Businesses need to consider dominant long-term goals, and how to get there by de-conflicting short-term incongruent goals.

Sustainable investments may have made recent headlines in the last few years, but this trend was likely introduced in the 18th century. PHOTO: AFP

SUSTAINABLE investments may have made recent headlines in the last few years, but this trend was likely introduced in the 18th century.

The approach then was driven by teachings in faith, as religious groups set out guidelines on the types of companies their followers should invest in - responsible investing begun as a way to follow one's moral compass when it came to financial dealings.

By the 60s, the socially responsible investment movement came about. It led investors to exclude stocks and industries involved in certain prohibitions, such as gambling and tobacco production. These were also known as "sin stocks".

Fast forward to 2021, and sustainable investments have found a firmer footing in the investing world. These run the gamut across securities, asset classes, investment styles and products. Governments, financial institutions and individuals are aligned with the view that investing with a sustainability lens can be a more robust, more fruitful pursuit. A global pandemic has also led investors to carefully consider the risks of ignoring climate change and broader social impact.

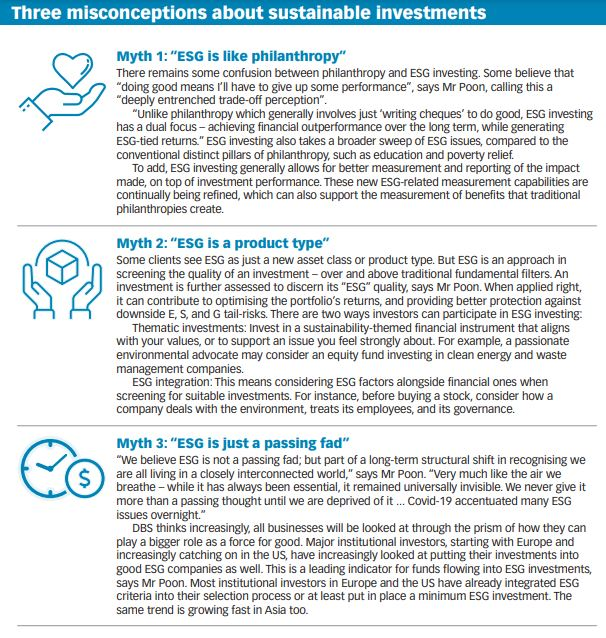

Still, misconceptions and confusion can threaten the path forward.

Joseph Poon, group head of DBS Private Bank, said: "Sustainable investments have become increasingly important in value-adding investment portfolios. However, their pace of growth has been compromised as there's still no clear definition for sustainable investments today, likely because it's a relatively nascent - albeit fast-growing - space.

"At present, 'sustainable investing' remains loosely defined and can differ based on the use case for the particular institution or investor."

Indeed, there is no single established industry benchmark for rating environmental, social and governance (ESG), which can be confusing for various stakeholders, he points out. And such benchmarks in ESG criteria or ratings are required in order for the industry to implement more systematic exclusion or integration processes when making investment decisions.

"We do see several major ESG rating agencies emerging as potential leaders, and in a few years, we can expect ESG ratings to function similarly to the present credit ratings ecosystem, where recognised benchmarks are provided by a few established agencies. That said, inaction is not an option while we wait for the 'most apt' benchmark to emerge," said Mr Poon.

To add, ESG has many parts. A company may be good at tackling the environmental aspect of its business, but poor at dealing with the social consequences of its business.

In response, Mr Poon said, an ESG rating is a useful measure when used to assess the ESG merits of different companies within the same sector. "So while the 'G' rating has historically been focused on as a standalone measure, the 'E' and 'S' factors, which have recently become more visible, can sometimes be in conflict with each other, depending on the business model of individual companies," he said.

In these instances, management would need to consider what their dominant long-term goals would be, and how to get there by de-conflicting short-term incongruent goals.

"This is especially so in Asia, which is home to many developing nations still in early stages of economic development and living standards, compared to the more developed economies, which are on a different trajectory in their ESG journeys."

DBS has an ESG portfolio-weighted rating methodology that enables clients to assess and approach ESG as a curated collection of investments.

The aim is to provide a simple methodology for clients to invest in a combination of varying levels of ESG-rated and non-rated investments that, together, achieve a certain level of ESG rating for the overall portfolio.

Mr Poon said: "This approach also enables clients to include ESG investments that have an improving ESG trajectory and other investments to achieve an expected level of risk-adjusted return. Over time, these portfolios provide a good baseline for clients to further adjust their investment portfolio to align with their personal values and investment goals."

More broadly, DBS defines sustainable investments as those rated BBB and above (based on MSCI ESG Ratings), taking reference from the MSCI ESG Leaders Index and leading global asset managers. In 2019, DBS Private Bank became one of the private banks in Asia to integrate MSCI ESG ratings into its product suite, noted Mr Poon.

Index provider MSCI's ESG Leaders benchmarks have posted stronger returns than broader indices across different regions and time periods, he noted. Integrating ESG factors have been shown to improve portfolio risk-reward characteristics.

DBS Private Bank rolled out the MSCI ESG Outperformance structured note in 2018 - the first of its kind in Asia. Almost all clients exited at profit. The bank relaunched it in 2020, and the assets under management (AUMs) raised through this second tranche was a seven-fold jump from the first one in 2018.

DBS has also committed to growing its suite of sustainable investments to more than half of its private banking AUMs by 2023.

Two-step approach

For investors just starting out on investing along ESG lines, Mr Poon noted that ESG is a long-term structural theme. The investment aim is to boost long-term portfolio performance while doing "good".

The bank takes a two-step approach:

Investors should know what they own, and assess the ESG rating of their current portfolio and products. This transparency will enable them to decide on what to do next. For example, they can then determine which investment to revisit, or whether to replace lower ESG-rated holdings with higher rated ones to improve the portfolio's overall ESG rating.

When assessing new investment opportunities, investors should also go beyond the usual financial criteria and consider their ESG ratings too. That would give them a more complete picture to make decisions.

This structured approach can help to set an investment framework for every individual, who will have different needs.

"Given that ESG can mean different things to different people, our mission is to help clients see how increasingly critical ESG issues are, to gain a better understanding of the nuances of ESG, and how clients can optimise their long-term investment return while shaping the broader societal agenda," said Mr Poon.

"Studies have shown that high-ESG-rated companies tend to have stronger financials, a positive association that reinforces the long-term outperformance potential of companies with good ESG ratings.

"Beyond expanding our product suite, our main commitment is thus to increase the ESG rating of our clients' portfolios."

This article was written by Jamie Lee and first published in The Business Times on 30 Jun 2021.