?

DBS Online Equity Trading is a complimentary part of your privileges online via DBS Digibank (Online/App).

What are the required documents for opening an account with DBS Online Equity Trading?

- A DBS Wealth account (either DBS Private Bank, DBS Treasures Private Client or DBS Treasures)

- Certified true copy of each applicant's identification document

- Copy of each applicant's residential address proof (such as latest 3 months bank statement, utility bill or personal income tax note)

- W-8 BEN

- Customer Account Review (CAR) acknowledgement, where applicable

- Risk Warning Statement acknowledgement, where applicable

For more details, please contact your Relationship Manager or our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas).

How long does it take to open an account?

For more information, please get in touch with your Relationship Manager.

Is there any minimum deposit required for account opening?

What is the difference between DBS Online Equity Trading (OET), a trading account and a securities account?

OET is a complimentary part of your DBS Private Bank, DBS Treasures Private Client or DBS Treasures account. This allows you to manage all your wealth with DBS Bank, leveraging off the expertise of our DBS Group research. You continue to have at your disposal – your Relationship Manager and our expert specialist team for your complete wealth management.

In addition to this, you will be able to trade online, anytime – and to include these holdings as part of your overall wealth for complete portfolio management as the traded holdings will be held with us. You will be able to view and manage your entire wealth online, and be able to view and track investment performance via your monthly consolidated statements.

On the other hand, a trading account is opened with a securities (stock broking) house, such as DBS Vickers Online. A securities account is opened with the Central Depository Pte Ltd (CDP). CDP acts as the custodian of your Singapore shares. If you have linked your CDP Securities Account with your trading account at a securities firm, your trade with the securities firm will be reflected in your CDP securities account directly. You will receive contract notes and statements from the CDP.

Both trading and securities accounts will not be consolidated with your bank accounts.

If I have a CDP Securities Account, how do I transfer my holdings from CDP to my DBS Online Equity Trading Account? (For Singapore Clients Only)

I have a Single / Joint alternate / Joint-All account. Can I trade on DBS Online Equity Trading (OET)?

OET is based on your account set-up in DBS Private Bank / DBS Treasures Private Client or DBS Treasures. Account holder of a Single and Joint-alternate accounts can trade online with that account; however Joint-All will not be able to do so.

To begin trading, all account holders in the Single or Joint-alternate accounts must ensure that they have met the necessary requirements to trade, eg:

- Minimum age requirement of 21 years old

- Acknowledged the Risk Warning Statement (RWS) for trading in Overseas-listed Investment Products

- Completed and acknowledged the Customer Account Review (CAR) for trading in of Listed Specified Investment Products (SIPs)

Can a mandatee trade on my behalf?

Trading: General Information

Which stock markets can I trade with DBS Online Equity Trading (OET)?

At present, you can trade Singapore, Hong Kong, U.S., Canada, UK, Australia and Japan stocks online. Below are the participating exchanges.

| Markets | Equities listed on |

|---|---|

| Singapore | Singapore Exchange (SGX), Main Board, Catalist, Global Quote |

| Hong Kong | Main Board, Growth Enterprise Market (GEM) |

| United States | New York Stock Exchange (NYSE), National Association of Securities Dealers Automated Quotation (NASDAQ), NYSE American |

| Canada | Toronto Stock Exchange (TSX), TSX Venture Exchange |

| United Kingdom | London Stock Exchange |

| Australia | Australian Securities Exchange (ASX) |

| Japan | Tokyo Stock Exchange (TSE) |

To view the full list of online brokerage and market charges, please refer DBS Online Equity Trading – Fees & Charges.

For other prevailing fees and list of RM assisted (offline) markets, please refer to Treasures Pricing Guide or Treasures Private Client / Private Bank Fee Schedule.

What quotes are available through DBS Online Equity Trading (OET)?

Trading: Placing an order

What is the cut off time for entering orders?

Orders can be entered throughout the day, 24 hours a day, 7 days a week. However, please be reminded that an order will be routed to the market in the next trading session if it is placed during non-trading hours.

Can I send trade instructions via e-mail?

No. DBS Online Equity Trading will not accept trade instructions via e-mail. If you encounter problems whilst trading on this website, please contact our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas)

What types of orders can I submit?

| Types of Orders | Singapore | Hong Kong | United States | Canada | United Kingdom | Australia | Japan |

|---|---|---|---|---|---|---|---|

| Market+ | ✓ | ✓ | ✓ | ✓ | - | - | - |

| Limit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Auction | - | ✓ | - | - | - | - | - |

| ELO | - | ✓ | - | - | - | - | - |

| SLO | - | ✓ | - | - | - | - | - |

| All or None | - | - | ✓ | - | - | - | - |

| Good for day | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Good till date* | ✓ | ✓** | ✓ | ✓ | ✓ | ✓ | ✓ |

| Fill or Kill+ | ✓ | - | - | - | - | - | - |

| Fill and Kill | ✓ | - | - | - | - | - | - |

* Maximum for 30 calendar days

** Maximum for 10 calendar days

+ Singapore Market: The Market Order type can only be entered during trading hours, from 08:30 - 17:04

Can I place an intraday sell order after my buy order is filled?

Yes, intraday selling is possible. At the order status page, please verify the status of your buy order by ensuring the order status is “Filled”.

Can I perform a contra trade?

Contra trades are not allowed. All buy trades are settled by cash upfront in your Wealth Management Multi-Currency Settlement Account (MCSA).

Why can't I place an order for a particular stock?

If you are unable to complete a buy order on DBS Online equity Trading, please check for any errors or read the on-screen notification message prompted.

There are a numbers of reasons why a buy order may be declined and the common ones are listed here:

-

Your settlement account (MCSA) has insufficient cash for trading. Please top up your settlement account (MCSA) in the trading currency.

- For non-borrowing clients, order placement is strictly on a cash upfront basis where your MCSA is required to have sufficient funds in your order’s base currency.

-

Your account has insufficient collateral value to support your current trade amount. Please reduce the order amount or call your relationship manager for assistance.

- For borrowing clients with a DBS Multicurrency Revolving Term Loan (MRTL) facility, the order will be successfully placed so long as your MRTL facility has sufficient loan drawdown amount supported by your pledged collateral & credit limit.

- For borrowing clients with a DBS Multicurrency Revolving Term Loan (MRTL) facility, the order will be successfully placed so long as your MRTL facility has sufficient loan drawdown amount supported by your pledged collateral & credit limit.

-

This security is not available for online trading.

- Not all asset classes, investment types and instruments are available on the platform. If you wish to place an order on an instrument that is not available on DBS Online Equity trading, please contact your Relationship Manager.

- Not all asset classes, investment types and instruments are available on the platform. If you wish to place an order on an instrument that is not available on DBS Online Equity trading, please contact your Relationship Manager.

-

The price entered is not in the correct bid size or out of the maximum price range allowed for this market. You can click on the 'Price' link above the price field for more information.

- Different market has a different price range, for more information, please refer to FAQ topic “at what price can I submit my order?”

- Different market has a different price range, for more information, please refer to FAQ topic “at what price can I submit my order?”

If you are unable to complete a sell order, please check for any errors or read the on-screen notification message prompted.

Some common reasons are listed here:

- Your transaction cannot be processed, due to insufficient holdings. Please contact your Relationship Manager.

- You can proceed to Invest > Equity to view your real-time holdings in Stock Holdings (digibank online).

- This security is not available for online trading.

- Not all asset classes, investment types and instruments are available on the platform. If you wish to place an order on an instrument that is not available on DBS Online Equity trading, please contact your Relationship Manager.

Can I trade US OTC counters, Preference Shares, Perpetual and Bonds via DBS Online Equity Trading?

DBS Online Equity Trading platform does not facilitate the trading of US (OTC) Over-the-Counter Shares, Preference Shares, Perpetual and Bonds.

Please contact your Relationship manager for more information.

What is the difference between Round Lot, Odd Lot & Mixed Lot?

| Round Lot | Odd Lot | Mixed Lot | |

|---|---|---|---|

| Description | Round Lot (also known as Board Lot) is a standardized unit for trading. The lot size, or number of shares per Board Lot, is determined by the exchange. | Any order quantity below the Board Lot size. Odd lot usually occurs when a company carries out bonus issue or rights issue. | A Mixed Lot order is a combination of both Board Lot and Odd Lot. |

| Singapore Market (SG) | In SG market, the minimum of 100 shares per order (Board Lot size) is required. i.e. Stock: DBS Bank (D05) Board lot size = 100 shares. Board Lot Order = Order Qty of 300 shares |

Odd Lot order refers to order quantity of 99 shares or below. i.e. Stock: DBS Bank (D05) Board lot size = 100 shares. Odd Lot Order = Order Qty of 59 shares |

Mixed Lot order refers to order quantity with a blend of Board Lot and Odd Lot. i.e. Stock: DBS Bank (D05) Board lot size = 100 shares. Mixed Lot Order = Order Qty of 359 shares |

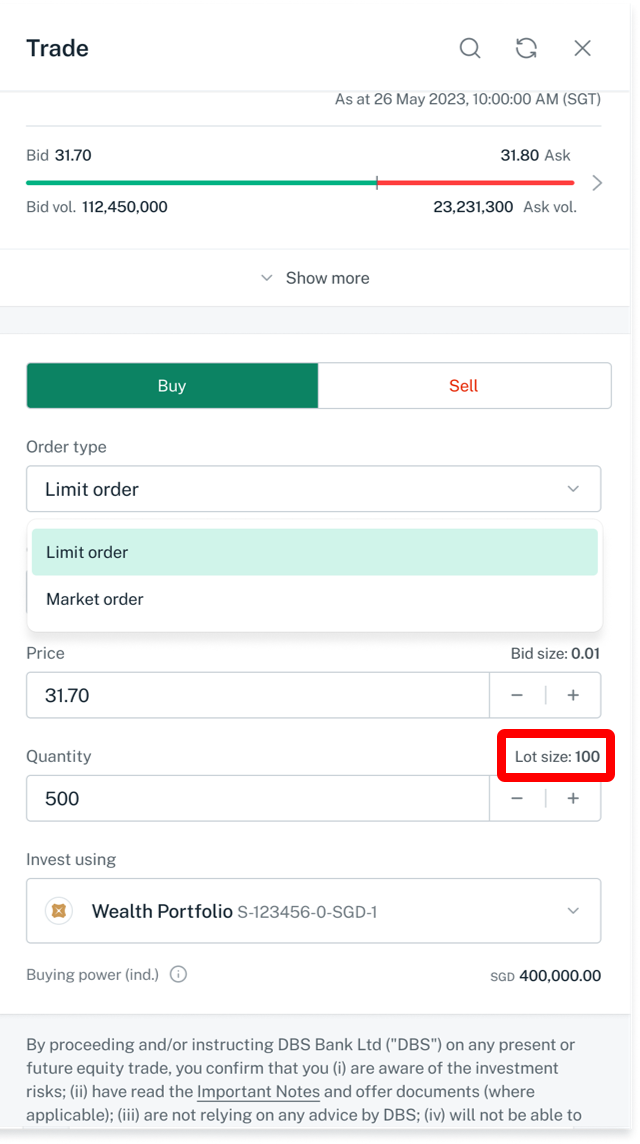

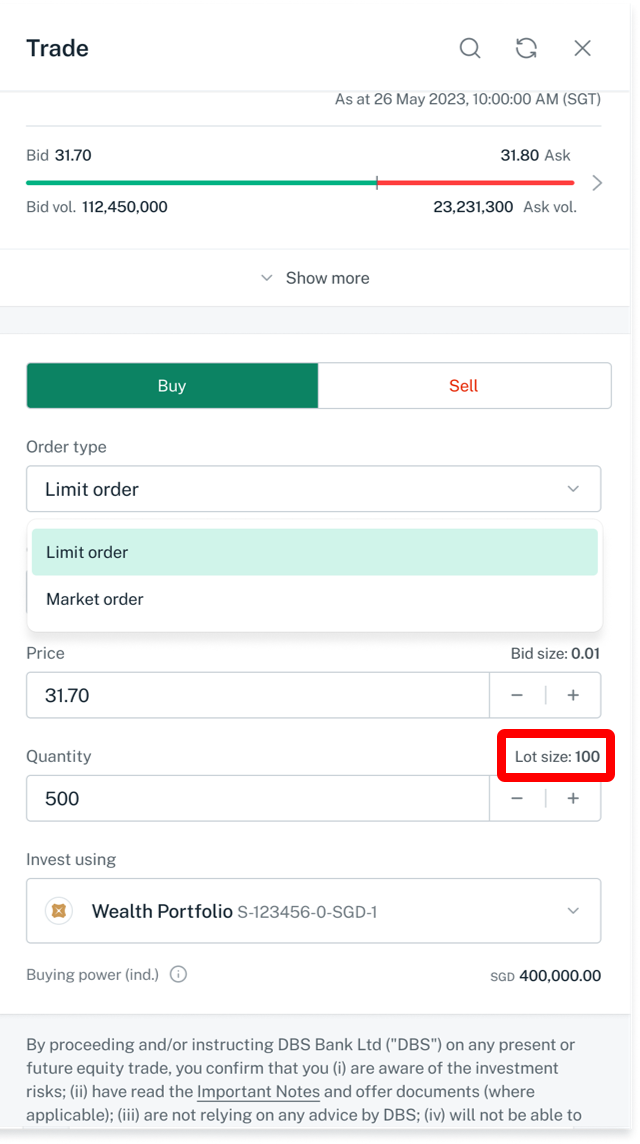

Order quantity must be in multiples of the lot size as indicated on the platform.

If the “Lot Size” of the counter selected is 100, Odd Lot/Mixed Lot order placement is not available online. Please contact your Relationship Manager.

i.e. Stock: DBS Bank (D05) lot size = 100 shares

Can I place Odd Lot orders via DBS Online Equity Trading?

Order placement for Odd Lot/Mixed Lot is not available online.

Order quantity must be in multiples of the lot size as indicated on the platform.

(Lot size is indicated under the Quantity field)

If you wish to place an order in the Odd Lot/Mixed lot, please contact your Relationship Manager.

What is the difference between market order and limit order?

Market Order*

When the market is opened, a market order will be executed at the best bid or ask price available. If a market order is placed when the market is closed, it will be executed at the bid or ask price when the market opens. A market order, unless it is a Fill or Kill (FOK), guarantees an execution but does not guarantee a price. A market order could be executed at a higher or lower price than what was quoted to you. Please note that market orders are not allowed for Australia, Japan and UK markets trading.

Singapore Market: The Market Order type can only be entered during trading hours, from 08:30 – 17:04

*For Hong Kong Market order, please refer to Trading: Hong Kong Market: “In Hong Kong market, what are the order types available?”

Limit Order

When you place a limit order, you are stating the price at which you wish to buy or sell a stock. If that price is not met, your order will not be executed. A limit order guarantees a price but does not guarantee an execution. A limit order can be executed at a better price than the limit price you set.

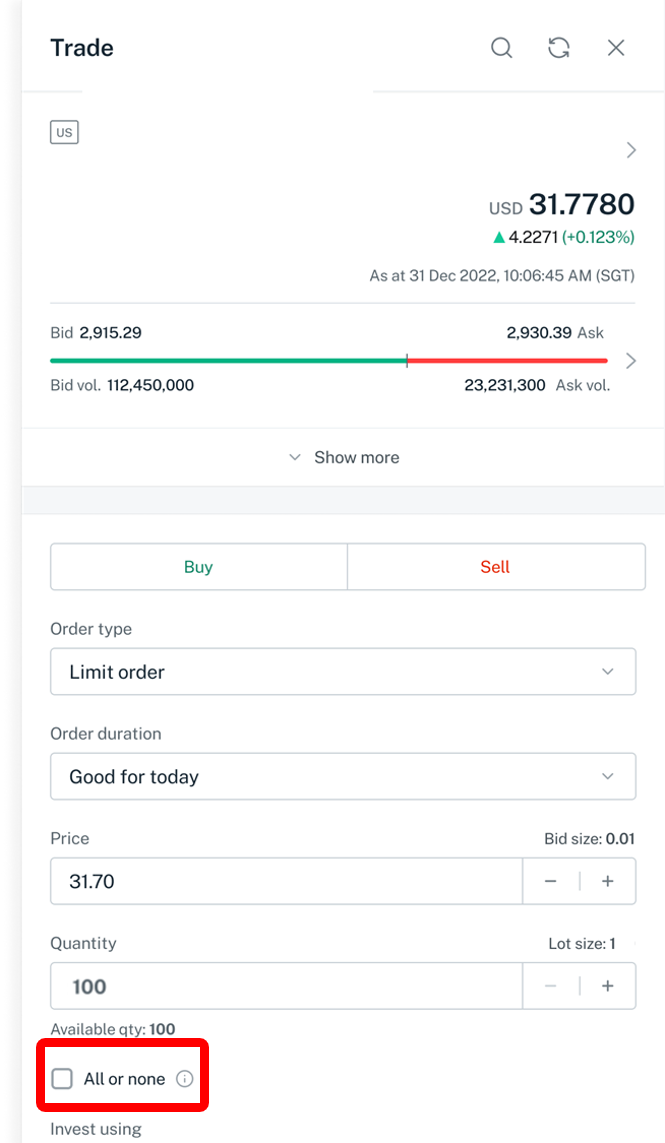

What is an 'All Or None' (AON) order?

'AON' is a type of restricted order where the entire order must be filled at one time or nothing will be filled at all. If you do not specify your order as 'All Or None' when placing a limit order, there is a possibility that your order will be filled partially. Full commission fees and charges apply for each partial fill, except those transacted within the same business day.

Please note that AON feature will only be available for limit orders in the US market and if the quantity is over 100 units.

What is a Good for Day order?

A Good for Day order is a limit order good for that business day only. If the order is not filled by the end of the trading day, the order will expire. A Good for Day order placed after the market is closed is good for the next business day, unless it is placed specifically for after-hours trading.

What is a Good till Date order?

A Good till Date order is a limit order that remains in the market queue for up to a specified date, until it is filled, specifically cancelled or expired, whichever occurs first. The orders will expire after the specified date. Clients can place GTD orders for up to 10 or 30 calendar days depending on the markets.

Good till Date order is only applicable to the following:

| Duration | Market |

|---|---|

| Up to 10 Calendar Day | Hong Kong |

| Up to 30 Calendar Day | Singapore, U.S., Canada, UK, Australia and Japan |

What is a Good till Max order?

A Good till Max order is a limit order similar to Good till Date order. Order will automatically be good for the next 30 calendar days after the order is placed, and cancelled on the morning following the 30th day, unless order is fully filled, specifically cancelled, instrument de-listed, or purged for corporate actions. Good till Max orders are available in the Singapore market only.

What is Fill or Kill order?

A market Fill or Kill (FOK) order is only applicable to the Singapore market. The entire quantity placed must be matched in full or the order will be cancelled. A market FOK order can only be entered during continuous trading hours from 09:00 – 12:00 and 13:00 – 17:00.

What is Fill and Kill order?

A market Fill and Kill (FAK) order is only applicable to the Singapore market. Any portion of a market FAK order will be matched as soon as the order is placed and the remaining order will be cancelled. A market FAK order can only be entered during trading hours from 08:30 – 17:04

Risks associated with using market orders

Please take note that by placing a market FAK order during SGX Opening Routine, Mid-Day Break or Closing Routine,

the order will be participating in Matching during Non-Cancel Phase. Orders that can be matched are matched at

a single price computed based on SGX Algorithm.

A buy order can be filled at a much higher price than intended,

or a sell order can be filled at a much lower price than intended.

Using market orders during a volatile market is

not recommended as there is a higher probability that the prices will change quickly.

Hence, the incidence of ‘slippage’ is higher in fast-moving markets or for illiquid securities with thin order book

and wide bid-ask spread.

The order may be split across multiple investors on the other side of the transaction,

resulting in different prices for the order.

For more information, please click here

Trading: Singapore Market

Summary

| Market | Singapore | |

|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

| Pre-Open (1) | 08:30 - 08:58-59* | |

| Non-Cancel (1) | 08:58-59* - 09:00 | |

| Continuous (1) | 09:00 - 12:00 | |

| Pre-Open (2) | 12:00 - 12:58-59* | |

| Non-Cancel (2) | 12:58-59* - 13:00 | |

| Continuous (2) | 13:00 - 17:00 | |

| Pre-Close | 17:00 - 17:04-05** | |

| Non-Cancel (3) | 17:04/17:05*-06 | |

| Trade At Close | 17:06 - 17:16 | |

| Order types |

|

|

| Order Validity |

|

|

*Pre-Open Phase (08:30 to 08:58-59 hours / 12:00 to 12:58-59 hours)

This phase will end randomly at any time from 08:58 to 08:59 hours, and from 12:58 to 12:59 hours.

Non-Cancel Phase (08:58-59 to 09:00 hours / 12:58-59 to 13:00 hours)

This phase will begin immediately after the Pre-Open Phase ends, which may be at any time from 08:58 to 08:59 hours, and from 12:58 to 12:59 hours. No input, amendment and withdrawal of orders.

**Pre-Close Phase (17:00 to 17:04-05 hours)

This phase will end randomly at any time from 17:04 to 17:05 hours (for normal day trading).

Non-Cancel Phase (17:04-05 to 17:06 hours)

This phase will begin immediately after the Pre-Close Phase ends, which may be at any time from 17:04 to 17:05 hours (for normal day trading). No input, amendment and withdrawal of orders.

Trade At Close (17:06 – 17:16 hours)

This phase will begin after the Non-Cancel Phase ends.

What are the hours for half day trading for Singapore market?

| Market | Singapore | |

|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

| Pre-Open | 08:30 - 08:58-59* | |

| Non-Cancel | 08:58-59* - 09:00 | |

| Continuous | 09:00 - 12:00 | |

| Pre-Close | 12:00 p.m. - 12:04 p.m. ** | |

| Non-Cancel | 12:04 p.m.** - 12:05 p.m | |

| Trade At Close | 12:06 p.m. - 12:16 p.m. | |

*Pre-Open Phase (08:30 to 08:58-59 hours)

This phase will end randomly at any time from 08:58 to 08:59 hours.

Non-Cancel Phase (08:58-59 to 09:00 hours)

This phase will begin immediately after the Pre-Open Phase ends, which may be at any time from 08:58 to 08:59 hours.

**Pre-Close Phase (12:00 to 12:04-05 hours)

This phase will end randomly at any time from 12:04 to 12:05 hours (for half-day trading).

Non-Cancel Phase (12:04-05 to 12:06 hours)

This phase will begin immediately after the Pre-Close Phase ends, which may be at any time from or 12:04 to 12:05 hours (for half-day trading). No input, amendment and withdrawal of orders.

Trade At Close (12:06 - 12:16 hours)

This phase will begin after the Non-Cancel Phase ends.

Can I place trades during pre-market session?

At DBS Online Equity Trading, we provide trading services in the pre-market sessions with the following conditions:

Pre-opening Session:

| Time Range | Period | New Order Input | Amendment | Cancellation | Order Matching |

|---|---|---|---|---|---|

| 08:30 - 08:58-59* | Pre-open | ✓ | ✓ | ✓ | - |

| 08:58 - 08:59* - 09:00 | Non-cancel | - | - | - | All unmatched orders will flow into the morning trading session |

| 12:00 - 12:58-59* | Mid-Day Break | ✓ | ✓ | ✓ | - |

| 12:58-59* - 13:00 | Non-cancel | - | - | - | All unmatched orders will flow into the afternoon trading session |

Pre-Close Session (Full Day):

| Time Range | Period | New Order Input | Amendment | Cancellation | Order Matching |

|---|---|---|---|---|---|

| 17:00 - 17:04-05** | Pre-close | ✓ | ✓ | ✓ | - |

| 17:04-05** - 17:06 | Non-cancel | - | - | - | All unmatched limit orders will be discarded after market closed. GTD/GTM orders will be carried forward to the next trading day. |

| 17:06 - 17:16 | Trade At Close | ✓ | ✓ | ✓ | Order Matching allowed only at closing auction price. |

Pre-Close Session (Half Day):

| Time Range | Period | New Order Input | Amendment | Cancellation | Order Matching |

|---|---|---|---|---|---|

| 12:00 - 12:04-05** | Pre-close | ✓ | ✓ | ✓ | - |

| 12:04-05** - 12:06 | Non-cancel | - | - | - | All unmatched limit orders will be discarded after market closed. GTD/GTM orders will be carried forward to the next trading day. |

| 12:06 - 12:16 | Trade At Close | ✓ | ✓ | ✓ | Order Matching allowed only at closing auction price. |

*The Pre-Open/Close phase ends randomly at any time within this one minute window and the Non-Cancel phase begins immediately after.

More information about pre-market sessions is available on SGX web sites.

In Singapore market, at what price can I submit my order?

The order price - Buying or Selling - should not be more than the stated forced order bid spread away from current market price. The size of a bid increases with the share price, as shown in the table below:

Minimum Bids Schedule

| Products | Price Range (S$) | Bid Size (S$) | Forced Orders (bids) |

|---|---|---|---|

| Securities | 0.001 - 0.199 | 0.001 | +/- 30 |

| 0.200 - 0.995 | 0.005 | ||

| 1.000 - 99.990 | 0.010 | ||

| 100.000 - 199.900 | 0.100 | +/- 300 | |

| 200.000 - 499.800 | 0.200 | ||

| 500.000 - 999.500 | 0.500 | ||

| Exchange Trade Funds | 0.010 - 999.990 | 0.010 | +/- 30* |

| 0.001 - 999.990 | 0.001 | ||

| Bonds listed in the Ready market, Debentures, Preference Shares with a $1 price convention | 0.010 - 999.990 | 0.001 | +/- 30 |

| Bonds listed in the Bond Market, Debentures, and Preference Shares with $100 price convention | 0.010 - 999.990 | 0.001 | +/- 1000 |

| Structured warrants and Structured Certificates | 0.001 - 0.199 | 0.001 | +/- 30 ticks |

| 0.200 - 1.995 | 0.005 | ||

| 2.000 - 999.990 | 0.010 | ||

| Daily Leverage Certificates (DLCs) | 0.001 - 0.005 | 0.001 | +/- 300%^ |

| 0.006 - 1.999 | 0.001 | +/- 50%^ | |

| 0.200 - 1.995 | 0.005 | ||

| 2.000 - 999.990 | 0.010 |

*Effective 17-Jan-2022, forced order range for all SGX listed ETFs will be revised to +/- 10%.

^Effective 02-Sep-2024, forced order range for all SGX listed DLCs will be revised to +/- 50% and +/- 300%.

Hong Kong Dollar (HKD) Minimum Bids Schedule

| Products | Price Range (HKD) | Bid Size (HKD) | Forced Orders (bids) |

|---|---|---|---|

| Securities denominated in Hong Kong Dollar | 0.001 - 0.249 | 0.001 | +/- 30 |

| 0.250 - 0.495 | 0.005 | ||

| 0.500 - 9.990 | 0.010 | ||

| 10.000 - 19.980 | 0.020 | ||

| 20.000 - 99.950 | 0.050 | ||

| 100.000 - 199.900 | 0.100 | ||

| 200.000 - 499.800 | 0.200 | ||

| 500.000 - 999.500 | 0.500 |

Japanese Yen Minimum Bids Schedule

| Products | Price Range | Bid Size (JPY) | Forced Orders (bids) |

|---|---|---|---|

| Securities denominated in Japanese Yen | 1 - 1,999 | 1 | +/- 30 |

| 2,000 - 2,995 | 5 | ||

| 3,000 - 29,990 | 10 | ||

| 30,000 - 49,950 | 50 | ||

| 50,000 - 99,900 | 100 | ||

| 100,000 - 999,000 | 1,000 |

In addition, your order price should be in exact multiples of the stated minimum bid size.

What is Trade At Close (TAC) Period (applicable to SGX market only)?

The 10-minute-long TAC session will immediately follow the closing auction routine and allows participants to execute orders at the Closing Auction Price (CAP) set during the closing auction routine. The TAC session will occur at 5.06pm to 5.16pm on a regular trading day and from 12.06pm to 12.16pm if the market is trading for half a day.

During the TAC session, trades can only occur at a fixed price, that is CAP established by SGX during the “Non-Cancel Last” session. The CAP will be displayed on our platform.

If there is no closing auction price established during Non-Cancel Last session for the counter, then all the order entries will be rejected and there will be no order matching during TAC session on that business day for that counter.

All unfilled long dated orders (GTD/GTM) during TAC, will be carried over to the following trading day.

Limit orders can only be entered at the closing auction price. Order amendments and cancellation is allowed during TAC.

For more information on TAC, please refer to SGX FAQ and News Release.

Examples

Closing Auction Price (provided by SGX) = $1.30

Limit Order Price = $1.30

Expected result: Order accepted by SGX

Closing Auction Price (provided by SGX) = $1.30

Limit Order Price = $1.40

Expected result: Order rejected by SGX

Closing Auction Price (provided by SGX) = Price Unavailable (-)

Limit Order Price = $1.40

Expected result: Order rejected by SGX

Trading: Hong Kong Market

Summary

| Market | Hong Kong | |

|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

| Pre-Open | 09:00 - 09:30 | |

| Continuous (1) | 09:30 - 12:00 | |

| Continuous (2) | 13:00 - 16:00 | |

| Closing Auction | 16:00 - 16:08-10* | |

| Order types |

|

|

| Order Validity |

|

|

*Hong Kong (16:00 to 16:08-10 / 12:00 to 12:08-10)

This phase will end randomly at any time from 16:08 to 16:10 hours (for normal day trading) or 12:08 to 12:10 hours (for half-day trading).

^Unfilled GTD orders will be resend to the HKEX daily until they expire:

- ELO, SLO, and Limit orders: 9:30 AM (Continuous Trading)

- ALO orders: 9:00 AM (Pre-Open)

Can I place trades during pre-market session?

At DBS Online Equity Trading, we provide trading services in the pre-market sessions with the following conditions:

Pre-opening Session:

| Time Range | Period | New Order Input | Amendment | Cancellation |

|---|---|---|---|---|

| 09:00 - 09:15 | Order Input Period, only at-auction orders and at-auction limit orders are accepted. | ✓ | ✓ | ✓ |

| 09:15 - 09:20 | No-cancellation Period, only at-auction orders and at-auction limit orders are accepted. Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) | ✓ | - | - |

| 09:20 - 09:22 |

Random Matching Period Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) Order matching will randomly start between 09:20am to 09:22am |

✓ Upon start of order matching input will not be allowed |

- | - |

| After match - 09:30 | Blocking Period | - | - | An unfilled at-auction order will be cancelled automatically after matching period. An unfilled at-auction limit order with input price not deviating nine times or more from the prevailing nominal price will be converted to limit order at the input price and carried forward to the continuous trading session. |

Closing Auction Session (Full Day):

| Time Range | Period | New Order Input | Amendment | Cancellation |

|---|---|---|---|---|

| 16:00 - 16:01** | Reference Price Fixing Period | - | - | - |

| 16:01 - 16:06** | Order Input Period, only at-auction orders and at-auction limit orders are accepted. Price Limit: +-5% of reference price |

✓ | ✓ | ✓ |

| 16:06 - 16:08** | Non-cancellation Period Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) | ✓ | - | - |

| 16:08 - 16:10** | Random Closing Period Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) Market will randomly close between 16:08pm to 16:10pm | ✓ | - | All Unmatched orders will be discarded. |

Closing Auction Session (Half Day):

| Time Range | Period | New Order Input | Amendment | Cancellation |

|---|---|---|---|---|

| 12:01 – 12:06 (Half day trading) |

Reference Price Fixing Period | - | - | - |

| 12:01 – 12:06 (Half day trading) |

Order Input Period, only at-auction orders and at-auction limit orders are accepted. Price Limit: +-5% of reference price |

✓ | ✓ | ✓ |

| 12:06 – 12:08 (Half day trading) |

Non-cancellation Period Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) | ✓ | - | - |

| 12:08 – 12:10 (Half day trading) |

Random Closing Period Price Limit: Within lowest ask & highest bid (recorded at the end of Order Input Period) Market will randomly close between 12:08pm to 12:10pm | ✓ | - | All Unmatched orders will be discarded. |

More information about pre-market sessions is available on the HKEX web sites.

In Hong Kong market, what are the order types available?

Market Order:

A Market Order is an order which is sent to the exchange with a specified quantity but without a limit price.

This order will be placed to the market by matching it up to the 10th queue at 9 spreads away at the Stock Exchange of Hong Kong at the time when the Market Order is processed. Any unfilled quantity of your Market Order would be cancelled immediately.

Limit Order:

A Limit order allows an order to be matched only at a specified price. A sell limit order cannot be below the current bid price, whereas a buy limit order cannot be above the current ask price. Any unmatched quantity will be placed in the price queue.

At-auction (Market) Order:

An at-auction order is a market order without a specified price. It enjoys a higher auction matching priority than an at-auction limit order. It will be cancelled automatically after order matching.

At-auction Limit Order:

An at-auction limit order is a limit order with a specified price. After order matching: Unfilled at-auction limit orders in the pre-opening session with input price not deviating nine times or more from the prevailing nominal price will be converted to limit orders at the input price and carried forward to the continuous trading session.

Enhanced Limit Order (ELO):

An ELO is similar to a Limit order. The difference between the two is that an ELO allows an order to be matched up to 10 price queues at one time. A buy order input price can be made at a price of 9 spreads above the current ask price, and a sell order input price can be made at a price of 9 spreads below the current bid price. Any unfilled quantity of an ELO after matching will be converted into a Limit Order and placed in the price queue at the order input price.

Special Limit Order (SLO)

An SLO allows an order to be matched up to 10 price queues, 9 spreads away, at one time as long as the traded price is better than the input price. There are no price restrictions on an SLO. However, the buy order input price must be at or above the best ask price, whereas the sell order input price must be at or below the best bid price. Any unfilled quantity of an SLO after matching will be cancelled.

More information about ELO and SLO is available on the Hong Kong Stock Exchange (HKEX) website.

In Hong Kong market, what is the difference between Limit Order, Enhanced Limit Order and Special Limit Order?

The following example illustrates the effect on the central order book if a sell order of 600K shares of XYZ stock is input at different selling prices and with different order types:

| Bid Price | Volume ('000) | Ask Price | Volume ('000) |

|---|---|---|---|

| $1.00 | 100 | $1.01 | 80 |

| $0.99 | 90 | $1.02 | 70 |

| $0.98 | 60 | $1.03 | 90 |

| $0.97 | ~ | $1.04 | 50 |

| $0.96 | 80 | $1.05 | 30 |

| $0.95 | 20 | $1.06 | 20 |

| $0.94 | 30 | $1.07 | 30 |

| $0.93 | 50 | $1.08 | 50 |

| $0.92 | ~ | $1.09 | 60 |

| $0.91 | 70 | $1.10 | 30 |

For example, client sells 600,000 shares of XYZ stock at the following illustrated prices:

| Illustrated prices | Case 1 Limit Order |

Case 2 Enhanced Limit Order |

Case 3 Special Limit Order |

|---|---|---|---|

| $1.01 | Order unfilled and put in the ask queue at $1.01 (680,000 @ $1.01) | Order unfilled and put in the ask queue at $1.01 (680,000 @ $1.01) | Order rejected by exchange (special limit sell order cannot be made at a price above the current bid at $1.00) |

| $1.00 | Order partially filled Filled: 100,000 @ $1.00 Outstanding: 500,000 put in the ask queue at $1.00 |

Order partially filled Filled: 100,000 @ $1.00 Outstanding: 500,000 put in the ask queue at $1.00 |

Order partially filled Filled: 100,000@$1.00 Outstanding: 500,000 @ $1.00 cancelled by exchange |

| $0.91 | Order rejected by exchange (limit sell order cannot be made at a price below the current bid at $1.00) |

Order partially filled Filled: 100,000 @ $1.00 90,000 @ $0.99 60,000 @ $0.98 80,000 @ $0.96 20,000 @ $0.95 30,000 @ $0.94 50,000 @ $0.93 70,000 @ $0.91 Outstanding: 100,000 put in the ask queue at $0.91 |

Order partially filled >Filled: 100,000 @ $1.00 90,000 @ $0.99 60,000 @ $0.98 80,000 @ $0.96 20,000 @ $0.95 30,000 @ $0.94 50,000 @ $0.93 70,000 @ $0.91 Outstanding: 100,000 @ $0.91 cancelled by exchange |

| Any price below $0.91 but above $0.111 (i.e. a price which does not deviate 9 times or more from the nominal price*) | Order rejected by exchange (enhanced limit sell order cannot be made at a price of 10 spreads (or more) below the current bid price at $1.00) |

Order partially filled Filled: 100,000 @ $1.00 90,000 @ $0.99 60,000 @ $0.98 80,000 @ $0.96 20,000 @ $0.95 30,000 @ $0.94 50,000 @ $0.93 70,000 @ $0.91 Outstanding: 100,000 cancelled by exchange |

|

| At or below $0.111 (i.e. a price which deviates 9 times or more from the nominal price*) | Order rejected by exchange (limit sell order cannot be made at a price below the current bid at $1.00 or deviates 9 times or more from the nominal price*) |

Order rejected by exchange (enhanced limit sell order cannot be made at a price of 10 spreads (or more) below the current bid price at $1.00 or deviates 9 times or more from the nominal price*) |

Order rejected by exchange (special limit sell order cannot be made at a price which deviates 9 times or more from the nominal price*) |

In Hong Kong market, at what price can I submit my order?

The bid size varies accordingly with the share price, as shown in the table below. For Hong Kong market, the default maximum number of bids is up to 20*.

*maximum number of bids for ELO order is 100

All orders input must be within the acceptable price range. Any orders with price beyond the price limit will either not be able to proceed upon order placement or get rejected by exchange.

Part A

All securities, other than those securities covered under Part B, Part C and/ or Part D, shall be traded in accordance with the following scale of spreads:

| Minimum Bid Size | ||||

|---|---|---|---|---|

| From | 0.01 | to | 0.25 | 0.001 |

| Over | 0.25 | to | 0.50 | 0.005 |

| Over | 0.50 | to | 10.00 | 0.010 |

| Over | 10.00 | to | 20.00 | 0.020 |

| Over | 20.00 | to | 100.00 | 0.050 |

| Over | 100.00 | to | 200.00 | 0.100 |

| Over | 200.00 | to | 500.00 | 0.200 |

| Over | 500.00 | to | 1,000.00 | 0.500 |

| Over | 1,000.00 | to | 2,000.00 | 1.000 |

| Over | 2,000.00 | to | 5,000.00 | 2.000 |

| Over | 5,000.00 | to | 9,995.00 | 5.000 |

Part B

Securities which are authorised by the Exchange to be traded in accordance with the scale of spreads in this Part B and all debt securities shall be traded in accordance with the following scale of spreads:

| Currency unit | Minimum Bid Size |

|---|---|

| From 0.50 to 9,999.95 | 0.050 |

Part C

Exchange Traded Options shall be traded in accordance with the scale of spreads as set out in the Operational Trading Procedures.

Part D

Exchange Traded Funds, other than those securities covered under Part B shall be traded in accordance with the following scale of spreads:

| Currency unit | Minimum Bid Size | |||

|---|---|---|---|---|

| From | 0.01 | to | 1.00 | 0.001 |

| Over | 1.00 | to | 5.00 | 0.002 |

| Over | 5.00 | to | 10.00 | 0.005 |

| Over | 10.00 | to | 20.00 | 0.010 |

| Over | 20.00 | to | 100.00 | 0.020 |

| Over | 100.00 | to | 200.00 | 0.050 |

| Over | 200.00 | to | 500.00 | 0.100 |

| Over | 500.00 | to | 1,000.00 | 0.200 |

| Over | 1,000.00 | to | 2,000.00 | 0.500 |

| Over | 2,000.00 | to | 9,999.00 | 1.000 |

Trading: Canada/United States Market

Summary

| Market | Canada / United States | ||

|---|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

(HKT/SGT) Daylight Time |

| Continuous | 09:30 - 16:00 | 22:30 - 05:00 | 21:30 - 04:00 |

| Order types |

|

||

| Order Validity |

|

||

In the United States market, at what price can I submit my order?

For limit orders, you may submit at any price range with the following exception relative to the different US exchanges:

NYSE, NASDAQ and NYSE American

- For counters with a Last Done Price that is more than or equals to one dollar, the limit price entered should not contain more than two decimal places.

- For counters with a Last Done Price that is less than one dollar, the limit price entered should not contain more than four decimal places.

Trading: United Kingdom Market

Summary

| Market | United Kingdom | ||

|---|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

(HKT/SGT) Daylight Time |

| Pre-Open | 07:50 - 08:00 | 15:50 - 16:00 | 14:50 - 15:00 |

| Continuous | 08:00 - 16:30 | 16:00 - 00:30 | 15:00 - 23:30 |

| Pre-Close | 16:30 - 16:35 | 00:30 - 00:35 | 23:30 - 23:35 |

| Order types |

|

||

| Order Validity |

|

||

In the United Kingdom market, at what price can I submit my order?

FTSE 100 constituents

| Price Range | Bid Size |

|---|---|

| GBX/GBP/USD/EUR | |

| Less than 0.9999 | 0.0001 |

| 1 - 4.9995 | 0.0005 |

| 5 - 9.999 | 0.001 |

| 10 - 49.995 | 0.005 |

| 50 - 99.99 | 0.01 |

| 100 - 499.95 | 0.05 |

| 500 - 999.9 | 0.1 |

| 1000 - 4999.5 | 0.5 |

| 5000 - 9999 | 1 |

| 10000 or more | 5 |

FTSE 250 constituents

| Price Range | Bid Size |

|---|---|

| GBX/GBP/USD/EUR | |

| Less than 0.5 | 0.0001 |

| 0.5 - 0.9995 | 0.0005 |

| 1 - 4.999 | 0.001 |

| 5 - 9.995 | 0.005 |

| 10 - 49.99 | 0.01 |

| 50 - 99.95 | 0.05 |

| 100 - 499.9 | 0.1 |

| 500 - 999.5 | 0.5 |

| 1000 - 4999 | 1 |

| 5000 - 9995 | 1 |

| 10000 or more | 10 |

For bid sizes of other product segments, please refer to LSE website:

https://www.londonstockexchange.com/products-and-services/trading-services/trading-services.htm

Trading: Australia Market

Summary

| Market | Australia | ||

|---|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

(HKT/SGT) Daylight Time |

| Continuous | 10:00 - 16:00 | 08:00 - 14:00 | 07:00 - 13:00 |

| Pre-Close | 16:00 - 16:12 | 14:00 - 14:12 | 13:00 - 13:12 |

| Order types |

|

||

| Order Validity |

|

||

(Note: We are not participating in ASX pre-opening session.)

In Australia market, at what price can I submit my order?

| Price Range | Bid Size |

|---|---|

| AUD | |

| Less than 0.1 | 0.001 |

| 0.1 – 1.995 | 0.005 |

| 2.00 or more | 0.01 |

Trading: Japan Market

Summary

| Market | Japan | |

|---|---|---|

| Trading Hours | Local Time | (HKT/SGT) Standard Time |

| Pre-Open (1) | 08:00 - 09:00 | 07:00 - 08:00 |

| Continuous (1) | 09:00 - 11:30 | 08:00 - 10:30 |

| Pre-Open (2) | 12:05 - 12:30 | 11:05 - 11:30 |

| Continuous (2) | 12:30 - 15:30 | 11:30 - 14:30 |

| Order types |

|

|

| Order Validity |

|

|

(Note: We are not participating in TSE pre-opening session.)

In Japan market, at what price can I submit my order?

TOPIX 500 and ETFs, ETNs, and Leveraged Products

| Price Range | Bid Size | |

|---|---|---|

| JPY | Lot size: 10 or more | Lot size: 1 |

| Up to 1,000 | 0.1 | 1 |

| Up to 3,000 | 0.5 | 1 |

| Up to 10,000 | 1 | 1 |

| Up to 30,000 | 5 | 5 |

| Up to 100,000 | 10 | 10 |

| Up to 300,000 | 50 | 50 |

| Up to 1 million | 100 | 100 |

| Up to 3 million | 500 | 500 |

| Up to 10 million | 1,000 | 1,000 |

| Up to 30 million | 5,000 | 5,000 |

| Over 30 million | 10,000 | 10,000 |

Other Product Segments

| Price Range | Bid Size |

|---|---|

| JPY | |

| Up to 3,000 | 1 |

| Up to 5,000 | 5 |

| Up to 30,000 | 10 |

| Up to 50,000 | 50 |

| Up to 300,000 | 100 |

| Up to 500,000 | 500 |

| Up to 3 million | 1,000 |

| Up to 5 million | 5,000 |

| Up to 30 million | 10,000 |

| Up to 50 million | 50,000 |

| Over 50 million | 100,000 |

Trading: Other Information

How can I make sure that my order reaches DBS Online Equity Trading over the Internet and is being placed?

You will immediately receive an online order confirmation with a reference number provided. This confirmation means that we have received your order instruction. You will need to check the order status by clicking to find out whether your order has been filled. The status shows the stage at which your order is being processed.

Under what circumstances could my order be rejected?

There are a number of reasons your order could be rejected and the common ones are listed here:

- The limit price of your order Bid size is out of range from the current bid/ask prices. (Refer to ‘at what price can I submit my order’ for the respective markets)

- The stock you selected has been suspended.

- The exchange has encountered technical problems.

- The system has encountered technical problems - such as outages, glitches and other delays.

- The price or order type of your order placed does not fulfil the requirement of the current trading phase (E.g. The limit price of your SGX order placed is not the same as the Closing Auction Price during Trade At Close session.)

- SGX - Long dated orders (i.e., Good-till-Date, Good-till-Max orders) already with the exchange, will be purged when there are corporate actions in the stocks/units or when the validity of the order expires. https://www.sgx.com/securities/trading

If your order is rejected despite having checked and corrected any possible errors, please contact your Relationship Manager or our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas).

How do I amend my order?

To amend your outstanding order, click the "Amend" button on the Order Status page to proceed with the amendment request. The Order Status page will indicate if your request has been successful.

We provide different amendment actions for different markets. Details are as shown below:

| Market | Allowed Amendment Action | |||

|---|---|---|---|---|

| Quantity | Price | |||

| Increase | Decrease | Increase | Decrease | |

| Singapore | - | ✓ | - | - |

| Hong Kong | ✓New | ✓ | ✓New | ✓New |

| United States of America* | - | - | - | - |

| Canada* | - | - | - | - |

| United Kingdom | - | ✓ | - | - |

| Australia | - | ✓ | - | - |

| Japan | - | ✓ | - | - |

*No Amendment action available. If the amendment action is not available for the market intended, please cancel your existing order and replace it with a new order with the desired price/quantity.

How do I cancel my order?

If you have an outstanding order that is not yet filled in the market, you may cancel it by clicking "Cancel" on the Order Status page to proceed with the cancellation. The status of your order cancellation can then be viewed in the Order Status page as well. Please note that all cancel orders are subject to prior fills.

If you are away from your computer and wish to make an amendment, you may contact our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas).

After I submitted an order amendment/cancellation request, why is my order status not updated?

Once the exchange is opened and acknowledges the request, the order status details will be updated accordingly.

How am I notified of the execution of a trade and the confirmation of the order when done?

You can check the order status online by clicking view Order Status to find out whether your orders have been filled.

You can also obtain trade confirmations via SMS and email. The activation process is easy, you can enable SMS and/or email alert via the secure site or through our investment service center.

Please update your mobile number and email address for alert notifications in DBS iBanking.

Final trade confirmation will be mailed to you on T+1.

Alternatively, you may also call our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas).

What happens if the orders are not executed by the end of the business day?

All unmatched orders will expire at the end of the business day. If you wish to keep the order for the next business day, you will have to re-enter the order after the trading hours. If you have selected "Good till date", your order will be cancelled automatically on the expiry date.

Delivery & Settlement

What do I need to do if I have some physical certificate that I want to sell for Hong Kong, US/Canada, UK, Australia & Japan market?

Please contact your Relationship Manager for assistance.

When can I pick up the money after I sell stocks?

All sales proceeds will be credited into your Wealth Management Multi-Currency Settlement Account (MCSA).

The funds will be available on the settlement date and you can withdraw the money as long as there is no outstanding amount due to us.

| Stocks | Settlement Date |

|---|---|

| Canada & United States | T+1 |

| Australia, Hong Kong, Japan, Singapore & United Kingdom | T+2 |

How do I make deposit to settle my trade?

All trades will be debited from your Wealth Management Multi-Currency Settlement Account (MCSA).

What should I do if I want to buy stocks in a particular market but do not have that currency in my DBS Online Equity Trading (OET) account?

You can either deposit the required currency to your Multi-Currency Settlement Account before beginning to trade or instruct us to convert other currencies in your DBS Bank accounts.

Unless you indicate otherwise, you are required to settle your trades in their base currencies. You can settle all your trades from different markets in Singapore, Hong Kong, U.S., Canadian, Euro, Australian dollars, Pound Sterling and Japanese Yen.

How do I transfer securities to DBS Online Equity Trading (OET)?

Please contact your Relationship Manager for assistance.

There is no fee involved for equities transfer in. However, out-of-pocket expenses such as stamp duties are payable by the client.

What type of statements do I receive?

Your online trades will be included in your DBS Private Bank or DBS Treasures Private Client or DBS Treasures consolidated statements.

How are dividends and other corporate actions managed?

Currently, you cannot manage dividend and corporate actions via our web site. However, you will receive notifications from us via mail for mandatory corporate actions. For voluntary corporate actions such as rights issues, takeovers, and dividends with scrip option, you will also receive response slips which should be completed and returned before the due date should you wish to participate. Alternatively, you can contact your Relationship Manager and request that they apply your decision.

For non-SGX trades, what is the cutoff time to convert funds to the settlement currency to settle the trade?

It is 5pm on the day before settlement date. Alternatively, you can contact your Relationship Manager and request for settlement in another currency by 5pm the day before settlement date.

Can I use CPF or SRS funds to trade online?

DBS Online Equity Trading does not facilitate trades with CPF or SRS funds.

What is SGX cash settlement?

When there are insufficient securities delivered from the sellers of the security, your buy trade may not settle on the intended settlement day (ISD) and the trade remains unsettled, cash settlement will take place.

You may refer to SGX website here for more information on cash settlement.

Note: ISD is also known as the settlement date (T+2).

How will i know if my SGX buy trade has been cash settled?

You will be informed when your buy trade has been cash settled.

Note: A buy trade may be cash settled as early as ISD+1.

How does the new SGX settlement process affect trades denominated in a foreign currency?

If the settlement date (T+2) falls on a holiday of your foreign currency trade, both money and securities settlement will take place on the next banking day.

In the event of an unscheduled holiday (E.g. Natural disaster) where it results in closure of a market, that particular day will be treated as a currency holiday.

Fees

What are the costs for opening an account with DBS Online Equity Trading?

No initial deposit or fee is required to open an account with DBS Online Equity Trading. It is one of the privileges of your DBS Private Bank, DBS Treasures Private Client and DBS Treasures account.

What are the online commission fees and market charges?

| Market | Online Rate | Minimum Charge |

|---|---|---|

| Singapore | 0.12% | No minimum |

| Hong Kong | 0.15% | HKD 80 |

| Canada | 0.25% | CAD 20 |

| United States | 0.15% | USD 18 |

| United Kingdom | 0.25% | GBP 20 |

| Japan | 0.25% | JPY 2000 |

| Australia | 0.25% | AUD 20 |

To view the full list of online brokerage and market charges, please refer DBS Online Equity Trading – Fees & Charges.

To view custody fee, please refer to Treasures Pricing Guide or Treasures Private Client / Private Bank Fee Schedule.

Does DBS Online Equity Trading charge any custodian fees?

To view custody fee, please refer to Treasures Pricing Guide or Treasures Private Client / Private Bank Fee Schedule.

Price Streaming & Real-time Quotes

What is 'Streaming Quote'?

'Streaming' refers to the ability of a website to dynamically display market data. This feature allows investors to receive continuous updates on the 'Streaming-enabled' pages.

What is Advanced Market Data (AMD)?

This is a tool that is only available for Singapore and Hong Kong markets.

Features of Advanced Market Data- Customise and view real-time data for up to 4 stocks simultaneously on the same page.

- Save your viewing options for easy access in the future.

- Trade Distribution: List all executed buy/sell transactions in real-time, sorted by transacted price.

- Bid & Ask (Market Depth): View up to 20 levels of Bid and Ask prices and monitor prices on both the buy and sell sides.

- Times & Sales: View a record of all transactions made; transactions with values of more than $100K are highlighted for easy reference.

Which markets have been enabled for real-time streaming quotes?

Real-time streaming quotes are available for Singapore and US stocks. The web pages for your Watchlists and the Market Top 20 lists are enabled for streaming quotes.

Real-time streaming quotes is also available for Hong Kong stocks, subject to meeting the eligibility criteria.

For the United Kingdom, Canada, Australia and Japan, we only offer delay prices (UK, Canada and Japan = 15 mins delayed, Australia = 20 mins delayed)

For more information, please refer to our Guide on Market Entitlement

Are all fields supported by streaming quotes?

All data fields within the Watchlists and the Market Top 20 lists pages are enabled with the streaming functionality. All data movements are highlighted with yellow flashes.

Most of the data fields on the Trade page are also enabled with the streaming functionality.

How do I Activate/Deactivate streaming quotes?

The Trade page has the streaming function built in. When you turn on “Stream Prices" on these pages, the data fields on the page will automatically refresh as updated data is served from the system.

Please note that the availability of streaming data is subject to your market data entitlement. To check your entitlement, click on “Market Data Entitlement” on the Trade page.

Is streaming quote service available all the time?

Streaming quote service on DBS Online Equity Trading is available during market hours.

What are the requirement to obtain live streaming quotes and/or Advanced Market Data?

| Markets | Services | Requirement |

|---|---|---|

| Singapore |

|

At least S$100 in online commission in previous month or At least S$300 in previous 3 months for SG market |

| Hong Kong |

|

At least S$300 in online commission in previous month for HKEx trades or At least S$900 in previous 3 months for HKEx trades |

How do I subscribe for HK real time snap shot quote?

All clients are provided with 1,000 real-time snap shot quotes per calendar month by default. This quota may be reduced or increased at the company's absolute discretion taking into account the business given by you.

What will happen if I use up all real-time snap shot entitlement?

You will not be able to get any more real-time snap shot quotes from your Watchlist, Top 20 and Custom Portfolio until your fresh entitlement of quotes is available at the beginning of the following month.

However, you can still use the delay streaming to view the prices for HK stocks. Prices will be delay 15 mins.

Can I carry over any unused quotes?

No.

How do I know my current usage of quotes entitlement?

Click on "Market Data Entitlement" on the Trade page to view your quote usage.

How is my quote usage counted?

Whenever you obtain snap shot quotes from any page on this website, all quotes displayed in that page are counted towards your quota. For example, if you have 20 HK stocks in your watchlist, 20 snap shot quotes will be deducted from total quotes quota per each refresh of the watchlist. Every click on Market Top 20 will count 20 quotes.

Risk Warning Statement

What is the Risk Warning Statement (RWS) about?

Foreign-listed investment products, including EIPs, may carry a different set of risks and different levels of protection for investors from those offered locally. Intermediaries such as banks are required to warn retail customers (i.e. Non-Accredited Investors) of the possible risks prior to the customer's first purchase of a foreign-listed investment product from 28 February 2013 and to obtain the customer's acknowledgement on the risk warning disclosure. This will apply to all foreign-listed investment products, regardless of whether the customer has transacted in such products prior to 28 February 2013, and whether the customer is assessed to have the relevant knowledge or experience to transact in listed SIPs.

If the retail customer has not acknowledged the RWS on or by 28 February 2013, he/she will not be allowed to transact in any Overseas-Listed Investment Product, notwithstanding that he/she has qualified for the CAR. For joint account, each of the account holders has to acknowledge the RWS before the joint account can be used for transacting in any Overseas-Listed Investment Product.

Retail customers can acknowledge the prescribed Risk Warning Statement (RWS) by accepting it electronically after login to Online Equity Trading Account or signing and returning the RWS to the bank in hardcopy. Please read and understand the contents of the RWS before indicating your acknowledgement of the RWS. If you have any questions on the RWS, please contact your Relationship Manager or visit any of our branches.

What are the Overseas Listed Investment Products that are re-classified as Excluded Investment Products ("EIPs")?

Overseas Listed Investment Products that are re-classified as EIPs are as below:

- Ordinary Shares;

- Preference Shares;

- Deferred Shares;

- Fully Paid Depository Receipts representing shares (e.g. ADRs);

- Subscription Rights and;

- Real Estate Trust.

Can I still sell my existing holdings of Overseas Listed Investment Products if I do not acknowledge the Risk Warning Statement?

You can still liquidate/close out your existing holdings of Overseas Listed Investment Products if you do not acknowledge the Risk Warning Statement. However, you would need to acknowledge the Risk Warning Statement should you wish to purchase any Overseas Listed Investment Product(s).

If I have multiple trading accounts with DBS Bank, do I need to acknowledge the Risk Warning Statement for every trading account?

The Primary Account Holder only needs to acknowledge the Risk Warning Statement once and the acknowledgement will be applied to all the Individual trading accounts that he/she has maintained with DBS Bank. However, the Joint Account Holder (if any) and Mandate(s) (if any) are required to sign all Risk Warning Statement Form(s) for the trading account(s) that they are authorised to operate.

Customer Account Review (Listed Specified Investment Products)

What is the Customer Account Review about?

Effective from 1 January 2012, financial institutions such as banks, broking firms and financial advisors are required to assess if a retail investor (i.e. Non-Accredited Investor) has the relevant knowledge or experience to understand the risks and features of derivatives before offering any Specified Investment Products (SIPs) to him/her. Therefore, the Bank requires you to complete a Customer Account Review (CAR) to ascertain your understanding of derivatives before you invest in any SIPs listed on an exchange, regardless you are new or existing customer. You must be assessed to possess knowledge or experience in derivatives in pursuant of CAR before the Bank allows you to request trading listed SIPs via your DBS Online Equity Trading accounts.

What are Listed Specified Investment Products?

Specified Investment Products (SIPs) are financial products that may not be as widely understood by investors as others, as their structures, features and risks may be more complex in nature.

There are two categories of SIPs:

I. Listed SIPs

Examples of SIPs listed on Singapore Exchange (SGX) and Overseas Exchange securities markets include the following:

- Certificates

- Exchange Traded Funds (ETFs)

- Exchange Traded Notes (ETNs)

- Futures (Extended Settlement Contracts)

- Structured Warrants

- Callable Bull / Bear Contracts (CBBCs)

II. Unlisted SIPs*

Examples of Unlisted SIPs include the following:

- Over-The-Counter Products

- Leveraged Foreign Exchange

How will the requirements affect retail investors (i.e. Non-Accredited Investors) like me?

If you wish to trade listed SIPs, the Bank will have to conduct a CAR based on your declaration of your educational qualifications, work experience and investment or trading experience to assess whether you have the knowledge or experience to understand the features and risks of SIPs before you can apply for a DBS Online Equity Trading account to trade in listed SIPs.

What are the qualifying criteria used in the CAR?

The criteria used in the CAR to determine if the investor qualifies are as follows:

- Educational Qualifications

Diploma or higher qualifications in one of the following fields:

- Accountancy

- Actuarial Science

- Business Administration/Business Management/Business Studies

- Capital Markets

- Commerce/ Economics /Finance

- Financial Engineering

- Financial Planning / Computational Finance and Insurance

- Professional Finance-related qualifications ( including Chartered Financial Analyst Examination conducted by CFA Institute, USA and the Association of Chartered Certified Accountants (ACCA) Qualifications)

- Working Experience

Have a minimum of 3 consecutive years of working experience in the past 10 years, in the development of, structuring of, management of, sale of, trading of, research on or analysis of investment products (as defined in Section 2(1) of the Financial Advisers Act (Cap. 110)), the provision of training in investment products or the provision of legal advice or possession of legal expertise in any of the foregoing. Work experience in Accountancy, Actuarial Science, Treasury or Financial Risk Management activities will also be considered relevant experience.

Note

Working experience in administrative and clerical work, or in general support functions such as, operations, human resources, corporate services and information technology will not be considered relevant experience.

Section 2(1) of the Financial Advisers Act (Cap. 110): Interpretations

“investment product" means — (a) any capital markets product as defined in section 2 (1) of the Securities and Futures Act; (b) any life policy; or (c) any other product as may be prescribed;

"capital markets products" means any securities, futures contracts, contracts or arrangements for the purposes of foreign exchange trading, contracts or arrangements for the purposes of leveraged foreign exchange trading, and such other products as the Authority may prescribe as capital markets products;

"life policy" has the same meaning as in the First Schedule to the Insurance Act (Cap. 142), but does not include any contract of reinsurance;

Insurance Act, First Schedule: Definitions related to life business

“life policy” means any policy which —

- provides for the payment of policy moneys on the death of a person or on the happening of any contingency dependent on the termination or continuance of human life;

- is subject to payment of premiums for a term dependent on the termination or continuance of human life;

- provides for the payment of an annuity for a term dependent on the termination or continuance of human life; or

- is a combination of any of the above.

An accident and health policy that provides for the payment of policy moneys on the death of a person is not a life policy.

- Investment Experience

At least 6 transactions in Listed SIPs in the preceding 3 years.

When the requirements became effective on 1 January 2012, the period of the preceding 3 years is from 1 January 2009 to 31 December 2011.

If you do not have a DBS Online Equity Trading Account but you have an offline Trading Account, you can contact your Relationship Manager to check your eligibility status for trading or investing in Listed SIPs.

Do I have to fulfill all 3 criteria in order to qualify for the CAR?

To pass the CAR, you only need to satisfy ONE of the 3 criteria.

For Joint Trading Account or Trading Account with Attorneys appointed pursuant to a Power Of Attorney, who must complete and pass the CAR?

- For Joint Trading Account - All Account Holders must complete and pass the CAR.

- For Trading Account with Attorneys appointed pursuant to a Power of Attorney – The DBS Online Equity Trading platform is only available to Account Holder(s). It will not be made available to Attorneys appointed pursuant to a Power of Attorney.

Who is exempted from CAR?

Customer who is an individual and who is an accredited investor* is exempted from CAR. Client who is a non-individual (e.g. corporate clients) are also exempted.

*Accredited Investor (for an individual) means -

- whose net personal assets exceed in value $2 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount;

- whose financial assets (net of any related liabilities) exceed in value $1 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount, where “financial asset” means —

- a deposit as defined in section 4B of the Banking Act;

- an investment product as defined in section 2(1) of the Financial Advisers Act; or

- any other asset as may be prescribed by regulations made under section 341; or

- whose income in the preceding 12 months is not less than $300,000 (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount;

What if I do not satisfy the CAR?

If you do not satisfy the CAR but still wish to invest in Listed SIPs, you may visit https://onlineeducation.sgx.com/specifiedinvestmentproducts/ to take the SGX learning module on SGX-Listed SIPs. Please select “NIL” under the drop down list for Broker. Upon passing the assessment at the end of the SGX learning module, you may contact your Relationship Manager to inform that you have passed the assessment and provide a copy of your assessment result to the Bank. Upon the Bank being satisfied that you have passed the assessment, you will be eligible to trade Listed SIPs.

What if the main Account Holder satisfies for the CAR but the 2nd Account Holder (in the Joint Trading Account) cannot satisfy the CAR?

The 2nd account holder may visit https://onlineeducation.sgx.com/specifiedinvestmentproducts/ to take the SGX learning module. Please select “NIL” under the drop down list for Broker. Upon passing, please provide your assessment result to your Relationship Manager. Upon the Bank being satisfied that the 2nd account holder has passed the assessment, both account holders will be eligible to trade Listed SIPs.

What if I cannot satisfy both CAR and SGX learning module but wish to dispose of the Listed SIPs bought before 1 Jan 2012 when CAR was introduced?

You will be allowed to dispose of your listed SIPs bought before 1 Jan 2012. However, you will not be allowed to purchase Listed SIPs.

How do I attempt to complete the CAR?

You may proceed to complete the CAR by clicking on the Customer Account Review Results on the DBS Online Equity Trading page.

How do I know if I am an Accredited Investor?

Under Singapore’s Securities and Futures Act (Cap. 289), an individual is an “Accredited Investor”:

- whose net personal assets exceed in value $2 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount;

- whose financial assets (net of any related liabilities) exceed in value $1 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount, where “financial asset” means —

- a deposit as defined in section 4B of the Banking Act;

- an investment product as defined in section 2(1) of the Financial Advisers Act; or

- any other asset as may be prescribed by regulations made under section 341; or

- whose income in the preceding 12 months is not less than $300,000 (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount;

Please contact your Relationship Manager to declare your Accredited Investor status to the Bank.

What is the validity period if I satisfy the CAR?

After you are assessed to be qualified to trade listed SIPs, we will conduct the CAR once every 3 years for accounts trading in Listed SIPs.

After you are assessed to be qualified to trade listed SIPs, we will conduct the CAR once every 3 years for accounts trading in Listed SIPs.

If you have transacted in a Listed SIPs at least two (2) times through your trading account during the preceding 3-year period, you may continue to trade Listed SIPs in that same trading account after 3 years has expired from the date of your last CAR assessment.

Notwithstanding that CAR is valid for 3 years, financial institutions are required to update Customer’s profile at least once a year. As such, the Bank will request for an annual update of your education qualifications and investment experience or work experience and any other relevant information.

What is the validity period of my declaration as an Accredited Investor?

Unless there is a change in your declared status which you undertake to inform the Bank within 7 working days, the Bank may perform periodic reviews on your status as an Accredited Investor to ascertain its validity.

If I have multiple Individual Trading Accounts with DBS Bank, do I have to undergo a separate assessment for each Individual Trading Account?

You would only need to undergo one assessment. If you pass the CAR, the outcome of the assessment will apply to all your Trading Accounts linked to your NRIC or Passport Number.

I have an Individual Trading Account and am a Joint Account Holder of another Joint Trading Account. How many times must I undergo the assessment?

You have to undergo 1 single assessment.

If I have completed and satisfied the CAR with another broking firm, do I have to undergo another assessment with DBS Bank?

Yes, each financial institution has an obligation to conduct its own CAR for their customers. The successful outcome of the assessments conducted with other financial institutions is not transferable to DBS Bank.

Exchange Traded Funds

Where can I buy or sell ETFs?

You can buy or sell ETFs through our DBS Online Equity Trading, just like buying or selling a stock.

How easily can I buy or sell ETFs?

You will be able to buy or sell ETFs on the exchange in the same way as stocks throughout the trading day.

What are the benefits to ETFs trading as stocks?

Here are some of the advantages of investing in ETFs:

- Diversification - instantly get exposure to a portfolio of stocks of your choice

- Convenience and Liquidity - buy and sell at any time during the trading day

- Cost-effectiveness - lower management and sponsor fees

Do I get paid dividends and/or capital gains?

ETF holders are eligible to receive their portion of dividends, if any, accumulated on the stocks held in trust, less fees and expenses of the trust. You may realize capital gains when you sell your ETF holdings at a price higher than your purchase price.

Why are some ETFs not tradeable on our website?

It may be due to the minimum bid size problem. Please call our DBS Wealth Management Hotline at 1800 221 1111 (Singapore) or (65) 6221 1111 (overseas).