- S. Korea & Taiwan: Worse-than-expected 4Q22 GDP numbers; growth numbers revised downwards

- Thailand: Elevated core inflation risks due to higher cost passthrough and rising inflation

- Indonesia: Strong private consumption and public spending to offset emerging commodities softness

- Central Banks Hold Steady19 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024

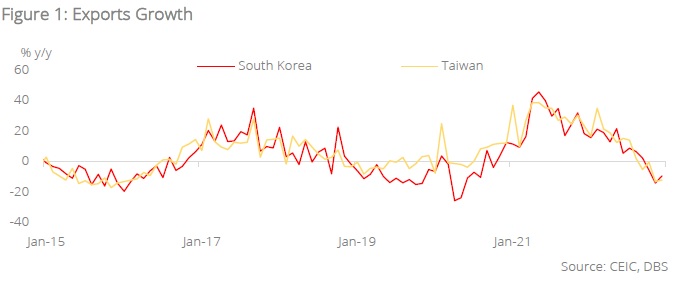

South Korea & Taiwan: Worse-than-expected 4Q22 GDP data has sharply lowered projection trajectories for 2023. Without a strong and immediate rebound in 1Q23, the annual growth figures in 2023 will be negatively affected. The latest PMI surveys suggest that the sequential contraction in manufacturing activities in these two economies has stabilised since the end of 2022. Still, a rebound is yet to be in sight.

From a fundamental point of view, the tech-driven exports downcycle in South Korea and Taiwan may not turn around very soon. The global semiconductor sector is undergoing a typical cyclical adjustment characterised by a supply glut and price declines. Historical experiences suggest that inventory correction in the semiconductor sector will last for 2-4 quarters. The current correction will likely continue into 1H23.

In South Korea, the headwinds weighing on domestic demand will likely persist through this year, considering the lagging impact of rate hikes and liquidity tightening. These include hard landing risks in the property market and deleveraging pressures in the indebted corporate and household sectors. The country’s property market downcycles typically take 2-3 years to complete.

China’s economic rebound may not translate into a full-fledged recovery in imports from South Korea and Taiwan in the near term. A normalisation of China’s consumption and investment demand and restoration of Chinese supply chains should help to lift the imports of intermediate goods from South Korea and Taiwan. Nonetheless, China’s access to advanced semiconductors will face restrictions due to the United States’ recent broadening of export controls on chip sales to China, which took effect in Oct 22.

Furthermore, the benefits of China’s reopening on South Korea’s and Taiwan’s tourism sectors will likely be limited. Beijing imposed a ban on mainland tourists visiting Taiwan in 2019 due to the deterioration in cross-Strait relations. It will likely retain the ban this year because of rising political uncertainties in the run-up to Taiwan’s next presidential elections in early 2024. China-South Korea ties also face new challenges as Seoul seeks closer collaboration with Washington on national security and defence. Recently, Seoul imposed screening measures against travellers arriving from China and suspended the issuance of tourism visas for Chinese travellers till end-January. China retaliated by suspending all short-term visas for South Korean travellers.

We are downgrading the annual GDP growth forecasts for South Korea and Taiwan. South Korea’s 2023 growth forecast is lowered to 1.5% from 1.8%, while Taiwan’s to 1.6% from 2.3%. Our base case forecasts imply a marginally positive q/q growth in 1Q23, on-trend 2-3% growth in 2Q23, followed by a stronger recovery in 2H23. Under the bear case scenario of a technical recession (two consecutive quarters of q/q contraction in 4Q22-1Q23), full-year growth in these two economies would fall further to around 1.0%.

Download the PDF to read the full report which includes insights on Thailand and Indonesia

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

- Central Banks Hold Steady19 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024

- Central Banks Hold Steady19 Apr 2024

- Fed Cut Hopes Fade on Sticky Inflation12 Apr 2024

- Growth Recovery in Focus05 Apr 2024