- Equities: Inflation concerns a drag on global equities; EM equities underperformed DM

- Credit: Environment of unabating uncertainty calls for high-quality, short-dated credit

- FX: GBP relief rally amid partial rolling back of unfunded tax cut plans

- Rates: Fiscal and monetary coordination needed to handle market volatility

- Thematics: Positive on EV sector for strong growth and attractive valuation

Inflation concerns continue to weigh on global equities. Global equities endured another week of volatility as concerns surrounding the inflationary outlook continue to dominate sentiments. The MSCI All Country World Index (ACWI) was down 1.9% with both Developed and Emerging Markets equities ending the week (week ended 14 October) down 1.7% and 3.8% respectively.

In the US, selling pressure on the S&P 500 and NASDAQ persisted as both indices fell 1.6% and 3.1% respectively on the back of hotter-than-expected inflation data for September which pushed the US Treasury 10Y yield above 4%. Over in Europe, the Stoxx 600 managed to buck the downtrend by closing 0.6% higher on Friday on news that the Truss administration is scrapping its tax-cutting plans in light of debt sustainability concerns.

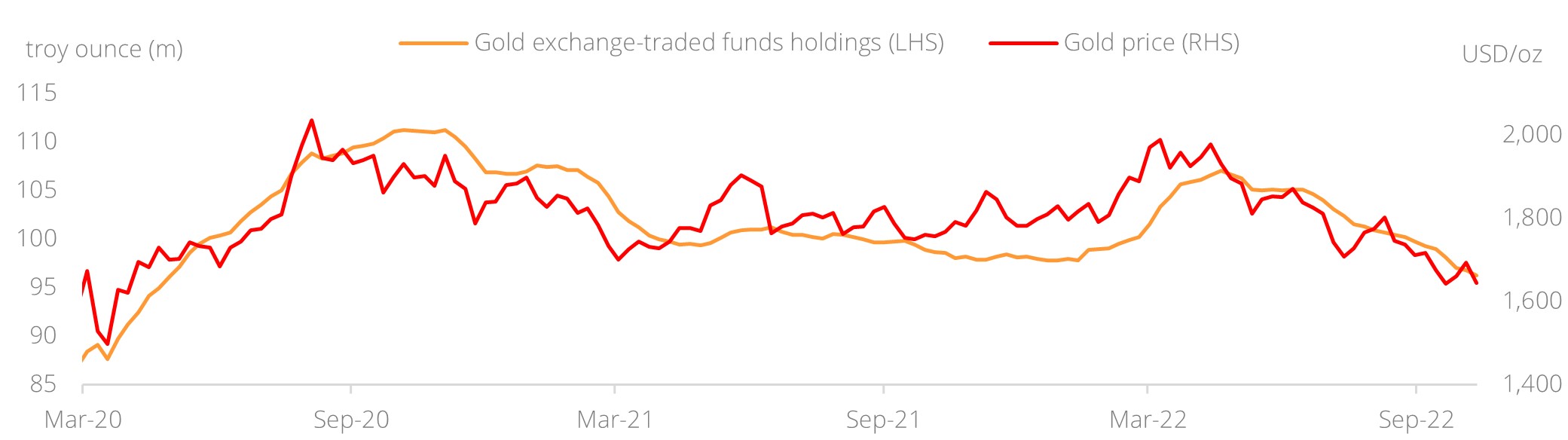

Asia equities were not spared from the selling pressure, however, as sentiments were suppressed by rising bond yields. The MSCI Asia ex-Japan index closed 4.2% lower with China and Hong Kong leading the decline.Topic in focus: Neutral gold equities; favour select gold miners on potential M&A catalyst. The relentless rate hikes by the Fed have sent gold down almost 10% year to date (YTD), and 20% from the high in March. Gold exchange-traded funds have driven much of the decline as holdings dropped to year’s low.

However, as risk-off selling by gold investors stabilises, a weak macro outlook should increase the desire for holding gold as a safe haven asset. Case in point, it has been reported that Londoners have been buying gold as insurance for the UK’s political and fiscal troubles.

Although their buying has not been significant enough to move the needle on gold’s demand in a global context, questions about public debt sustainability and rising recession risks are likely to dominate headlines globally and form potential catalysts for the yellow metal.

Although down on a YTD basis, gold prices have been more resilient than other asset classes, especially in non-US currencies. Potential peaking of the dollar and bond yields early next year should also find gold investors some further relief.

From a gold mining equities stand point, we remain neutral on the sector given margin compression (from increased labour cost and energy bills), but favour select senior miners given potential M&A driven growth.

Figure 1: Retail holdings fell to below pre-Russia/Ukraine crisis and near pre-pandemic levels

Source: Bloomberg, DBS

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.