Key points:

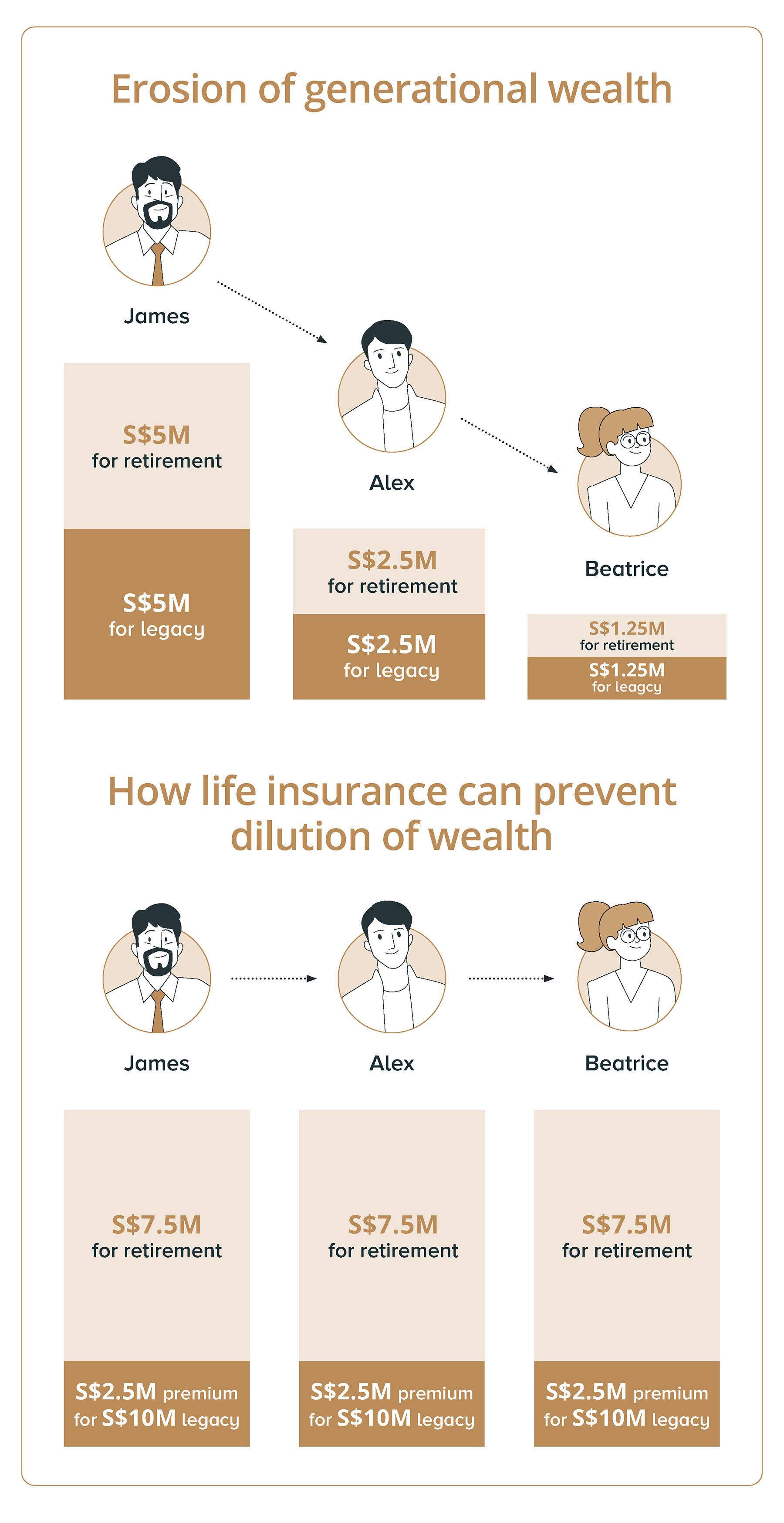

- When wealth is passed through the generations, there is usually less wealth left for the next generation.

- While it may be tempting to quickly resolve this by deciding to retire on less, there are ways to address these competing needs.

- One key strategy is to harness various types of life insurance such as term life, whole life, and universal life insurance.

- Another strategy is to bundle legacy planning with retirement income solutions.

- Life insurance also helps when assets cannot be distributed equally.

Keen to get started on wealth succession planning that’s suited for you?

When it comes to apportioning funds for your retirement and for your legacy, it may seem like a trade-off between a more comfortable retirement, or a more robust legacy. Not necessarily so. You can have your proverbial cake and eat it too by using retirement income products and life insurance.

These financial solutions are designed to provide for both your retirement and legacy needs simultaneously. Life insurance offers guaranteed lump sum payouts that can be used to generate more wealth for your retirement, and augment the assets you want to distribute.

Just like how exercising to keep fit improves your body’s strength and flexibility, life insurance can enhance your retirement as well as legacy planning.

Competing needs of retirement and legacy planning

While each family faces different circumstances, a common issue often recurs: When wealth is passed through the generations, there is usually less wealth left for the next generation. While it may be tempting to quickly resolve this by deciding to retire on less, there are ways to address these competing needs. One key strategy is to harness various types of life insurance.

Augmenting the legacy to be passed on

For instance, James has $10 million of assets and plans to use half for his retirement, leaving the remaining half for his legacy. If his descendants did the same, his grandchild Beatrice would be left with $1.25 million after two rounds of generational wealth transfers.

A solution to maintaining generational wealth could involve purchasing a single-premium life insurance policy.

By paying a $2.5 million premium for a life insurance policy with a $10 million payout, James would have more for his retirement, while leaving a larger legacy. Following this strategy through each generation keeps the family wealth from dwindling.

Having more for retirement and wealth transfers

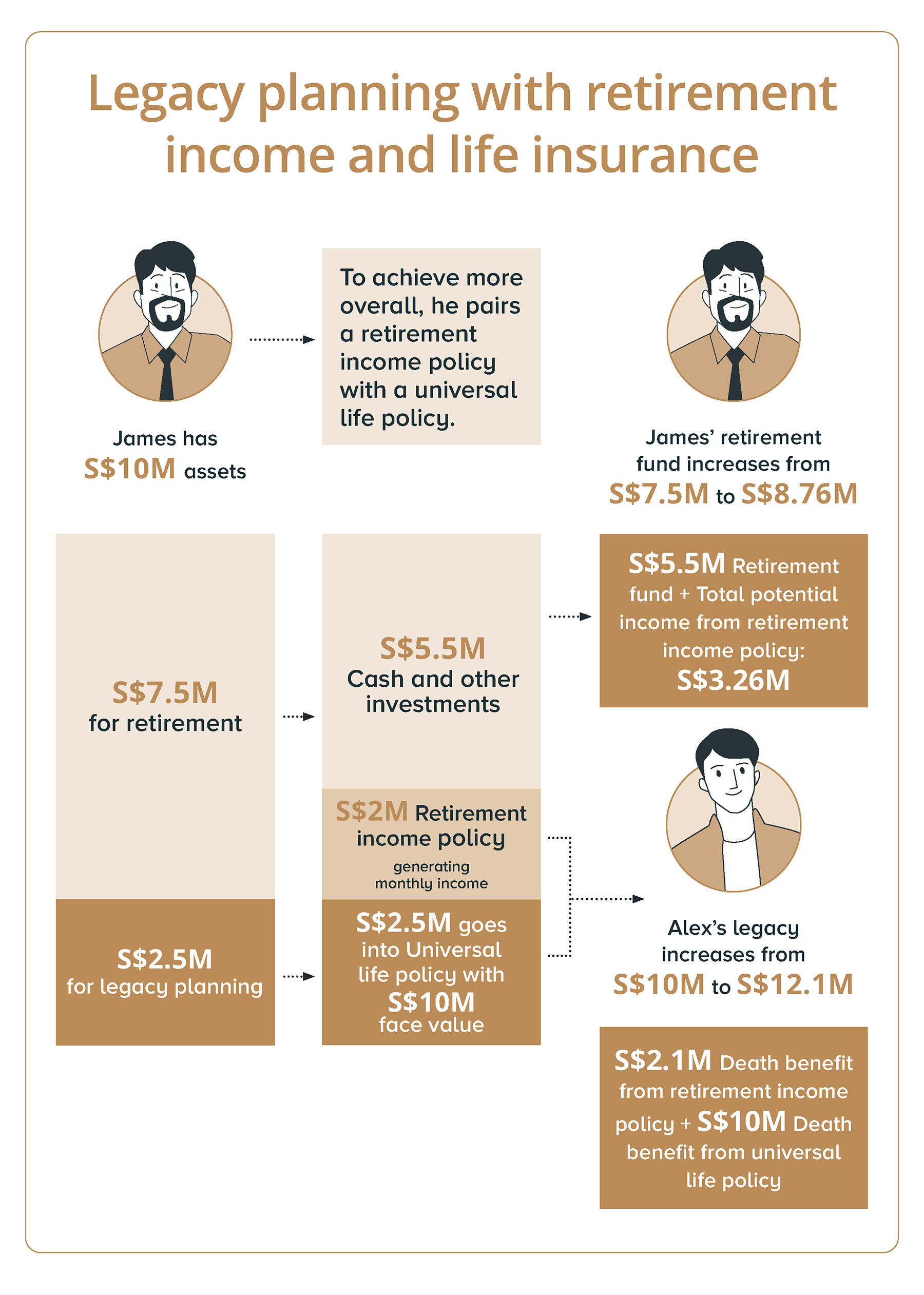

Another solution is to bundle legacy planning with retirement income products.

With this strategy, your retirement needs are sorted by monthly retirement income policy payouts, and your legacy is preserved by a universal life policy.

Take James for example, who has $10 million of cash and investments. Before adopting this strategy, he would have $5 million to retire on, leaving $5 million for his son Alex.

By bundling legacy planning and income stream products, James is able to increase his retirement fund to $7.5 million, and transfer $12.1 million of wealth to Alex.

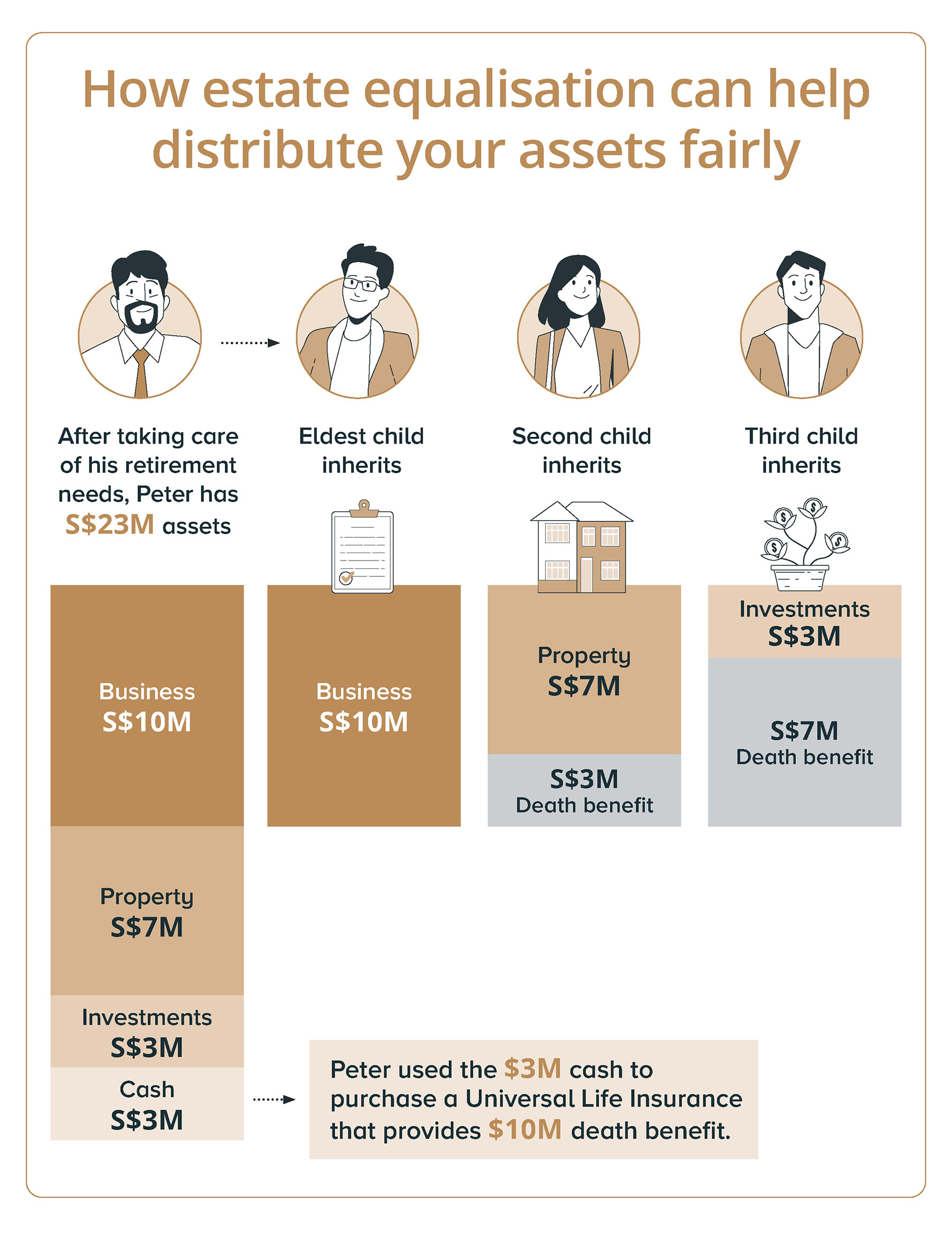

Life insurance also helps when assets cannot be distributed equally

Another common issue arises from the illiquid nature of assets that many high net worth individuals face, despite their wealth. For instance, assets such as real estate, antiques, and heirloom jewellery cannot be split easily.

Instead of being forced to sell these illiquid assets to distribute them fairly, life insurance payouts can enable you to distribute one asset to a beneficiary and an asset of equal value to another.

This is also known as estate equalisation.

For instance, Peter has assets amounting to $23 million – a business worth $10 million, property worth $7 million, $3 million of investments and $3 million in cash.

Of his three children, only the eldest is actively involved in the family business and James plans to pass the business on to his eldest child. His second will inherit the landed property, and his youngest will get the investments portfolio and cash.

Each child would inherit assets that differ in total value. This is where life insurance can be used to make up the differences in inheritance to balance out the distribution.

Types of life insurance used for legacy planning

1. Term insurance

Term insurance covers the insured person for a fixed period, such as 10 years, 22 years or until they reach a specified age. The policy pays out the sum assured as a lump sum to beneficiaries in the event the insured passes away during the policy term.

As term insurance is a pure protection product without any savings element, it is the most affordable tool to provide insurance coverage. Examples of term insurance plans include TermProtect and ManuProtect Term (II).

Pros and Cons of term insurance

| Pros | Cons |

|---|---|

|

|

Whole life insurance

Whole life insurance provides the policy holder with life-long protection. Besides protection coverage, part of the premiums is invested in a participating fund managed by the insurance company.

Upon death, the policy will pay out the sum assured together with bonuses that have been accumulated. An example of a whole life insurance plan is the LifeReady Plus (II).

Pros and Cons of whole life insurance

| Pros | Cons |

|---|---|

|

|

Universal life insurance

Universal life insurance can help you achieve your financial goals by allowing you to build cash values through the accumulation of interest, or by allowing you to access those cash values when necessary. You have the flexibility to manage both potential risk as well as your potential cash flow needs over time by varying the amount and timing of premium payments.

Examples of universal life insurance plans include Heirloom and Signature Indexed Universal Life Select (II).

Pros and Cons of universal life insurance

| Pros | Cons |

|---|---|

|

|

Getting started on your legacy plan

It is a good idea to start planning early. Decide what you want to set aside for your own retirement and your legacy planning will take shape simultaneously. Financial solutions like life insurance and retirement income policies can enhance both your legacy and your retirement provisions, so that you can sit back and retire comfortably.

However, keep in mind that these financial products are just one of many tools that can help with your retirement and wealth transfer. With intelligent insights about your wealth portfolio, DBS Treasures relationship managers can help you customise a retirement and legacy plan, which addresses the complexities and needs of your family.

Whether this means reviewing your existing insurance policies, setting up retirement income streams or enhancing your legacy, with DBS Treasures you’ll get wealth management powered by insights.

Get in touch for wealth succession planning that’s suited to you.

Or if you’re new to us, find out what a DBS Treasures client has access to.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimers and Important Notice

This article is for information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.