- RMB outperformance has been driven by reopening, equity inflows, and reduced geopolitical risk

- But further RMB gains could be far modest, and with greater two-way volatility

- China’s reopening entails a significant resurgence in tourism related outflows in the pipeline

- Exuberant equity inflows could normalize, while fixed income inflows are held back by low yields

- Finally, China’s geopolitical environment is still fragile, beset by strategic rivalry with the US

To read the full report, click here to Download the PDF.

China’s reopening and RMB strength

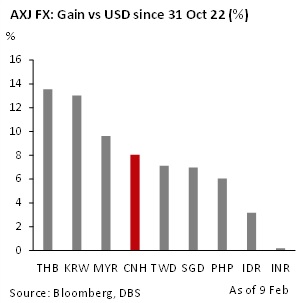

The RMB has recorded a significant appreciation since its nadir in end Oct. The offshore RMB has rallied by 8% against the USD, outperforming all AXJ currencies except THB, KRW, and MYR. Three key drivers are behind this RMB resurgence: 1/ A rapid turnaround in China’s growth outlook given reopening and more policy support, 2/ a rush of foreign equity inflows, 3/ a perceived reduction in geopolitical risks given constructive diplomacy.

While RMB positivity is not unwarranted, there are nuances with regards to all three drivers. We discuss each driver in turn, drawing the implication the RMB gains are likely to be modest going forward, and with possibly more two-way trading that investors expect.

(i) Reopening will re-pressure current account

China’s retreat from Covid measures, and their associated disruptions to livelihoods, sentiment, and supply chains, are clearly positive for growth. We have raised our 2023 growth forecast to 5.5% from 4% (see China: Subdued 2022, brighter 2023, 13 Jan 2023), and the IMF has also lifted its China’s 2023 growth forecast in Jan to 5.2% from 4.4% previously.

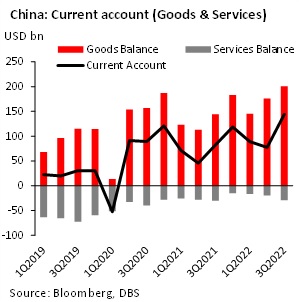

Economically, China’s balance of payments had hardly taken any hit due to Covid control measures, unlike growth. The net impact may even be positive. Since the start of the pandemic, China’s current account did not narrow and rose continuously from USD103bn in 2019 to USD249bn in 2020, USD317bn in 2021, and a record USD311bn for the first three quarters of 2022.

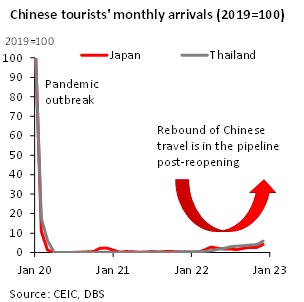

Though goods have largely continued to flow over borders through the pandemic, tourist outflows had sharply dwindled since Q1 2020. This contributed to a substantial narrowing of China’s services balance deficit from USD260bn to USD80bn. Post-reopening, tourism-related outflows are likely to rise sharply.

We estimate the services deficit to eventually widen by USD130bn to a more normal level of around USD210bn (annualized). Given this, China’s current account surplus could narrow by around a third from its current elevated level and erode the impetus for further sharp RMB gains.

(ii) Exuberant portfolio inflows may normalize

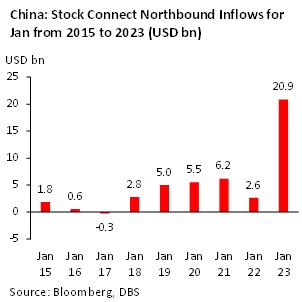

Portfolio inflows had been the most proximate driver of RMB strength since December, as investors returned swiftly, banking on a rapid recovery post-reopening. Northbound inflows via the Stock Connect scheme had surged to a staggering USD20.9bn in January. Such a quantum was the largest monthly inflow on record and was 50% larger than the second highest monthly inflow in Dec 2021. For Chinese fixed income markets, foreign net purchases of RMB bonds have also been encouraging, coming in strongly at around USD15bn for Dec 2022. Could such a rapid pace of portfolio inflows continue for the rest of the year?

The fast-moving nature of markets is such that investor positioning for a reopening happens in a short space of time. With Chinese equities having rebounded by 16% since the nadir in Oct, equity related gains and inflows are perhaps quite front-loaded by now. This means that foreign equity inflows may soon ease back to more normal levels, just when current account outflows begin to pick up.

As for fixed income, December’s increase in the foreign ownership of RMB bonds was marginal relative to sustained foreign bond outflows in 2022. Geopolitical risks, and the wider negative yield differential between CGBs and US Treasuries, are reasons for tepid inflows. With US rates expected to be higher for longer amid a robust job market, there is no structural reason for a sustained pick-up in fixed income inflows unless the PBoC begins to normalize its monetary policy.

(iii) Fragility over latent geopolitical risks

Finally, a tentative and still fragile US-China rapprochement after last year’s Bali G20 summit has also been constructive in easing the geopolitical risk premium for the RMB. Geopolitics can be one of the most consequential drivers for the yuan, but it is also the most difficult to make prognostications on.

Our working assumption is that the current US-China rapprochement efforts will continue as both sides seek to reinforce their economies. Still, strategic interactions may sporadically occur given a deepening rivalry, which could result in investor anxiety and RMB volatility. One recent strategic interaction is the US downing of a Chinese stratospheric balloon traversing sensitive US areas. While these interactions are not uncommon during the Soviet era, the key difference today is that the US and China are much more integrated across both trade and investment dimensions, and market consequences are therefore material.

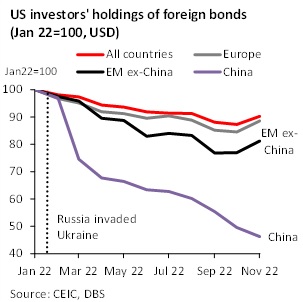

Post Russia’s invasion of Ukraine, US investors’ holdings of RMB bonds have shown a rapid decline. The reduction in US investors’ RMB bond holdings were proportionally much larger than reductions of EM and European bond holdings. This suggests that RMB bond outflows are not just impacted by market risk, commodity supply chain risk or yields, but they have become susceptible to a unique political risk given the strategic context.

On the positive side, given US investors’ currently underweight positioning, a meaningful improvement in the geopolitical environment could provide a boost to RMB bond inflows. A resumption of US Secretary of State Blinken’s visit to Beijing will certainly be constructive to such a scenario.

More measured RMB appreciation ahead

All things considered, we believe the RMB still has scope to appreciate as the growth outlook improves, but by a more modest degree. A smaller current account surplus from tourism outflows, the front-loading of equity inflows and a persistently negative US-China rate differential are all set to weigh. Geopolitical risks have also not disappeared. While we hope for a more constructive US-China relationship, it is not impossible to see more volatility in the RMB due to strategic interactions amid US-China rivalry. The upshot is that USD/CNY could find it difficult to break below 6.70 without a meaningful change in the broader USD.

To read the full report, click here to Download the PDF.