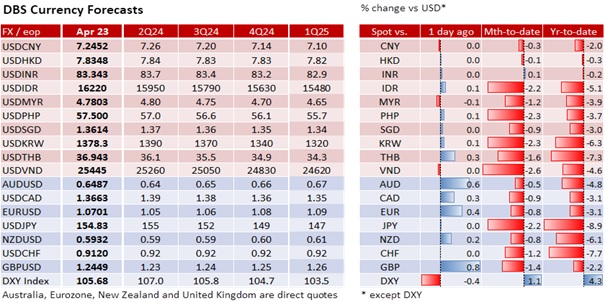

DXY depreciated by 0.4% to 105.7 in the overnight session, its lowest close since April 11. The greenback shed its haven status as worries of a broader conflict in the Middle East subsided. Despite a 1.7% rise to USD88.50 per barrel, Brent crude oil prices held below the 89-92 highs during the Iran-Israel tit-for-tat attacks. Instead, investors focused on the US earnings season, lifting the Dow, S&P 500, and Nasdaq Composite indices by 0.7%, 1.2%, and 1.6%, respectively. The US Treasury 10Y yield eased a third session by 1 bps to 4.60% from softer-than-expected US data negating talks that the Fed would not hike this year. However, DXY should be underpinned at 105 by Thursday’s US advanced GDP affirming the US’s economic resilience and Friday’s US PCE deflators tempering Fed cut bets.

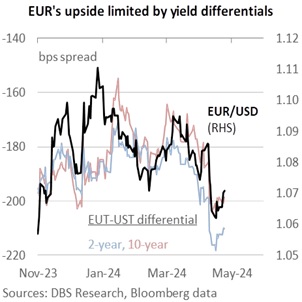

EUR/USD appreciated 0.4% to 1.07, its highest close since April 11. Purchasing Managing Indices slowed to 50.9 in April from 52.1 in March in the US but improved to 51.4 from 50.3 in the Eurozone. Today, consensus expects German IFO to improve a third month to 88.8 in April from 87.5 in March, adding to recent optimism that Europe’s largest economy was turning the corner. Despite expectations for the US Federal Reserve to signal fewer rate cuts at its next FOMC meeting on May 1, the European Central Bank did not pre-commit to more rate cuts beyond the one for June. However, EUR/USD remains weighed by the EU’s negative and wide bond yield differentials against the US. The OIS market is still looking for the ECB to lower rates by 74 bps this year, which is more than the 43 bps discounted for the Fed.

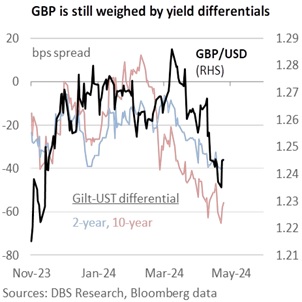

GBP/USD appreciated most on Tuesday by 0.8% to 1.2450. Mirroring the Eurozone, the preliminary UK PMI was stronger-than-expected at 54.0 in April; consensus had expected a slowdown to 52.6 from 52.8 in March. At the Bank of England, hawkish Jonathan Haskel and Chief Economist Huw Pill pushed back early rate cut expectations fuelled by last week’s dovish comments by Governor Andrew Bailey and Deputy Governor Dave Ramsden. Pill maintained that the risk of lowering rates too soon outweighed that of moving too late. Although the UK’s CPI inflation kept falling to 3.2% YoY in March from 3.4% in February, it was firm at 0.6% MoM for a second month. Even so, the OIS market has started betting that the BOE would reduce rates earlier and more than the Fed this year. Hence, GBP/USD still faces downside risks from its negative bond yield differentials vs. the US.

Quote of the day

"The human body has limitations. The human spirit is boundless.”

Dean Karnazes

24 April in history

The Hubble Space Telescope is launched from the Space Shuttle Discovery in 1990.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.