- China policymakers have been addressing market overhangs and are working to resolve the situation

- Progress is being made on the Covid situation, e-commerce and tech regulation, ADR delisting issue

- Institutional underweight of China equities relative to benchmark is at a 10Y low.

- We see asymmetric risk-reward in favour of being invested, on the back of returning to normalcy

- We prefer China large SOE banks, platform e-commerce, technology, and insurance companies

China has been addressing market overhangs such as the Covid situation, China real estate developers, platform e-commerce and technology regulations, and American depositary receipt (ADR) delisting issue. We maintain the view that the market will find a bottom at current levels to stage a long-awaited recovery as policymakers have been proactively introducing supportive measures and working to resolve the situation.

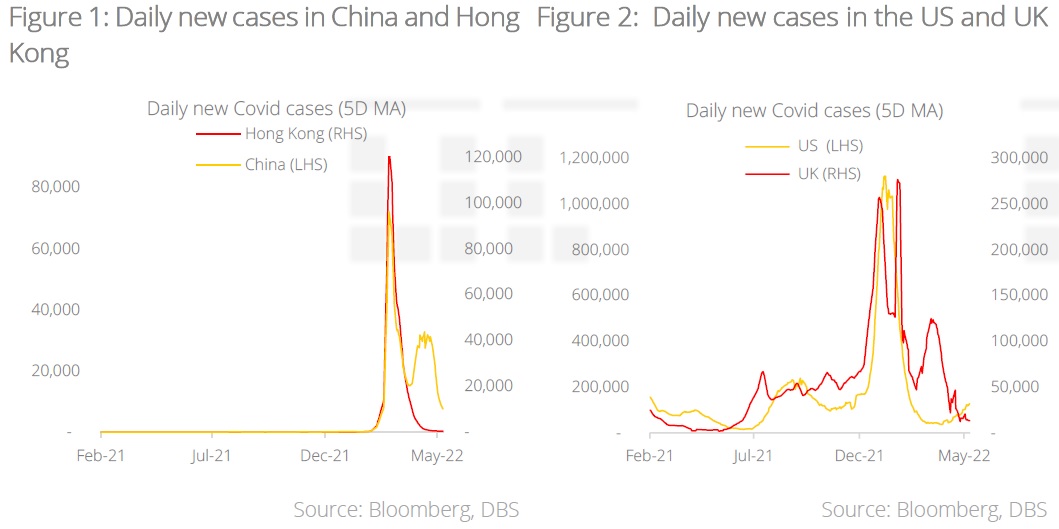

Covid cases are falling and should further subside in due course. While there has been headline news on lockdowns and the impact on the economy, the actual number of Covid cases in China is falling (Figure 1), paving the way for reopening. Drawing from the experience in the US and UK, the current Covid outbreaks in various parts of China should eventually subside to pre-omicron levels. In the US and UK, it took approximately six weeks to peak and six weeks to fully subside (Figure 2). If China and Hong Kong follow the same pattern, daily new cases should return to low levels in China towards summer.

Covid impact on EPS being factored in. Consensus on earnings per share (EPS) downward revisions have been largely priced in (Figure 3).

China property market supportive policies. Various local governments have relaxed limitations on property purchases, and banks have lowered borrowing costs for mortgages. Further tightening measures seem unlikely while gradual support to the property market is being administered at a measured pace.

Platform e-commerce and technology. New government regulations continue to be introduced at a faster pace as promised and on a stable and transparent basis. The markets are looking forward to clarity and the end of further tightening.

ADR delisting issue. China regulators are considering allowing the US Public Company Accounting Oversight Board to conduct joint inspections with Chinese regulators on Chinese ADR companies’ auditors. Should this transpire, it may resolve the issue.

Institutional holdings at 10Y low. Global equity funds have greatly underweighted China relative to benchmark weight for the most part of the past 10 years, and aggressively reduced the weights since 4Q18. Currently, the benchmark-relative underweight in China is at 10Y low.

China equities at historical trough valuations. China’s forward PER (price earnings ratio) has dropped to below historical mean while the P/B ratio is below -1 standard deviation, both at the lowest in seven years. Such compelling valuations are adding to the support against downside risk. On a relative basis, China equities are trading at a steep discount to global average.

Risk-reward in favour of being invested. A lot of pessimism has been priced in and expectations set low. On an absolute and relative basis, China equities are inexpensive and being underweighted. We see asymmetric risk-reward in favour of staying invested, on the back of returning to normalcy, progress in removing the market overhangs, and compelling valuations. Sectors we prefer are China large state-owned enterprise banks for their stable yields of 6-7%, platform e-commerce, technology firms, and insurance companies that ride on long-term secular growth trends.

Download the PDF to read the full report.

Topic

Explore more

CIO PerspectivesThis information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.