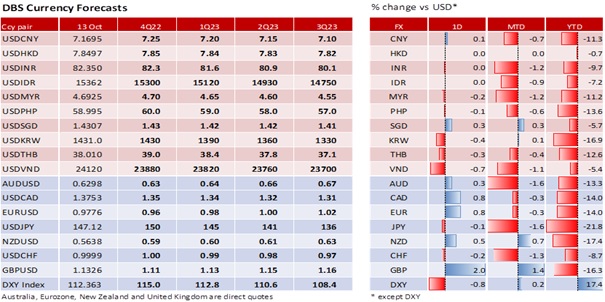

Dow, S&P 500, and Nasdaq Composite surged 2.8%, 2.6% and 2.2% respectively. Reuters cited market participants closing out defensive put options positions placed before the higher-than-expected US CPI released yesterday. The US Treasury 2Y yield firmed 17.2 bps to 4.464% on the stronger-than-expected US CPI report, holding the session’s high of 4.529%. The market fully bought into the Fed’s projections for rates to end 2022 around 4.50%. They also believed in the Fed’s willingness to risk a recession to control inflation. The 10Y yield rose less by 4.7 bps to 3.943%, down from the session’s high of 4.075%. US CPI inflation fell slower-than-expected to 8.2% YoY in September; consensus had expected a drop to 8.1% from 8.3% in August. Conversely, core inflation rose from 6.3% to 6.6%, a new high for the year.

We are wary of volatility even as GBP appreciated 2% to 1.1326, near its high a week ago. The 10Y Gilt yield eased a third day by 23.7 bps to 4.198%, its lowest level in a week. The Bank of England stepped up gilt purchases to counter another sell-off, leading market participants to cover their shorts. Rumours also floated that Chancellor Kwasi Kwarteng would U-turn on the plan to freeze the corporate tax rate. He has brought forward the publication of his fiscal plan and the OBR forecasts to 31 October from 23 November. Pension funds want the BOE to extend its emergency bond purchases to 31 October. However, BOE Governor Andrew Bailey told them the emergency support would end as scheduled on 14 October. Bailey will be speaking and participating as a panelist at a G30 event tomorrow. Kwarteng said BOE would be to blame for any fresh market turmoil. The IMF urged the Truss government not to prolong the pain on the mini budget which it criticized for working against the BOE’s priority to control inflation. Many still expect the BOE to deliver a 100 bps hike at its next meeting on 3 November. Given the fluid situation, ratings agencies remained negative on the outlook for UK debt.

Quote of the day

“The target for every great champion is to play for the team.”

Antonio Conte

14 October in history

First live telecast from a manned US spacecraft Apollo 7 in 1968.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.