- Markets entered "capitulation mode" with broad-based selloff in risk assets

- This comes despite Fed Chair Powell downplaying plausibility of a 75 bps hike this year

- In spite of headwinds arising from Fed hawkishness, we see light at the end of the tunnel

- Our defensive asset allocation stance pays off as Alternatives outperforms Equities & Bonds

- Stay invested with the Barbell portfolio; focus on inflation winners, quality equities & credit

Glass half full or half empty? Seeing light at the end of the tunnel. The respite in global risk assets post-FOMC meeting on Wednesday (4 May) – which saw Fed Chair Powell downplaying the plausibility of a 75 bps hike this year – proved short-lived. Markets have since entered “capitulation mode” with broad-based selloff in equities and corporate bonds. The S&P 500 lost 7.2% while the Technology-heavy Nasdaq index suffered heavier selldown of 10.3% as yield concerns weighed on growth equities. Bonds were not spared from the volatility either with US HY spreads widening 47 bps.

Clearly, investors’ fears have reverberated across risk assets this year on concerns of Fed hawkishness in tackling multi-decade high inflation. Despite the prevailing headwinds, we see light at the end of the tunnel and our optimism is based on:

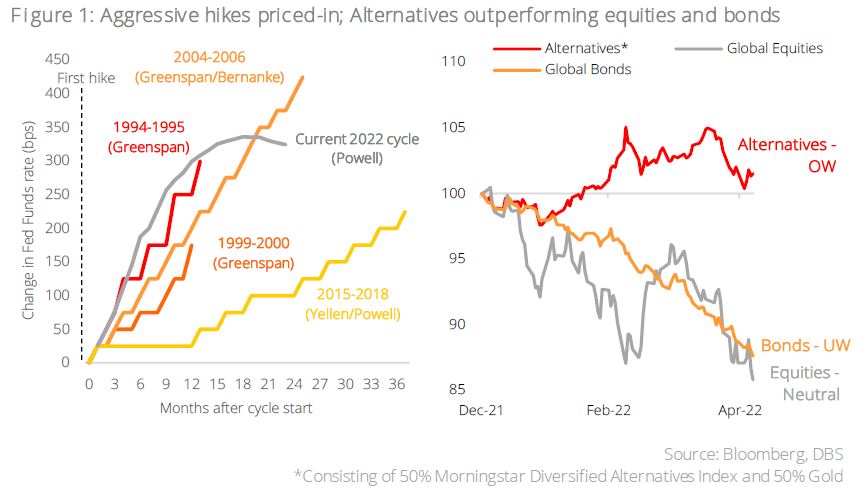

- Aggressive rate hikes priced-in: Fed funds futures pricing shows that this hiking cycle is one of the most rapid in the last 30 years and this suggests that most of the aggressive hikes have already been priced-in.

- Decelerating core inflation: Stripping out the effects of higher food and energy prices, core inflation prints have already begun to show signs of deceleration, given the slowing global growth trajectory as well as moderating base effects.

- Potential U-turn in Fed rhetoric: The present inflation is driven by supply chain disruption, labour force attrition, and exogenous oil shocks – all largely supply-related factors. Monetary tightening is more effective against demand-driven inflation and may not cure this inflationary episode with necessary precision. There is, therefore, a likelihood that the hawkish Fed rhetoric will reverse once fundamental realities begin to materialise in economic data.

Alternatives outperforming Equities and Bonds; Defensive CIO asset allocation reaping dividends. From an asset allocation perspective, our strategy of Overweighting Alternatives over Equities and Bonds has paid off in the current environment. Year-to-date, Alternatives* has gained 1.5% while global equites and global bonds lost 14.2% and 12.4%, respectively.

Gold, in particular, proved its resilience by registering a 3.0% increase. Within equities, our long-term conviction on the US has panned out marginally well as the market outperformed Europe and Japan by 1.8% pts and 0.3% pts, respectively.

Stay invested with Barbell Strategy – Focus on inflation winners and quality plays. We advocate portfolio allocators to stay invested with the Barbell portfolio approach (comprising growth equities, dividend equities, high grade credit, and gold as risk diversifier) to steer their investments during this period of extreme market volatility. From a top-down perspective, the key areas of focus will be on:

- Inflation Winners: As we have highlighted in our report CIO Vantage Point – Inflation Chronicles (April 2022), the key beneficiaries of a rising inflation environment are (a) Commodities, (b) Energy Majors, and (c) Singapore Real Estate Investment Trusts (S-REITs).

- In commodities, we believe oil, base metals, and gold will outperform given the supply shortage and energy transition narratives behind them. These factors will underpin prices in the commodity complex.

- Energy Majors are geared beneficiaries of rising energy prices (a key contributing factor to the inflation surge that we see today). Another tailwind adding to the sector’s resilience lies on its ability in maintaining stable earnings through the cycles, underpinned by structural factors such as the underinvestment in fossil fuels capacity.

- Lastly, S-REITs also serve as a good inflation hedge given that rental and property values tend to rise in tandem with rising inflation. Importantly, the ability of S-REITs in paying dividends is less impacted by rising interest rates due to their reasonable levels of gearing.

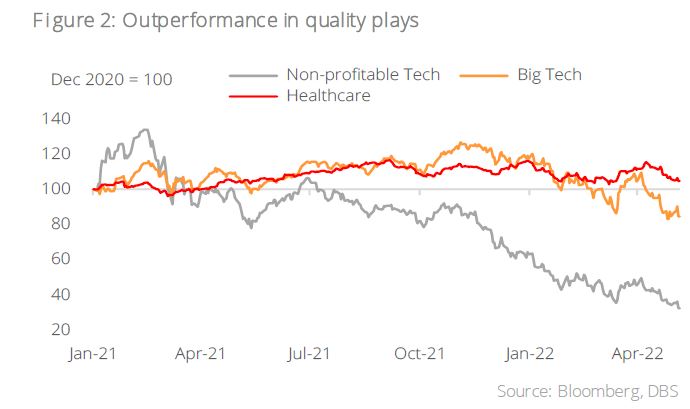

- Quality Growth Equities: Growth equities have underperformed the broader market as a result of concerns on rising bond yields. However, we advocate investors maintain exposure to this space (such as Technology and Healthcare) to capture growth opportunities when macro conditions turn. We have a particular preference for quality companies with strong market positioning and resilient earnings profile as they are more likely to navigate a rising bond yields environment successfully. Since the start of the year, non-profitable Technology stocks have corrected c.60% while Big Tech and Healthcare remained resilient.

- High Grade Credit: The dual headwinds of tighter monetary policy and modest growth outlook support expectations of aggressive bear flattening which is typically accompanied by a widening of credit spreads across bond markets. Considering this, we prefer to focus on quality credit to reduce portfolio spread volatility, with Developed Markets Investment Grade (DM IG) markets demonstrating the lowest volatility historically under bear-flattening yield curves. And while it is difficult to anticipate when a turnaround would come, investors are currently well compensated for waiting; global high grade credit aggregate yields have exceeded 3.8%, a level that exceeds even the 2020 pandemic crisis – and more than 2 standard deviations wide of its 10-year history. Should the economy take an unforeseen downturn, the unwinding of hawkish expectations would become a strong tailwind for this asset class.

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.