- S-REITs serve as a good inflation hedge while remaining fertile hunting ground for dividend yields

- Risks to DPU are mitigated by healthy gearing levels and high proportion in fixed rate debts

- Opportunities include reopening plays which benefit from strong pent-up demand to travel

- S-REITs remains an essential component in the income part of our barbell portfolio construct

Singapore continues to be the preferred location for companies looking to set up regional headquarters and such a trend will underpin rental momentum across the retail and commercial segments within S-REITs. Strong demand, particularly from Tech giants amid tight supply, continues to support positive rental reversions. For instance, the upcoming Central Boulevard is turning into a CBD tech hub with Amazon potentially its fi rst anchor tenant. Other tech giants like Meta and ByteDance are also potentially exploring options at Central Boulevard.

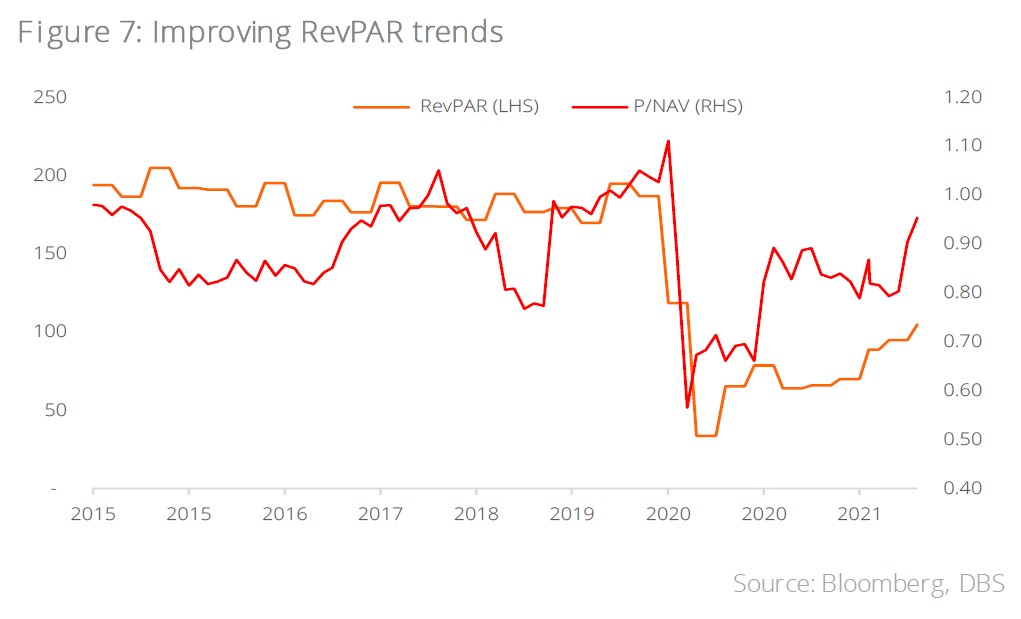

Furthermore, pent up demand to travel is recovering fast as economies reopen, as evident in the broad-based recovery in revenue available per room (RevPar) for hotel REITs and improving occupancy rates and traffic footfalls across retail REITs in 1Q22.

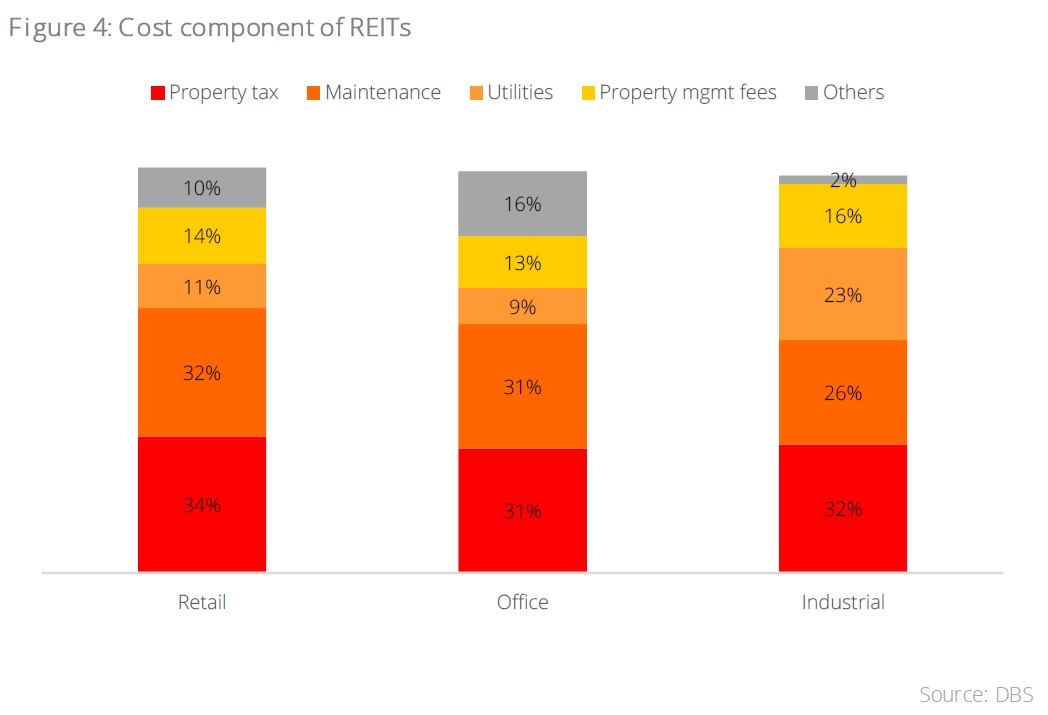

On utility cost guidance from the S-REITs sector, utility costs typically comprise only between 1-3% of revenue, except for hospitality, where it ranges between 3-5%. Industrial and office sector utility costs are largely borne by the tenants. While hospitality may bear the brunt of the high costs, these could be passed on via room rates, given the strong demand and that these rates see ongoing adjustments. Retail landlords may have to bear higher utility costs as the pass-through mechanism may have some timing issues. Nevertheless, some of these costs could be offset with the return of atrium sales and parking income.

In the near term, as energy prices have spiked since the Russian-Ukraine war started, most S-REITs have relooked at their utility contracts to ensure the rates are substantially locked in to minimise the utility cost impact in FY22.

Interest rates sensitivity: According to DBS Group Research, based on management guidance and sensitivity analysis, a 25 bps increase in interest rates is estimated to have a 0.4-2.3% impact on FY22F distribution per unit (DPU).

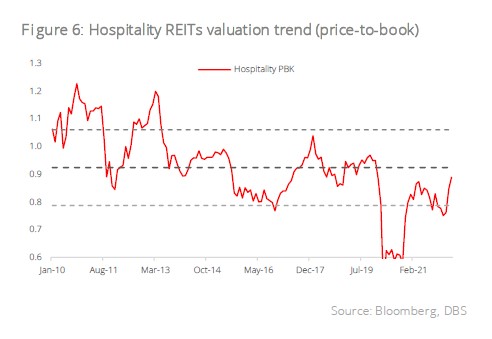

Hospitality S-REITs’ key markets like (i) Singapore (c.40% of asset value) have substantially opened its borders with a robust line-up of MICE events in 2H22, while staycations are still key, (ii) Europe (c.15%) and Australia (14%) will likely shrug off the Omicron impact as international travel return. In Asia, we await the re-opening of Japan (c.13%) to tourists, and China, which are the next catalysts to drive a further hike in RevPARs.

Key risk on the S-REITs remains a prolonged and persistent spike in interest rates. We believe this will be largely mitigated by:

- Healthy gearing at around 38% vs the regulatory gearing limit of 50%

- High proportion in fixed rate debt (c.75% of interest cost)

- Low refinancing risks over the next two to three years, with staggered debt maturities of <11% of overall debt expiring in 2022 and <17% of debt expiring in 2023

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.