- Global oil prices on a tear amid production cuts in Saudi Arabia and Russia

- OPEC forecasting potential supply shortfall of 3.3m barrels a day for 4Q23

- Correlation between oil price and equities is on the rise

- Equities tend to rally in tandem with oil prices during periods of economic expansion

- Stay engaged on quality plays in the equity space

Rising energy prices bad for equities? Not necessarily so. Global oil prices have been on a tear, rising 29% since 27 June amid production cuts in Saudi Arabia and Russia. Not surprisingly, this has triggered concerns on the trajectory of risk assets. Based on conventional wisdom, rising oil prices translate to higher input cost which will, in turn, result in margin squeeze and lower corporate profitability. This is particularly so for net importer countries such as United States and China.

To be sure, for companies operating in the consumer staples or industrials space with limited pricing power, such train of thought makes sense. But to apply this logic wholesale on the entire equity universe is misguided as historical data shows. There are different moving parts at play here and the important factors which we need to consider are: What is the prevailing state of the economy? And is the increase in oil price demand-driven or supply-driven?

Supply concerns aside, rising energy prices also reflect economic resilience. Saudi Arabia announced plans to extend production cuts till the end of the year and this prompted OPEC to forecast potential supply shortfall of 3.3m barrels a day for 4Q23. The likelihood of Saudi Arabia putting a lid on production and keeping oil price elevated is high. According to Bloomberg Economics, the country needs oil price to stay above USD100/bbl in order for the government to cover its expenditure.

Beyond supply concerns, the recent oil price rally also reflects resilient demand, particularly from China. Based on OPEC’s projections, global oil demand is expected to increase by 2.44m bpd this year, followed by 2.25m in 2024. The robust demand for oil suggests that the current rally is also a function of economic resilience and this augers well for the outlook of risk assets.

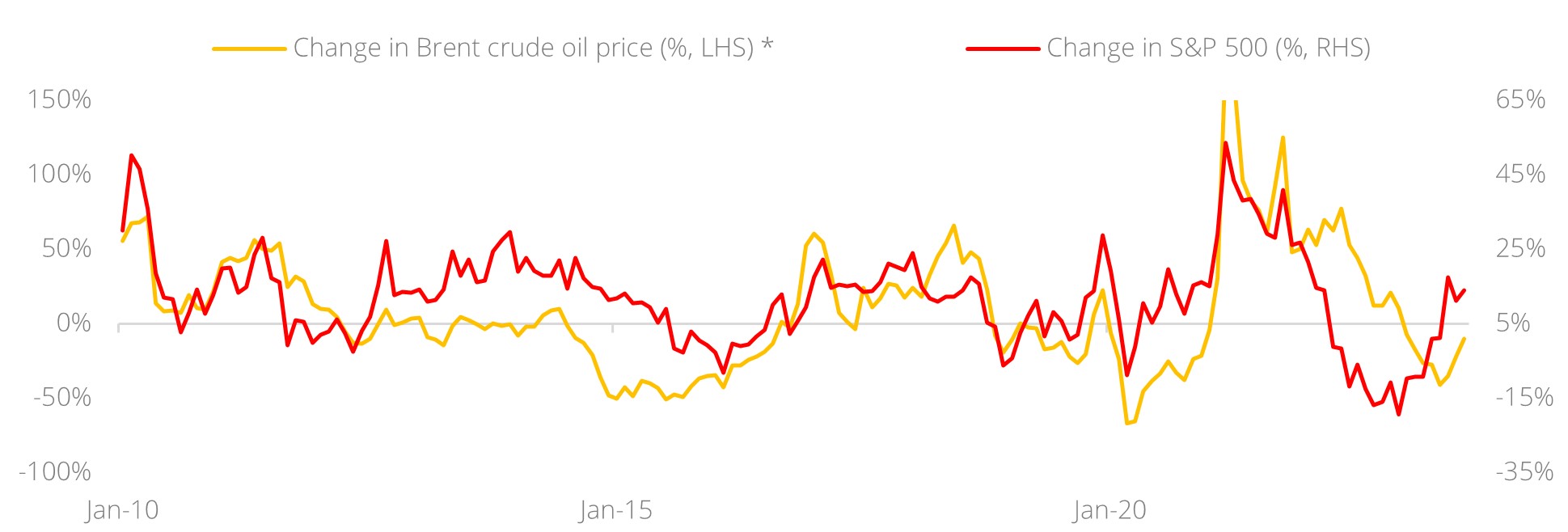

Positive historical correlation between oil price and equities. The relationship between oil price and equities has evolved over the years. From 1970 till 1999, we observed a slight negative correlation of -0.046. But by the turn of the century, this relationship is noted to evolve, with correlation turning positive at +0.159 from 2000 till 2009. And since 2010, correlation between the two assets classes went one notch higher to 0.423. This explains why equities has rallied in tandem with oil prices during periods of economic expansion in the recent years.

Figure 1: Relationship between oil and equities

Source: Bloomberg, DBS

*Chart is truncated

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.