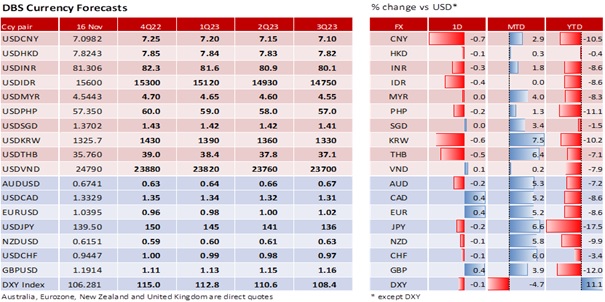

DXY depreciated 0.1% to 106.29, the same level as last Friday. Markets struggled to push the DXY lower after the 4.1% sell-off last week. The Fed pushed back against the dovish bets triggered by US CPI inflation falling to 7.7% YoY in October, its lowest level since January. US stock markets also gave back gains after US retail sales rose 1.3% MoM in October, its fastest pace since February. October was also the month that the S&P surged 8%.

Kansas City Fed President Esther George did not see enough evidence of a deceleration in inflation or a loosening in the labour market to warrant an internal debate of where or when Fed hikes can pause. Fed Governor Christopher Waller backed a smaller 50 bps hike in December but kept the markets guessing if the hikes in 2023 would keep to 50 bps or slow to 25 bps. San Francisco Fed President Mary Daly added that the Fed Funds Rate (FFR) could peak and pause between 4.75% and 5.25%, more than the 5% consensus. Goldman Sachs raised its forecast for the FFR to peak at 5-5.25% in May instead of 4.75-5% in March. Today, let’s see if St Louis Fed President James Bullard, a renowned hawk, signals his intention to pencil in a higher peak at next month’s FOMC.

Fears of more Fed hikes leading to a recession inverted the US Treasury 10Y/2Y yield curve deeper to 66.5 bps, its worst since 1982. The 2Y yield rose 2.1 bps to 4.36%. However, the 10Y yield fell 8 bps to 3.69%, below the FFR range of 3.75-4%. Economists surveyed by Bloomberg project the FFR peaking at 5% in 2023 resulting in a 65% chance of a US recession in the next 12 months and the FFR dropping to 3% in 2024. With Fed hikes seen risking recession again, the incentive to keep selling the greenback has ebbed.

GBP’s rally stalled after briefly testing 1.20 on 15 November. UK recession worries will turn up at the (Budget) Autumn Statement today. Chancellor Jeremy Hunt is set to plug the GBP60bn fiscal hole with spending cuts and tax hikes. The Office for Budget Responsibility (OBR) is expected to join the Bank of England in forecasting a recession throughout 2023. Real GDP contracted 0.2% QoQ sa in 3Q22 and, according to Bloomberg consensus, is expected to remain negative through 2Q22. Unlike the US, UK’s CPI inflation did not slow and soared to 11.1% YoY in October, its highest in 41 years. The Office for National Statistics (ONS) reckoned inflation would have been higher at 13.8% if not for the government’s energy price cap of GBP2500. However, the Chancellor is expected to lift the cap to GBP3000-3100 next April. The Bank of England told lawmakers that today’s Budget was not factored into its monetary policy. Bloomberg consensus projects the BOE bank rate rising from 3% to 4.25% in mid-2023. The futures market is discounting a 50 bps hike to 3.50% at the MPC in mid-December after 75 bps hike on 3 November. We doubt that this is enough to push GBP above 1.20.

Quote of the day

“Excessive sorrow laughs. Excessive joy weeps.”

William Blake

17 November in history

Suez Canal opened in 1869, linking the Mediterranean and Red seas.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.