Sentiment turned sour on a confounding Bank of England meeting. The monetary policy committee delivered a dovish hike on the back of forecasts for double-digit inflation in 4Q22 and a UK recession in 2023. Six members voted to increase the bank rate by 25 bps to 1%, while three wanted a larger 50 bps increase. GBP plunged below 1.24 from its open above 1.26, with markets scrambling for the US dollars they sold at the well-toned FOMC meeting. US inflation worries returned and sent the US Treasury 10Y yield above 3%, resulting in the DXY closing at a new year’s high of 103.75. The BOE’s outlook renewed fears that central banks could only address the higher-for-longer supply-side price pressures by reining domestic demand with rate hikes. Subsequently, US equities wiped out post-FOMC gains. The S&P 500 Index plunged 3.6% and reversed Thursday’s 3% rally. The sell-off in the Nasdaq Composite Index was more brutal, with investors suffering a 5% loss vs 3.2% gains a day earlier.

Today, US nonfarm payrolls might miss expectations. Consensus expects payrolls to slow to 380k in April from 431k in March. The 4-week moving average of initial jobless claims increased to 188k from 178k. The ADP Employment Survey reported 247k jobs, fewer than the 383k consensus and the 479k jobs added a month earlier. In the ISM PMI Surveys, the employment sub-index fell to 50.9 from 56.3 for manufacturing and a more unsettling fall to 49.5 from 54.0 for services. However, the unemployment rate is expected to ease again to 3.5% from 3.6%. Average hourly earnings might slow but stay firm at 5.5% from 5.6%.

Five Fed Presidents will be speaking within the next 24 hours. John Williams (New York) and Mary Daly (San Francisco) should support Fed Chair Jerome Powell’s stance to return rates to neutral on a soft landing in the US economy. Neel Kashkari (Minneapolis), a renowned dove, believes it could take a few years to get inflation back to the 2% target because of the Ukraine war and China’s Covid-Zero policy prolonging supply-chain disruptions. Before the surprise negative US GDP growth in 1Q22, Raphael Bostic (Atlanta) reckoned the global economic slowdown was reason enough for the Fed to be cautious about rate hikes in the coming months. Markets will be keen to see if James Bullard (St Louis), the Fed’s renowned hawk, will rescind his push for a 75 bps hike and his goal to lift rates above neutral to 3.50% by end-2022. At the FOMC meeting on 4 May, the Fed lifted rates by 50 bps to 1%, signalled similar moves at the next two meetings while pushing pack expectations for a 75 bps.

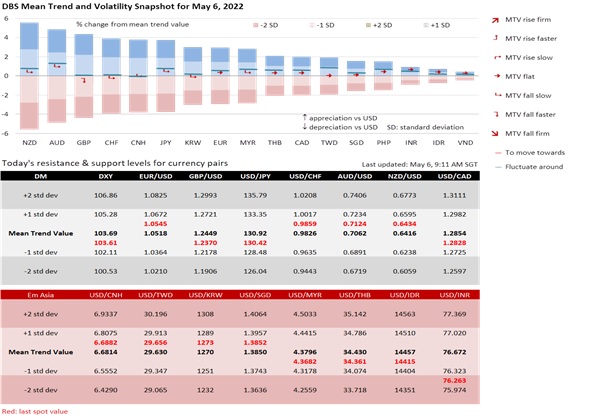

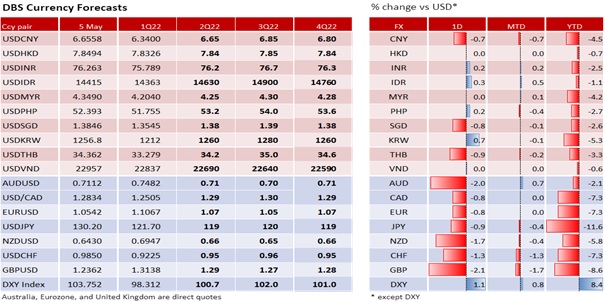

Despite the market volatility, most Developed Market currencies, except GBP and CHF, are still in familiar ranges. DXY is still between 102 and 104. EUR, AUD and NZD remain supported at 1.05, 0.71 and 0.64 respectively. USD/JPY keeps gravitating back towards 130. USD/CAD is holding a 1.27-1.29 range. GBP could stabilize if it appreciates and closes the week inside its 1.24-1.26 range, preferably on a short-covering in US equities and bonds.

Quote of the day

“Just when you thought it was safe to go back into the water…”

Jaws 2 movie poster

6 May in history

West Germany joined NATO in 1955.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.